Strategy Overweight

2020 in review

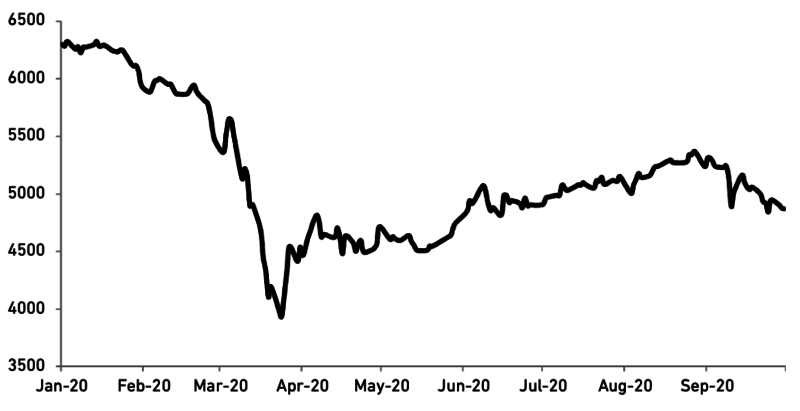

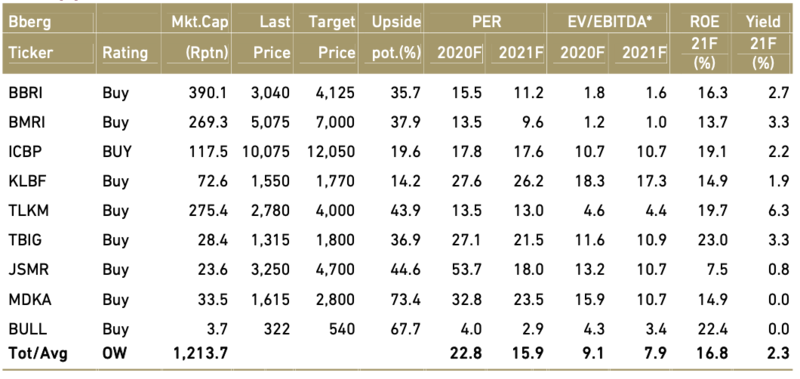

In March this year, global equity markets was caught in the perfect storm of outbreak of a new coronavirus, an oil price collapse and an intensified US-China trade war. On 9 March, most global markets reported severe contractions which are colloquially known as Black Monday and JCI dropped 6.6%. Three days after Black Monday there was another drop, where stocks across Europe and US fell more than 9%, the largest single-day percentage drop and then followed by major indices sank across the Asian region triggering trading halts in several markets including Jakarta. The stock market has been in a downward trajectory since the beginning of March when the country announced its first confirmed case of Covid-19, which forced the bourse to implement the circuit breaker in the first place. The JCI hit its lowest point when it plunged to 3,938 on 24-March.

- Uptrend market trajectory in April-August period

After market turbulence in March Indonesia stock market have risen steadily from its March low to August high of 5,371(+36%) , driven by i) various forms of stimulus pledged by governments to mitigate the economic fallout from the COVID-19 pandemic, ii) optimism on the coming relaxation of social distancing and gradual economic re-opening iii) potential coronavirus vaccines. This is in tandem with global market trends. Another factor that has helped ignite markets is that so many of them are awash in liquidity mainly supplied by retail investors. We opine that the rally had been mostly domestic investor driven dominated by retailers. According to data from Indonesia Stock Exchange (IDX) and OJK (Indonesia FSA), domestic investors contributed 73.3% of total trading of Rp161 tn in Aug-20, 55% of which is retail investors, and foreign investors made up the 26.7% balance. Based on data from KSEI (Indonesia Central Securities Depository), retail investors’ value of equity holding continued to rise by 10.4% to Rp853 tn in 8M20 which is 31% of total domestic investors holding and 20% of total investors holding (domestic and foreign). Moreover, the number of retail investors in the country had risen to 1.2 mn as of Jun-20, an increase of around 12% from December last year, according to data from KSEI. To sum it up, Indonesia equity market has shown it ability to decouple from the bleak economic data, weak earnings and heavy net foreign selling of USD1.9 bn in Mar-Aug 2020

