Telecommunication Overweight

Sector Outlook

- Pricing stabilization is here to stay for at least a few more quarters

In YtD 2022, competition has been stabilizing for telecommunication (telco) industry and we foresee the trajectory to remain positive for at least a few more quarters. We arrive at this conclusion following our industry analysis from multiple perspectives. Firstly, we study the past price war and find out two main drivers of intense competition in the industry which are: regulation and rapid declining revenue market share of TLKM/Tsel. As such, we see no trigger for another intense competition in the near future. Secondly, based on our ground checks, we observe steady offerings from telcos, though selective promotions do occur intermittently on specific customer segments. Thirdly, we think at the current industry setting, telcos need to maintain a healthy conduct in a bid to prepare for impending spectrum auction and more network rollouts amid more challenging macro backdrop.

- If history is a guide to the future: 15 years of telco industry

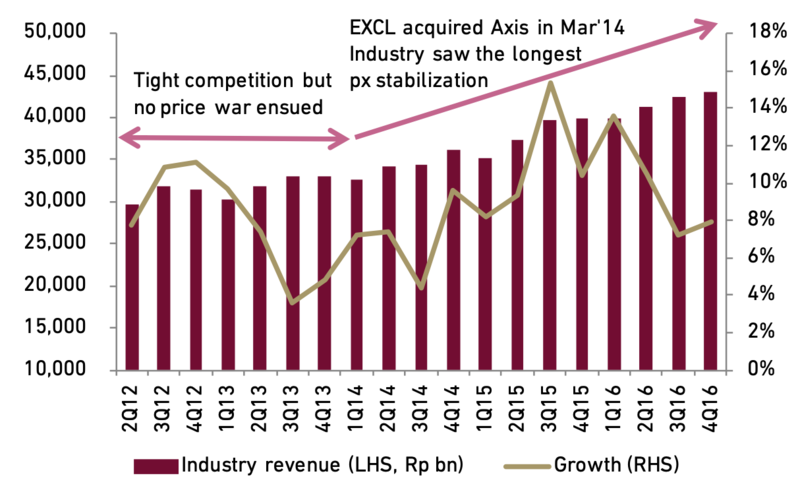

In the past fifteen years, telco industry has faced four episodes of price war that lasted for approximately 3 to 6 quarters per incidence. At the conclusion of each price war, typically pricing repair would follow, lasting for at least one year. Longest post-price-war market stabilization occurred in the period of 2H11-3Q17 for around six and a half year when the market was also supported by one major consolidation with the acquisition of Axis by EXCL in 1Q14.

We conduct an analysis on the historical industry trend and identify each price war in the industry. We also observe the revenue trend of the industry during each period. We sum up the revenue of TLKM, EXCL, and ISAT as proxy to industry revenue in our analysis. Note that we use TLKM revenue as proxy to Tsel due to data limitation on our side. Based on our analysis, the four episodes of price war in the industry are as follow:

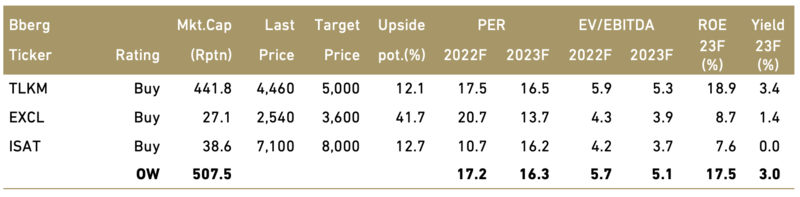

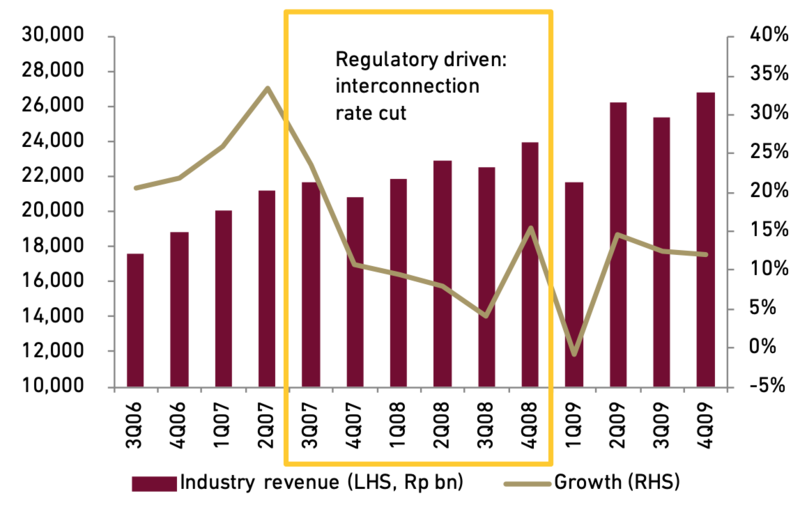

1) One regulatory-driven price occurred in mid 2007 until 2008. This was triggered by MoCIT (Ministry of Communication and Information Technology) decision to cut interconnection rates, driving telcos to switch to high-volume, low-price strategy. This quickly stunted industry growth from 20-30% to single digit and even negative growth in 1Q19 as the aftermath impact. The market entered into stable competition for one year after the price war concluded.

