Economic Outlook

Bloom amid adversity

Many unfortunates happen in 2022 but Indonesia emerges unlike the others. Prolonged pandemic joins Russia-Ukraine war to bring the volatility in global food and energy crises resulting in soaring inflation. However, Indonesia’s GDP was able to rocket by 5.4% YoY in 2Q22 way above the consensus. The domestic inflation is also one of the lowest among others even after the Government of Indonesia (GoI) increased the subsidized fuel prices. Moreover, the rupiah is relatively stable compared to other as well as JCI hits the high records. Therefore, we believe Indonesia can bloom its true mettle ahead.

- Welcoming several challenges ahead

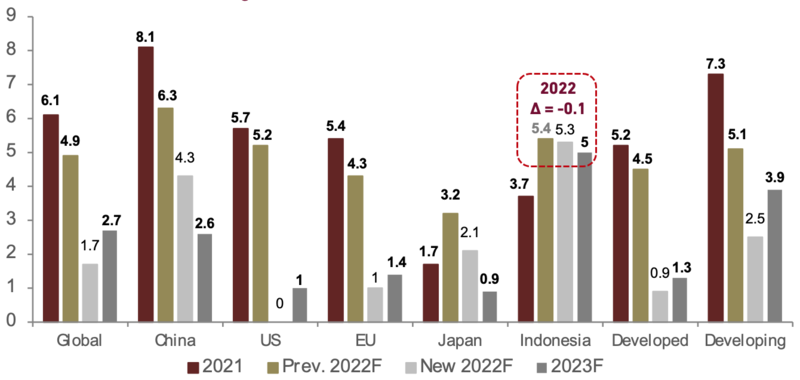

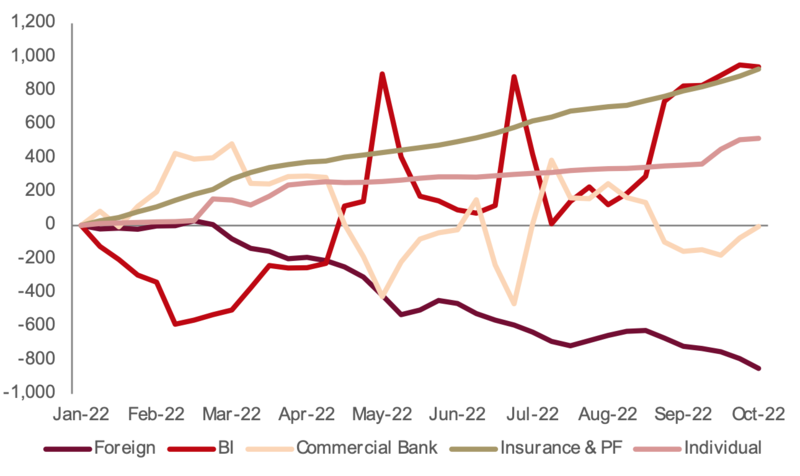

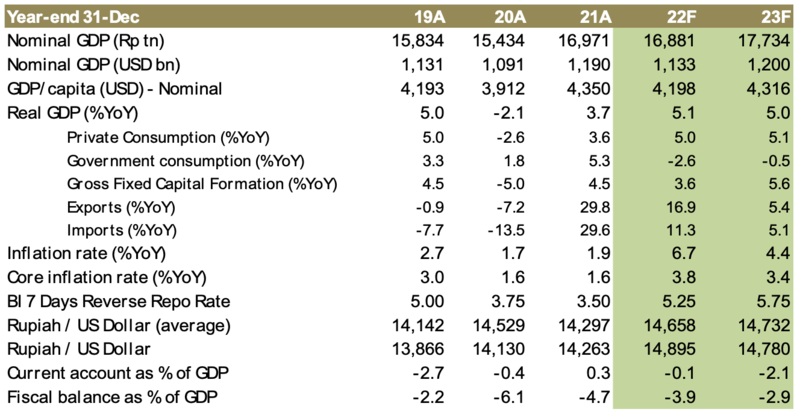

Episodes of the pandemic have hampered the economic activity since 2020.Many countries including Indonesia recorded a negative growth in 2020 but now they have already bounced back. However, in Oct-22, IMF revised down many countries’ GDP growth forecast for 2022. Many significant changes made but IMF only cut 0.1% for Indonesia to 5.3% YoY in 2022. In line, the GoI believes that the growth can achieve 5.2% YoY this year and 5.3% YoY next year. Similarly, we maintain our view at 5.1% YoY in 2022 and 5% YoY in 2023 as the consumption recovers gradually under several challenges including the soaring inflation. Throughout this outlook, we elaborate the catalysts of Indonesia resilient economy for 2022 and 2023.

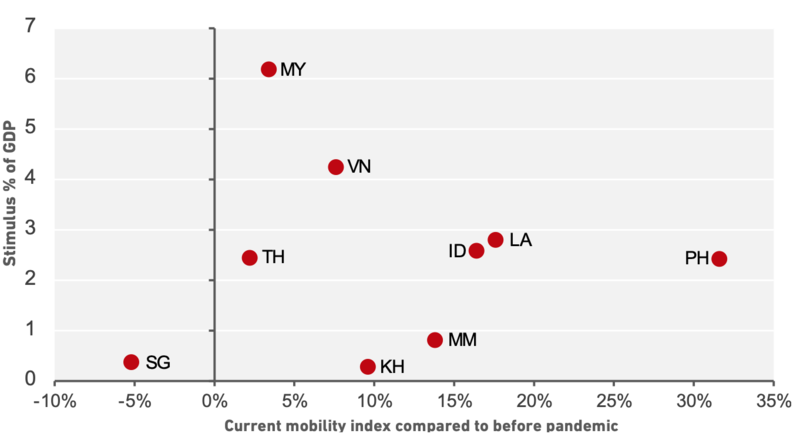

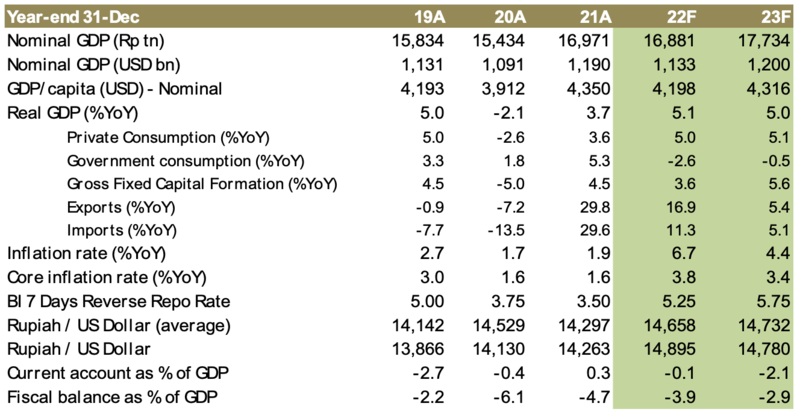

The great effort in Covid-19 handling supports the promising growth above. The herd immunity has been achieved in Mar-22 and as many as 73% of population have taken the second dose of Covid-19 vaccine in 3Q22. Thanks to the fiscal stimulus that keeps the economy afloat through the pandemic amounting Rp455.6tn through the National Economic Recovery (PEN) program. The people’s mobility in ASEAN has also returned to normal or even higher than before the pandemic, led by Philippines, Laos, and Indonesia. Thus, we believe the pandemic will turn into endemic stage then we can say goodbye to its detrimental effect in 2023.