- September sell-off but market remains intact

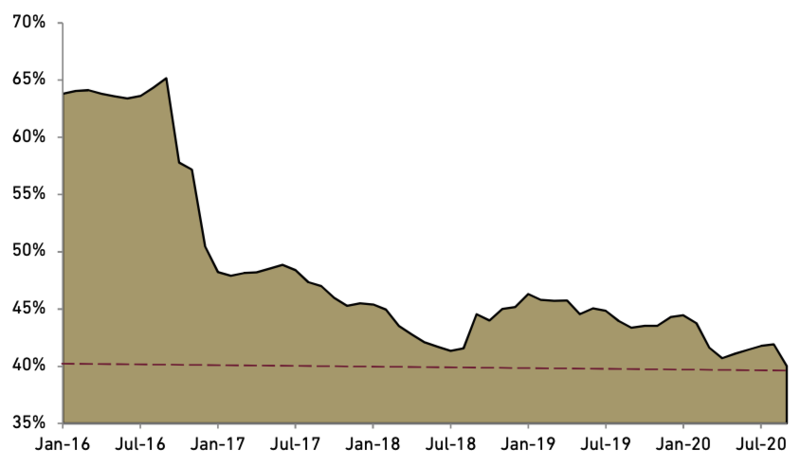

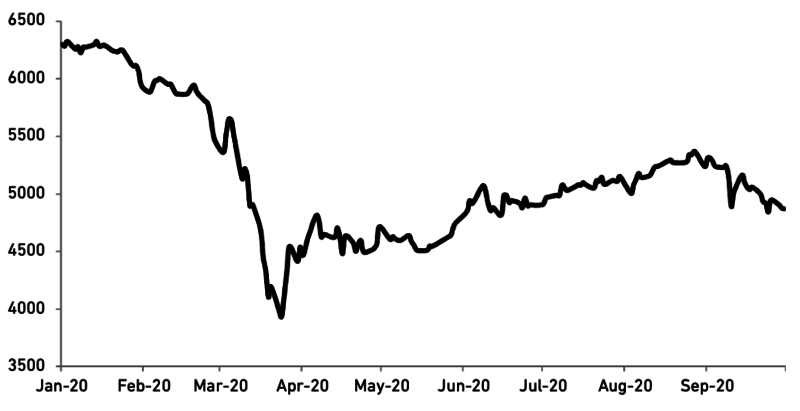

The JCI dropped by 7.0% in September to 4,870 level , in-line with global markets that were in a sea of red led by the slump in US stocks and profit taking activities . We believe recent market weakness is driven by domestic sentiment such as concern on i) more fiscal support from government , ii) BI’s independence , iii) continued rising Covid-19 cases prompting longer strict mobility measures as well as iv) persistent net foreign selling partly due to Indonesia’s weighting loss in MSCI EM mainly on increased weight in China weightings. Foreign investors recorded net foreign selling of USD2.91 bn in 9M20 leaving foreign ownership of Indonesia to lowest level of 40%.

and gradual economic re-opening iii) potential coronavirus vaccines. This is in tandem with global market trends. Another factor that has helped ignite markets is that so many of them are awash in liquidity mainly supplied by retail investors. We opine that the rally had been mostly domestic investor driven dominated by retailers. According to data from Indonesia Stock Exchange (IDX) and OJK (Indonesia FSA), domestic investors contributed 73.3% of total trading of Rp161 tn in Aug-20, 55% of which is retail investors, and foreign investors made up the 26.7% balance. Based on data from KSEI (Indonesia Central Securities Depository), retail investors’ value of equity holding continued to rise by 10.4% to Rp853 tn in 8M20 which is 31% of total

domestic investors holding and 20% of total investors holding (domestic and foreign). Moreover, the number of retail investors in the country had risen to 1.2 mn as of Jun-20, an increase of around 12% from December last year, according to data from KSEI. To sum it up, Indonesia equity market has shown it ability to decouple from the bleak economic data, weak earnings and heavy net foreign selling of USD1.9 bn in Mar-Aug 2020

