Banking Overweight

Sector Outlook

- Earnings continue to rebound on the back of CoC and resilient NII

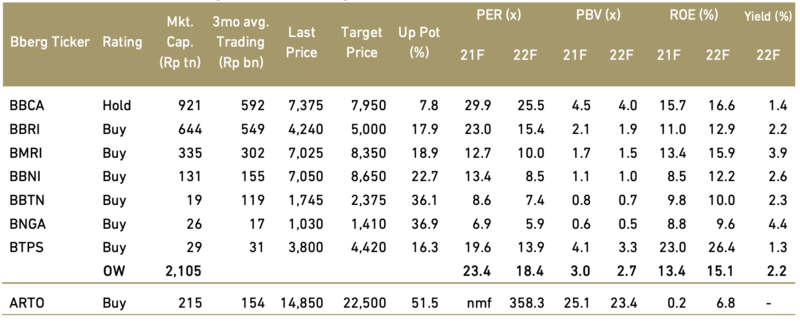

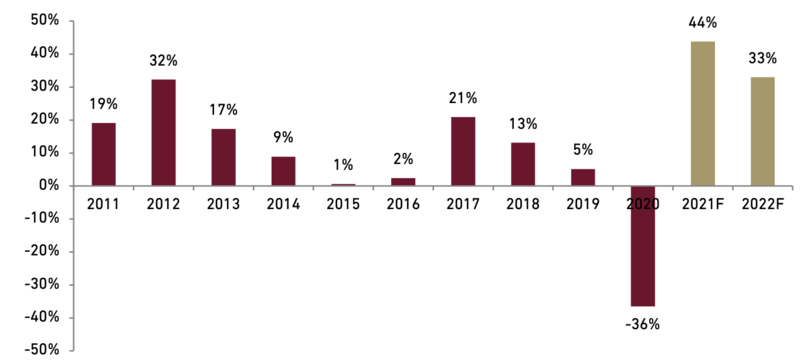

After posting a significant decline in 2020 at -36% YoY, earnings for banks under our coverage continues to recover as we expect a 44% YoY in 2021F. We believe the earnings growth would still robust for 2022F at 34% YoY following the recoveries on economy. We think the two main drivers of banks’ earnings for 2022F are: 1) cost of credit normalization as it comes from high-base level in 2020-21F and 2) resilient NII, in which lower yield from loan competition will be offset by stronger loan growth along with room for lower cost of fund for certain banks. Credit cost averaged at 2.9/2.6% in 2020/21F, respectively, for banks under our coverage (vs. avg. 1.7% before pandemic), and should improve to 1.7-1.8% in 2022/23F, in our view. Banks were able to generate double digit net interest income growth at 13% in 2021F, but expected to slow to 10/9% in a strong environment of low interest rates and strengthening loan growth in 2022/23F.

Exhibit 28: Earnings growth for banks under our coverage

Source : Companies and Ciptadana Sekuritas Asia

- Stronger-than-expected loan growth in 3Q21; loan recovery to continue in 2022F

Banks under our coverage reported a 9.4% YoY loan growth as of 3Q21. Hence, we believe our loan growth target for 8.5% YoY in 2021F would be easily achieved seeing the already improving loan demand. The loan growth achievement also beat consensus which expects a mid-single digit loan growth. Loan growth was mostly contributed by retail (especially micro) and consumer (especially mortgage) in 2021F. However on 2022F we expect the loan demand is more distributed to every segment. We expect loan growth would be contributed by big banks, as they could secure more loan volume considering their competitive lending yield. Therefore, we expect a higher loan growth for banks under our coverage compared to the banking system overall. We expect the loan growth would improve furthermore to 9.5% for banks under our coverage (vs. 7% for the banking system) in 2022F.