Exhibit 1: Global economic growth forecast (% YoY)

Source: IMF

Exhibit 2: Covid-19 handling in SEA

Source: Google Mobility Report, Ciptadana estimates

Global challenges

External resiliency will be challenged in a hard way in 2023. The geopolitical tension in the Europe may be contagious and spread to Asia in the form of logistical activity but also brings positive outcome in the form of trade diversion. Either way, both lead to the global economic slowdown in 2023 which in turn letting the commodity price to lose its steam after it experienced the commodity super-cycle in 2022.Besides, this year fight towards soaring inflation might be won next year but at the cost of highly tightened monetary regime and bounded economic growth, including Indonesia.

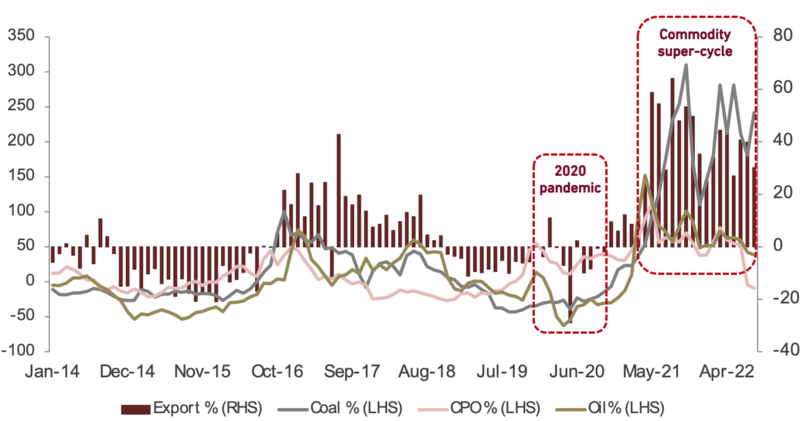

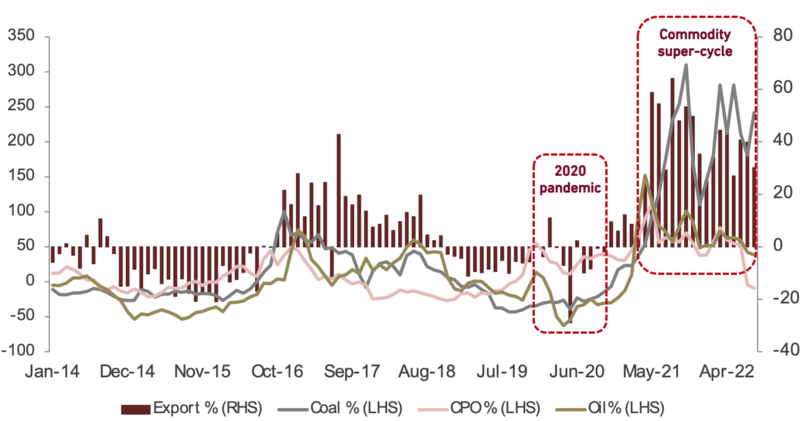

- Commodity price to go downhill

After the global economy reopening in 2021, commodity consumption went back resulting the commodity super-cycle in 2022 where several important commodities like palm oil and coal prices reached their all-time high records. However, due to the slower global demand, many believe the commodity prices will go normalize in 2023. We expect the price normalization will take place gradually in 2023 due to the prolonged Russian-Ukraine war. This is significant to the energy sector as Russia is the second largest crude oil exporter in the world, not to mention both countries are among the biggest global wheat producer. In consequence, inflation soars globally due to the supply disruption where IMF revised up the global inflation from 3.4% to 6.8% YoY in 2022.

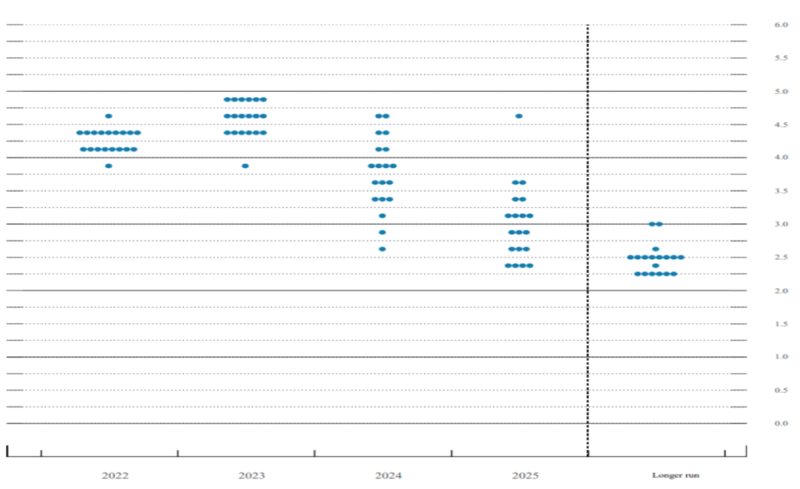

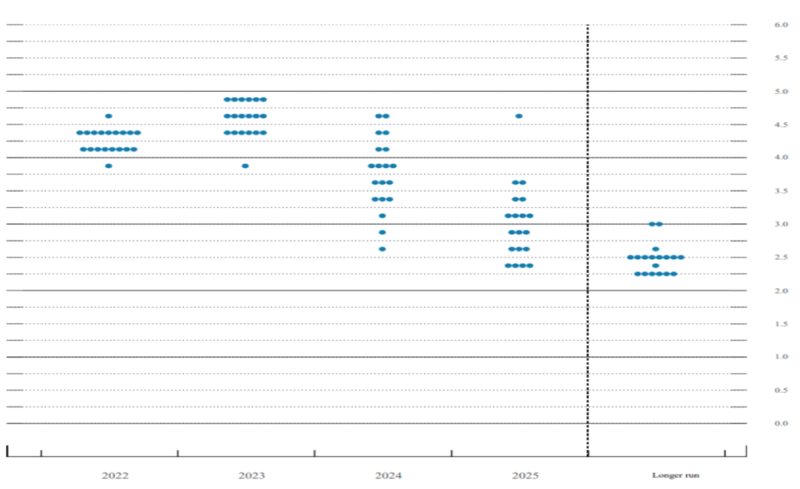

Unfortunately, the global economy has to face the potential stagflation where IMF also revised down the global economic growth from 4.9% to 3.6% YoY this year. Many central banks cope up with the stagflation by taming the inflation first with interest rate hike including the Fed. Historically, the fight against inflation has been won by raising Fed Funds Rate (FFR) above prevailing levels of inflation. Now, the FFR is lying at 3-3.25%. Quantitative easing (QE) will follow as well amounting to USD142.5 bn in 2H22. Even though the inflation has eased to 8.3% YoY in Aug-22, it is still unacceptable. So, the Fed is nowhere near putting the brake and turning dovish. With 2 remaining FOMCs left in 2022, we expect the Fed will continue its 75 bps of rate hike in Nov-22 then 50 bps in Dec-22. Eventually, FFR will achieve 4.25-4.5% in YE 2022, followed with a 25-50 bps hike in 2023, to juggle with the stability and inflation.