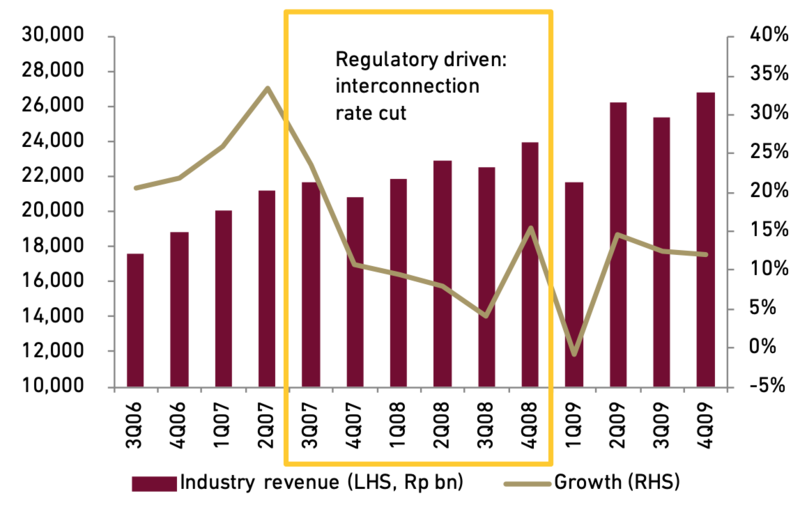

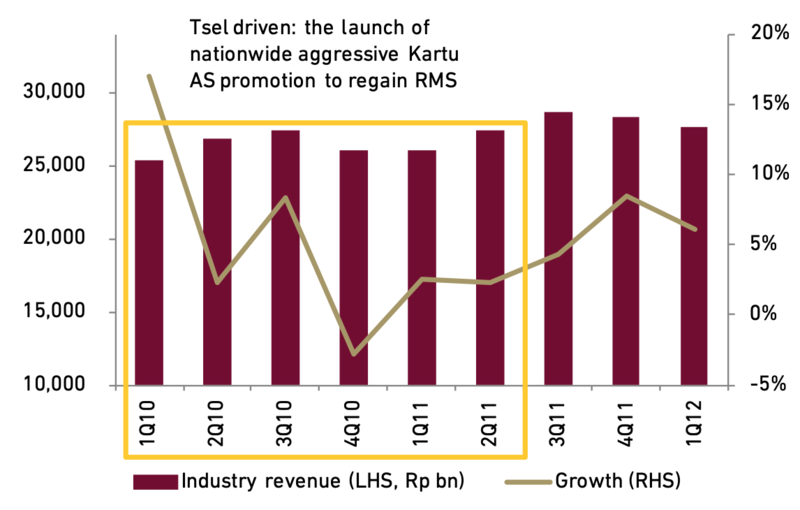

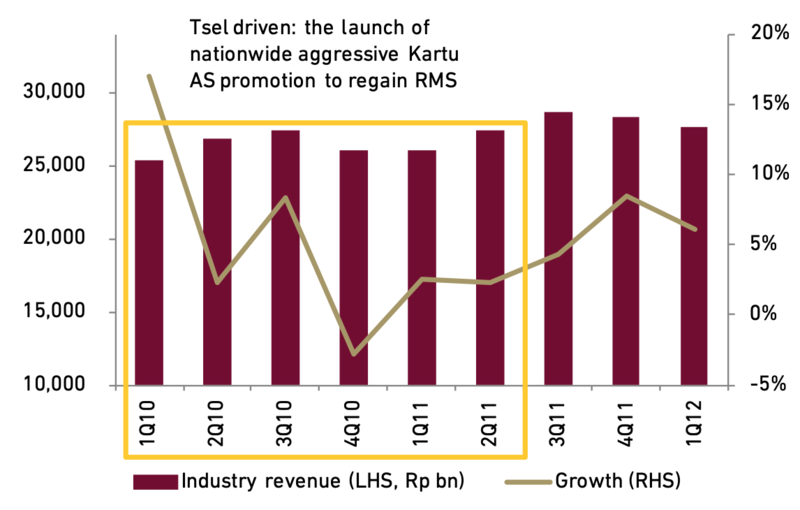

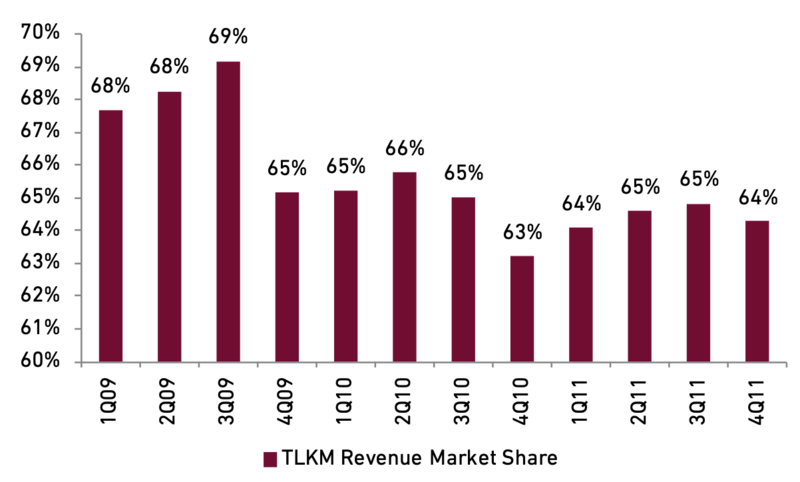

2) In 2010-mid 2021 the industry saw another price war. This time it was initiated by Tsel who was trying to win back revenue market share and enacted pricing discipline in the industry. Tsel launched aggressive promotion on ‘Kartu As’ for its voice service after smaller telcos gobbled its revenue market share from the tune of 68% in 1Q09 to 65% in 1Q10 and even lower to 63% in 4Q10. The price war ended after Tsel regained some of its revenue share (64-65%).

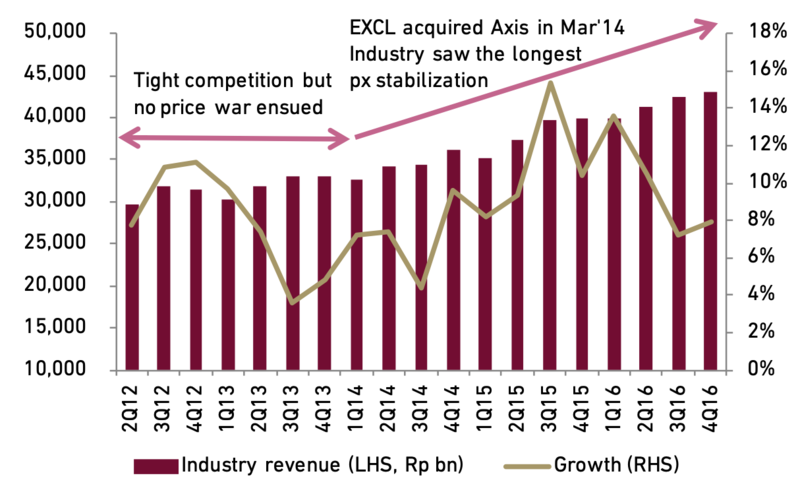

Following this period, the market saw the longest post-war market stabilization that lasted for six and a half years. Consolidation played a part for the mild competition as one major M&A occurred after EXCL acquired Axis. BTEL, with its Esia brand, also ceased operation in 2016, further supporting the industry health.

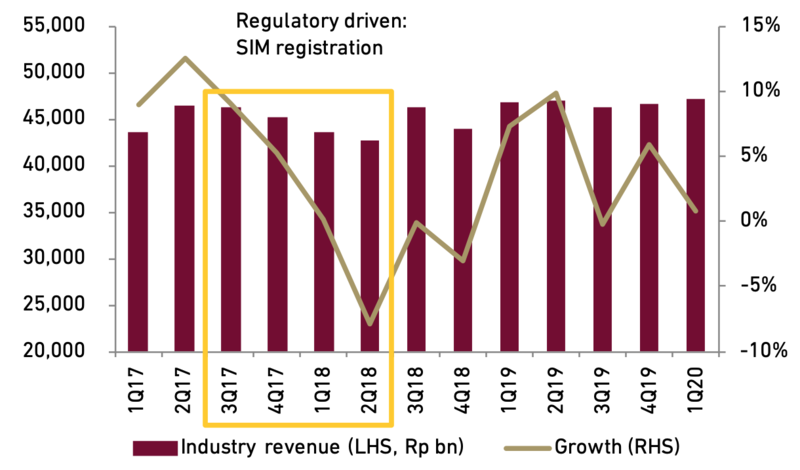

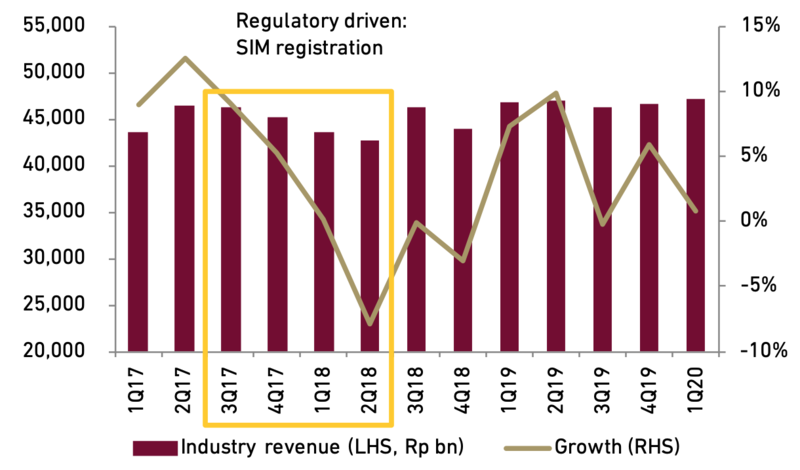

3) MoCIT instituted a mandatory SIM registration in late 2017, triggering another round of price war, albeit rather short, as telcos were striving to keep subscribers in their respective network. At its worst, industry revenue declined sharply by 8% YoY. After the program completed, market repair once again occurred. From this point until the next price war, competition had remained stable but quite intense as smaller telcos were expanding to ex-Java aggressively, gradually eating up Tsel’s market share.