Exhibit 29: Loan growth trends

Source: OJK, Companies, and Ciptadana Sekuritas Asia

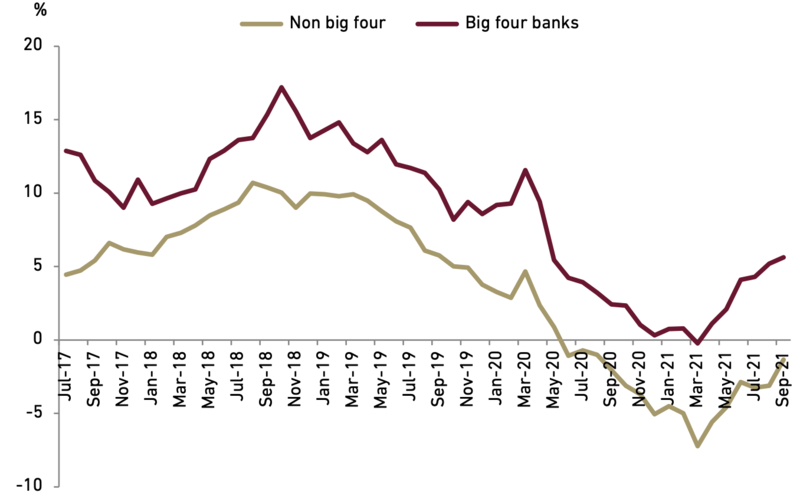

- Loan competition to push down asset yield

We see that loan pricing will not be robust as banks try to maintain market share in the middle of economic recovery and at the same time protect asset quality. While the room for lower yield is quite ample given the much lower CoF based as compared to before pandemic. We also see differentiation on CoF on among banks under our coverage to be lesser than in the past, especially before pandemic, hence providing a more playing field level for loan competition and loan yield, in our view.

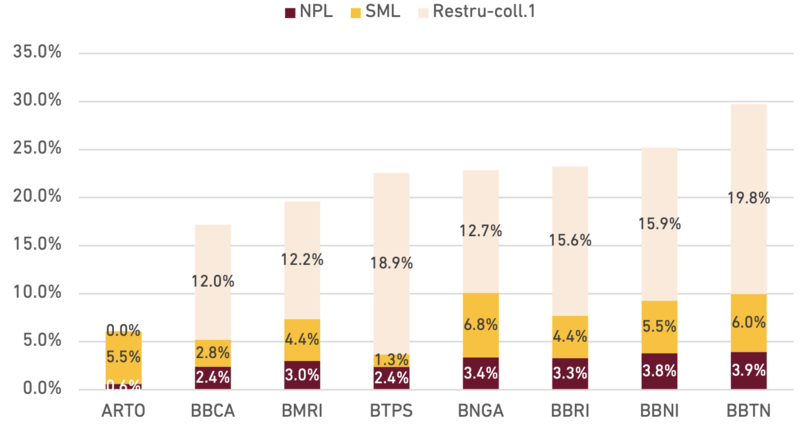

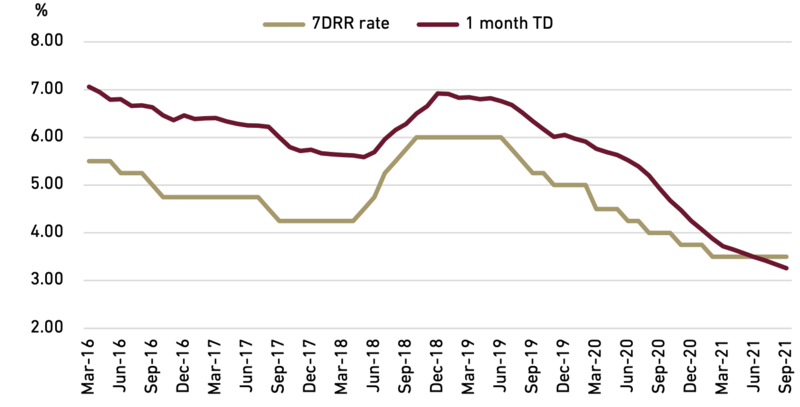

However overall we expect the decline would not be as steep as 2021F considering: 1) bottoming BI benchmark rates at 3.5% (we expect BI 7DRR rate to ticked up to 3.75% in 2022F, and 2) normalisation of loan yield come from loan restructuring. We see that around one third of loan under restructuring flag has exited the restructured scheme, and more to come in 2022F. We see this will support our thesis of resilient NIM for banking sector in 2022F. Tighter-than-expected competition in lending market would be the main threat to the loan yield.

