Healthcare Overweight

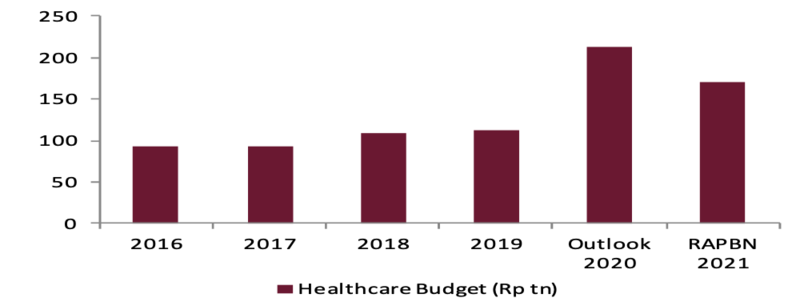

- Budget allocation for healthcare in 2021

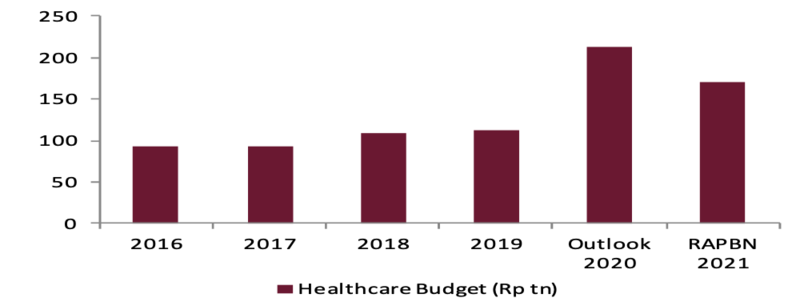

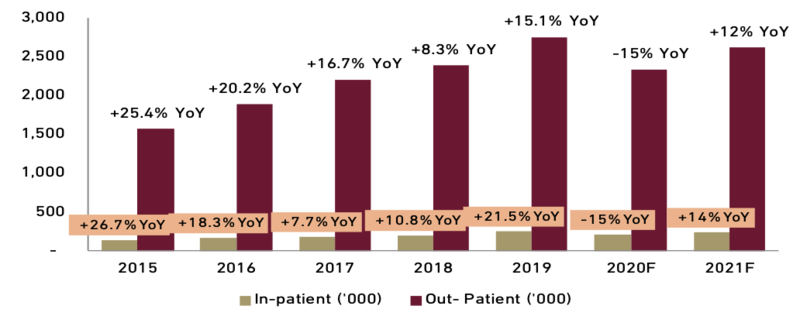

Indonesian government sets Rp169.7 tn of healthcare budget allocation in 2021 (-20.1% YoY), representing 6.2% of state budget in 2021 (.vs 5.23% of state budget in 2020). Government allocate lower budget, as some of the healthcare equipment that was already purchased in 2020 can still be used in 2021. However, the budget for healthcare ministry (Kemenkes) increased by 7.4% YoY to Rp84.3 tn. Government spending for healthcare budget booked solid growth of 12.8% CAGR from 2016 – 2021, it indicates that the demand for healthcare services and products in Indonesia are keep increasing, which will benefit hospital companies, due to higher patient volume. For pharmaceutical industry, we expect higher healthcare budget allocation would lead to higher demand for unbranded generic products, under prescription pharmaceuticals division. In 2021 government plans to do JKN reformation through better services, JKN cost effectiveness, payment scheme improvements, data validation for PBI (recipients of government allowance for Indonesian poor society), and strengthening the role of local gorenment. We believe, if JKN is improved, this will benefit pharmaceuticals and hospital players including KLBF and SILO in-term of better administration process.