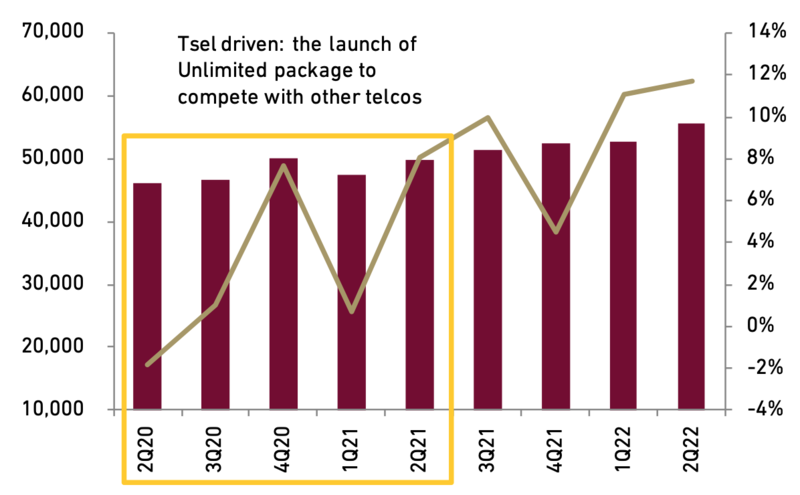

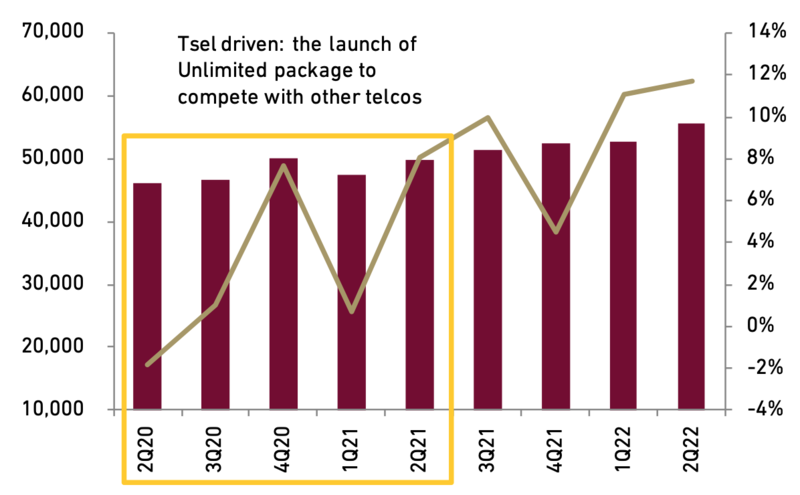

4) The latest price war started in mid 2020 triggered by the introduction of Tsel’s Unlimited Max plan. This was again to fight the revenue market share declines as subscribers down-traded to cheaper package amid weak purchasing power impacted by Covid-19 pandemic. This lasted for around one year before Tsel and later followed by other telcos withdrew or tweaked their unlimited offering. Along with the economy recovery, EXCL begun to lift tariffs and followed by other telcos in 4Q21-2Q22, resulting in healthier industry condition.

Exhibit 45: Price War #1 in 3Q07-4Q08

Source : Companies, Ciptadana

Exhibit 46: Price War #2 in 1Q10-2Q11

Source : Companies, Ciptadana

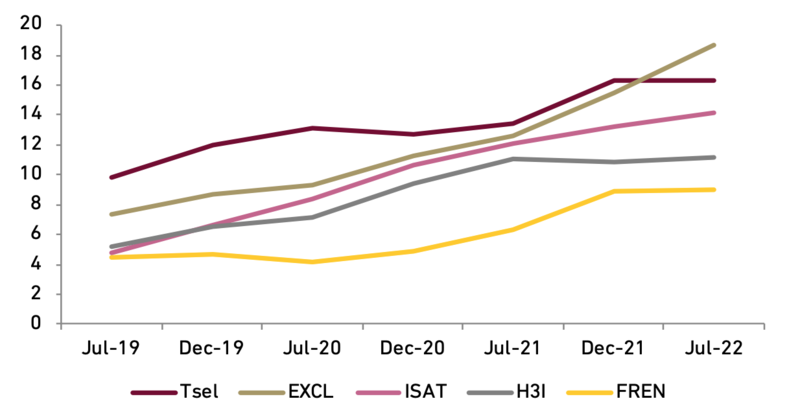

Exhibit 47: Declines in TLKM’s Revenue Market Share Led to Price War

Source : Companies, Ciptadana

Exhibit 48: Longest Market Stabilization Supported by Axis Acquisition

Source : Companies, Ciptadana

Exhibit 49: Price War #3 in 3Q17-2Q18

Source : Companies, Ciptadana

Exhibit 50: Price War #4 in 2Q20-2Q21

Source : Companies, Ciptadana

- Low risk of price war in the near future based on historical triggers

Studying the past episodes, we identify that Government regulation and rapid falls in Tsel’s revenue market share are two main triggers of telco industry price war. At this juncture, we see low risk of price war to ensue in the near future.

1) On the regulatory side, we currently do not see any potential regulatory developments that could trigger a price war. The Government might push telcos to beef-up network roll-out in a bid to reduce coverage deficit, especially in remote areas. Also, talks have also circulated in the past that the Government will institute a price floor and price cap. The former we believe would not trigger intense competition as this is typically part of USO program that is not economically feasible, hence low revenue potential. The latter, if tread carefully, will actually help to regulate a healthier competition in the industry, rather than exacerbate competition, in our view. One that could potentially increase industry competitiveness, albeit indirectly, is the permit for active infrastructure/spectrum sharing policy among telcos. This could accelerate smaller telcos expansion to ex-Java. Nevertheless, the regulation will only permit new technology (5G) roll out for technology sharing, which we believe would not be roll-out aggressively in the near future.

