Consumer Neutral

Sector Outlook

- 2022 recovery will be highly dependent on vaccines

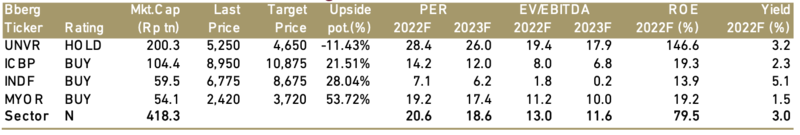

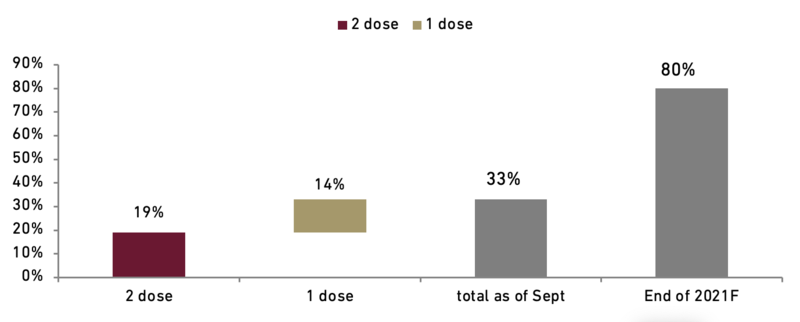

Heading to 2022F, we believe in order to achieve sustainable recovery in consumer buying power will require higher vaccinations rate to curb any potential mobility restrictions in the future. Regardless the efficacy rate among various vaccine we think that it will provide some degree of protection and help populations immune system to fight the virus, and serve as the most scientifically reliable factor to gauge future recovery, sustainable improvement in consumer confidence and buying power. So far Indonesia already administered vaccination to 33% of its populations as of September 2021, in which 19% of it already fully vaccinated with 2 dose of vaccine, and the rest 14% already received 1 dose of vaccine. Moreover government targeting 80% of Indonesia population will be vaccinated by the end of 2021F. Hence, we think post massive vaccination, the infection rate of severely ill cases among COVID patients should be dampened, and would not put higher risk of hospital systems breakdown as previous wave. Looking at Israel as a cased study the fourth wave of COVID pandemic could be a benchmark of life post vaccinations as the county has the highest vaccination rate. Based on Israel health ministry the most of severely ill patients and death from COVID infections was highest among un-vaccinated populations. Hence we believed vaccine is the key to have new normal life and sustainable way to return to society for work, and socialized.

- Consumer confidences are highly dependent on government policy towards mobility

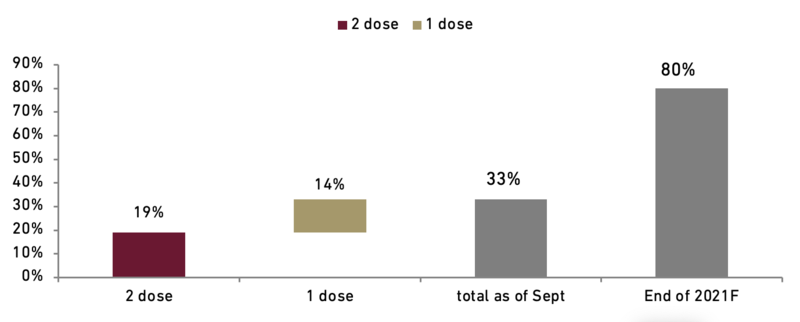

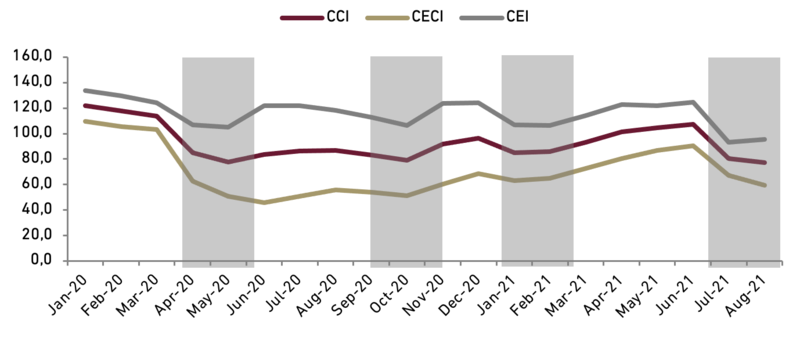

Looking at the last 4th wave of COVID infections, consumers’ sentiment as reflected by Consumer Confidence Index (CCI) was highly dependent on government policy towards mobility restrictions. Every time the government imposed stricter mobility restrictions the index dipped below confidence level of 100, and post restriction being lifted by governments the CCI sentiments improved further as people could back to life again. We believed if government could achieve its vaccination target the recovery in consumer’s sentiments will be warranted. Once the sentiments improved and people start to back to normal life the spending power could come back as the society no longer worry about the uncertainty from this pandemic and they can start to socialize and work in more efficient way. We also believed there will be a pent up demand once we return to normal life as consumers keep saving money during the pandemic and soon the money will be spend outside essentials and consumer confidence enough to trade up from value goods into more premium products.