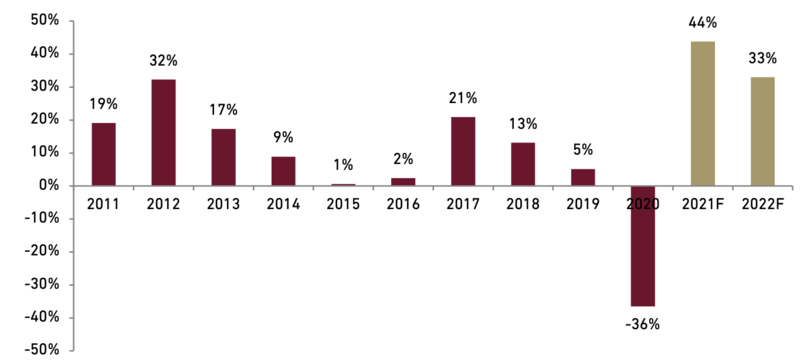

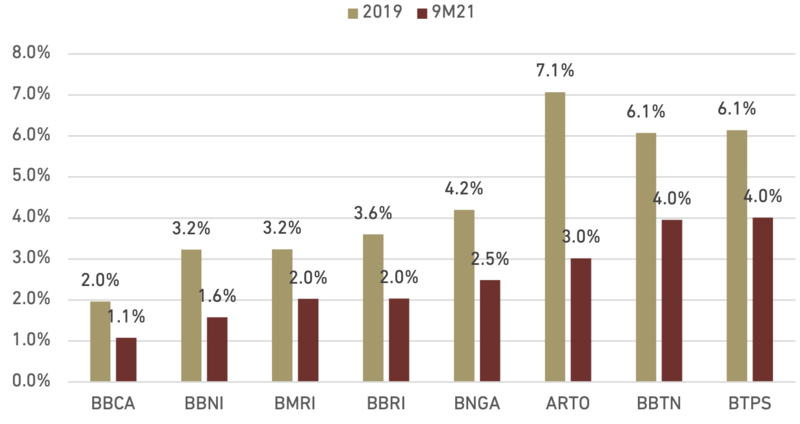

Exhibit 30: Cost of funding for banks under our coverage

Source: Companies and Ciptadana Sekuritas Asia

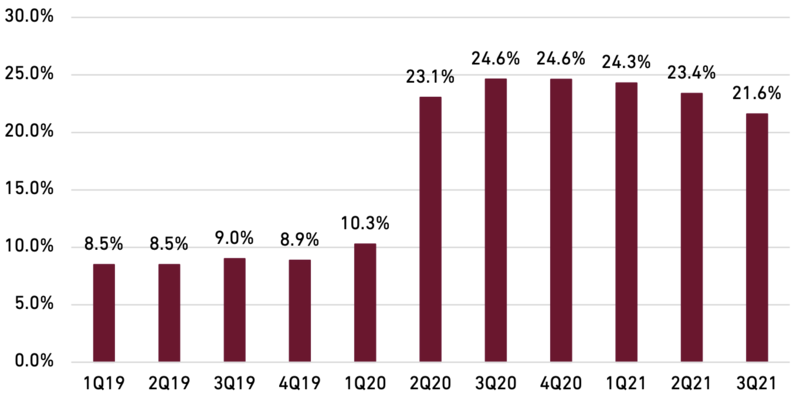

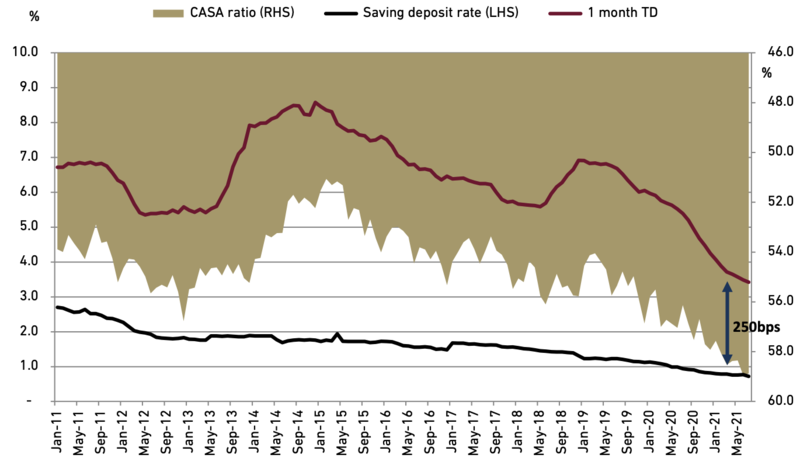

- Lower spread encourages shift from time deposits to CASA

Deposit competition would stay low for 2022F, in our view. This is as liquidity is still very ample and the spread between TD and CASA become narrower following the decline in TD rates. TD rate spread has arrived at only 250bps above CASA and this has encouraged shifting to CASA. Historical data also showed the same negative correlation whereas CASA ratio will improve along with decrease in TD rates. Therefore, we expect that bank’ deposit mix will continue to be better in 2022F. The expected increase in BI benchmark rate in 2022F is quite limited hence this environment would still good for deposit pricing in our view. At the current spread, banks’ deposit mix will continue to improve as growth in CASA outpaces TD. We expect the CASA in the system would stay at around ~60% of total deposit (vs. 59% as of 1H21). This also will contribute in robust cost of funds in our view.

