Construction Overweight

Sector Outlook

- Difficult days for constructors continue in 2021

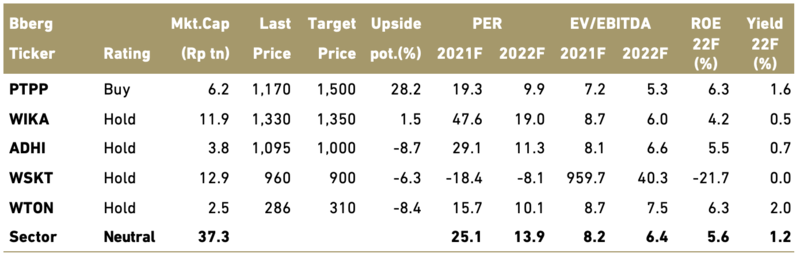

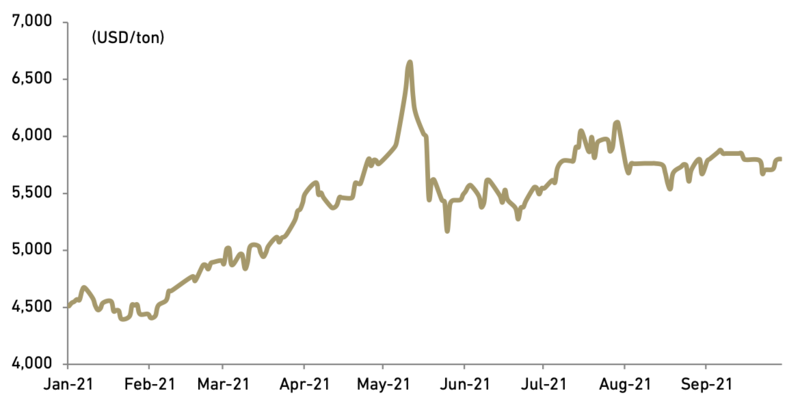

SOE contractors under our coverage reported weaker-than-expected net profit for 2Q21 and 1H21. This was mainly caused by 1) longer-than-expected tender process for new infrastructure project and 2) slower existing projects completion spoiled by working capital difficulties. Aggregate net profit of construction stocks declined by 45% QoQ to Rp269 bn in 2Q21 due mostly to weaker revenue, bucking seasonal trend as historically 2Q was normally higher than 1Q. PTPP recorded net profit growth while WSKT swung to profit in 2Q21 were mostly helped by gain from their toll road divestment. Cumulatively, contractors net profit dropped by 27% YoY to Rp370 bn largely dented by 67% drop in WIKA’s net profit while positive growth seen at WTON, ADHI, PTPP and WSKT were helped by non-operating items such as divestment gain and gain impairment of financial instruments. Moreover, 1H21 earnings only met 18.1% of our 2021F as compared to historical range of 28-42%.