Exhibit 161: Current vaccination rate and 2021F target

Source : Ourworldindata, Ciptadana Sekuritas

Exhibit 162: CCI development during the last 4 mobility restrictions

Source : BI, Ciptadana Sekuritas

- More mobility will accommodate more spending

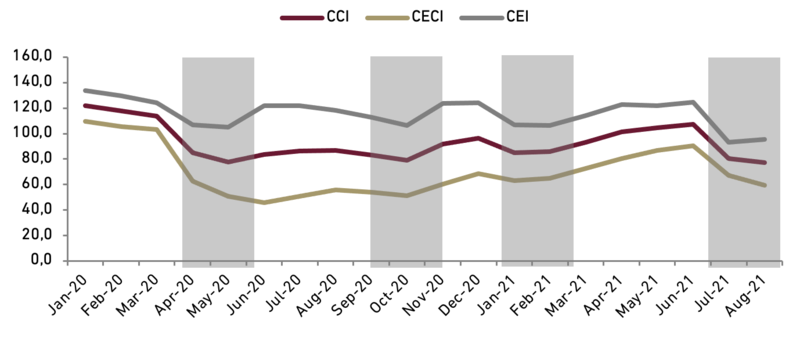

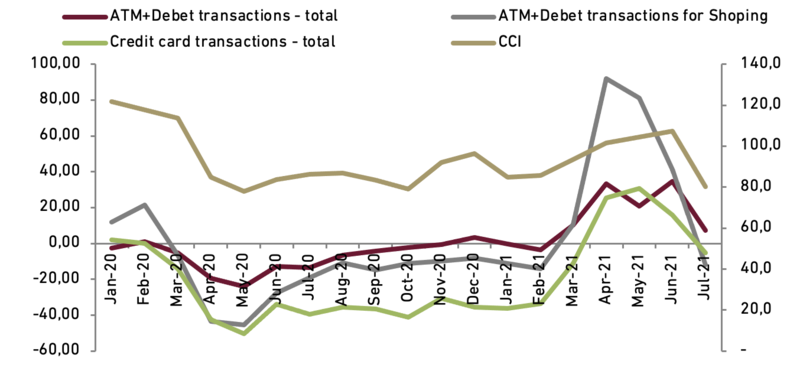

Based on our study during the course of this pandemic, we saw that the core problems on the lacklustre of spending were driven by mobility restrictions and fear of getting infected by virus and financial stability. Hence looking at Bank Indonesia (BI) data on ATM+ debit and credit card transaction value growth since the onset of COVID in March 2020 the transaction value growth from this two cards grew at negative territory in-line with depressed CCI sentiments, however when CCI start to improve in March 2021 before the delta variants became a major problem the transactions value jumped by double digit. And when the delta variants caused spiked in hospitalizations both of CCI sentiment and transactions value growth dipped again. Hence since Indonesia just rolled out massive vaccination in 2H21 we believed heading to 2022F the numbers of critical case on COVID patients should be dampened and allow more accommodative policy for government to improve better mobility for the society.