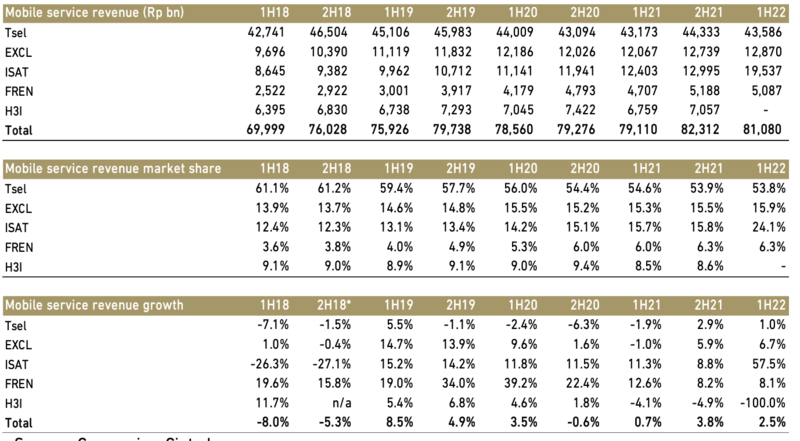

2) On Tsel side, we also see low odds of aggressive price actions by Tsel in the near future. While we will continue to see Tsel’s mobile service revenue to grow slower than smaller peers (as they gradually gaining market share in ex-Java), we the market share declines will be more manageable compared to previously. This will also be supported by less drags from the structural legacy revenue declines, which we estimate would have dropped to 19% of Tsel’s mobile service revenue in 2022F (vs. 22% in 2021 and 28% in 2020). Note that Tsel’s revenue market share has stabilized at 53.8% in 1H22 (vs. 54.6% in 1H21 and 56.0% in 1H20) and we expect this to only fall mildly to around 53.5% by 2022F.

With low impending risk on both regulatory and Tsel’s side, we think it is possible that mobile market competition to remain stable for longer than two years as happened in previous M&A.

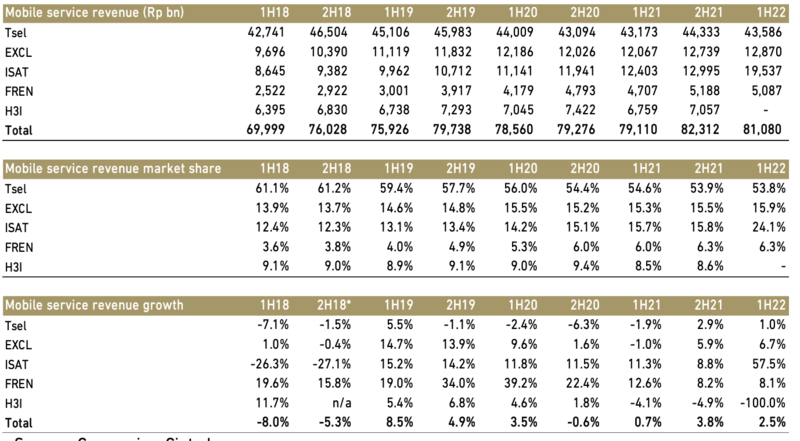

Exhibit 51: Industry Revenue, Revenue Market Share, and Growth

Source : Companies, Ciptadana

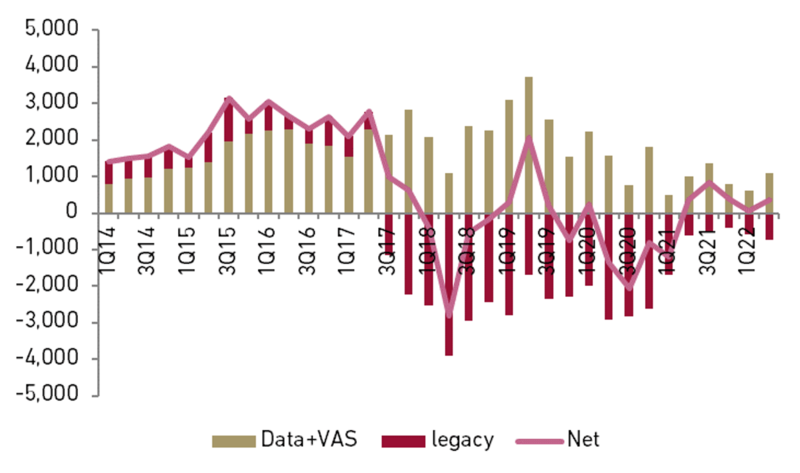

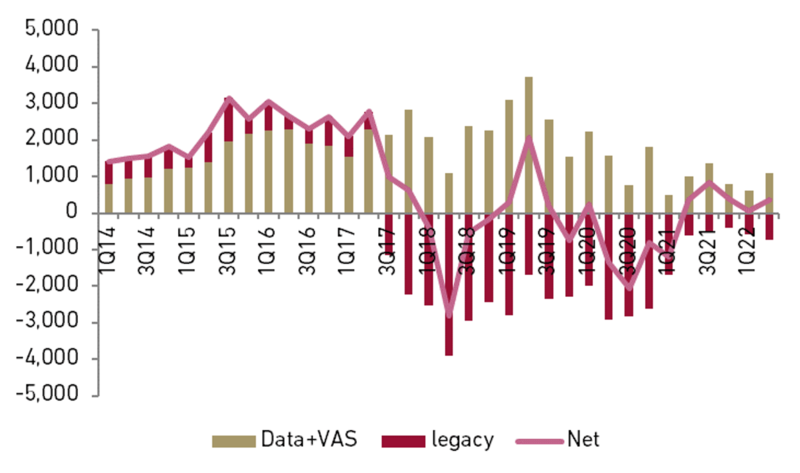

Exhibit 52: Tsel’s Revenue Changes YoY (in Rp bn)

Source : TLKM, Ciptadana

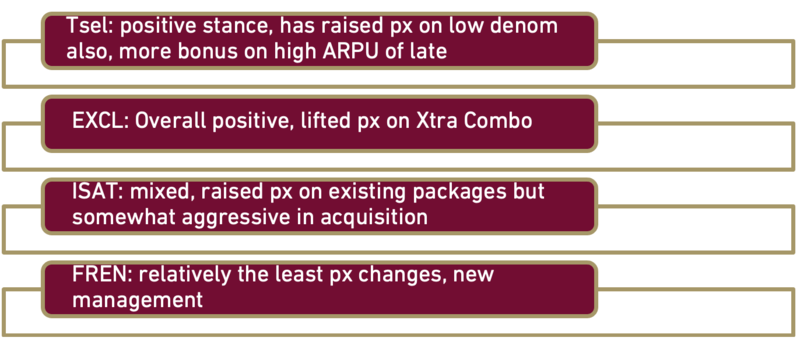

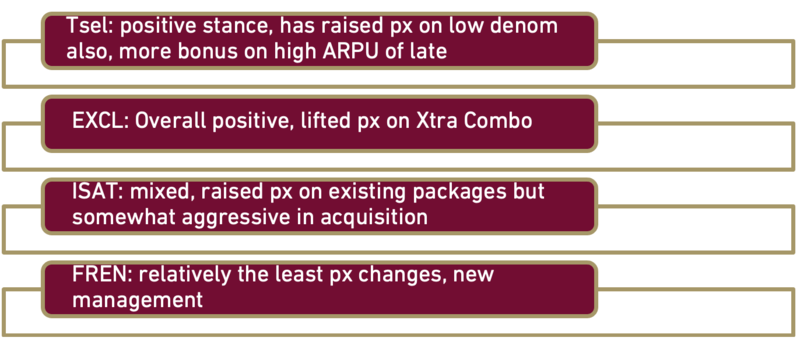

- On the ground: generally steady offerings from telcos

As of the first week of Oct-22, our on the ground tracking revealed that pricing discipline is still enacted by telcos. Telcos have begun raising tariffs since 3Q21 and albeit some tweaks on bonus or volumes, we are confident that the overall industry trend is still positive on YoY basis. Tsel and ISAT have lifted the headline product prices meaningfully two times YtD 2022F by around 7-10% each round, following EXCL who have raised tariffs since 3Q21, the first one to raise tariffs in current cycle. Additionally, other telcos have also curbed their below-the-line promotions, effectively increasing their prices. Nevertheless, we also note some dialled-back from telcos selectively. For example, Tsel is now offering more bonus quota on its high ARPU packages (>100K/month), in a bid to protect its high-value subscribers to stay on its network. Another example is ISAT who is selectively aggressive on its Tri starter pack brand and recently giving more bonus data quotas in some select regions as part of its cluster base pricing.