Exhibit 31: TD rates spread and CASA ratio

Source: Companies and Ciptadana Sekuritas Asia

Exhibit 32: 1-month TD vs. 7DRR rate

Source : BI and Ciptadana Sekuritas Asia

- NIM would be resilient for 2022F

That said, we see banking NIM would be relatively resilient in 2022F after recorded a sharp increase in 2021F. We expect NIM to extend its gradual downward trend in 2023F onwards, due to declining blended asset yield trends. NII on the other side would still robust as it is also helped by the strengthening loan growth.

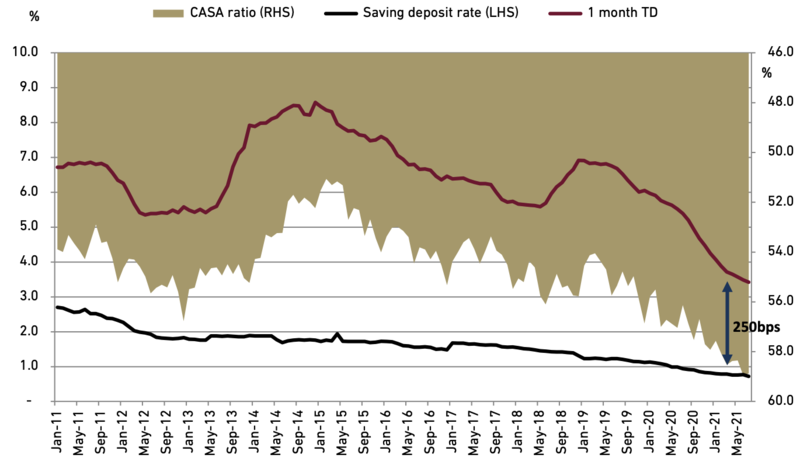

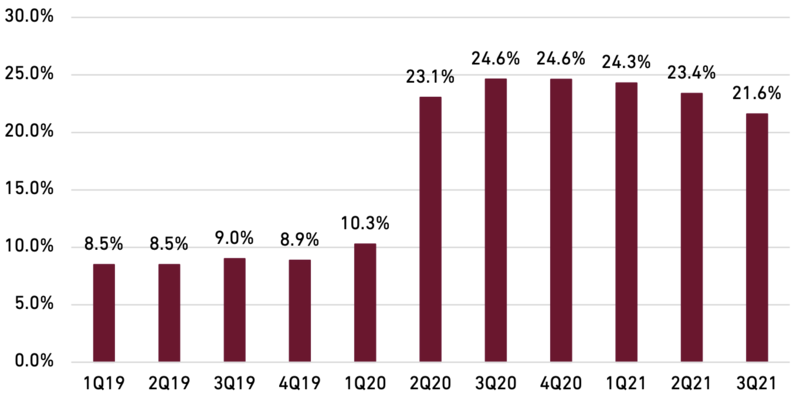

- LAR continue to decline as restructured loan graduates

We believe the worst of asset quality cycle has been behind for banking sector. Loan-at-risk (LAR) for banks under our coverage has been peaking at 25% as of 4Q20 and trended down to 22% as of 3Q21. The most significant improvement came from restructured current loan, which peaking at 17.6% of total loan in 4Q20 and down to 14.3% of total loan as of 3Q21. Moreover, the real loan-at-risk, which only includes the active restructured loan, should have fall even steeper as active restructured stood at only 50-70% of the total restructured flag.

