Metal Mining Overweight

Sector Outlook

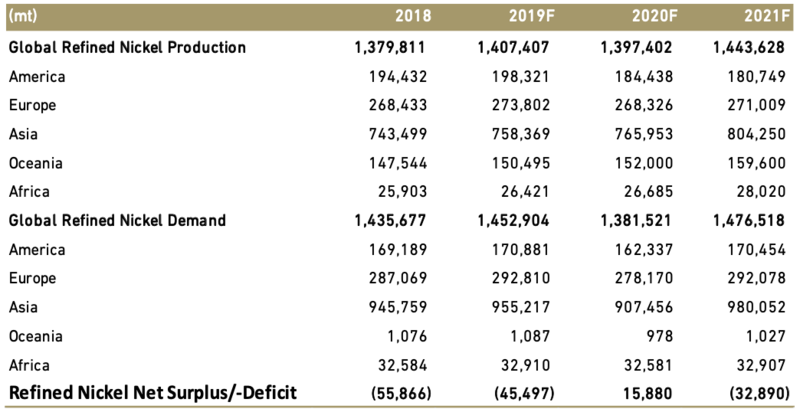

- China steel production boost nickel prices

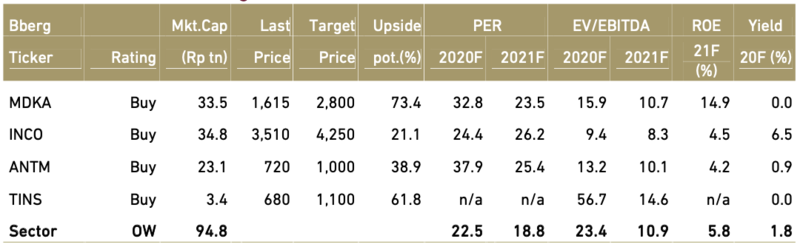

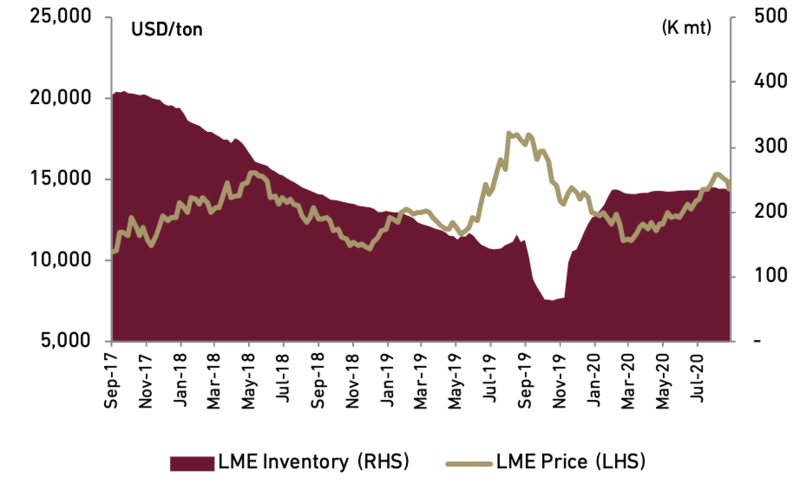

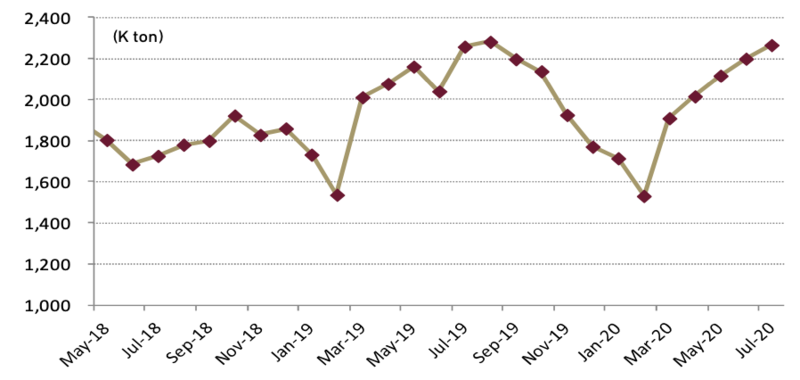

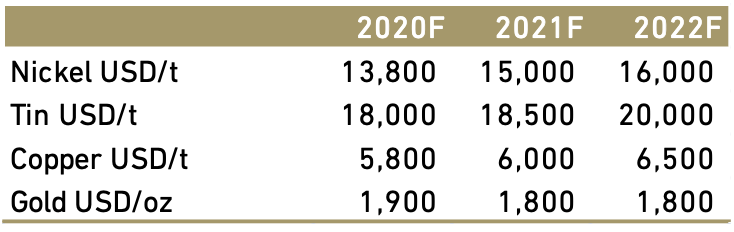

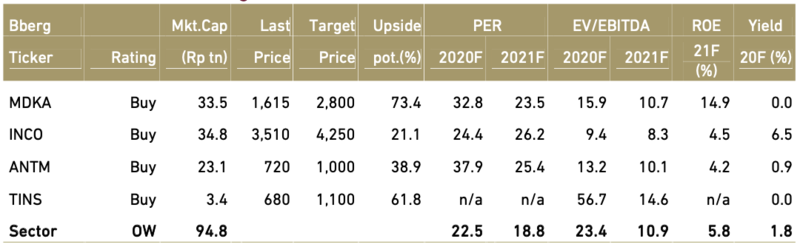

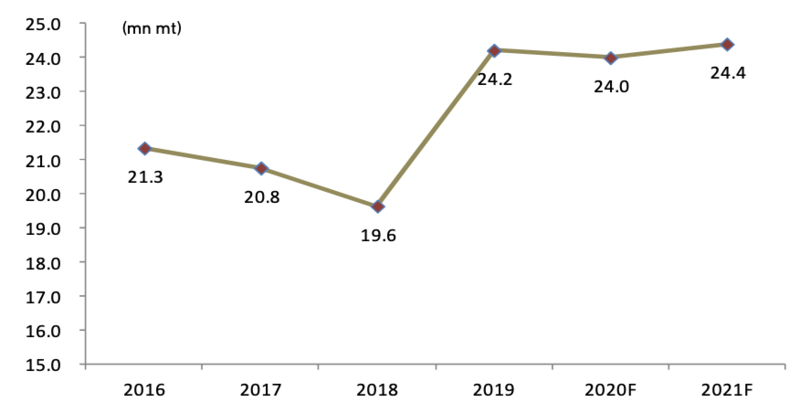

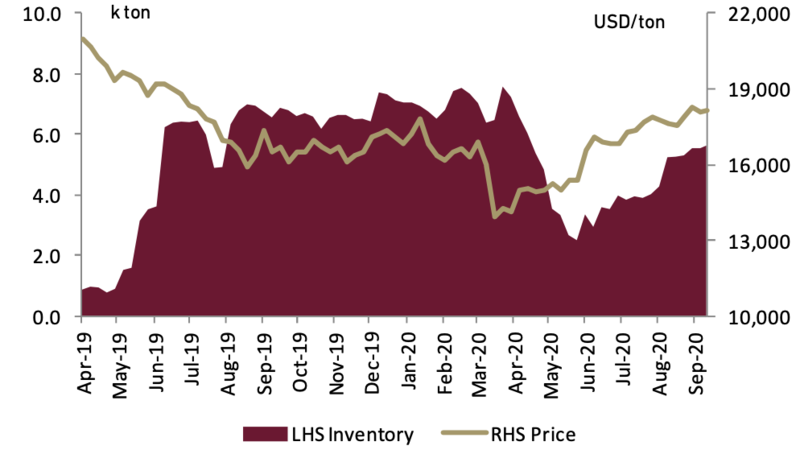

Nickel prices slumped to USD11,225/ton Ytd in March 2020 because of China’s pandemic situation and steel mill shutdowns in 1Q20 as China contributing around 52% of the world stainless steel production. At the time of writing however, despite an alarmingly high level of nickel inventory of 236k ton (+51% Ytd), nickel prices have surged