- September sell-off but market remains intact

The JCI dropped by 7.0% in September to 4,870 level , in-line with global markets that were in a sea of red led by the slump in US stocks and profit taking activities . We believe recent market weakness is driven by domestic sentiment such as concern on i) more fiscal support from government , ii) BI’s independence , iii) continued rising Covid-19 cases prompting longer strict mobility measures as well as iv) persistent net foreign selling partly due to Indonesia’s weighting loss in MSCI EM mainly on increased weight in China weightings. Foreign investors recorded net foreign selling of USD2.91 bn in 9M20 leaving foreign ownership of Indonesia to lowest level of 40%.

On global factor, upcoming US election, less dovish Fed were also contributed to the market anxiety. Historically, September is also not a great month for the markets. The average daily trading value (ADTV) of shares traded on Indonesia bourse (IDX), which touched a peak of Rp8.13 tn in August dropped by 16.9% in September to Rp6.76 tn. However, we believe retail investor that has been dominating daily trading did not flee the market as ADTV in September is relatively equal to average turnover in April to August period of Rp6.84 tn when market staged rally. Therefore, we believe the downtrend is likely temporary and part of market correction and profit-taking after a strong rally.

Exhibit 18: JCI performance in 9M20

Source: Bloomberg

Exhibit 19: Foreign ownership of Indonesia equity

Source: KSEI

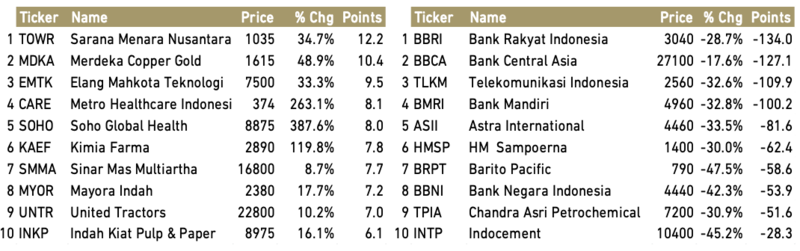

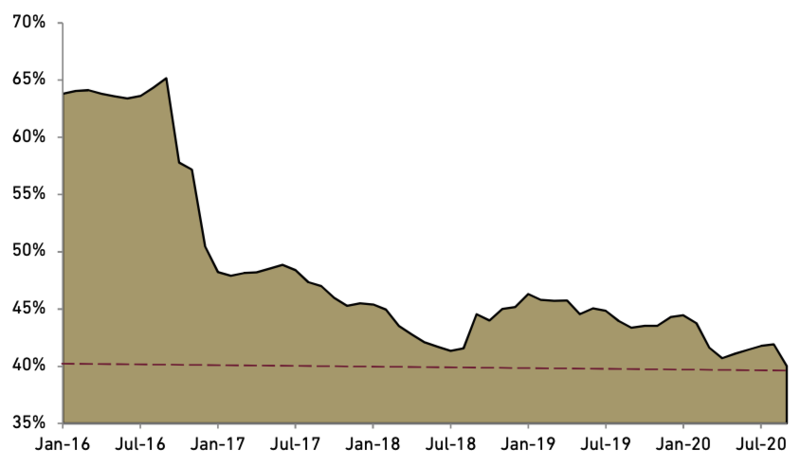

- The top laggards & leaders stocks

The JCI dropped by 1,429 points or 22.6% to 4,970 as at 30 September and among worst performing markets in the region. One of the main reasons for Indonesia did not participate in the global rally is its lack of technology stocks. We looked at various stocks in JCI that have contributed the most to the decline and have seen selling pressure. Among JCI constituents, large-caps bank led the lagging movers include: BBRI (-28.7% YTD ; contributing -134.0 points decrease to JCI) , BBCA (-17.6% ; -127.1 points), BMRI (-32.8% ; -100.2 points). We believe this is due to the expectations that the Covid-19 outbreak will hit banking sectors through weaker economic growth, slower credit growth and dampened profitability. This is followed by TLKM (-32.6%; -109.9 points) and ASII (-33.5%; -81.6 points) due to 51% YoY . Among the top leaders pack are TOWR (+34.7%; 12.2 points), MDKA (+48.9%; 10.4 points). There were plenty of rallies in several stocks that might have got unnoticed due to their thin trading liquidity such EMTK, CARE, and SOHO

