Shipping Overweight

Sector Outlook

- Extraordinary rate in 1H20

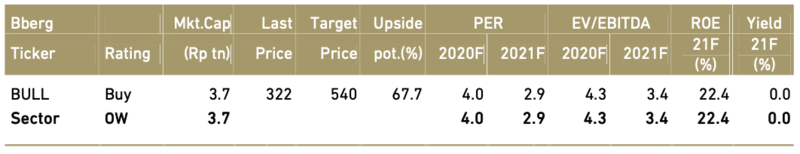

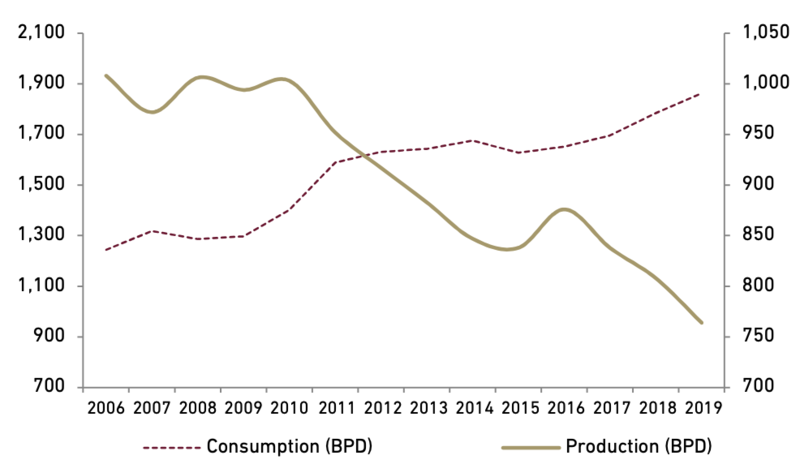

Tanker market trading conditions have been robust since Sep-19 and continue to 2020. The special case developed in the spring when oil demand plummeted as economies worldwide were shut down to control the spread of Covid-19. The resulting oil price collapse created a demand for tankers as temporary floating storage facilities, and tanker rates spiked. The most recent spike in tanker rates came in 2H20, with an Aframax/ LR2 product tanker reached a historic peak of USD170,000/day. Rates were supported by a sudden increase in demand for floating storage, caused by the OPEC+ alliance failing to agree production cuts in March. With significant demand destruction caused by Covid-19 lockdowns and increased supply, mainly from Saudi Arabia, the stark mismatch between demand and supply caused a rapid build-up in onshore inventories, with tankers acting as the last resort to place excess oil and peak floating storage absorbed nearly 500 tankers.

Exhibit 99: Aframax tanker spot rate

Source: Tanker market research

- Rates outlook in 2H20-2021

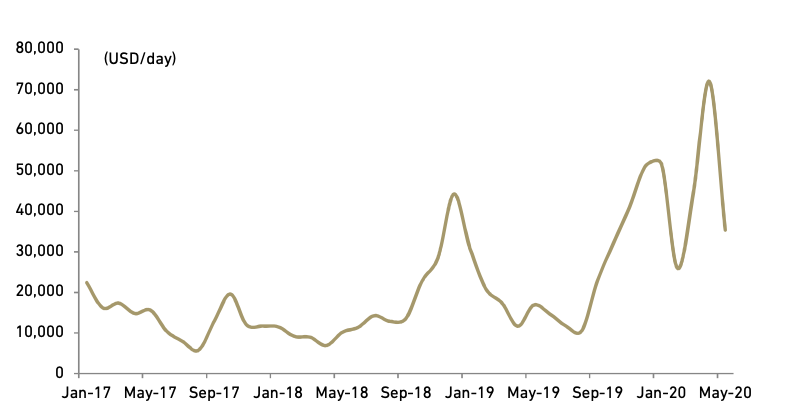

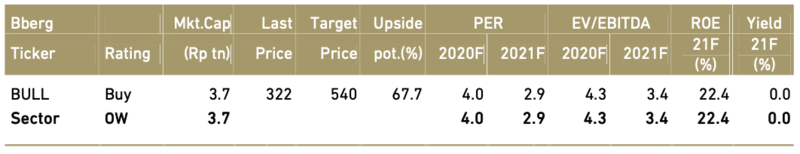

More challenging future tanker market conditions seen in 3Q20, with an accumulation of oil products in key regions expected to pressure product tanker flows. Therefore, rates for crude tankers were negatively impacted resulted average Aframax Time Charter Equivalent (TCE) rate fell to USD22.4 k/day from USD47.7 k/day. We believe tanker supply fundamentals can offer a positive counterbalance to support rate going into 4Q20 and 2021. Although floating storage has fallen from its early-May peak, it remains near historically high levels and will continue to occupy a significant number of vessels for the foreseeable future. Chinese plants are taking advantage of the lower oil price environment to ramp-up imports and output. Notably, China’s crude oil imports jumped by 20% YoY to an all-time high of 13 mb/d in July, resulting long port congestion that may last in 3 months.