by 28.6% since March to USD14,431/ton. This is primarily due to strong production recovery of China’s nickel-based stainless steel production, sparked by Chinas improving economy post Covid-19 restrictions. The country has been able to produce 13.7 mn tons in July 2020 only down 0.5% YoY and is still on track to produce around 24 mn tons of stainless steel this year.

Exhibit 84: LME Nickel price and inventory

Source: Bloomberg

Exhibit 85: China monthly nickel based stainless steel production

Source: Bloomberg

Exhibit 86: EV demand estimate

Source: Bloomberg, Ciptadana estimates

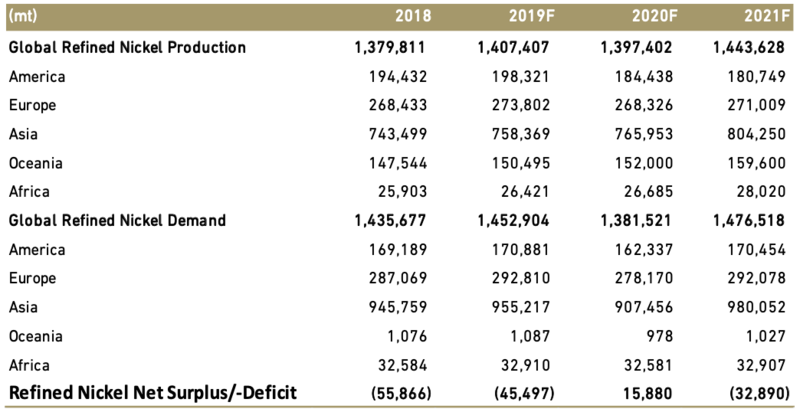

Despite strong demand recovery from China’s stainless steel industry, we still expect a surplus of 15.8k tons this year, before returning to a deficit of 32.8k tons in 2021. As a result, we recently increased our FY20-22F nickel price to USD13,800, USD15,000 and USD16,000/ton, respectively.

Exhibit 87: China yearly nickel based stainless steel production

Source: Bloomberg, Ciptadana estimates

- Tesla proves to be a catalyst for nickel prices in the long run

Tesla CEO Elon Musk recently appealed for mining companies to produce more nickel which is a key source for its electric vehicle (EV) batteries. Elon Musk further added that he would award companies with a huge and long time contract that for those that can provide him with the raw materials that he needed. This would bode well for nickel prices in the long run as Tesla is the predominant EV producers in the world.

