Healthcare Overweight

Sector Outlook

- Budget allocation for healthcare in 2022

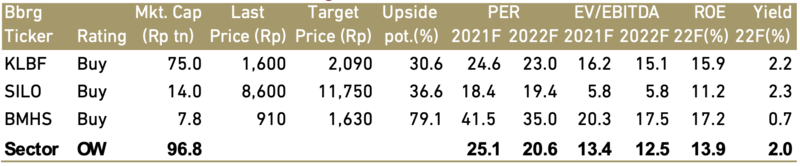

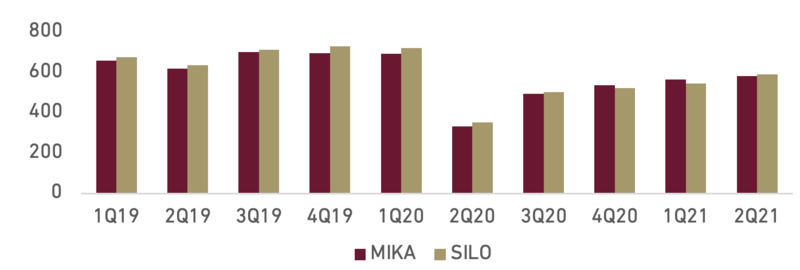

Indonesian government sets Rp255.3 tn of healthcare budget allocation in 2022 (-21.7% YoY), which is 9.4% of the state budget. This consist of Rp139.4 tn regular healthcare budget (+11.3% YoY), and Rp115.9 tn PEN (covid-19) budget (-42.4% YoY). Government allocate lower budget compared to 2021, as covid-19 situation is getting better in Indonesia. However, the regular healthcare budget increased by 22.9% compared to 2019 (pre-covid level), this due to higher allocation for JKN instalment and budget for healthcare reformation system. Government spending for healthcare budget booked solid growth of 8.6% CAGR from 2017 – 2022, it indicates that the demand for healthcare services and products in Indonesia are keep increasing, which will benefit hospital companies, due to higher patient volume. For pharmaceutical industry, we expect higher healthcare budget allocation would lead to higher demand for unbranded generic products, under prescription pharmaceuticals division.

Exhibit 83: Indonesia Healthcare Budget

Source: Finance Ministry, Ciptadana Sekuritas Asia

- Testing, Tracing, Treatment

Even that the pandemic situation is getting better, government still put some focus for covid-19. Some of the government highlights in 2022 are, covid-19 patient treatment, vaccination financing, public encouragement to do self-vaccination, Covid medicine procurement, and incentives for health workers. We see this positively, as government keep put a lot of efforts to end the pandemic and cut the covid-19 trace. Therefore, people will be more confidence to get treatment in the hospitals, instead of doing self-medication.

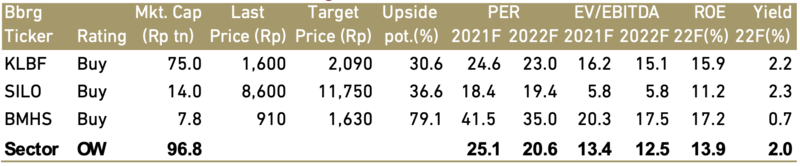

- Opportunities on underpenetrated market

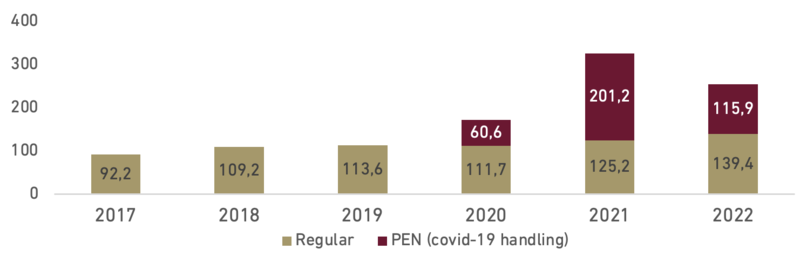

According to world bank data, the ratio of hospital’s bed in Indonesia for every 1000 populations is only 1.2, lower than Singapore with 2.3, and South Korea with 12.27. The doctor ratio for every 1000 populations is only 0.4, lower compared to other countries. In terms of spending, healthcare spending is still low, at 2.9% of GDP, lower than the average of countries with low income level 6.1% of GDP, and also lower than the average of East Asia Pacific countries with 7.4% of GDP. Even with the currently-low healthcare spending, most private hospitals are already overcrowded and profitable, which implies a huge growth opportunity. Hence, we believe, there is still much room for improvement on Indonesia Healthcare sector.