Exhibit 100: Quarterly Aframax TCE rates

Source: BULL presentation material

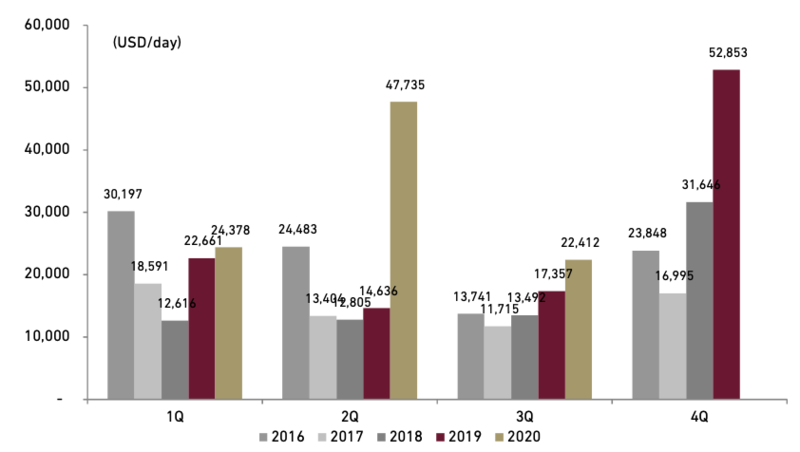

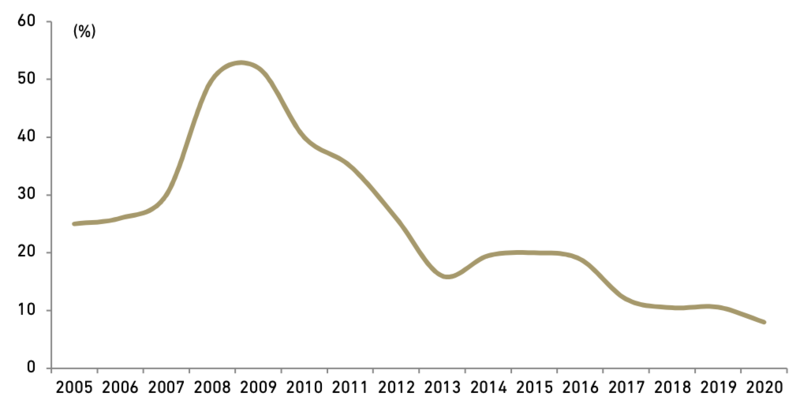

Moreover, rates in 4Q have been the seasonally highest with QoQ increase between 45% to 145% compared to the 3Q rates. The tanker orderbook, measured as a percentage of the existing fleet, is currently at a 23-year low of around 8%. This compares to an orderbook of around 20% at the peak of the last market cycle in 2015 and around 50% in 2008 with end with oil contango. Moreover, we believe that many of the older tankers that now go into the floating storage market are unlikely to come back once their storage contracts are over, and the charter rates are lower again. Those tankers will likely be sold for scrap.