At this juncture, we expect telcos to at least maintain their pricing discipline though some tweaks and extra promotions might occur, despite the more challenging macro backdrop going forward. In addition, the society’s mobility also continues to normalize especially in big cities which should revert back data consumption to mobile broadband.

Exhibit 53: Telcos’ General Stance on Data Tariff

Source : TLKM, Ciptadana

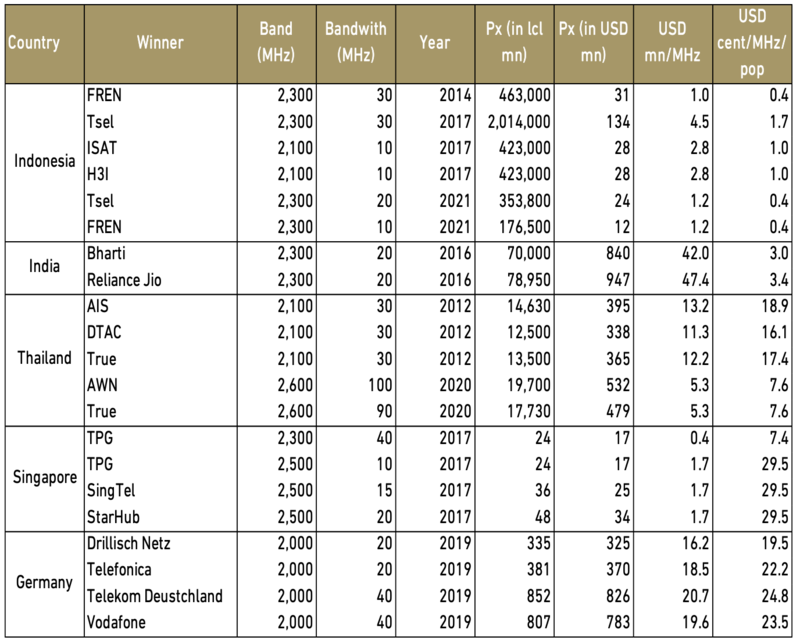

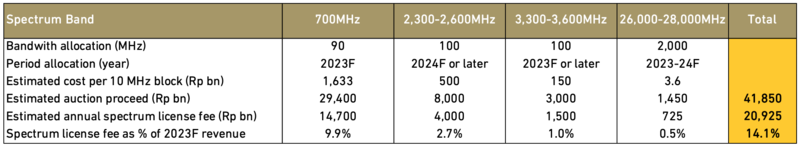

- Telcos need healthy pricing environment ahead of spectrum auction

We think at the current industry setting, telcos need to maintain a healthy conduct in a bid to prepare for impending spectrum auction and more network rollouts amid more challenging macro backdrop. While telcos are currently having healthier balance sheet (thanks to asset divestments and cost rationalization), they would welcome further pricing discipline in the industry. Telcos are currently spending 10-12% of their revenues for spectrum fees and the subsequent spectrum auctions could potentially increase spending portion by c.15pps by 2025F. Therefore, any improvements in data monetization are imperative to sustain profitability

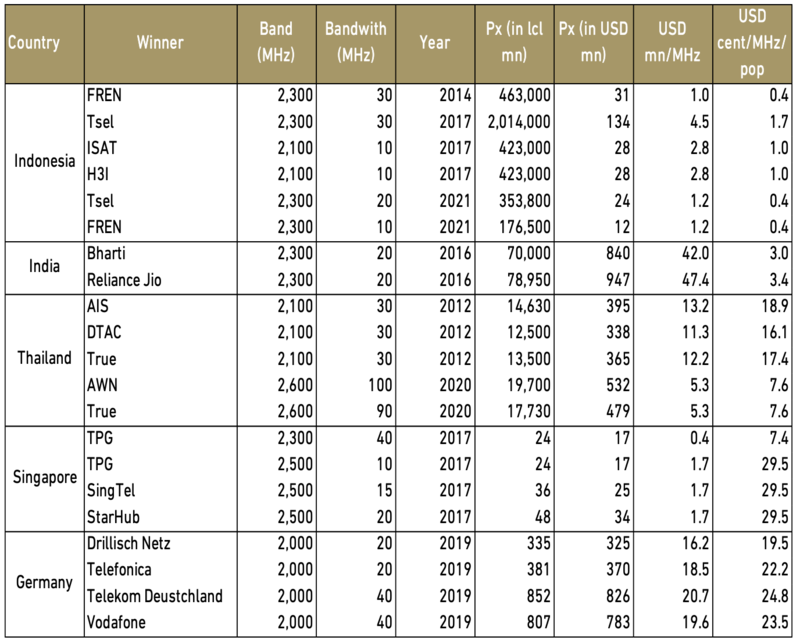

From Government’s perspective, healthier industry landscape would ensure telcos’ commitment for network expansion to meet Government’s aspiration of equal internet access in the country. Further, with stronger telcos, it is more likely that the Government could garner greater auction proceeds. We note that spectrum licensing fees in Indonesia are one of the cheapest in the world both in perspective of cost per MHz and cost per MHz per population. Government would certainly welcome any potential increase in fiscal revenue from spectrum fees which is more feasible to take place in a better industry landscape.

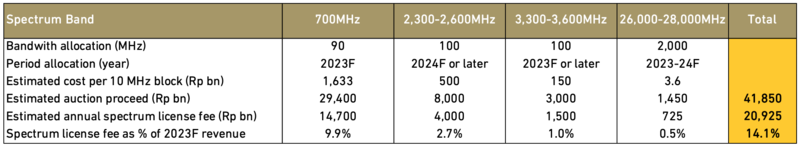

We estimate the spectrum capex spree could cost Indo telcos Rp41.9 tn in spectrum acquisition price (including 1-year prepayment of annual spectrum fees) and Rp20.9 tn in additional annual spectrum fees if all of the planned spectrum are auctioned according to the plan.