- Very strong consumer balance sheet, yet waiting to be spend

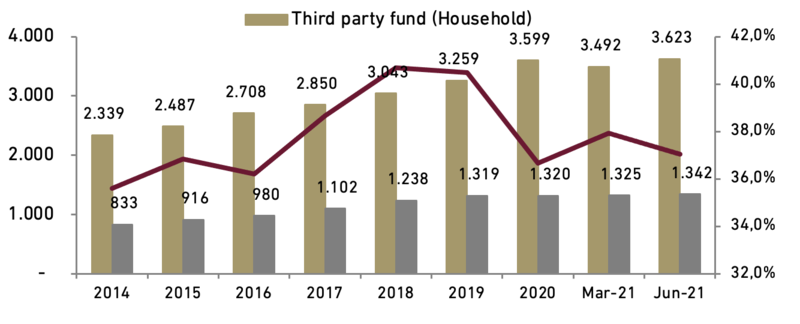

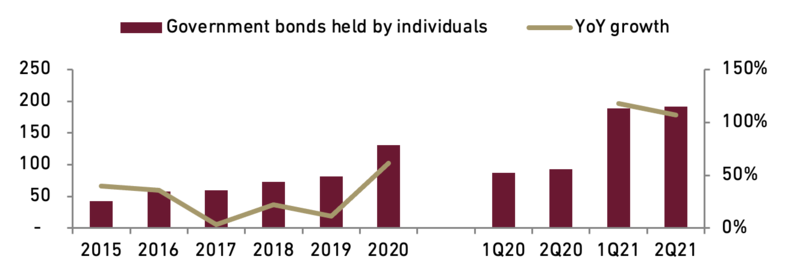

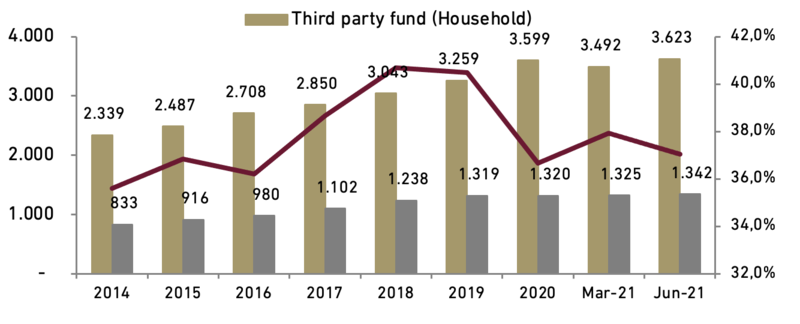

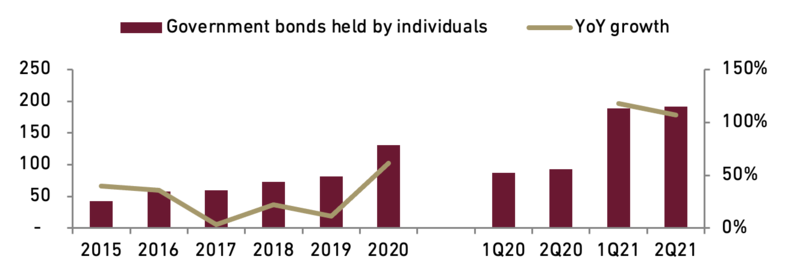

Looking at Bank Indonesia (BI) data we saw that consumer balance sheet during pandemic keep getting stronger as people holding back their consumptions and turns to save more. Based on the data we saw encouraging trend that household credit compared to third party fund in the banking systems keep getting stronger and by June 2021 the numbers now stood at 37% level which is much healthier than 2017 period at 38.7%. Moreover individual ownership of government bonds also surged substantially during pandemic, in 2020 goverments bonds hold by individual increased by 62% YoY to Rp131 tn, and by 1H21 the numbers jumped by 107% YoY to Rp192 tn. This is in-line with Nielsen recent survey that most consumers still considers savings and investments remain their top priority as shown by 79% of respondent and 53% of it consider pandemic situation as perfect timing to invest. Moreover we think the high growth in consumer saving and investment was induced by precautionary motives and also lack of mobility which allow them to re-allocate some of their spending for the rainy day during the new normal and wait for vaccination progress cover broader population. Hence, in order to induce more spending and monetize current consumer saving it requires more accommodative environment where people can move freely without fear of getting severe infections and government policy to support back to office activities which will improve mobility and spending.

Exhibit 163: ATM, Debit, Credit card transactions growth (LHS), CCI (RHS)