Exhibit 101: Tanker orderbook as % of total fleet

Source: BULL presentation material

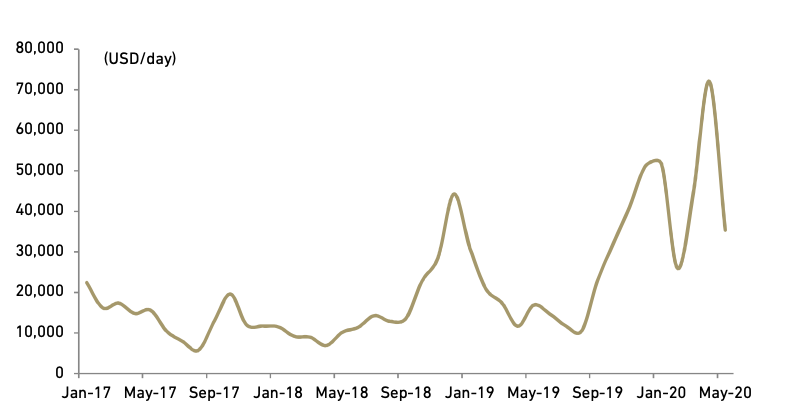

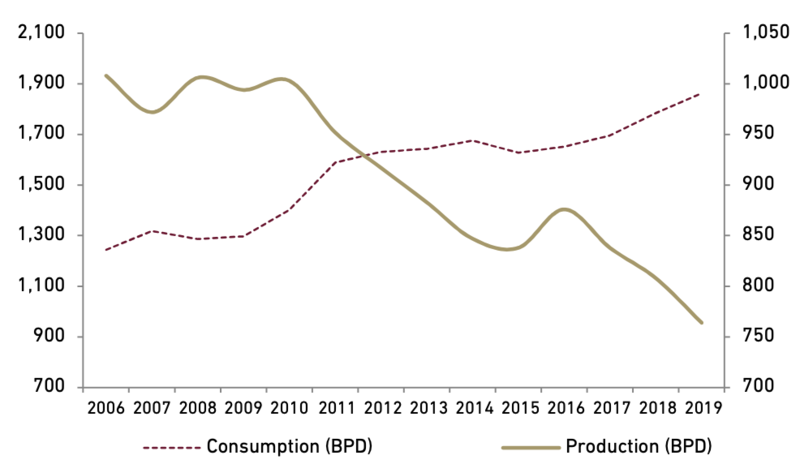

- Domestic market also offers strong long-term outlook

We see continued increase in oil and gas imports to meet oil and gas consumption needs will support Indonesia’s tanker demand as it implies longer distance to ship oil & gas compared the ones originates from Indonesia. Meanwhile, we believe that the continued economic growth and rising per capita income in Indonesia will drive energy consumption growth, which will be partly fulfilled by domestic resource production. In order to optimize the use of petroleum for domestic needs and improve national energy security, the Government issued a regulation in the form of Regulation of the Minister of Energy and Mineral Resources (MEMR) No 42 of 2018 concerning Priority of the Use of Petroleum for meeting domestic needs. The regulation also states that the Cooperation Contract Contractors (KKKS) are obliged to offer their production to Pertamina at a price that is in line with business or business to business. These should help to fuel tanker demand in domestic routes.

Exhibit 102: Indonesia oil production and consumption

Source: Bloomberg and BPS

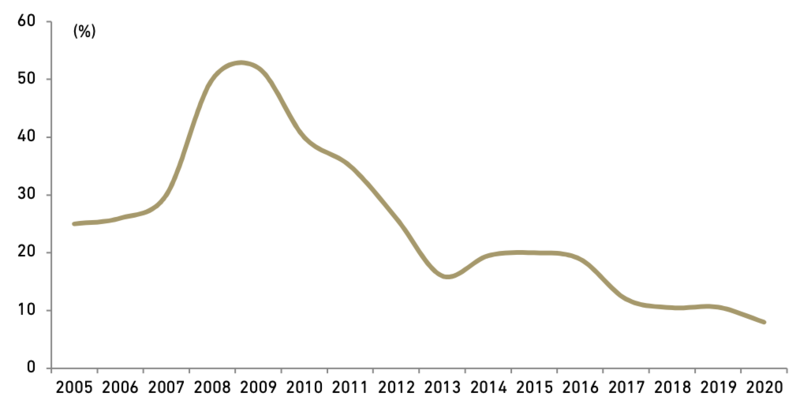

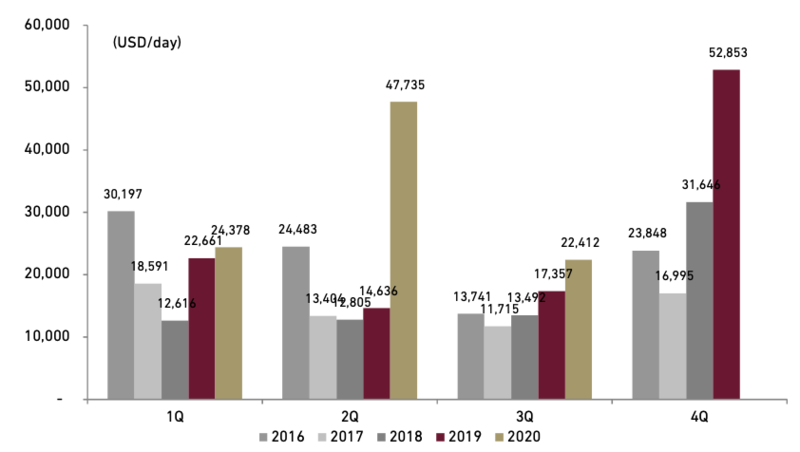

- Our stock picks and stock ratings

Buana Lintas Lautan (BULL) is the only stock we cover in the shipping space. We are convinced that the stock will continue to enjoy higher rating as investors will price in what we perceive as solid business profile , underpinned by time charter contracts and high utilization rate which provide good revenue visibility and strong profitability. We like BULL’s very thick margins, strong ROE, and fast growing fleet, We believe there is scope for BULL’ share price to rise further as a combination higher revenue and margin expansion should underpin 2019-21 F strong 94% CAGR in net profit.

Exhibit 103: Shipping sector rating and valuation