Exhibit 54: Spectrum Fees Across Countries

Source : Multiple Sources, Ciptadana

Exhibit 55: Potential Spectrum Auction in upcoming years

Source : Multiple Sources, Ciptadana

- Brighter outlook for telcos in 2023F

The sector is still in a structural transition stage from legacy services (voice and SMS) to data services. The phase of the transition, however, is different from one telcos to another. The silver lining is that the level of competition has been stabilizing of late. From this point onward, we believe competition will still be intense but manageable. Telcos may have their own agendas, however, none would benefit from a severe price war. Tsel instilling pricing discipline by introducing ‘Unlimited Max’ package has somewhat successful in stamping its authority as the telcos with unparalled network quality. Also, further economy recovery will certainly help telcos with monetization. With ISAT-H3I is pre-occupied in integrating its network, we see the bigger odds of data tariffs repair that will translate to higher data yield and ARPU uplift. This will benefit telcos given that data traffic is still expected to continue to grow strongly. Another key driver is cost discipline which in turn befits into another important lever to cash flow generation.

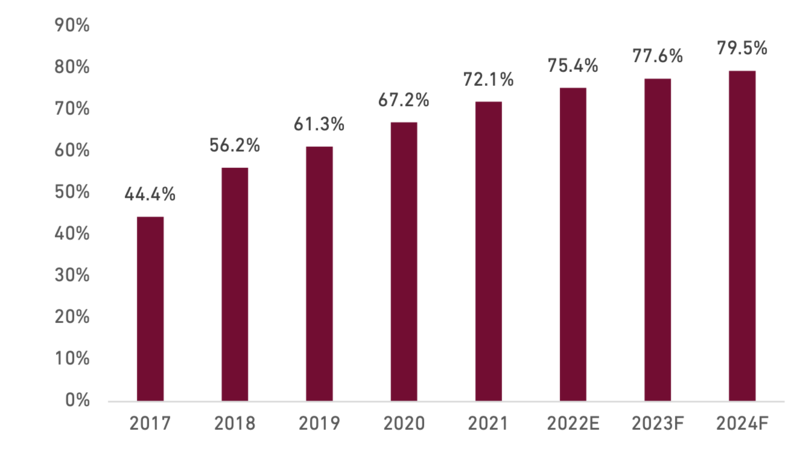

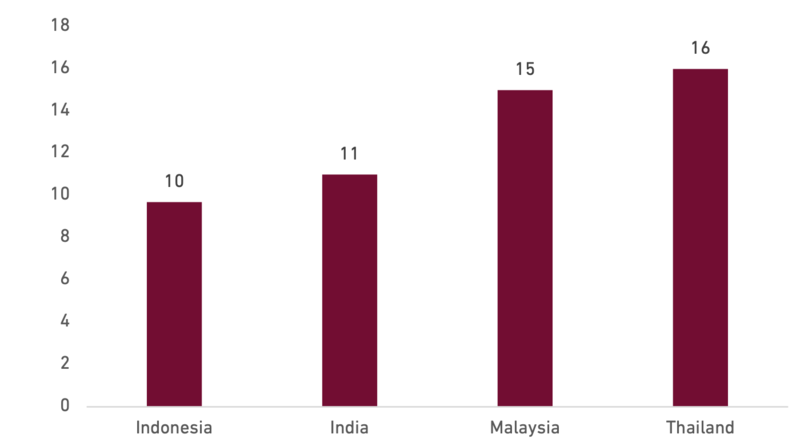

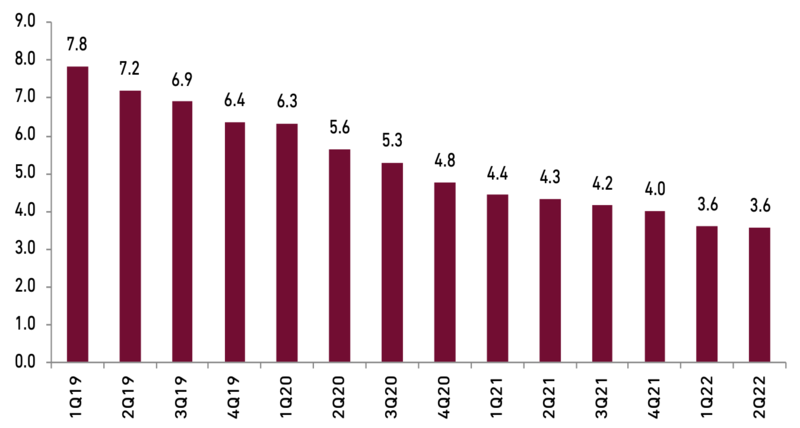

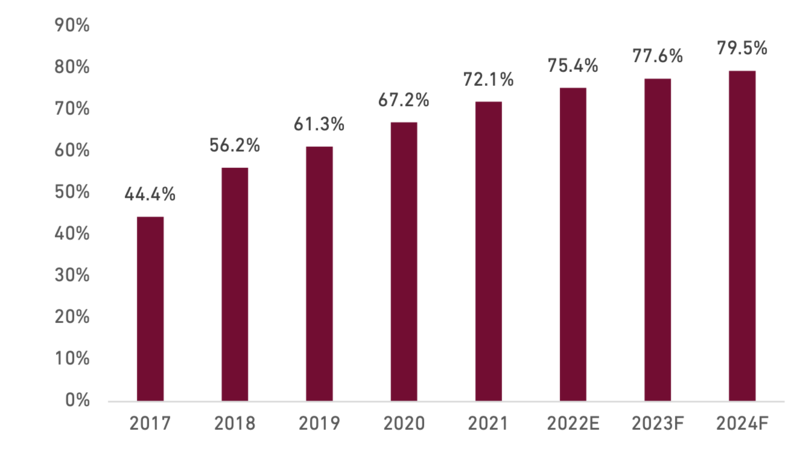

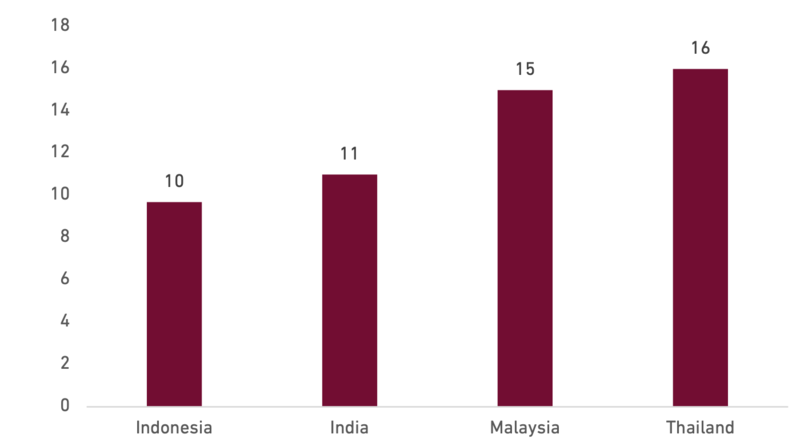

- Industry data traffic growth is set for further growth

Since the beginning of 4G roll-out in 2015, data consumption has witnessed a tremendous growth. Data traffic (from the top-3 operators) grew at 13.9% compounded quarterly rate in 1Q15-2Q22 with 2Q22’s figure is at 43.5x of that in 1Q15. Notwithstanding the explosive growth, we believe Indonesia is still in the earlier phase of mobile data adoption. Indonesia’s smartphone penetration picked-up rapidly in the last few years due to the rise of cheaper handsets especially the Chinese brands. However, Indonesia’s smartphone penetration rate of 75% in 2022F is still low compared to neighbouring countries (Thailand: 85-90%, Malaysia: 80-85%, Philippines: 75-80%). Furthermore, monthly data-consumption-per-subscriber number also suggests ample further growth potential as the average from top-3 telcos is currently at 9.7GB, far lower than that of other South East Asian countries (Malaysia at 15GB/subscriber/month, Thailand at 16GB/subscriber/month) or India (11-12GB). Having a young demographic profile, coupled with the acceleration of digitalization trend, we estimate data traffic could still post 30% CAGR in 2021-24F.