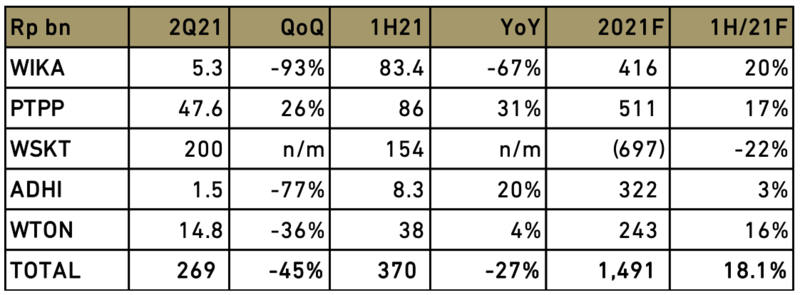

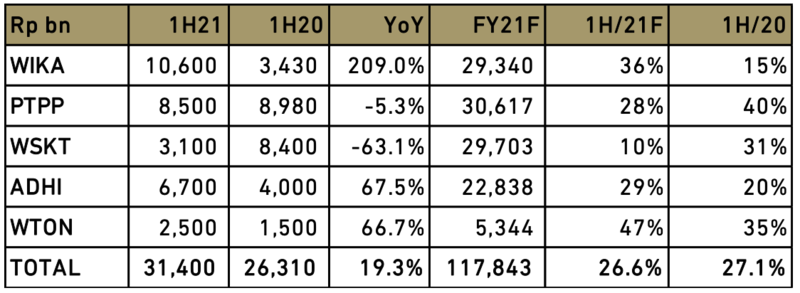

Aggregate new contracts grew by 19.3% YoY to Rp31.4 tn in 1H21, which is recovery from low base year 2020, the first year Covid-19 pandemic hit Indonesia. WIKA saw its new contract more than tripling to Rp10.6 tn, while ADHI and WTON booked around 67% YoY growth in new contract to Rp6.7 tn and Rp2.5 tn , respectively. PTPP saw its new contract declining by 5.3% YoY to Rp8.5 tn. WSKT is the only contractor registering significant drop in new contracts of 63% YoY due mainly to its weak financial capacity during debt restructuring programs. However, 1H21 new contracts only met 26.6% of our 2021F and 17.4% of management’s guidance as we both expect much stronger recovery this year. Beside project tender delay and tight working capital problem faced by contractors, we believe the introduction of emergency public activity restrictions (PPKM Darurat), which include tighter travel checks and road closures also slow construction activities despite it is included in critical sector than can apply 100% of maximum work from office (WFO).

Exhibit 179 : 2Q/1H21 net profit and full-year target

Source: Company and Ciptadana estimates

Exhibit 113: New contracts and achievement to target

Source: Company and Ciptadana estimates

- 2022: Cautious optimism to recovery

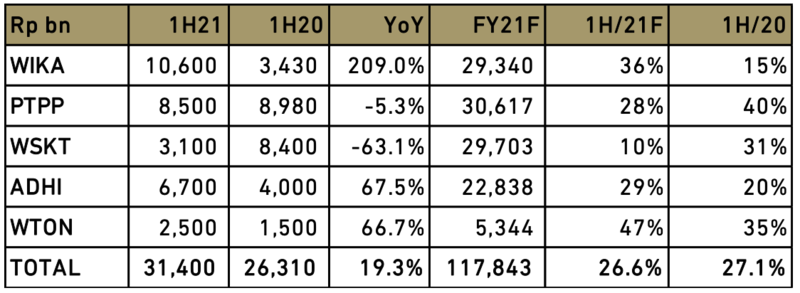

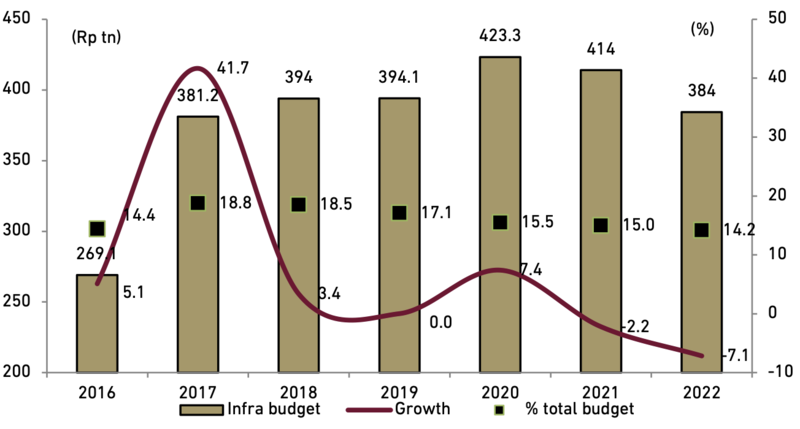

The infrastructure budget for 2022 is set at Rp384.8tn, down 7.1% YoY, which represent 14.2% of total budget or historically among the lowest. Infra budget for 2022 covers Rp170.4 tn (-29% YoY) for central government spending, Rp119.2 tn (-10% YoY) for Transfer to Region and Village Fund (TKDD), and Rp95.2 tn (+122% YoY) for budget financing. The policy for next year's infrastructure budget aims to expedite the completion of infrastructure projects delayed due to COVID-19 and strategic output to support economic recovery. The infrastructure budget will also be utilized to support the availability of basic infrastructure services, such as 2,250 special housing units and 3,501 apartment units. In addition, budget will be utilized to bolster productivity through connectivity and mobility infrastructure such as the construction of 205 km of new roads, 8,244 m of new bridges, 6,624 sqm of railways, six new airports, and the Trans Sumatra toll road.

Higher budget financing of Rp95.2 tn is related to SOE Ministry proposal of Rp72 tn in state capital injections (PMN) for state-owned companies next year, marking an increase of more than 7% from this year’s allocation. SOEs, particularly in the construction sector, were too short on capital to implement government projects and that some even lacked the cash to stay afloat in the pandemic-ravaged economy. Half of the proposed funds would therefore be directed to this sector.