Exhibit 3: Commodity prices (% YoY)

Source:Bloomberg, BPS

Exhibit 4: The Fed’s dot plot projection

Source: The Fed

Inevitable soaring inflation

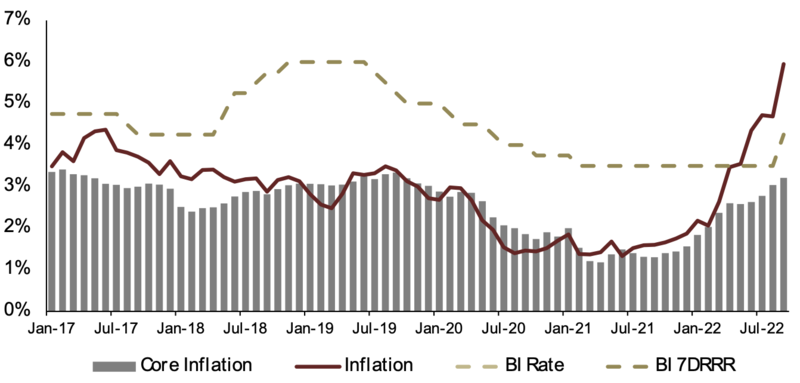

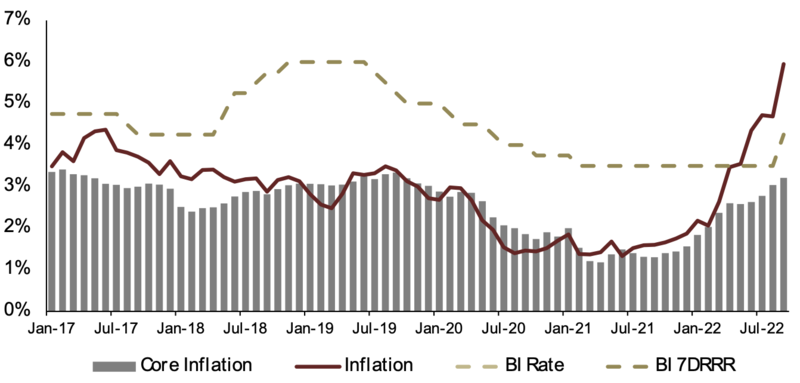

After being muted for a year, the inflation is rocketing. Indonesia's inflation rate accelerated to its highest since Oct-15 at 5.95% YoY in Sep-22 due to the higher subsidized fuel prices. Alongside, the stronger domestic demand and the prolonged international disrupted supply side, both will bring higher inflation in 2022 then slightly decrease in 2023 due to the global economic weakening ahead. BI predicts the inflation rate will achieve 6.5% YoY in 2022, surpassing the target at 2-4% YoY. After peaking in 4Q22, we expect it may achieve 6.7% YoY in 2022 then decelerate to 4.4% YoY in YE 2023.

As the global oil price rises, GoI has adjusted the fuel prices so the inflation jumped high in Sep-22. This is the direct impact of the subsidized fuel price hikes around 30% in earlySep-22 as GoI moved to rein the swelling energy subsidy. It led to the elevated cost of transportation where fuel contributed 82.4% of inflation in total transportation. However, the inflation could heat up next month as several regions have not yet increased their transportation fares. We expect the second-round impact of fuel price hike will continue towards the inflation until 1Q23 as the inner-city and cross-city transportation fares are just going to adjust the price. The elevated inflation may remain in 1H23 also due to the base-year effect of subdued inflation in 1H22. Then in 2H23, it starts to normalize.

With the soaring core inflation, BI is preparing for the more tightened monetary policy. On the other hand, the Fed might be less aggressive amid the fear of US technical recession and the ease of inflation in Sep-22. BI is waiting the impact of higher RRR and bond sells to show up parallel with utilizing the interest rate hike. Next, BI aims to sell about Rp70 tn of bonds with maturities of five years and below in order to soak up excess market liquidity. It has to be realized as well that the “money printing” from BI through the Joint Ministerial Decree (SKB) III regarding burden sharing mechanism contributes to the soaring inflation. However, this program will end in Dec-22 so the money supply can normalize as well in 2023. Thus, we see that BI rate will face hikes for another 50 bps 5.25% until YE 2022 then another 50 bps to 5.75% in 2023 to stay competitive yet accommodative.