Source : BI, Ciptadana Sekuritas

Exhibit 164: Household saving vs. household credit

Source : BI, Ciptadana Sekuritas

Exhibit 165: Individual holding in government bonds

Source : BI, Ciptadana Sekuritas

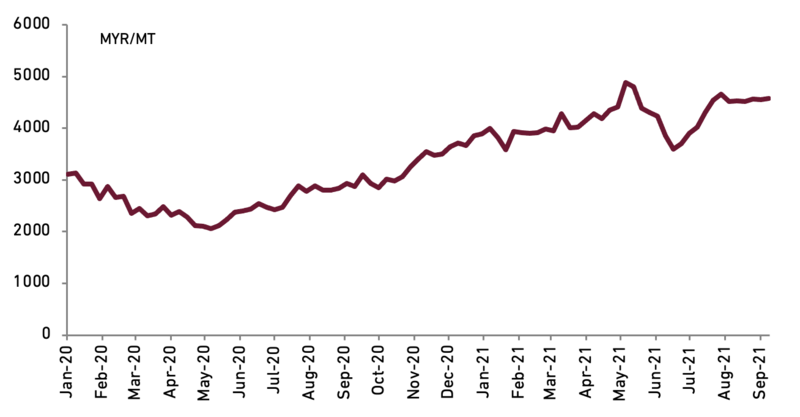

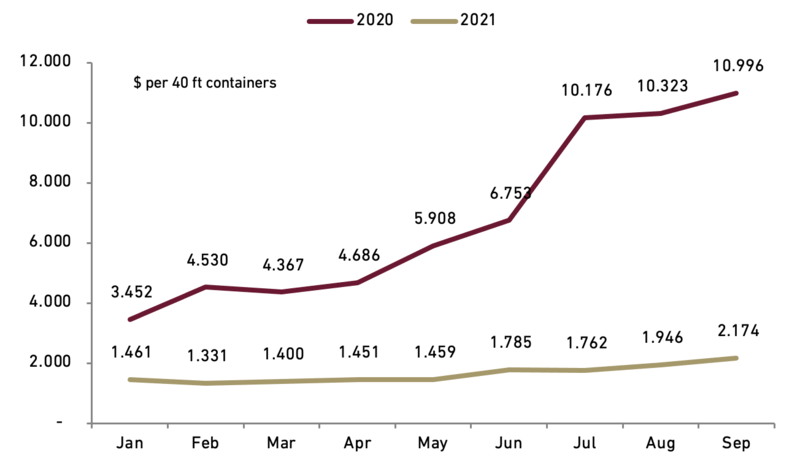

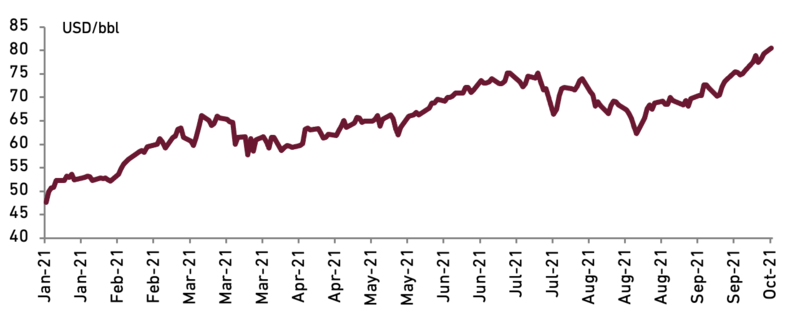

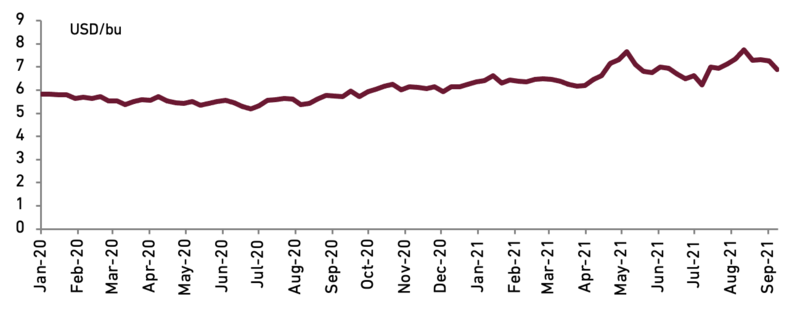

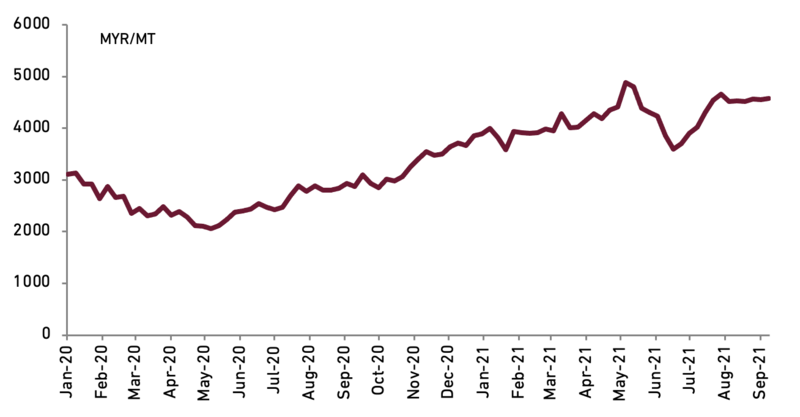

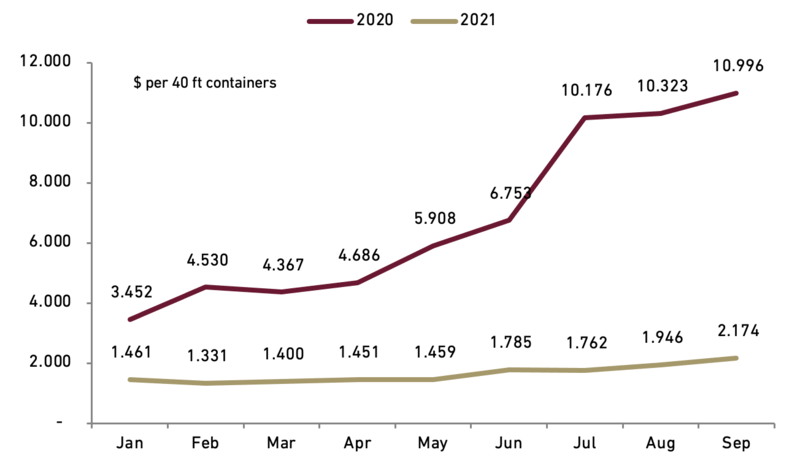

- Input cost remain a major concern as disruptions persist, and there will be a pass on effort

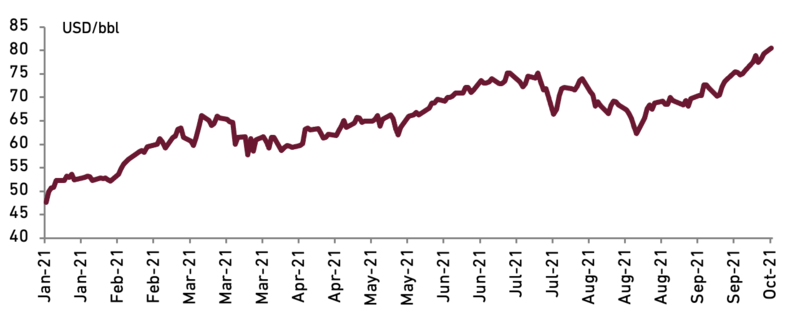

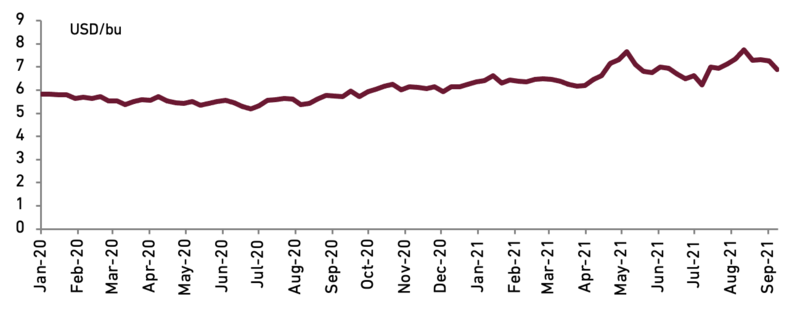

Key Input cost still remain major problems in 2022F as lots of disruptions still happen in the sectors from CPO, Oil, and Wheat and These upward directions in soft commodities will have an impact on packaging price, fuel cost, raw material for personal and home care materials, as well as food related products. On the other hand, the sharp surge in cost of 40-ft containers size is steeper than the previous lockdown in both 2020 and 2021 period; we believed these conditions should add another pinching factor to FMCG margins if consumers companies delayed its price hike strategy. In 3Q21 alone freight cost increased by 62.8% QoQ, and 218.5% YTD. Hence, we think heading to next year we believed all consumer companies will pass on this soft commodities spike to slightly improve their GPM although some companies will be still below 2020 level. To note our CPO analyst forecasted that average 2022F CPO price will likely to stay at RM4,000/MT, and our oil & gas analyst sees 2022F average oil price for WTI of 67/bbl, and USD69/bbl for Brent.