Exhibit 56: Smartphone Penetration in Indonesia

Source : Statista, Ciptadana

Exhibit 57: Data Consumption per Subscriber per Month (in GB)

Source : Companies, Ciptadana

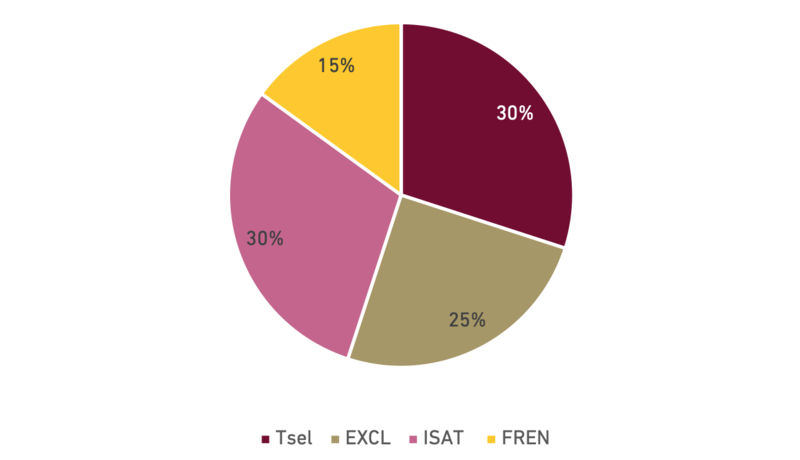

- Smaller telcos are expanding to ex-Java…

Competition landscape in telcos sector is dynamic and intricate. Differences in ex-Java presence, economic of scale, and legacy/data revenue mix are complicating the competition dynamics. For instance, apart from the incumbent Telkomsel (Tsel), smaller telcos are expanding their ex-Java coverage as a greenfield revenue opportunity. EXCL as the early mover, started its ex-Java expansion in 2H16 and has managed to reach >90% population coverage in key islands with current estimated ex-Java market share at c.15%. ISAT and H3I (before merger) have also started expanding to ex-java in 2018/2019 with ex-Java population coverage at around 90%/80-85%, respectively. FREN, while also has initiated ex-java expansions, is more focused to cover more sites in Java and gain more subscribers. We believe EXCL has already achieved the appropriate scale in some of its early ex-Java investments. It now needs to balance out between monetizing and filling-in more subscribers to its networks. On the other hand, ISAT and to some extend FREN will continue to expand their coverage into new areas over the next few years and customers’ acquisitions will be their focal points for a while. That said, they will tread carefully as triggering another round of price war is not what they are looking for.

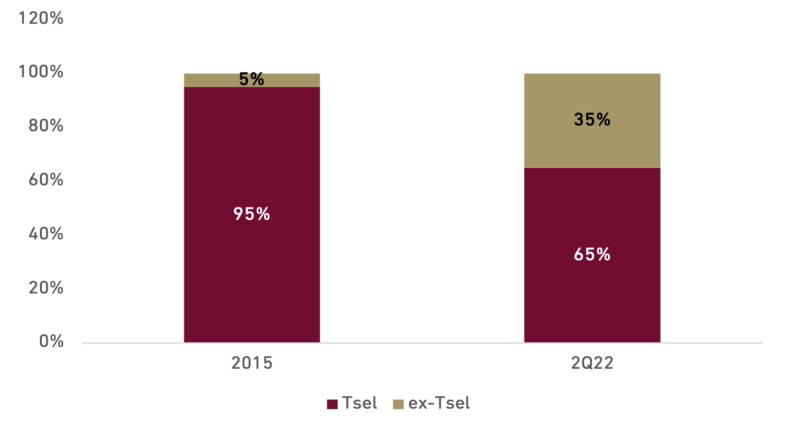

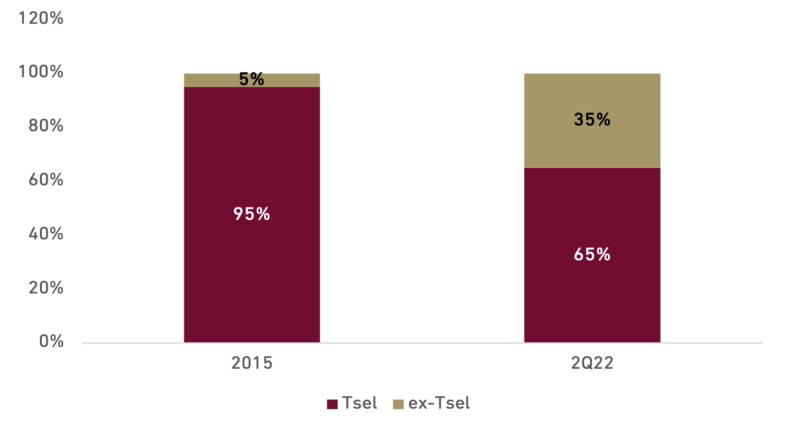

- … taking Tsel market share for a while

Tsel is the network leader in Indonesia and is the incumbent operator in ex-Java with nationwide coverage of >95%. At the same time, Tsel is the latter in term of legacy transition to data/digital services as 19% of revenue is still derived from legacy services in 2022F. Before smaller telcos rolled out ex-Java expansions intensively, Tsel could maintain its legacy revenue while growing data business at the same time. As digital adoption accelerates throughout the country, in some part thanks to smaller telcos expansions, Tsel currently suffers the highest revenue decline from legacy services. Furthermore, its relatively low data engagement compared to peers and some market share losses resulting in slower revenue growth. This situation is exacerbated in 2020. As Covid-19 struck, economy deteriorated and people’s purchasing power shrank materially, especially those in the lower income bracket. Downtrading trend occurred during this period, driving subscribers to switch away from Tsel and switch to other telcos. Nevertheless, in-line with the economy reopening the sector is recovering as explained previously.