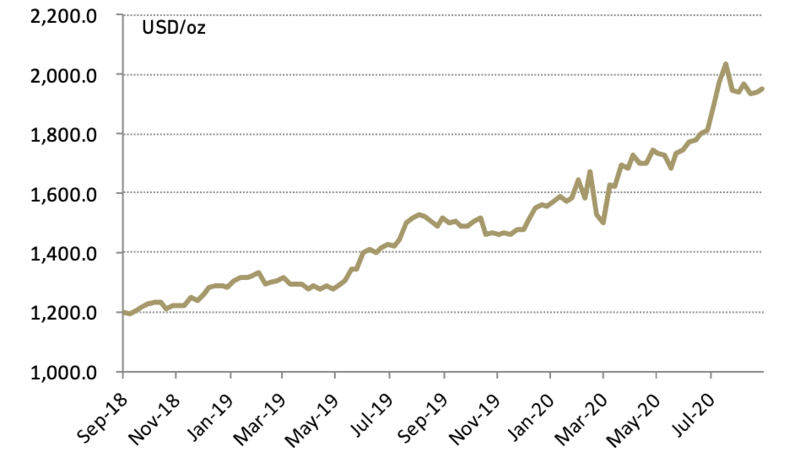

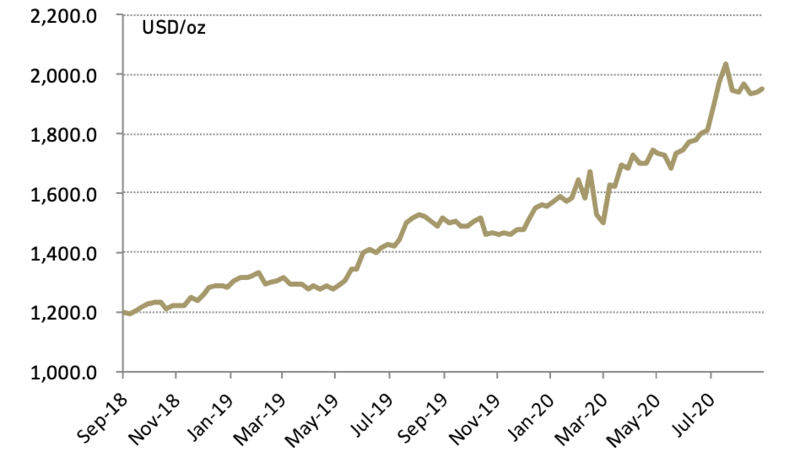

- U.S economic uncertainty and the pandemic stoke gold prices

At the time of writing gold prices has been soaring 25.7% YTD to USD1,950/oz driven primarily by; 1) global coronavirus pandemic, 2) doubt over the speed of U.S. economic recovery, 3) U.S. senate stalemate concerning further stimulus package and 4) fear of another prolonged trade war following president Donald Trump’s recent ban on China mobile apps on the US. The aforementioned factors caused investors to peel-back from the weakening US dollar, boosting gilds safe-haven appeal. Subsequent to gold prices rally, we recently increased our FY20-22F benchmark gold prices to USD1,900 and 1,800/oz, respectively.