Exhibit 33: LAR as % of total loan trend for banks under our coverage

Source : Companies and Ciptadana Sekuritas Asia

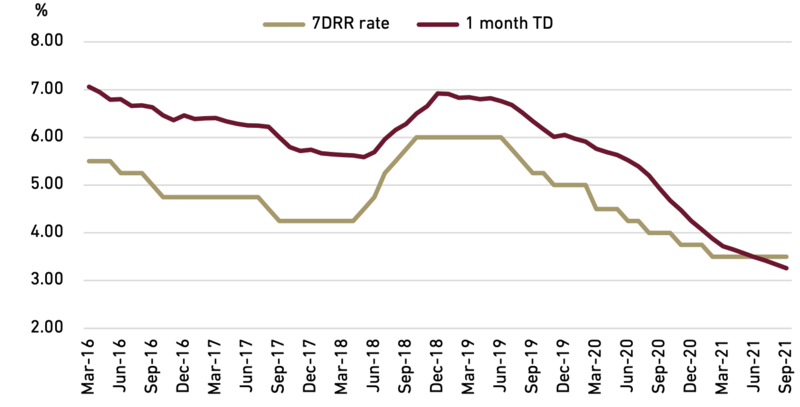

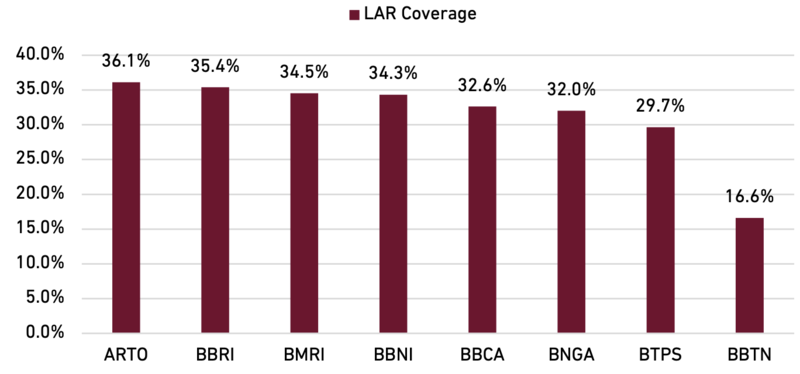

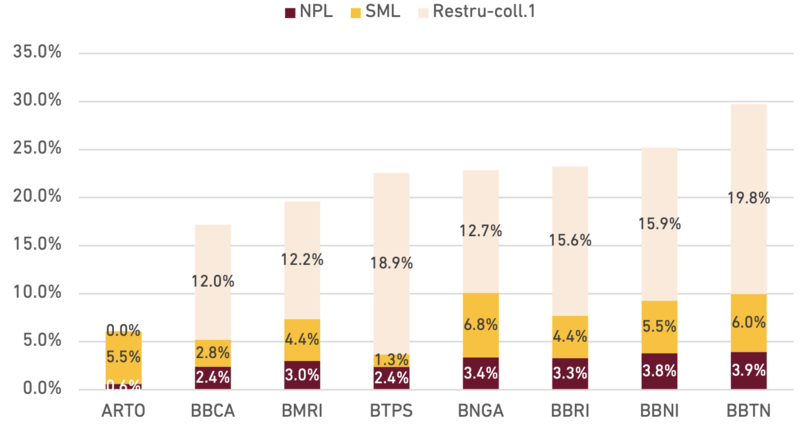

Exhibit 34: Loan-at-risk as of 9M21

Source : Companies and Ciptadana Sekuritas Asia

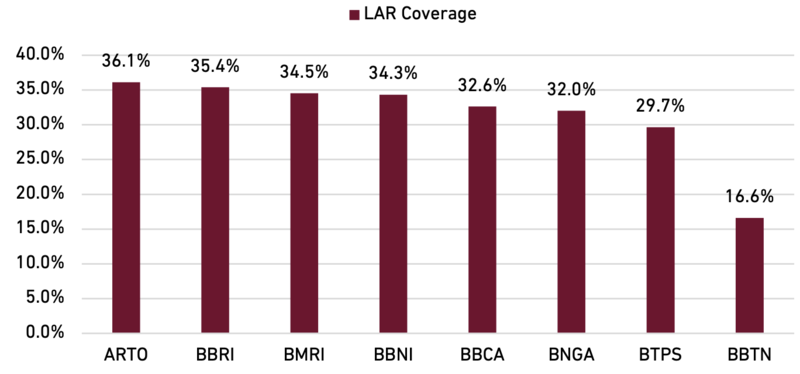

Exhibit 35: LAR coverage as of 9M21

Source : Companies and Ciptadana Sekuritas Asia

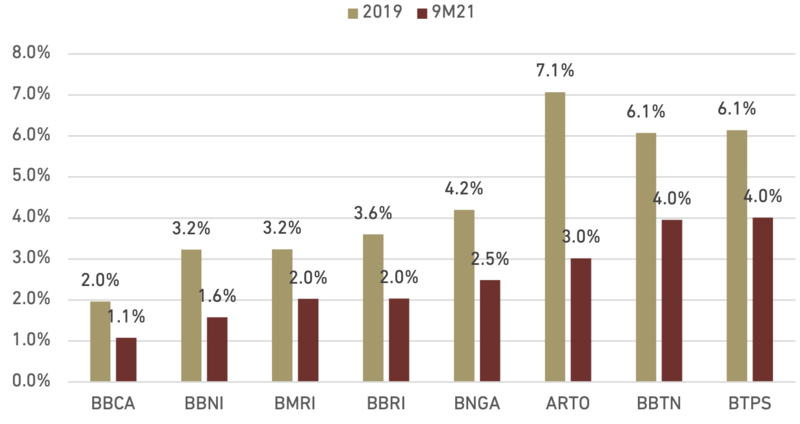

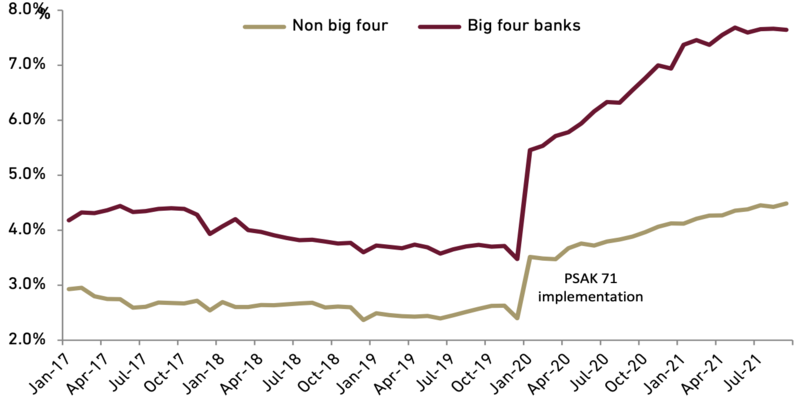

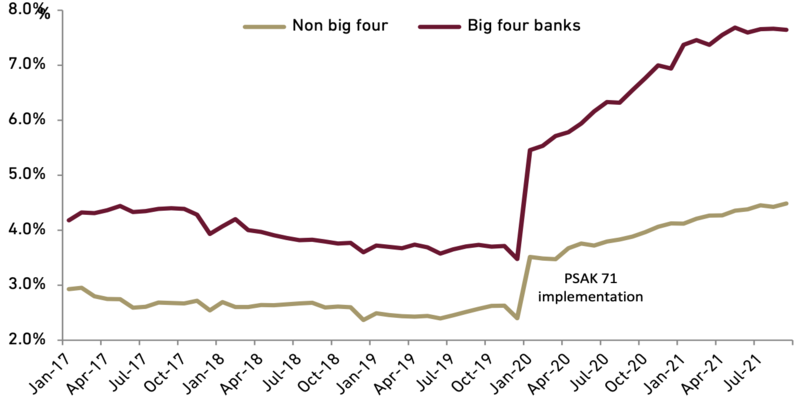

- Potential NPLs from pandemic

Key risk in asset quality for overall banking system will be seen after 1Q23, in which regulator ended the restructuring relaxation period. However, we see the risk is quite minimal for the big four banks, as they have bee conservatively downgrading the loan despite relaxation. For banks under our coverage, almost all of the medium-risk covid impacted loan has been downgraded to stage-2, hence lifetime analysis is in-place to access on how much they need loan loss reserves. Hence this is the reasoning behind on much higher loan loss coverage on the big four banks, who applies the conservative strategy on provisions. For overall banking system, we see the end