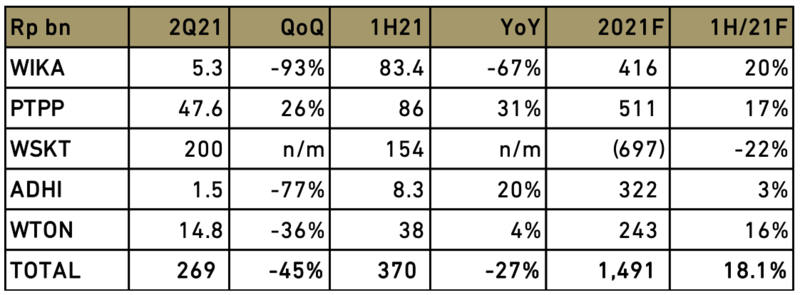

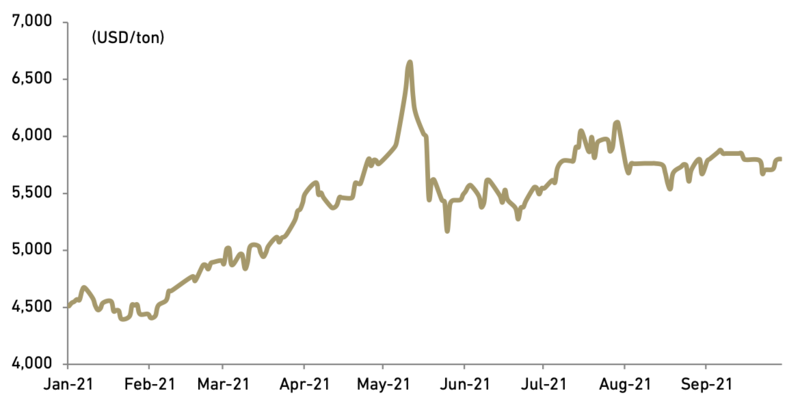

We are also concerned that the recent surge in steel prices may disrupt infrastructure projects execution. The international price of steel has continued to increase by 30% YTD. Normally, during the preparation of the tender a reference steel price is used within a 20% margin (namely the reference price plus and minus 10%). However, if the actual steel price rises more than 10% above the reference rate used in the preparation of the tender, then the tender needs to be delayed and requires recalculation.