Exhibit 88: Gold price

Source: Bloomberg

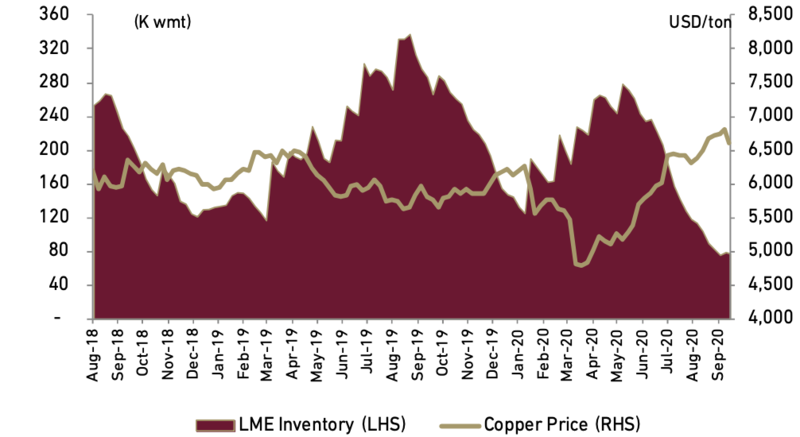

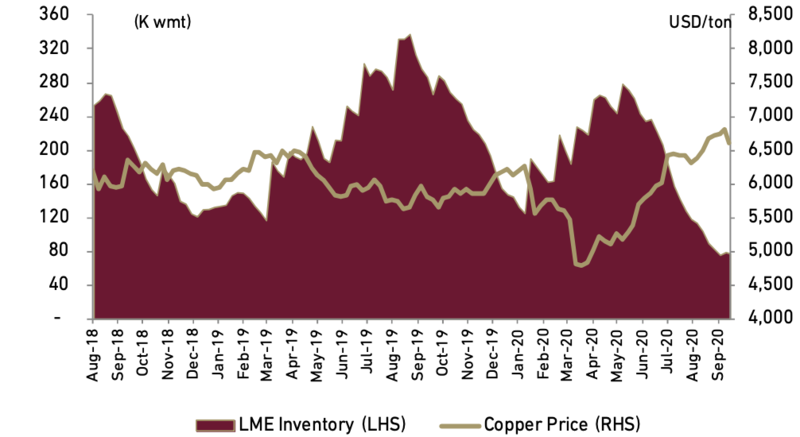

Copper prices have steadily increasing by 37.3% from its lowest point in March to USD6,604/ton, primarily due to a fresh positive economic outlook which predicted a swifter recovery post pandemic mainly from US and China. Moreover, this was further compounded by thinning copper supply which has been steadily declining by 46.5% Ytd to 77k wmt from 144k wmt in the beginning of the year. With demand reinvigorated primarily from China, we anticipated a more balanced market this year, followed by a deficit in 21F. As a result we maintained our FY20-22F copper forecast at USD5,800, USD6,000 and USD6,500/ton, respectively.

Exhibit 89: LME copper price and inventory

Source: Bloomberg

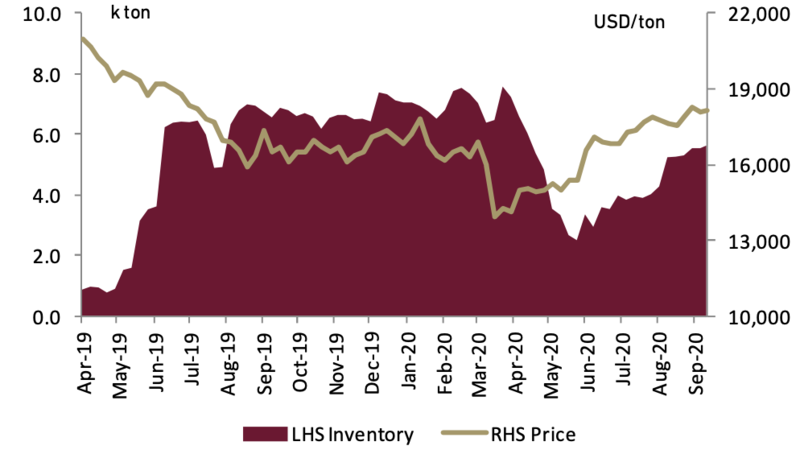

- Rising Chinese demand stoking tin prices

Tin prices have been rising steadily 6.3% Ytd whilst LME inventory has been steadily declining (-21.0% Ytd) to 5.6k wmt from 7.1k wmt in the beginning of the year. This is primarily due to recovering Chinese economy sparking an increase of demand for refined tin. Furthermore, smelter maintenance and declining tin ore supply from Myanmar further tightened the already tight raw materials for Chinese smelters, causing Chinese consumers to import more refined tin. Following a faster than expected China economic recovery, we anticipated a more balanced market this year, followed by a deficit in 21F. As a result, we maintained our FY20-22F tin benchmark forecast at USD18,000, USD18,500 and USD20,000/ton respectively.