of relaxation in 1Q23 is quite optimal, with three years’ time span has been given to provide coverage, along with economy on the path to fully recover. Hence we see the NPL to be flat in 2022F for the overall banking system.

We also see the banks to remain conservative in the commodities sector despite recent commodity price surge. This is to limit the NPL cycle that has been closely tied to commodity cycle in the past.

Exhibit 36: Loan loss coverage increase more significantly in the big banks

Source : OJK, companies, and Ciptadana Sekuritas Asia

- Digital banks: a game changer in financial industry

The covid-19 pandemic has turned customers into digital-first users, hence accelerate the practice of digital banking. For most of the digital banks, the year of 2022 would the first year for digital banks to fully operate its digital business after being launched in 2021. This could be a game changer for banking sector as they go with economies of scale and mainly targeting market of outside the current banking system. Hence this would result in expanding market size of banking system instead of being major threat to existing traditional banks in our view.

Digital banks also change both the business process and business model for banking. On business process, automation will help leverage customer data and analytics. This will affect credit quality along with loan pricing. Hence digital ecosystem, partnership, and open APIs would have critical role in this case. Features that made banking become so much easy, seamless, and much more personalized compared to the past will also take practice. We will also see how it transfer into financial performance, most importantly low-cost funding (CASA) and loan volume in the next couple of years. On the regulatory standpoint, support is also strong given the recent launch of digital transformation blueprint and as the government continues to use digitalization as financial inclusion’s tool.

Many traditional banks would try to tap into digital service by launching super-app. Some of notable super-app namely Livin by BMRI and Octomobile by BNGA for banks among our coverage. As for the rest of big banks, they have created their own separate entity of digital banks namely BBCA with Blu, BBRI with BRI Agro, and BBNI (as they have announced plan to soon acquire a digital bank). Overall, for traditional banks, we think digital expense will still grew at mid-teens, hence driven up some growth in opex. We expect overall opex to grow at 9% in 2022F (vs. 2/8% in 2020/21F, respectively).