Exhibit 5: Inflation and policy rate estimates

Source: BI, BPS, Ciptadana estimates

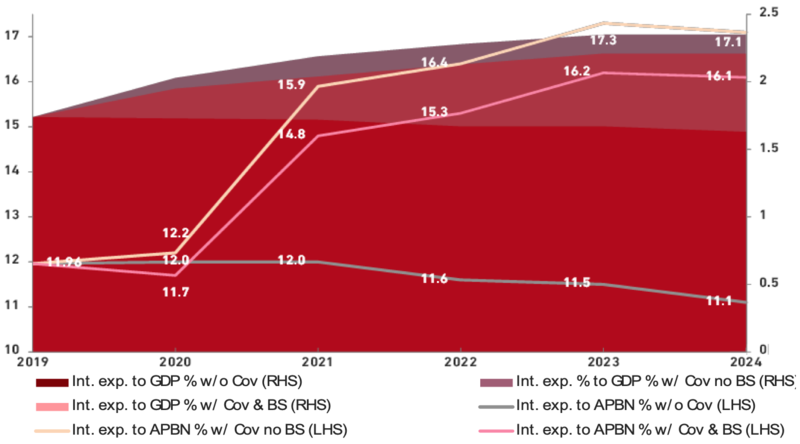

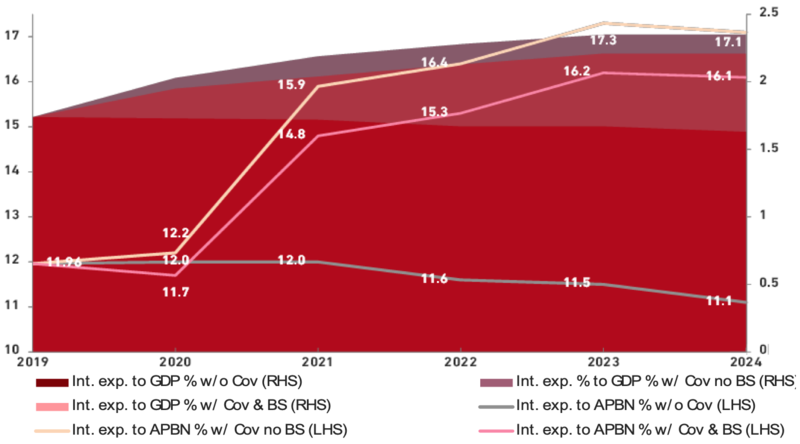

Exhibit 6: Interest expense to state expenditure under BS scheme

Source: MoF, BI

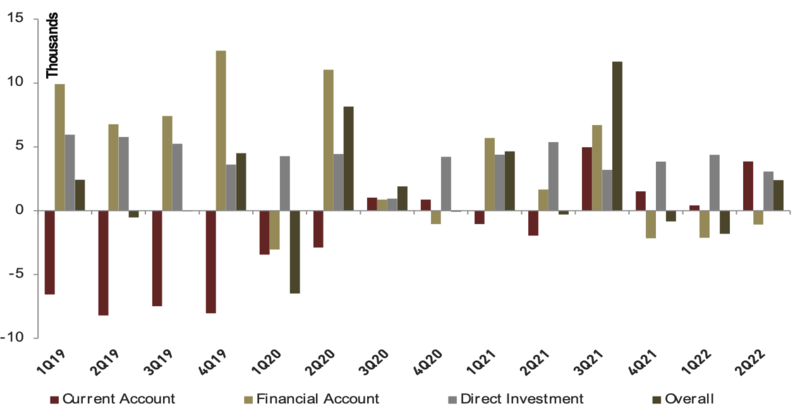

Buoyant external sector

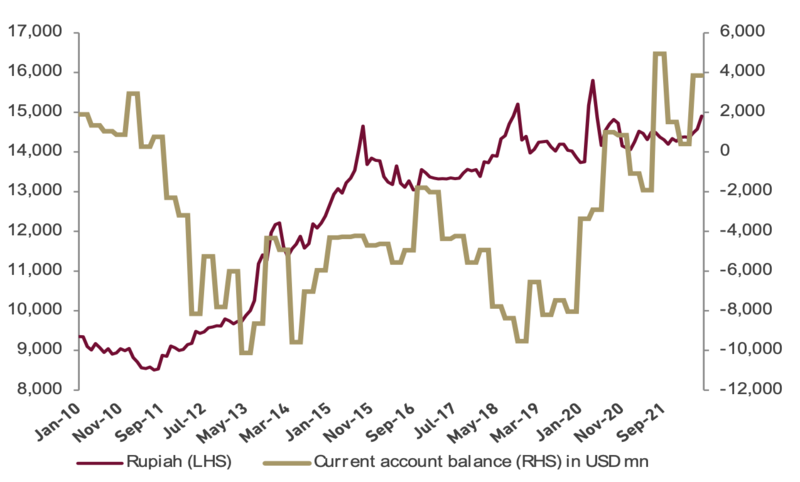

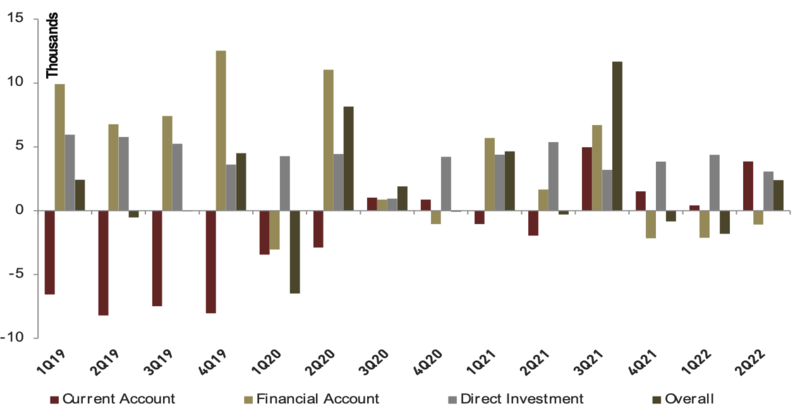

Since late 2011, Indonesia recorded current account deficit (CAD) until it reversed to surplus in 3Q20. Until 2Q22, it remains at positive territory at USD3.85 bn (1.14% of GDP). With the elevated VIX index at 31.4 (88.9% YtD) in Oct-22, it will be hard to hope the financial account back to positive territory as investors secure their assets into safe havens including dollar. As the result, DXY goes bullish to 112.7 (17.2% YtD) in Oct-22.

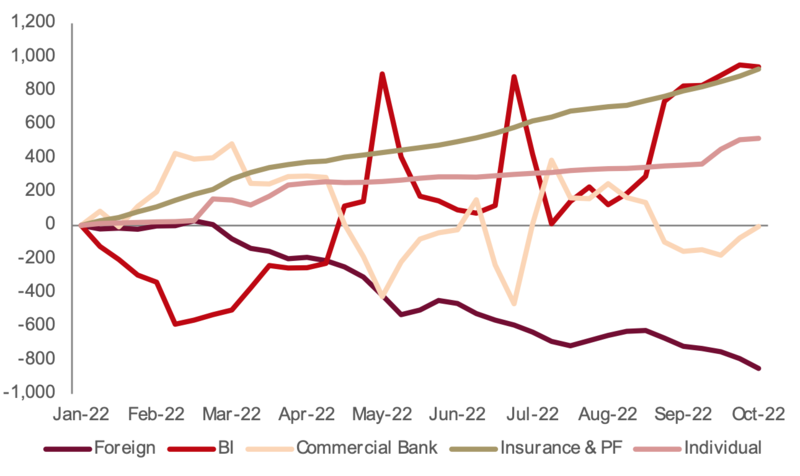

- Pressure on financial account

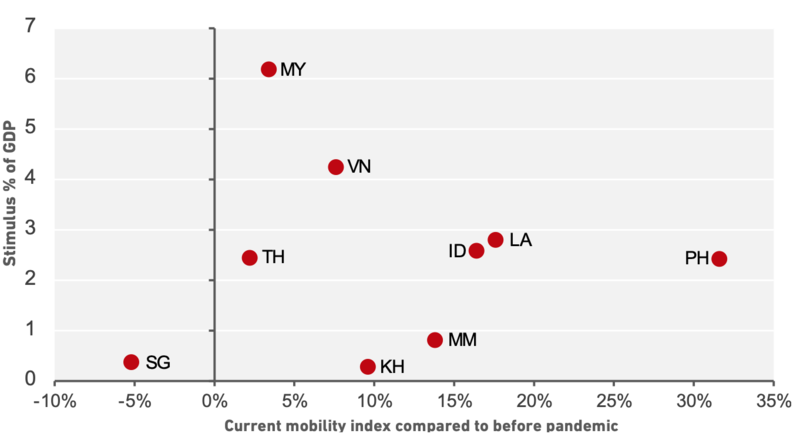

Alongside with the Fed’s tightening policy, the financial account was back to the deficit since 4Q21 until now. However, due to the increasing global volatility, some investors will return or stay on safe havens (including dollar) in 2022. Assuming the volatility will ease but the developed countries’ economic growth is decelerating, we are sure that the portfolio flows will be more conducive in 2023. Until Oct-22, non-resident investors booked a net sell totaling Rp167.8 tn in the bonds market and a net buy of Rp69.7 in the stock market. The trend of capital outflow from foreign ownership on government bonds is likely to continue as the foreign ownership is still enormous around USD47 bn (14.2% of total amount of outstanding government bonds) on government bonds. Thus, we expect the CAD will occur slowly to 0.1% of GDP in 2022 and widen to 2.1% of GDP in 2023 as the normalization of commodity prices.

Despite the volatility in financial market, Indonesia remains resilient as commodity super-cycle brings super trade surplus amounting USD60.9 bn (123.8% YoY) from Jan-Aug 2022. It has been a 28th straight month of surplus until Aug-22 for Indonesia but GoI has to be cautious as the commodity price hike is not forever. The jump on trade performance rides on the back of price hike, not the solid improvement of trade fundamentals. The growth of non-OG export volume has actually slowed down in 2022 due to the weaker global demand. There are also serious logistic issues that remain this year and may persist until 2023 such as the delayed shipments, price volatility and material shortage. The slackening global trade volume is reflected from lower BDI index at 1,961 (-14.7% YtD) in Oct-22. Thus, we expect the trade surplus will narrow in 2023.