Exhibit 166: Oil Price (WTI)

Source : Bloomberg, Ciptadana Sekuritas

Exhibit 164: Household saving vs. household credit

Source : Bloomberg, Ciptadana Sekuritas

Exhibit 168: CPO Price

Source : Bloomberg, Ciptadana Sekuritas

Exhibit 169: 40ft container price

Source : Bloomberg, Ciptadana Sekuritas

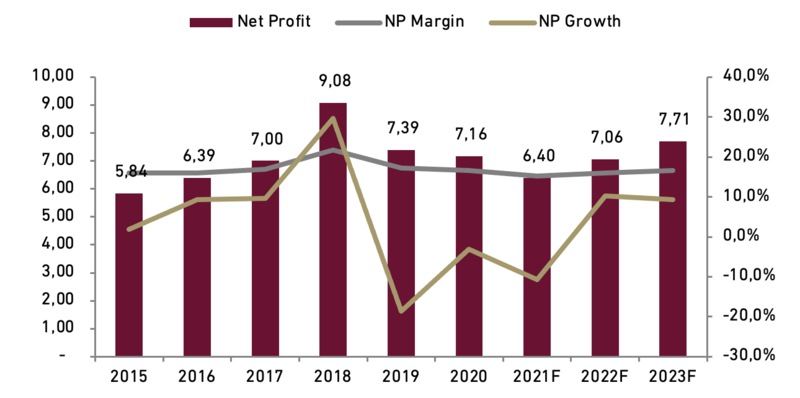

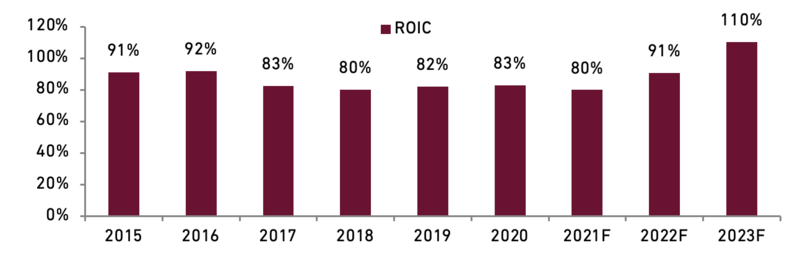

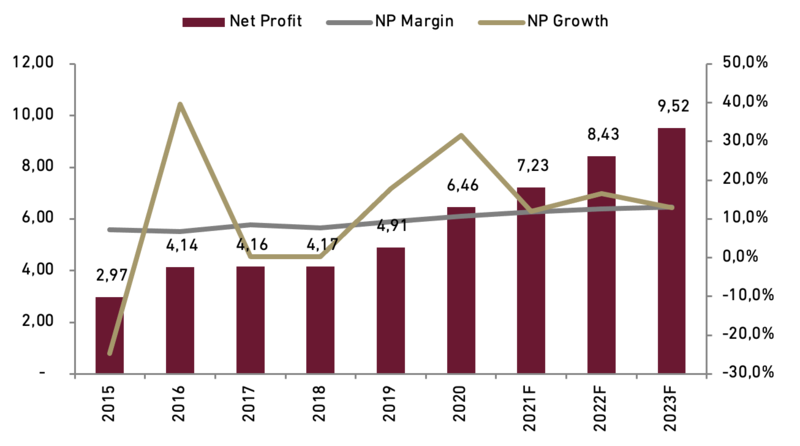

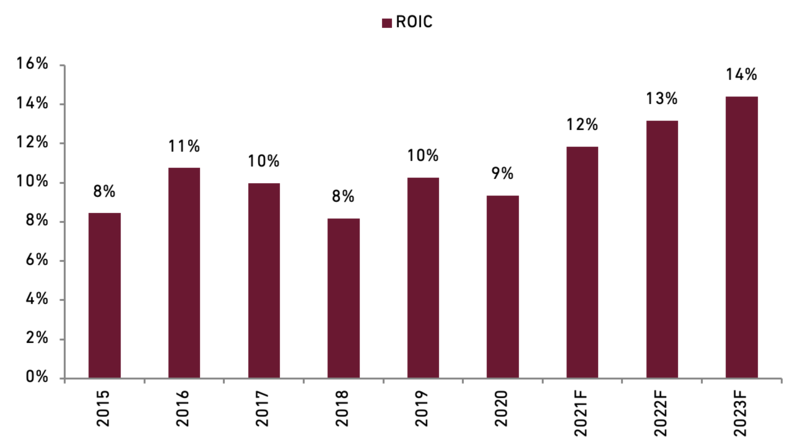

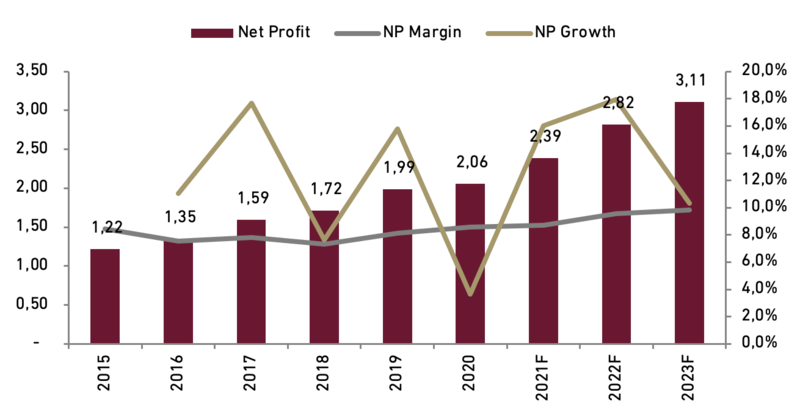

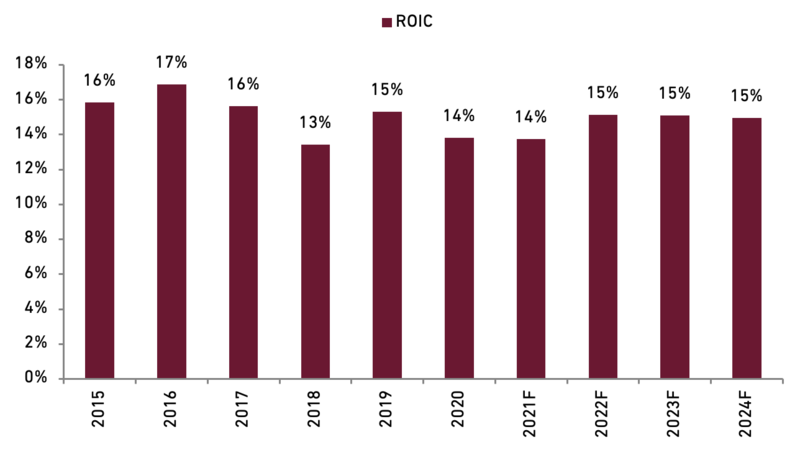

- Most companies earnings and ROIC will improve in 2022