Exhibit 181 : Infrastructure budget , growth, as % of total spending

Source: Ministry of Finance

Exhibit 182 : Rising steel prices

Source: Bloomberg

- Neutral stance premised on the absence of strong catalyst

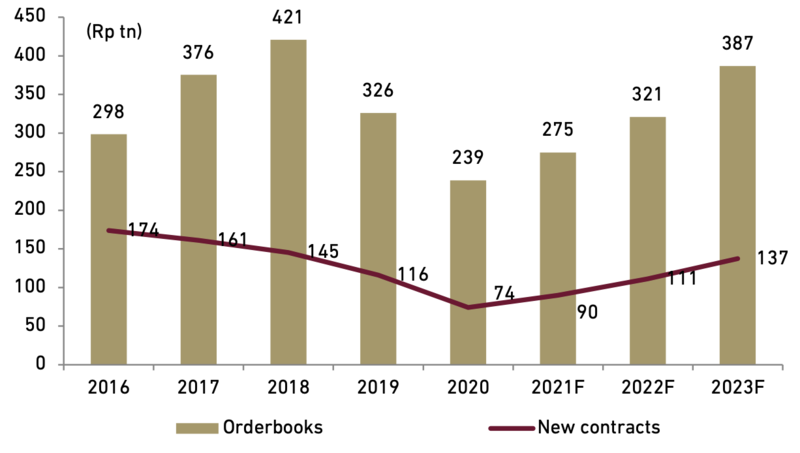

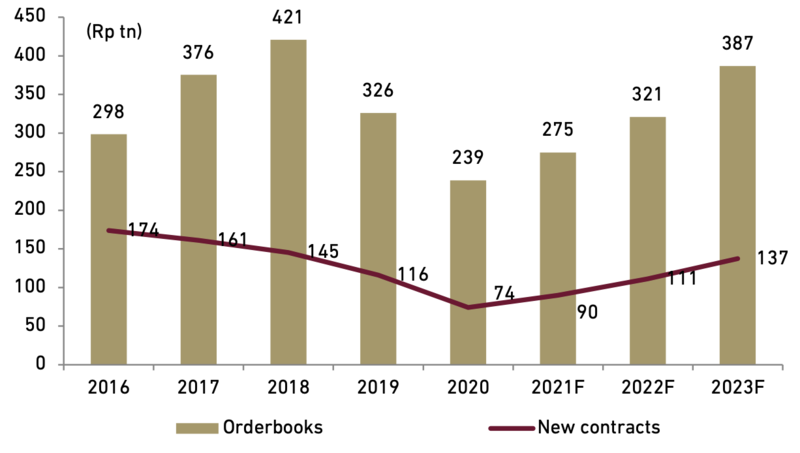

We maintain Neutral view on construction sector given subdued financial performance in 1H21 has kept stocks of construction companies under pressure as they face various challenges on the execution front. The aggregate new contracts reduced greatly during Covid-19 situation (36% YoY 2020 to Rp74 tn), despite government considering construction an essential service and allowing companies in the industry to continue operating. Following government lower infra budget and PMN plans which are mostly focused to expedite current projects delayed, we recently slashed our aggregate new contracts for 2021-22 by around 25-15% to Rp90-111 tn, which are still lower than pre-Covid level of Rp116 tn. Meanwhile, most of contractors also plan to revise down their new contracts guidance where WIKA and PTPP cut its target from Rp40.1 tn to Rp35.5 tn and from Rp30 tn to Rp25.5 tn, respectively, which are still considerably high given 1H21 figures of Rp10.6 n and Rp8.5 tn, respectively.

Exhibit 183 : Contractors new contracts and orderbook growth

Source: Company and Ciptadana estimates

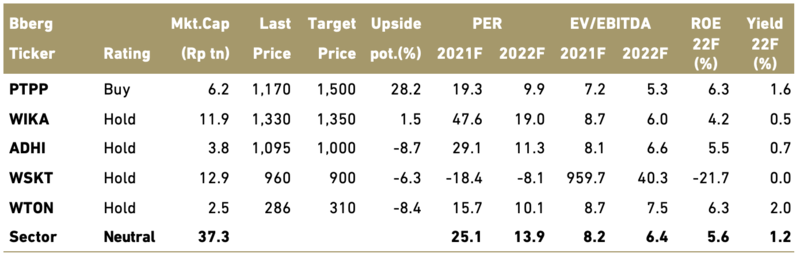

We believe an important aspect of contractor, particularly at the current time, is maintaining the right level of working capital, or access to funds to meet short-term obligations — especially when profit margins generally are very tight and increased gearing level. This is given that their working capital might continue to be stretched by delayed payments from project owners, potentially creating further lower execution risks (slower burn rate) and need to finance the delays with debt , reflected by many bond/sukuk issuances by SOE contractors lately. On that basis, we select PTPP our top pick as it has relatively higher gross margin of 12.4% vs. peers of single digit while it also the lowest DER of 1.8x at end of 1H21 vs. WIKA of 1.9x, ADHI of 2.1x and WSKT of 9.0x (Note: we exclude non-controlling interests in equity calculation).

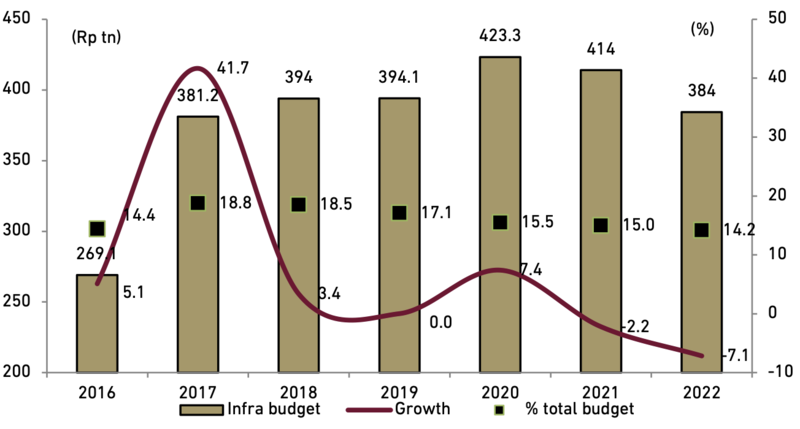

PTPP is trading at attractive valuation of 2022F PER of 9.9x vs. sector’s average 13.9x. We assign Hold rating on WIKA, PTPP, ADHI and WTON given relatively higher valuation and limited upside/downside potential to our target prices. We see upside risks to our call might come from i) the implementation of contractors’ asset divestment to INA which is expected to help reduce contractors over-leveraging and restart the asset recycle and ii) retail inflow to construction stocks that would help the rally on buy on weakness stance given that the construction stocks have corrected by 37-47% in 9M21.

Exhibit 184: Construction sector rating and valuation