Exhibit 7: Balance of payment

Source: BI

Exhibit 8: Commodities price forecast (annual average)

Source: WB, Fitch, Capital, EIA, Ciptadana estimates

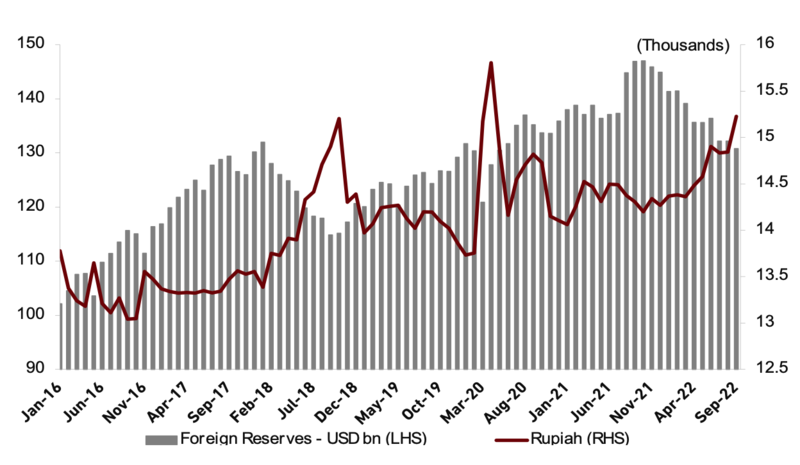

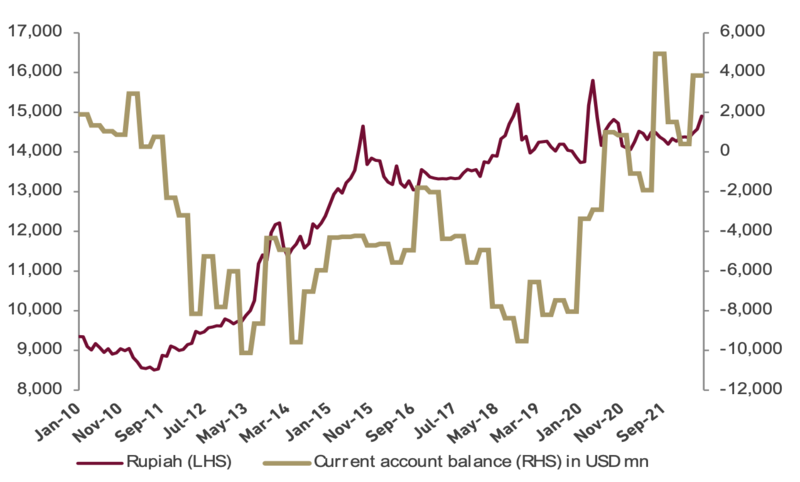

Relatively resilient exchange rate

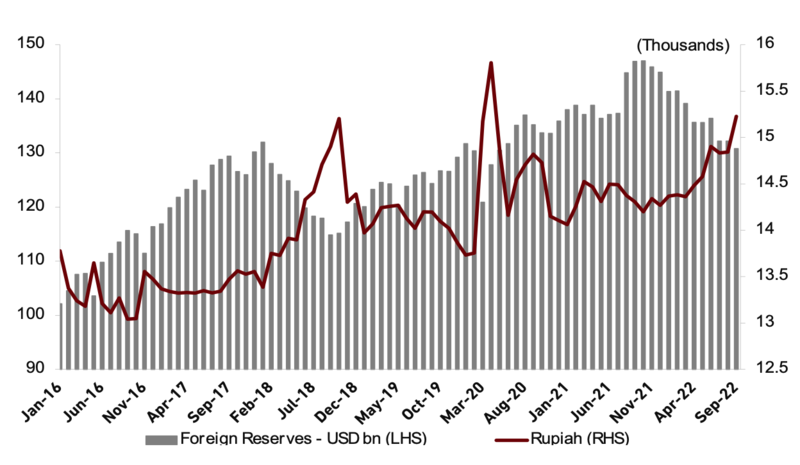

Rupiah exhibits better performance (depreciated 7.08% YtD in the beginning of Oct-22) among other peers’ (depreciated around 10% YtD) especially with Indonesia’s nascent economic growth in 1H22 which was higher than our peers as well. However, the road will be rocky ahead accompanied with the Fed’s hawkish stance. CAD might get back into negative territory as previously explained. Even though forex reserve is still enormous, it is alone is not enough to keep the rupiah stability as 9.5% of it is in short-term liabilities. The soaring inflation and the limited fiscal space to maintain the energy subsidy also put rupiah on risk ahead. We believe rupiah is relatively resilient compared other currencies where we expect rupiah will be at Rp14,895/USD in YE 2022 as we expect BI will intervene near the year end. Then, it may appreciate slightly to Rp14,780/USD due to the weakening US economy in 2023.

Despite the setbacks, Indonesia, as a rich-resource country, is still benefited from the commodity price hike while other countries are struggling. It brings the tax windfall so Indonesia even still recorded a fiscal surplus at 0.58% of GDP until Aug-22. The lower fiscal deficit compared its target and the relatively low debt-to-GDP ratios built up the better macro fundamental, much better than years before. From the external factor, we expect DXY will eventually decrease as the current level is already overvalued on the back of monetary hawkish force. On the other hand, the Fed already gave hint on toning down its rate hike so we expect the current UST yield hike will cool down approaching YE 2022.

- Less but stable foreign exchange reserves

In Sep-22, the foreign exchange reserves were at USD130.8 bn. The downward trend since the beginning of 2022 was influenced by the payment of government's external debt and the need of rupiah stabilization in line with persistently elevated global financial market uncertainty. Due to the lower bond issuance and the lower trade surplus ahead, we expect the foreign reserves will slip slightly in 2023 to maintain the debt ratio manageable. Although the recent Asia’s currencies depreciation has sparked the vibes of the Asian Financial Crisis, most countries in the region have since built up larger reserves of foreign exchange, limiting the spillover effects in region.