Since input cost remain major problems for 2022F, and most consumers still have not pass on the cost inflation we believed margin recovery, earnings and ROIC will improve in 2022F. Moreover if we dig down on company specifics the pace of the recovery will be different due to several factors such are:

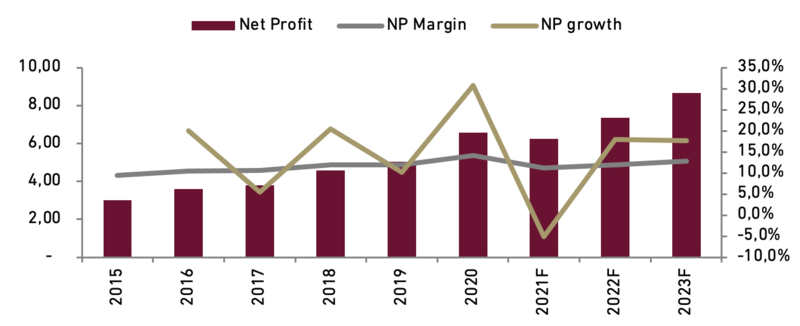

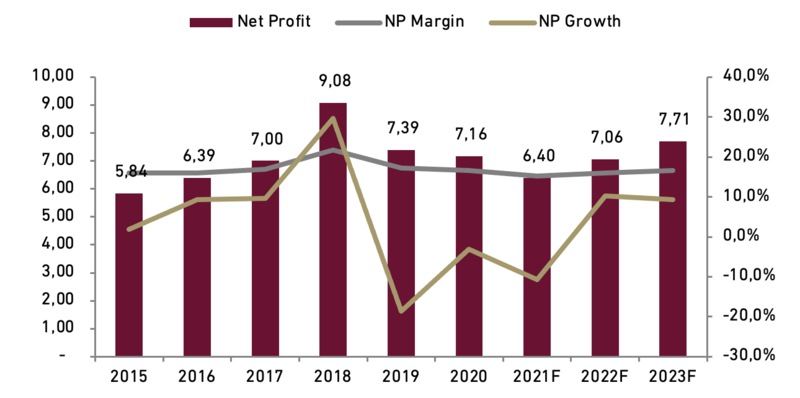

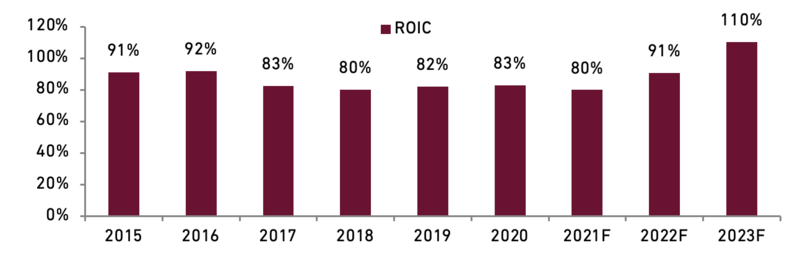

1). UNVR earnings and ROIC recovery could be seen beyond 2022F supported by vaccinations roll out which should improve buying power, as UNVR is pure domestic demand play. However, we think UNVR might provide some dividend surprise in medium terms as its parent is now trying to divest non-core brands globally.