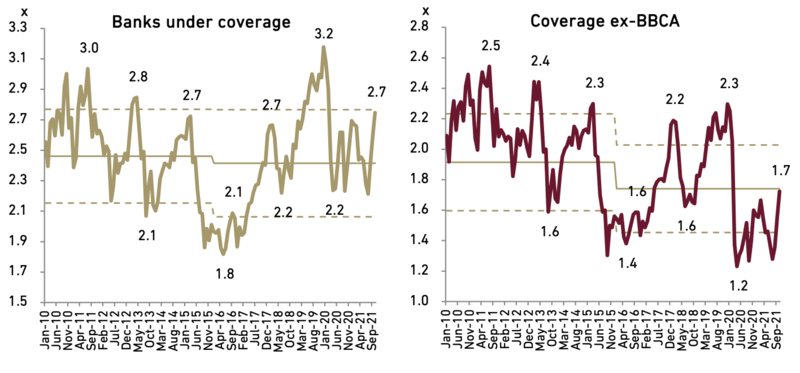

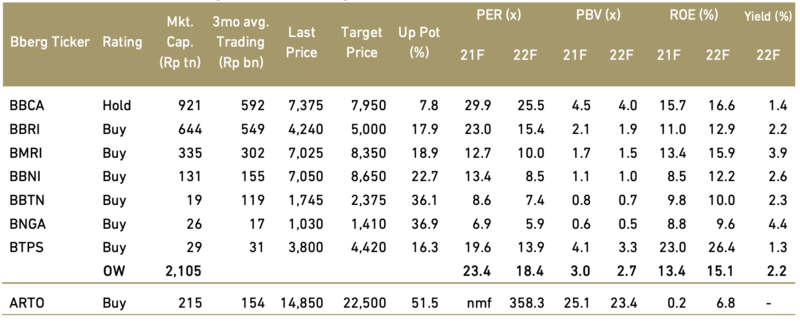

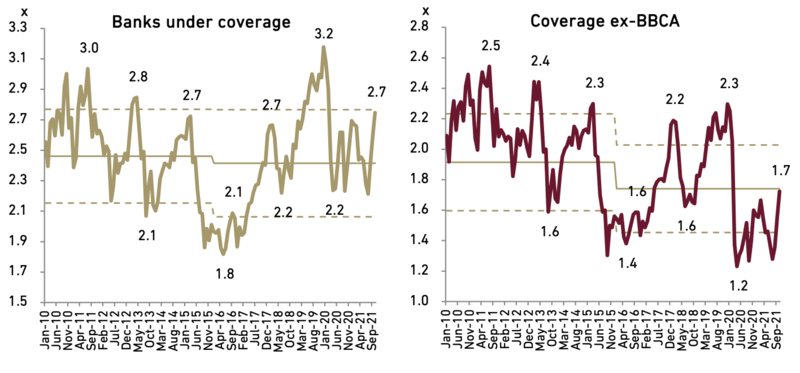

- Maintain Overweight for Indonesian Banking Sector

We maintain our Overweight stance on banking sector with BBNI and ARTO as our top pick. Our thesis remains that recovery in earnings will continue in 2022F lead by normalizing credit cost, and supported by a relatively resilient NIM and better loan growth which provides robust NII growth. Valuations for the Indonesia banking sector are still compelling in our view. Excluding BBCA, our coverage is trading at 1.7x forward PBV or slightly below the five years trading average.

BBNI has relatively compelling valuation among the big banks considering its ROE profile which expected to close their normal level at 12-13% in 2022/23F, backed by earnings recovery and strong transformation strategy inside the bank. Among the digital banks, we prefer ARTO as we believe the bank will be one among few digital banks that will succeed to win digital banking market share, underpinned by its strong digital platform and complete digital ecosystem, and backed by strong management team.

Key risks for banking sector would come from worse-than-expected asset quality especially post restructured relaxation ends in 1Q23 and more than expected competition in lending resulting in more severe asset yield and NIM decline.

Exhibit 37: Forward PBV*

Source : Ciptadana Sekuritas Asia

*excluding ARTO due to scalability

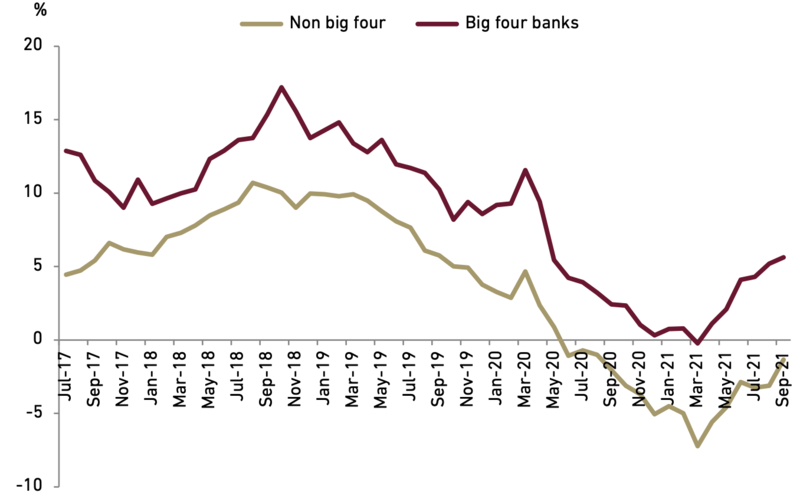

Exhibit 38: Banking stocks rating and valuation