Exhibit 9: Rupiah and current account balance

Source: Bloomberg, BI

Exhibit 10: Rupiah and foreign exchange reserves

Source: Bloomberg, BI

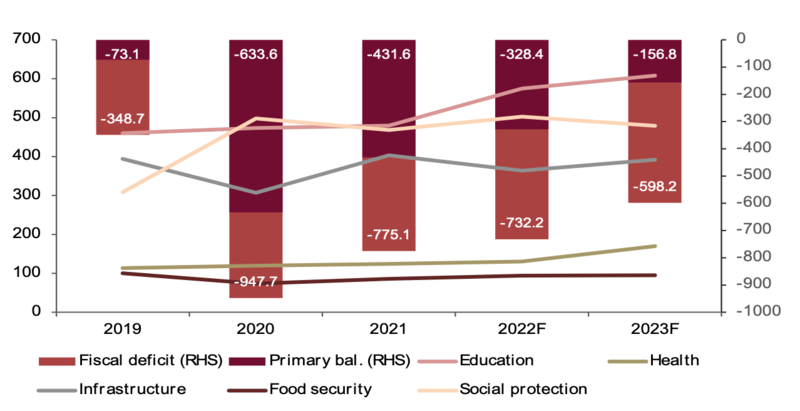

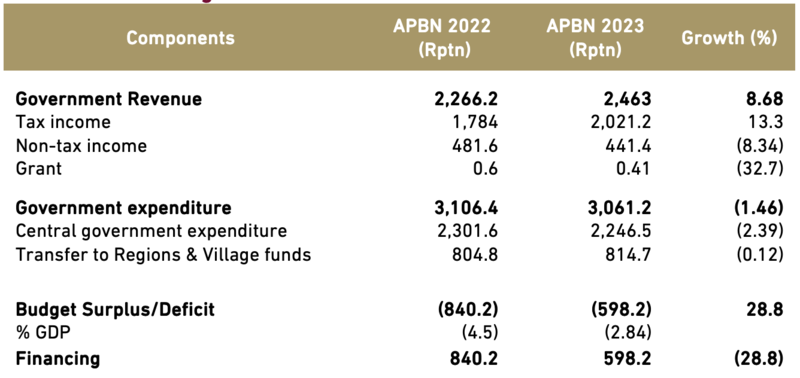

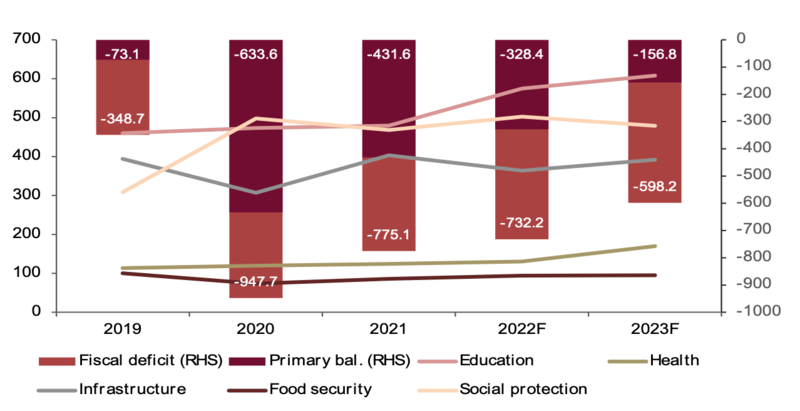

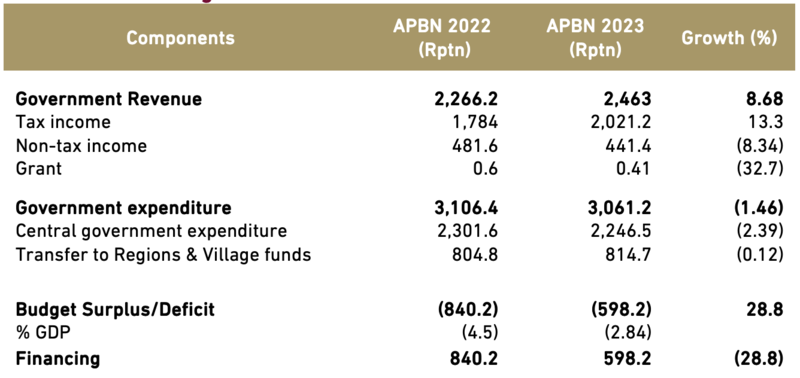

Fiscal policy ahead

The state expenditure is set at Rp3,041 tn (-2% YoY) while the state revenue is at Rp2,444 tn (7% YoY), resulting fiscal deficit at 2.85% of GDP for 2023. The National Economic Recovery (PEN) program totaling Rp455.6 tn will end this year, compensated by the higher (30.2%) health budget next year. With compulsory smaller cap of fiscal deficit at 3% of GDP in 2023, MoF increases the education and infrastructure budget at the cost of lower social protection budget, assuming the economic recovery process will still be on going.

- Concerning issues in 2023

However, our main concern is the wider gap between fiscal deficit and the primary balance. With the rising proportion of interest payment (widening to 79.2% of total deficit in 2023 from 69% in 2022), the productive spending automatically decreases. Besides, we see the quite sizeable budget surplus at Rp107.4 tn (0.58% of GDP) in Aug-22 is far from the target of fiscal deficit this year. It is good that GoI has wide room before going back to the fiscal deficit, but the fiscal deficit is meant for spurring the economic growth. Hasty and ineffective spending could be the case if the realization is done in the last minutes. This will limit the countercyclical fiscal policy and fail to reach optimum economic expansion for 2023.

Pledge to return the fiscal deficit at max 3% of GDP is the main focus in 2023. Returning the budget shortfall below the ceiling will mark the end of 3-years of debt-fueled spending due to the pandemic. By having “Higher Productivity for Sustainable and Inclusive Economic Transformation” as fiscal policy theme in 2023, GoI focuses more on 5 priority agendas: (1) quality of human resources; (2) acceleration of infrastructure development; (3) bureaucratic and regulatory reform; (4) industrial revitalization and; (5) green economic development.

To cope up with future pandemics, GoI initiates Financial Intermediary Fund (FIF) under the G20 to raise USD1.5 bn. Generally, the State Budget (APBN) will be flexible to juggle with several challenges ahead. The MoF has Rp214tn of other expenditure post that may serve as contingency fund (outside energy compensation), providing an adequate buffer against shocks for 2023.

Exhibit 11: Government expenditure and the fiscal deficit (in Rptn)

Source: MoF

Exhibit 12: State budget for 2022 and 2023

Source: MoF

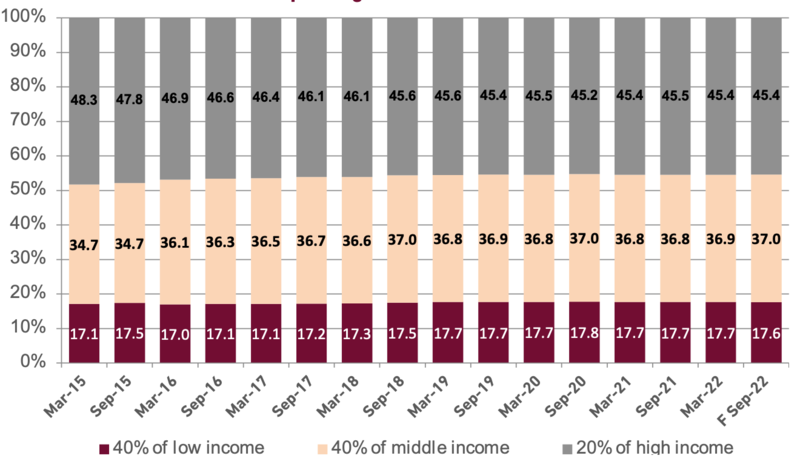

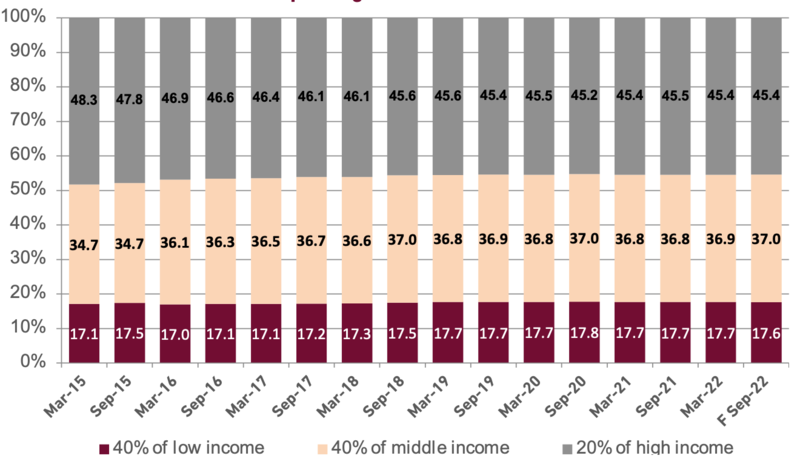

On the back of domestic consumption

One of the reasons why Indonesia can stand still amid the global economic hardship is because its solid household consumption, building 53% of GDP in 2Q22. Despite of the hardships during pandemic, according to BI’s consumer survey, people tend to increase their spending reflected from the average propensity to consume ratio that increased to 74.8% in Sep-22. The Consumer Confidence Index shows a downward trend where the latest is 117.2 in Sept-22. Despite the drop, it still remains in optimistic territory. The Consumer Expectation Index also slipped due to the declining of current income and the job availability. Nevertheless, the expectation is still rosy. Under the soaring inflation, we expect the household consumption can grow by 5.02% YoY in 2022 and stay around at 5.13% in 2023.