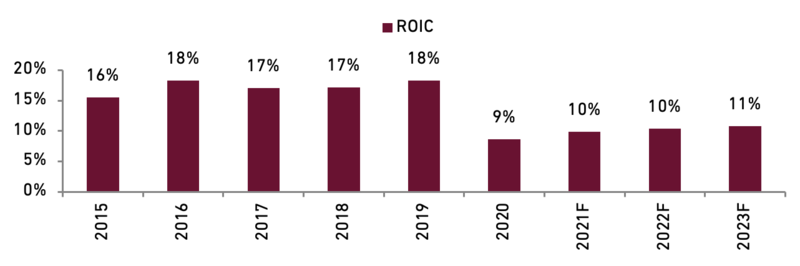

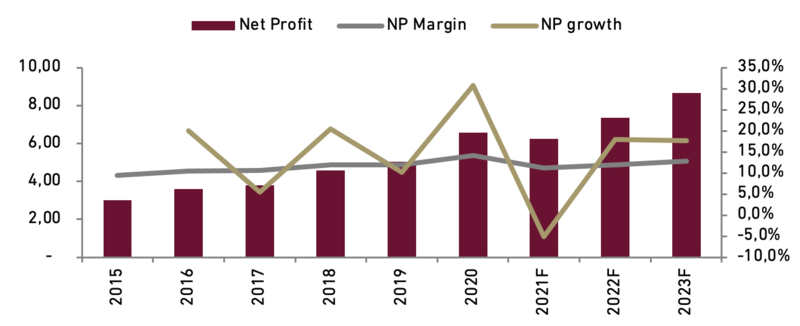

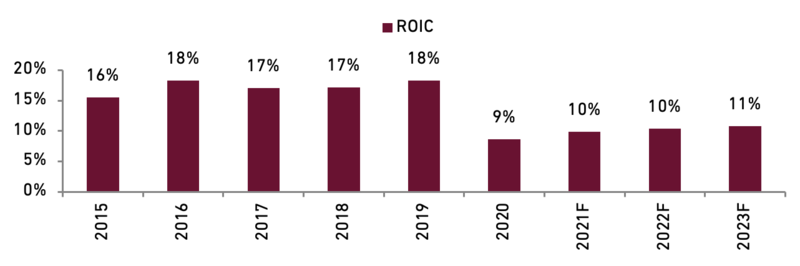

2). ICBP earnings could recover in 2022F driven by strong volume growth from its overseas operation (Pinehill), but ROIC improvement will take longer as the company has already taken new debt to finance its acquisition and dividend payout being reduced.

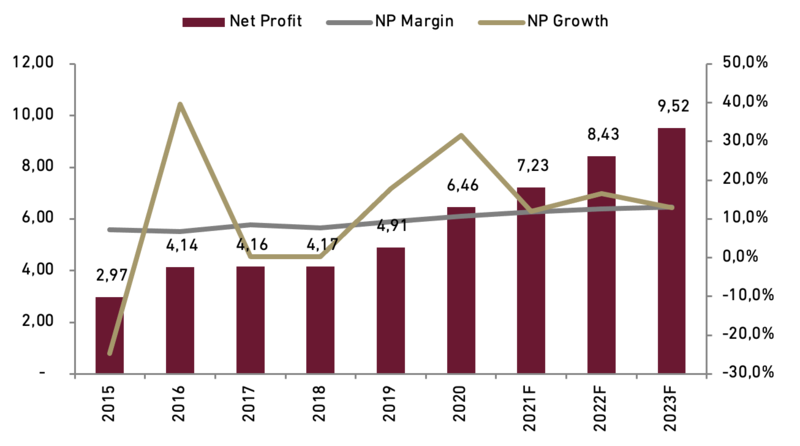

3). INDF will have no issue on earnings and ROIC as the company enjoy benefits from rising commodity prices and ICBP future growth.

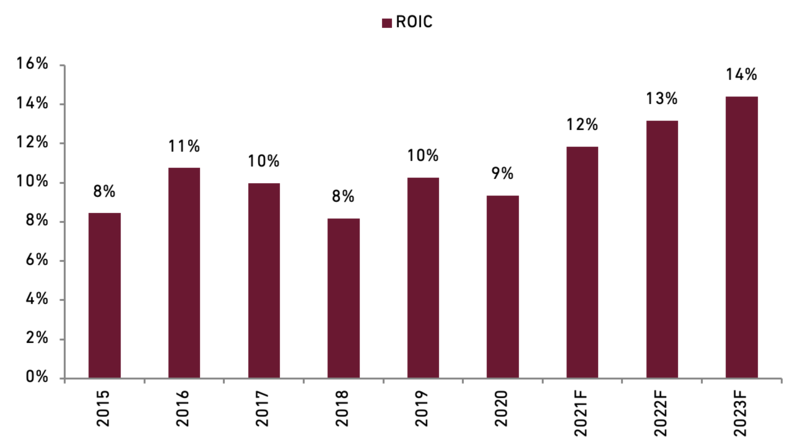

4). As for MYOR, the company is still on the secular growth mode due to higher foreign market exposure which allows them to sell more volume in various countries.