Exhibit 20: Top leaders and top laggards in JCI in 9M20

Source: Bloomberg

All other sectoral indices ended in the red in 9M20 in the following order : Misc. Industry of -33.0%, Construction / property of -32.4%, Infra/utilities of -30.9%, Basic Industry -27.5%, Agricultural of -25.4%, Finance -23.2%, Trade & Service of -18.0%, Mining of -14.0% and Consumer goods of -10.9%.

2021 : Moving from recession to recovery

- Gradual recovery seen next year after poor 2020

The global markets look optimistic on the shape of the economic recovery going into 2021 supported by further easing of movement restrictions, boost in fiscal spending, low interest rates and vaccine developments. Based on recent news flow we witness the global race to develop a vaccine with China is as it has four candidates in the last phase of clinical trials, more than any other country. The U.S. has three vaccine candidates in late-stage trials, with Pfizer saying it could apply for emergency approval in October-November. Russia has announced that it has granted regulatory approval to a Covid-19 vaccine. According to WHO, more than 200 vaccine candidates are being developed and trialled globally. In other words, the plausibility of a Covid-19 vaccine is no longer a matter of if, but when. Working on a base assumption that Indonesia economy will gradually reopen, we believe the worst is somewhat priced-in for Indonesian economy and market despite confidence is still lacking in the speed of the economic recovery. We also expect foreign investors to return to into Indonesia as weakened USD and a global hunt for value while we also expect stable Indonesia weighting in the MSCI EM going forward.