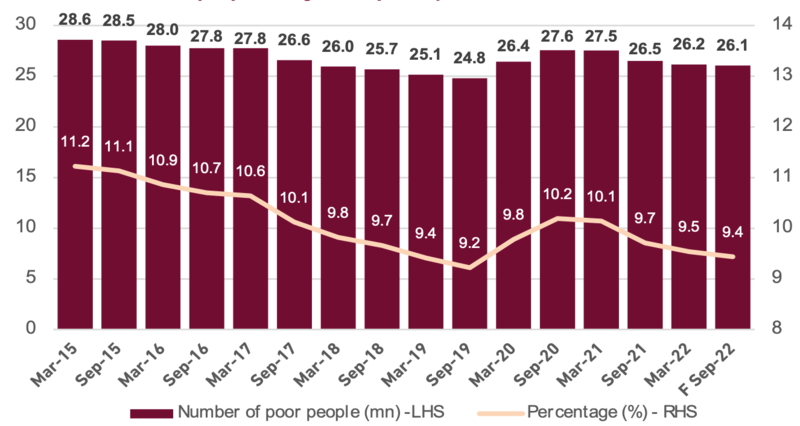

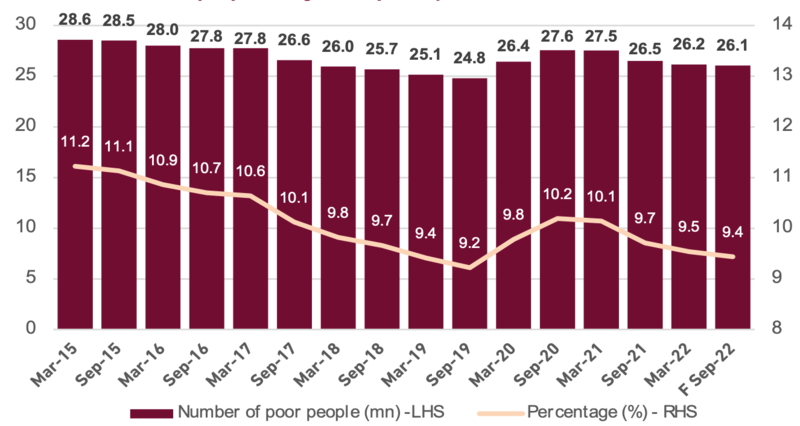

- Flattening the poverty rate

The GoI targets to reduce the poverty rate to 7.5% in 2023 by increasing productivity for an inclusive and sustainable economic transformation. To make it happen, the GoI allocates Rp479.1 tn for social protection in 2023. It will be disbursed for 10 million beneficiaries of Family Hope Program, Basic Food Card Program for 18.8 million beneficiaries, Pre-Employment Card Program for 500,000 participants, electricity subsidies for 40.7 million customers, 3 kg LPG subsidies for 8 mn MT, subsidy assistance for 220,000 house units, and cash assistance subsidies. By having it all, we expect the poverty rate can at least flattened in 2023 as the soaring inflation still threatens the domestic consumption. This is important as investment in the people is a prerequisite for rapid growth.

In general, there is a downward trend in 2022 where people tend to reduce their savings and allocate it more to consumption and installment payment. It may vary along the expenditure categories. However, if we take a look deeper on the lowest and the highest expenditure group of households, we find that there is a decrease of saving proportion by 0.52% and 25.3% MoM in Sep-22. This supports our thesis that the haves are able to save more during the hardships so the domestic consumption may be under pressure in 1H23 when the inflation is still elevated. They tend to allocate their income to face future uncertainty through financial products. However, we see the domestic consumption can bounce back when inflation is more manageable in 2H23.