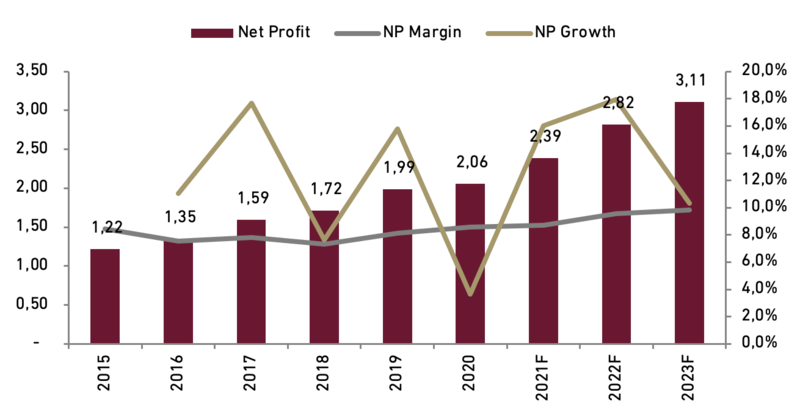

Exhibit 170: UNVR Net profit (LHS), Net profit growth and margin (RHS)

Source : Company, Ciptadana Sekuritas

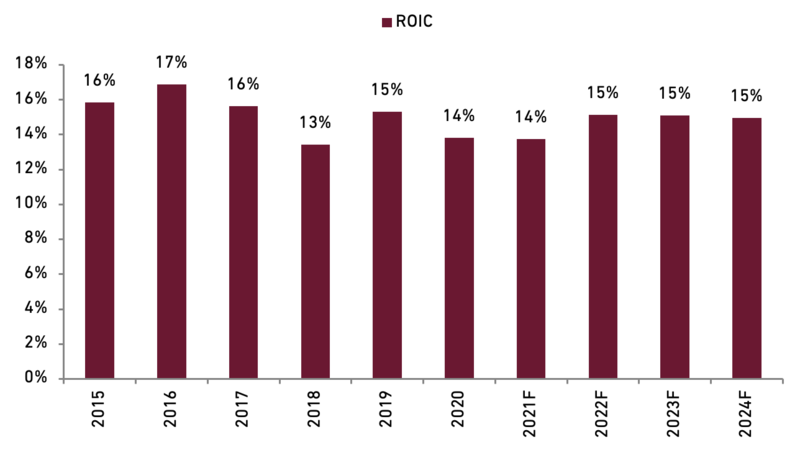

Exhibit 171: UNVR ROIC

Source : Company, Ciptadana Sekuritas

Exhibit 172: ICBP Net profit (LHS), Net profit growth and margin (RHS)

Source : Company, Ciptadana Sekuritas

Exhibit 173: ICBP ROIC

Source : Company, Ciptadana Sekuritas

Exhibit 174: INDF Net profit (LHS), Net profit growth and margin (RHS)

Source : Company, Ciptadana Sekuritas

Exhibit 175: INDF ROIC

Source : Company, Ciptadana Sekuritas

Exhibit 176: MYOR Net profit (LHS), Net profit growth and margin (RHS)

Source : Company, Ciptadana Sekuritas

Exhibit 177: MYOR ROIC

Source : Company, Ciptadana Sekuritas

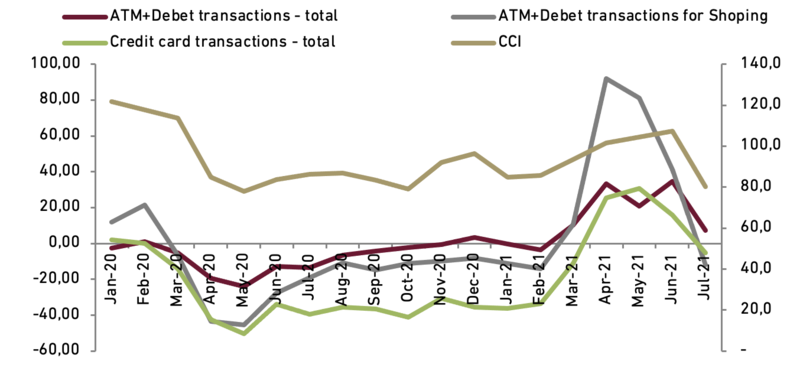

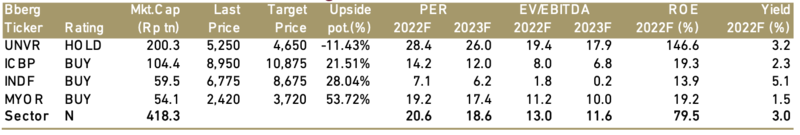

- Maintaining Neutral view for the sector

As the sector is still facing a lot of headwinds in the near term, we are maintaining our Neutral view, as we believed the buying power recovery will start to happen next year after vaccination reach broader population. Hence better spending environment should help profit panaceas effort during rising soft commodities price, we view that this will also lead to more and more companies realizing that they have to increase prices to neutralize impact from cost inflations. Furthermore apart from aforementioned headwinds we still consider the sector attractive for long term view as it already offers attractive valuations because of the massive de-rating in valuation this year, and lagging compared to global peers. At this juncture we cherry pick INDF as sector play with 2022F TP of Rp8,675 using target PER of 9.1x (-1 Stdev of 3 year average), vs. current valuation of 7.1x translating to 15.6%/5.1% earnings and dividend yield. We view INDF now experiences the biggest dislocations as share price de-rated despite its strong agriculture earnings growth and long term growth potential at ICBP.

Exhibit 178: Consumer stocks rating and valuation