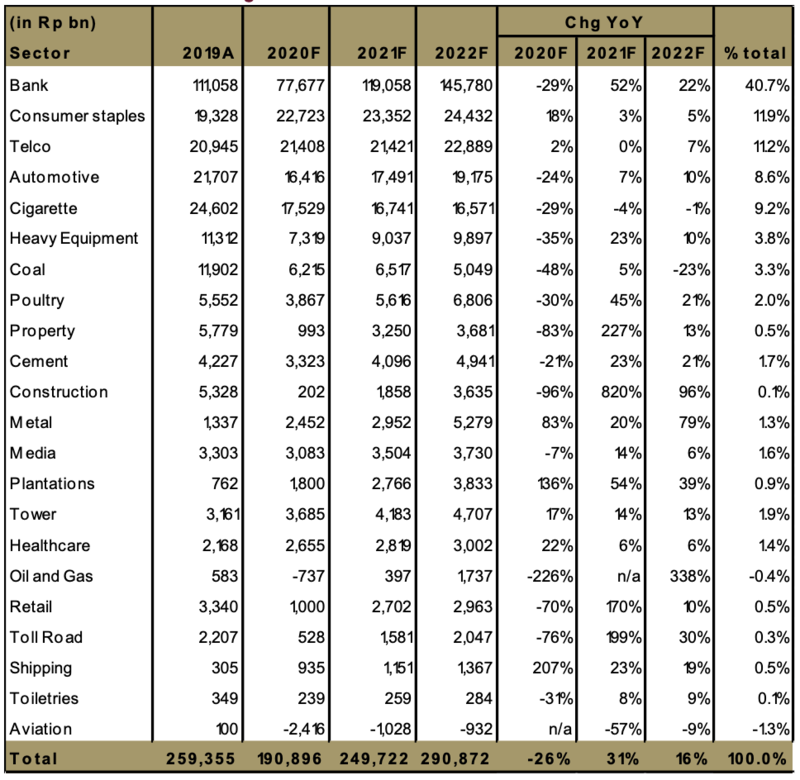

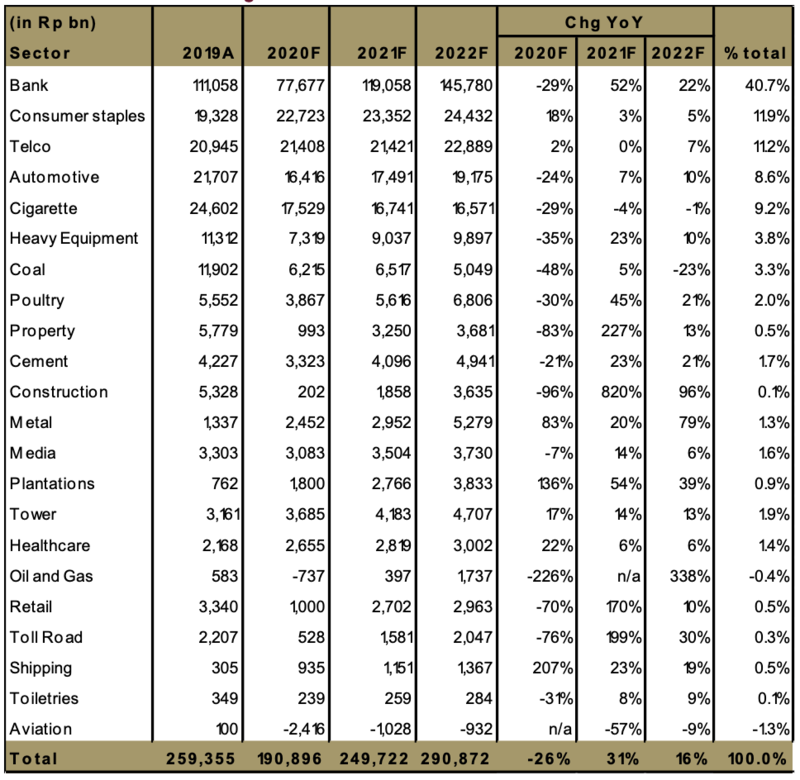

- Corporate earnings to strongly recover off low-base

The aggregate 2020F and 2021F earnings of the JCI constituents under our coverage, representing 68% of the JCI’s market cap, are Rp191 tn and Rp250 tn, translating to market EPS of 297 (-26% YoY) and 389 (+31% YoY). The earnings growth in 2021F will be boosted largely by the banking sector with net profit growing by 52% (vs. -29% in 2020F) led by BBRI of 79% (vs. -40% in 2020F) , BBCA of 34% (vs. -17% in 2020F) and BMRI of 54% (vs. -30% in 2020F). Other sectors such as heavy equipment, cement, and metals and plantation are also forecast to post double-digit earnings growth. Our 2020F market EPS of 297 returns to 2014 level (296), 2021 EPS of 389 is between 2018 (378) and 2019 (401) levels and we expect our market EPS to exceed pre-Covid level in 2022F at 452.

Exhibit 21: Sectoral earnings

Source: Listed companies and Ciptadana estimates

- Valuation and index target

JCI valuation is mostly cheaper and more attractive relative to its regional peers. The PER of JCI stood at 2020-21F PER of 16.4-12.5x (31% earnings growth ) which is cheaper than ASIA Ex-Japan PER of 19.3-15.8x (22% growth). We are still positive on the market, on the basis of potential near-term catalysts such as i) better quarterly earnings in 3Q20 supported by higher earnings from banks on higher NIM and better cost of fund. Banks earnings accounts for 41% of our aggregate earnings of Rp191 tn in 2020F. We also saw volume improvement in car sales, cement and gas volume in 3Q20. ii) Additional stimulus from government including tax relief for automotive sector, 3) finalization of omnibus law, and 4) news about vaccine development. At this juncture, we retain our year-end 2020 JCI target of 5,530 that would mean 13.5% upside over September’s close, but 12.2% negative return for the calendar over the December 31, 2019 close of 6,299. We also introduce year-end 2021 JCI index target of 6,425 based on 14.2x forward earning (-1stdev of mean).