Exhibit 84: Hospital Bed and Doctor Ratio

Source: WDI World Bank, Ciptadana Sekuritas Asia

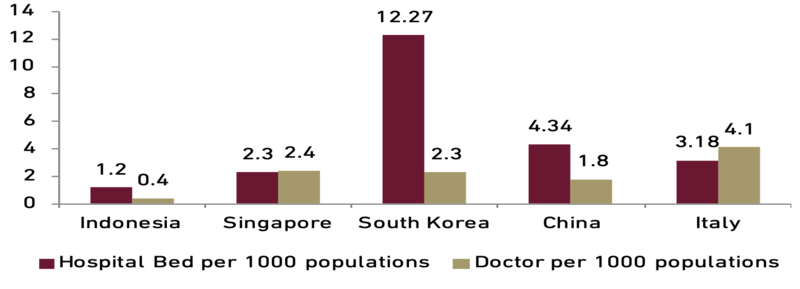

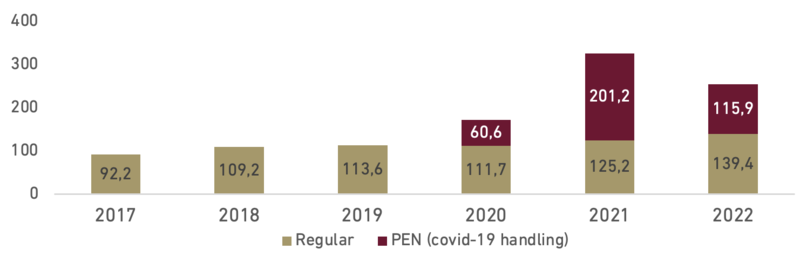

- Patient volume recovery in 2022

We see patient volume to improve gradually in 2022, due to declining covid-19 cases, and massive vaccination progress. This made patients to return to the hospitals, as we also expect there will be no significant restrictions. Post covid, we expect the average revenue per patient to normalize, and gross margins will be supported by returning patients for normal cases (base cases) and surgeries.

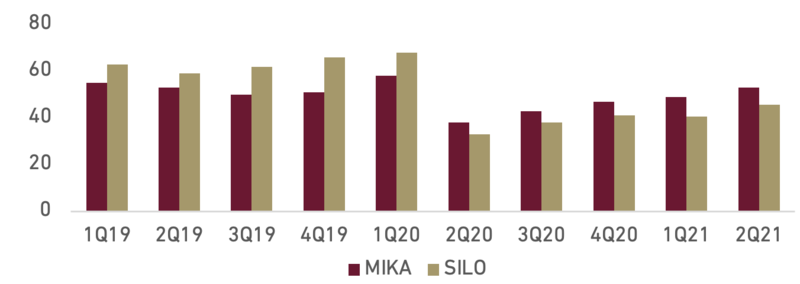

Exhibit 85: Hospitals In-patient volume (‘000 ppl)

Source: Company, Ciptadana Sekuritas Asia

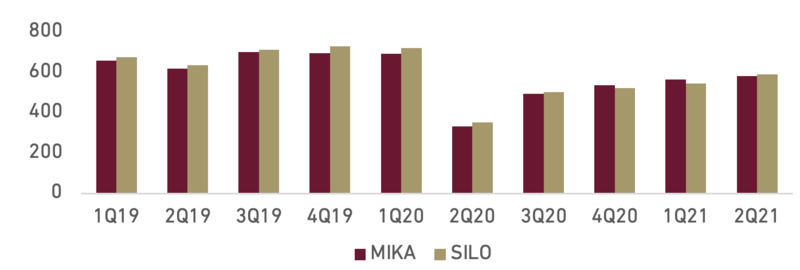

Exhibit 86: Hospitals out-patient volume (‘000 ppl)

Source: Company, Ciptadana Sekuritas Asia

- BPJS class simplification in 2022.

According to Presidential Rules No.64/2020, Government plans to do simplification on BPJS classes. Three classes of BPJS will be simplified into two class. We believe this will deliver more traffic to the hospitals, as people will get better services and treatment.

- Innovation through digital apps

Hospitals companies has mobile applications for their patients, we believe this will help to support their operational performance. For instance, SILO has MySiloam app, this application improves the efficiency and helps patients through its online function that directly enhances Siloam’s offline services. Patients can use the MySiloam application as a virtual assistant when they are visiting Siloam's hospitals. This feature enables patients to do touchless check in and virtual queue lines, thus improving patient experience. We believe mobile application will improves the Hospitals’ service and strengthen the loyalty of existing patients.

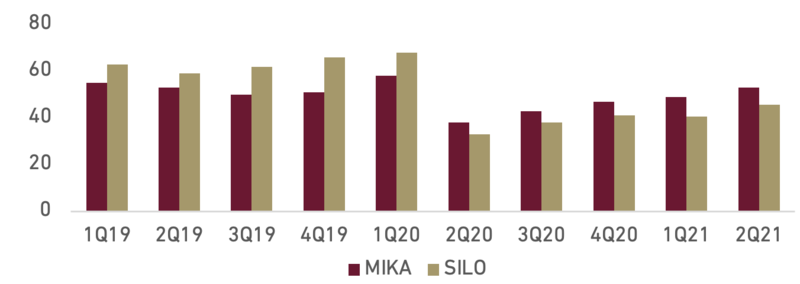

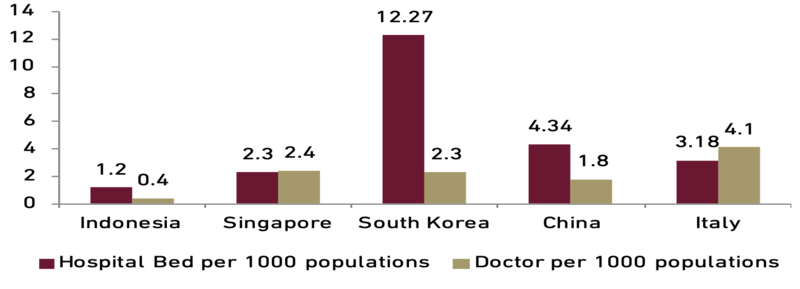

We have an Overweight rating for healthcare sector, with BMHS as our top picks. We like BMHS as more premium cases such as surgery, mother and child birth will return post covid-19. We also expect volume for Morula IVF (in-vitro fertilization) will keep increasing in 2022F. We have a BUY rating for BMHS with 2022F DCF-based TP of Rp1,630/sh

Exhibit 87: Healthcare stocks rating and valuation