Exhibit 80: Indonesia Healthcare Budget

Source: Finance Ministry, Ciptadana

- Government priority in 2021

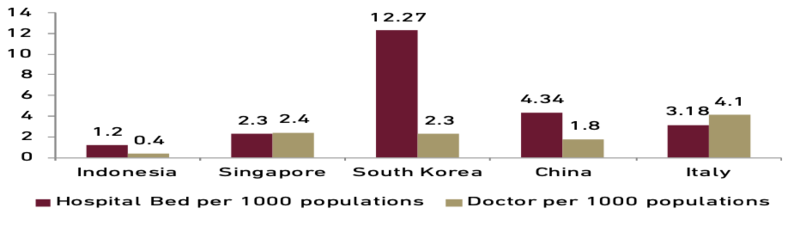

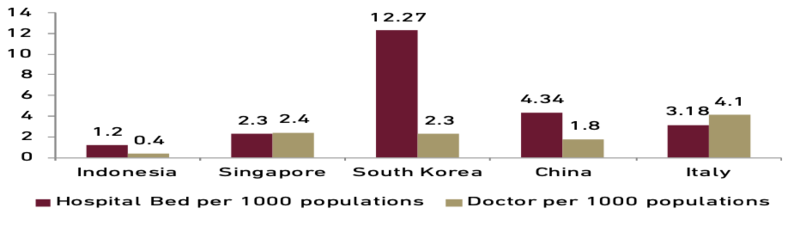

During Covid-19 pandemic, Indonesia is far behind other countries in terms of lack in bed capacities and doctors. To support the Indonesian healthcare system reformation, government point out some important focus such as, targering 96.8mn people of PBI (recipients of government allowance for Indonesian poor society), amounting to Rp48.8 tn. Helping on the payment scheme for PBPU (non-government salary recepients) and BP (non-worker), amounting to Rp2.4 tn. Government also focus on vaccine procurement, targeting 160 mn people, which cost around Rp18 tn. From the hospitals side, government aim to build and renovate 559 designated hospitals also build 971 public health centers. We see this as a positive catalyst for hospitals sector, as government try to make accessible and affordable healthcare services to all society level, especially for the low-income society. This may increase the patient volume of the hospitals operator in second tier cities, and rural area.

- Indonesia’s healthcare industry is still underpenetrated

According to world bank data, the ratio of hospital’s bed in Indonesia for every 1000 populations is only 1.2, lower than Singapore with 2.3, and South Korea with 12.27. The doctor ratio for every 1000 populations is only 0.4, lower compared to other countries. In terms of spending, healthcare spending is still low, at 3.3% of GDP, lower than the average of countries with low income level 6.1% of GDP, and also lower than the average of East Asia Pacific countries with 7.4% of GDP. Even with the currently-low healthcare spending, most private hospitals are already overcrowded and profitable, which implies a huge growth opportunity. Hence, we believe, there is still much room for improvement on Indonesia Healthcare sector.