Exhibit 22: JCI forward PER band

Source: Bloomberg and Ciptadana estimates

Our preferred sectors for 2021 are banks, consumers, telecom/tower, cement, utilities, and metal commodity based on our gradual economic recovery theme coupled with earnings growth, valuations, and attractive entry points.

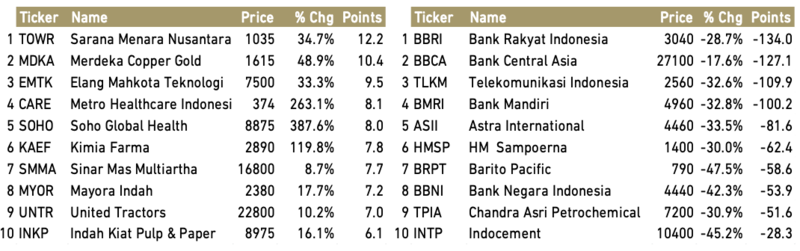

- Banks: The fate of the banking sector is closely tied to the economic cycle. Just as banks are negatively affected when the economy heads into a downturn, the fortunes of banks are expected to improve in a cyclical recovery as the pressure from credit cost recedes and loan demand picks up. Our top bank stock picks are : BBRI and BMRI

- Consumer (staples and pharmacy): While the sector is clearly defensive in nature during recessions, packaged food and pharmaceutical products will continue to benefit from an uptick in demand because of stay-at-home behavior is expected to continue at least until 1H21 and an increased focus on health. The extended stimulus/benefits for household will also help support households disposable income. We like ICBP and KLBF on this theme.

- Telco/tower operator : We believe TLKM will be beneficiaries of the Indonesia’s use of technology-enhanced infrastructure such as the internet and long-term digitalization trends coupled with its attractive valuation at 4.4x 2021F EV/EBITDA , dividend yield of 6.9% as well as its stock laggard performance this year (-32.6%). We also like TBIG, the telco tower operator which should benefit from robust data demand and competition among telcos.

- Toll road operator: We expect toll-road traffic levels should recover quickly as lockdown measures are loosened to support economy recovery. JSMR is our top pick in this sector.

- Commodity: We believe it is also suitable to add commodities in the recovery phase with MDKA as our top pick. The improvement in global economic activity with - monetary policy remaining accommodative - has led to some gains in industrial (copper) and precious (gold) metals while current gold rally.

- Tanker operator: We expect tanker rates to remain strong going into 2021 on global tight supply as tanker orderbook, measured as a percentage of the existing fleet, is currently at a 23-year low of around 8%. We like BULL, tanker operator with extraordinary earnings growth of 94% CAGR seen in 2019-21F.

Sector wise, we are overweight on banks, consumer staples, telco, tower, healthcare, metal, toll-road, shipping, plantation, property, media. We are neutral on cigarette, cement, automotive, heavy equipment, construction, retail, coal and poultry. We assigns an underweight rating on aviation.

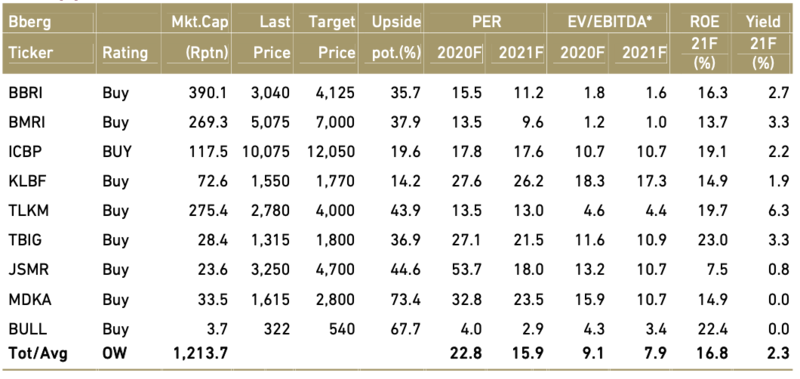

Exhibit 23: Our top picks

*PBV for banks

Source: Bloomberg and Ciptadana estimates