Exhibit 13: Number of people living under poverty rate

Source: BPS, Ciptadana estimates

Exhibit 14: Share of household spending

Source: BPS, Ciptadana estimates

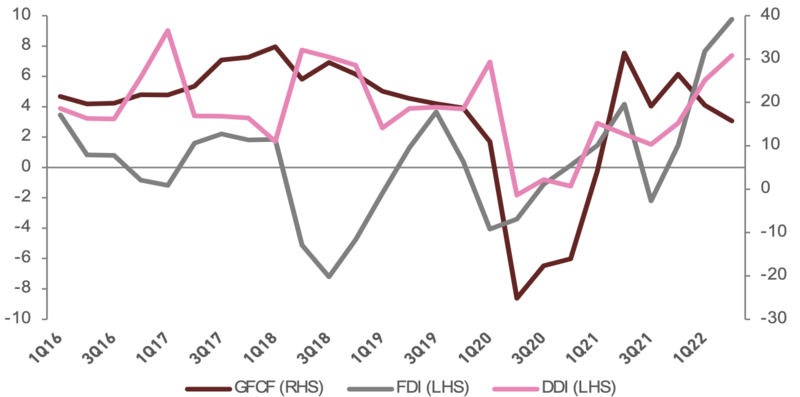

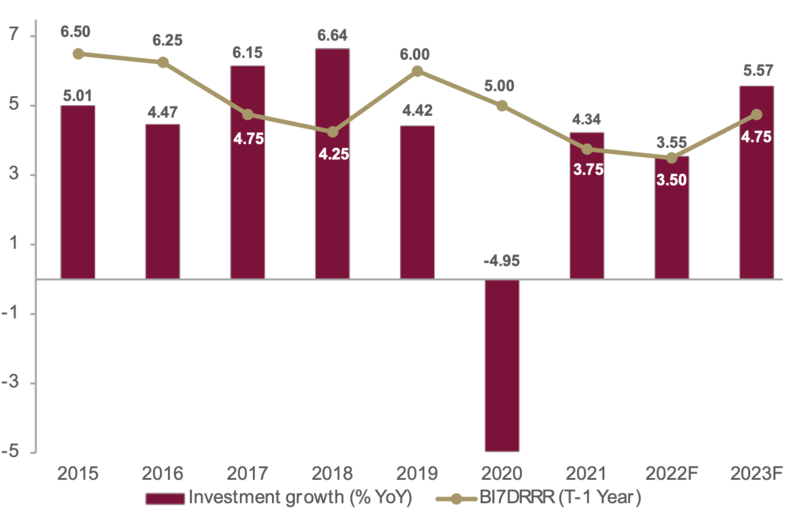

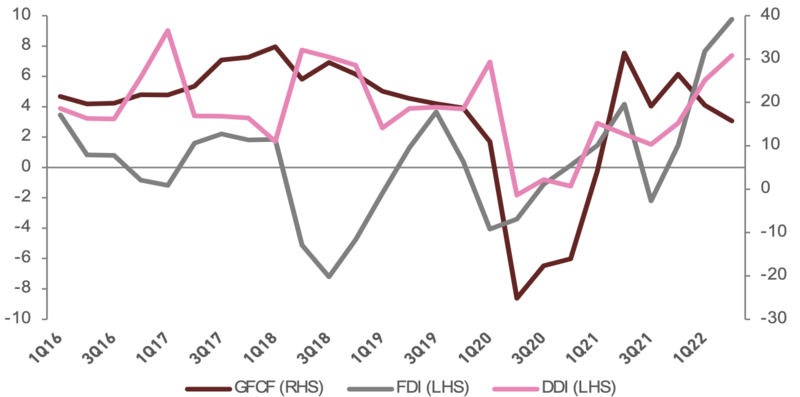

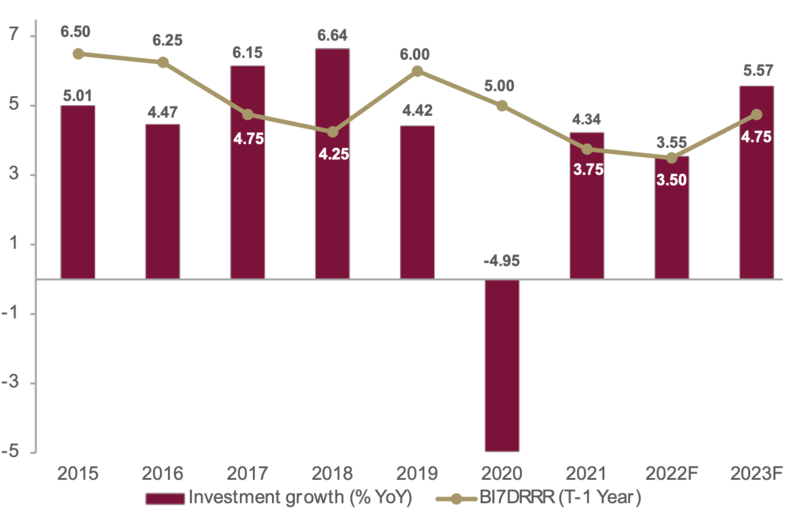

Stable investment growth

Despite of getting inert, investment still contributes 33% of GDP. Until 1H22, the investment realization grew by 32% YoY to Rp584.6 tn or 51% of this year target at Rp1,200 tn. Total investment realization came from FDI and DDI worth of Rp310.4 tn and Rp274.2 tn, respectively. The job creation from the investment built up to 639,547 jobs as well. Singapore (27.7%) and China (20%) led the way as the biggest contributor for Indonesia investment realization. Based on the sector, Basic Metal, Metal Based Goods (15.9%) and Mining (10.9%) are two top contributors for investment realizations. We expect that the target of Rp1,200 tn for investment realization this year can be achieved successfully as last year target was surpassed by 104.9% during harder momentum where pandemic was still vivid.

United Nations Conference on Trade and Development (UNCTAD) increased Indonesia’s ranking on investment ease rating to 18 while Singapore is 19. There are at least five indicators: permit transparency, speed synchronization, service, Online Single Submission (OSS), and efficiency in licensing management and certainty. Up to now, there are more than 170 foreign firms that have revealed their interest in relocating their investment to Indonesia and 30 of them have walked the talk. Thanks to the better investment climate and enormous effort by GoI in approaching many significant countries directly.

The Ministry of Investment (MoI) has revealed higher target of investment realization for two next years from this year at Rp1,200 tn to Rp1,400 tn in 2023 then Rp1,600 tn in 2024. There are three focuses to achieve the target: (1) developing green or sustainable investment like Tesla, (2) increasing value added industries through down-streaming natural resources and (3) supporting collaboration between big players with Micro, Small, and Medium Enterprises (MSMEs). However, the monetary tightening may become the challenge as the policy rate is getting higher, making the higher cost of borrowing. With stable and longer-term source of foreign investment, it will surely support the macroeconomic stability in long run. We expect the gross fixed capital formation (GFCF) itself may jump to 5.6% YoY in 2023.

Exhibit 15: GFCF and FDI-DDI realization (% YoY)

Source: BPS, MoI

Exhibit 16: Investment growth and BI-7DRRR

Source: BPS, BI, Ciptadana estimates

What to expect

Global monetary tightening and the economic slowdown amid the soaring inflation are the main topic in 2023. Those catalysts trigger the capital outflow so the domestic ownership on government bonds is getting sizeable. However, we believe Indonesia is standing still despite of global turbulences supported by the better macroeconomic bedrock. Despite of already waving goodbye to Covid-19, we are still keeping eyes on health issues in 2023. Prolonged Russia-Ukraine war that may escalate to the wider region is also challenging. Due to the global supply disruption, the rising protectionism may occur. This can be burdensome as Indonesia still needs the economic spillover such as transfer knowledge and tech advancement. Thanks to the not-so integrated us in the global value chain, Indonesia is relatively impacted but limited.

- The final decision of Omnibus Law

After declared as “conditionally unconstitutional”, the House of Representative (DPR) is reviewing the Law No. 11 of 2020 on Job Creation or the Omnibus Law. Should DPR fail to complete this by Nov, 25th 2023, the Omnibus Law will be deemed unconstitutional. One of the most contentious changes in the law is the qualifications set for BI’s Board of Governors, opening the chance of political candidate to govern BI. Independence of BI is utmost important and impactful for the economy. We expect DPR will let BI to guard its independence as we heard from our source that several components of the Omnibus Law have drastically changed, including this one. In the meantime, the amendment itself is still subject to constitutional challenges. Thus, the major change in the law is able to determine the climate of business in Indonesia.

- Worry not about recession

As widely believed, the world will enter recession next year. However, with many robust macroeconomic fundamentals as discussed above, we are sure that Indonesia is in much better place. Thanks to the relatively stable political condition, it gives business activity a favor. Next year, maximum 3% of GDP for budget deficit hinders the optimal expansionary fiscal policy. Moving forward, election year will bring advantage for the economic growth from higher domestic consumption as the main driver. No doubt Indonesia will bloom amid the adversity in 2023, but being vigilant is a must.

Exhibit 17: Outstanding government bonds flow (in Rp tn)

Source: Bloomberg, Ciptadana estimates

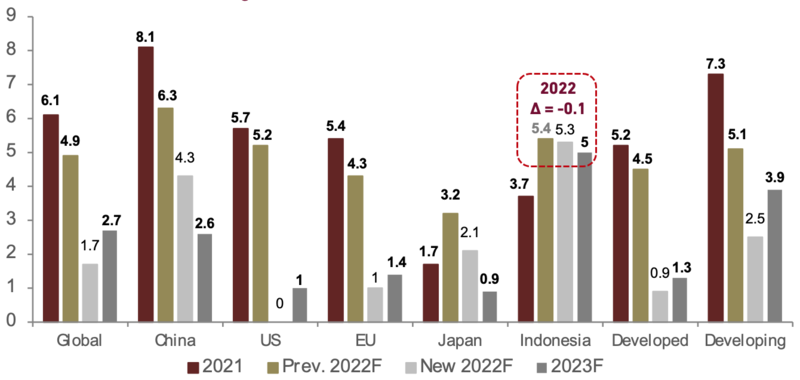

Exhibit 18: Indonesia’s macroeconomic projection

Source: BI, MoF, BPS, Ciptadana estimates