Exhibit 81: Hospital Bed and Doctor Ratio

Source: WDI World Bank, Ciptadana

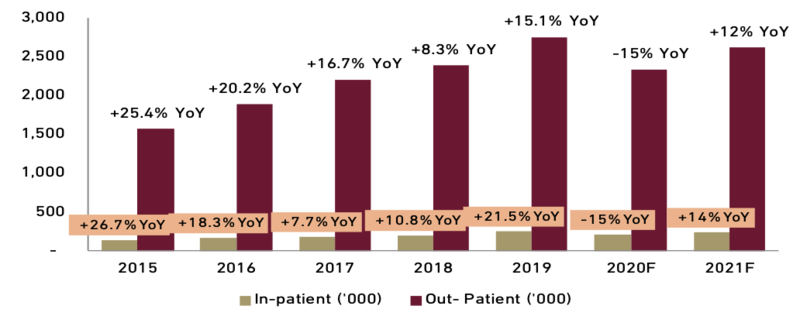

- Patient volume recovery in 2021

Covid-19 have negative impact for hospitals, in terms of decline in patient volume. We believe people prefer to do self-medication for non-serious illness,especially during PSBB (social distancing) in April and May. Using SILO as an example, in 2Q20, SILO in-patient volume dropped by 44.8% YoY to 32.7 th. While Out-patient volume fell by 45.4% YoY to 347.1 th. However, we believe patient volume to improve in 2021, due to economic recovery and vaccine (we expect vaccine to be available in 2Q20). Other hospital operators (MIKA and HEAL) claimed on significant volume improvements after total PSBB in April and May 2020, which made current volume level to reach 90% pre Covid-19 level. Improvement in patient volume lead to higher revenue per patient and higher gross margin.

Exhibit 82: SILO patient volume (in th. people)

Source: SILO, Ciptadana

- Pharmacy business will keep growing in 2021

Using KLBF as a proxy, Pharma sales declined by 16.4% QoQ, as in 2Q20, hospitals patient volume declined due to covid-19, this negatively impact this segment, where some of the products are BPJS related medicines for hospitals patient. As we expect patient volume to recover in 2021, pharmaceuticals sales will improve as well. Other than that, government focus on increasing JKN coverage will accelerate demand for unbranded generic products. On the other hand, we see that covid-19 will increase people’s health awareness which should boost demand for OTC and vitamins product.

- The rise of Telemedcine in Indonesia

According to Mckinsey survey on more than 700 Indonesian customers, telemedicine usage growth increased by 67% in the past six months. According to Good Doctor, during Covid-19 pandemic, the user traffic increased by eight-fold since early Covid-19 in Indonesia, and 25% of it were related to covid-19. On the otherhand Halodoc app offers affordable consultation cost from Rp10,000 to Rp50,000, depending on the doctor’s type (general or special practitioner). Users can receive their prescribed medicines via Gojek or Grab delivery services. Telemedicine offers more convenient and affordable way in obtaining healthcare services. We see this positive trend will continue to grow in 2021, which create a good synergy between online and offline healthcare system, users of telemedicine can be further being referenced to hospitals or clinics, as many diagnoses still need brick and mortar medical treatment.

- Valuation and recommendation

We have an OVERWEIGHT rating for healthcare sector, we believe on patient volume recovery in 2021 and government support on healthcare revolution system which may boost demand for perscibtion pharmaceuticals. Our top pick is KLBF, as pharmaceutical business will keep growing in 2021. We like pharmaceuticals industry on its defensive nature, people will keep looking for medcines in any situations because health is one of the most important aspects in human’s life. We see KLBF will benefit from growing OTC products and stable IDR. We have a BUY call for KLBF with 2021F TP of Rp1,770/sh, based on 30x multiple or at its 5-yr historical average. Currently, the stocks trades at 26.2 x 2021F PER. Risk to our call; slower than expected GDP, Rupiah depreciation, surge in skimmed milk price.

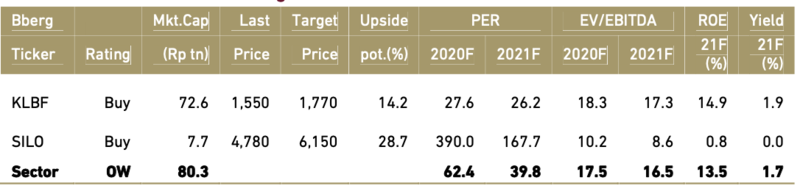

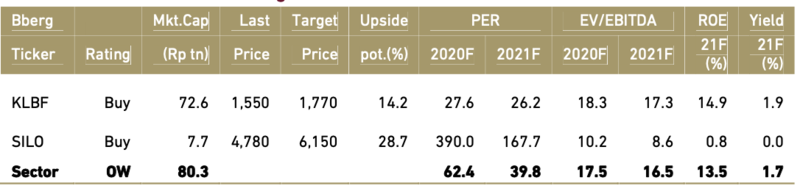

Exhibit 83: Healthcare stocks rating and valuation