Exhibit 90: LME tin price and inventory

Source: Bloomberg

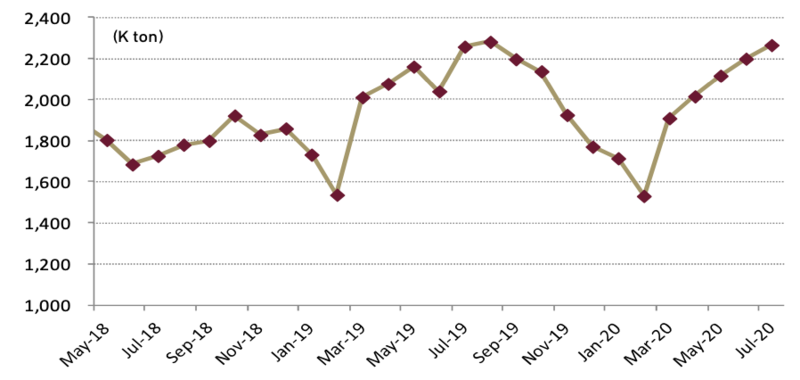

- Maintain Overweight rating for metal sector

We maintained our overweight rating for metal sector on account of positive gold price outlook and recovering metal price outlook. We select MDKA as our top pick, mainly due to MDKA’s gold producing capabilities ensuring a relatively stable earnings growth caused by gold price stability. Furthermore, MDKA’s Copper and Pani Project potentials are also too good to ignore.

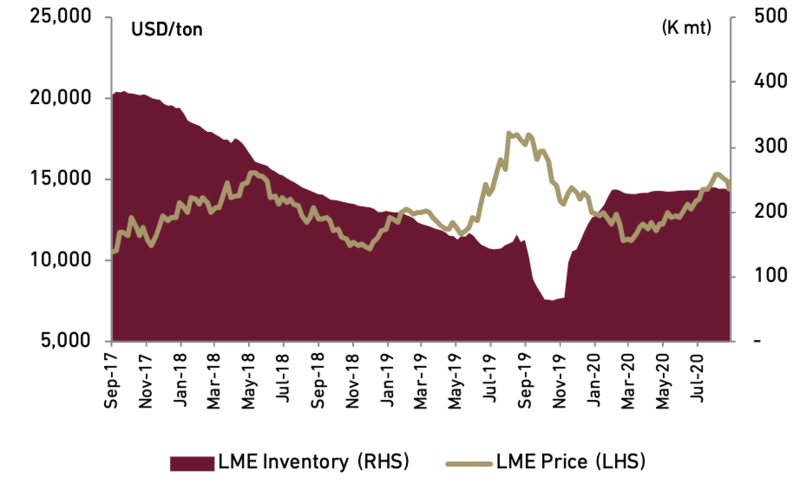

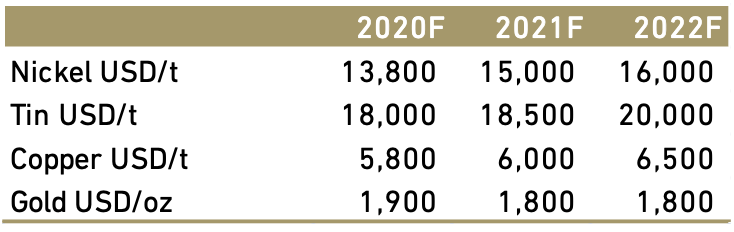

Exhibit 91: Our metal prices estimate

Source: Ciptadana estimates

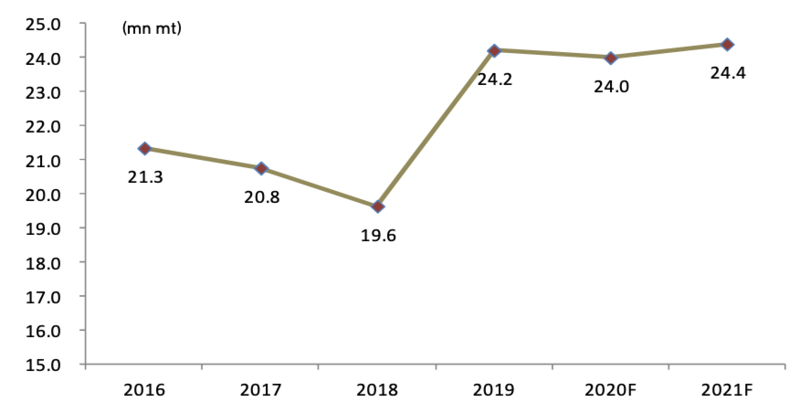

Exhibit 92: Metal stock rating and valuation