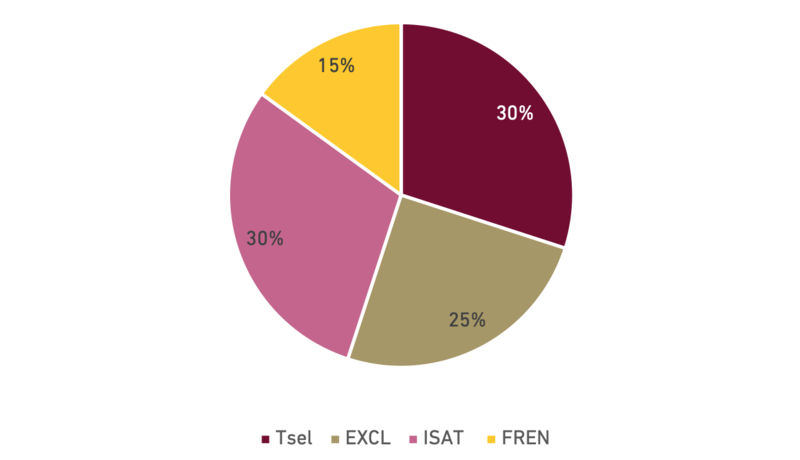

Exhibit 58: Estimated Java Market Share

Source : Companies, Ciptadana

Exhibit 59: Estimated ex-Java Market Share

Source : Companies, Ciptadana

- Well-sheltered to face more challenging macro backdrop

The question for now is whether the industry could maintain its momentum ahead of a more challenging macro backdrop especially with high inflation and lower purchasing power post the fuel price hikes. Some are concerned that the fuel price hikes would push some subscribers, especially those heavily affected by the fuel price hikes and those who are in the lower ARPU segment, to cheaper data packages. However, we argue that the impact would be not be significant/neutral. Many people and businesses are now largely depending on cellular service to function, in part thanks to the Covid-19 lockdown. For instance: the ride-hailing drivers or shop owners in e-commerce are dependent on data as without mobile services they could not make a living or their income will be dramatically affected. Therefore, traffic from such people/businesses would sustain, we believe.

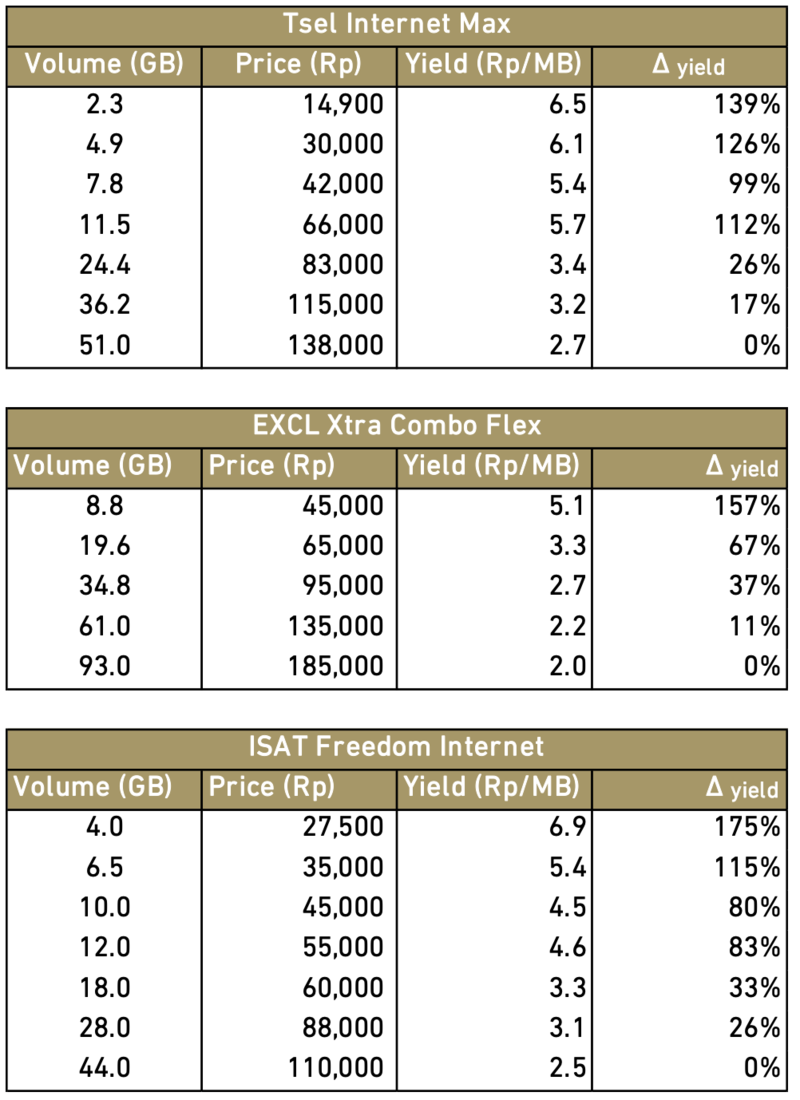

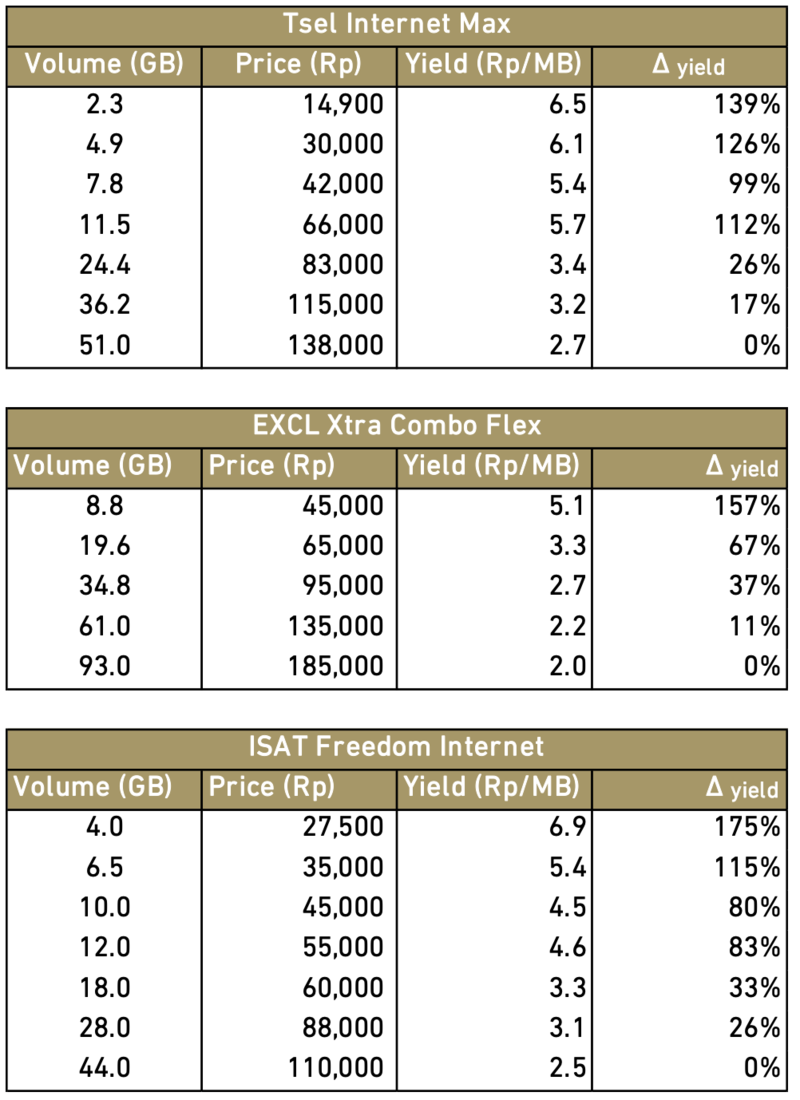

Following the fuel price increases, it is possible that some subscribers are changing their purchasing behaviour, for example: by making smaller top-up for data packages. However, we argue that by shifting to smaller data packages would eventually cost more than packages that offer a large amount of data as well as long duration. Data packages that offer low data are typically more expensive than high data packages in term of data yield (Rp/MB). That said, given the increasing importance of data in daily lives as explained previously, we believe subscribers could not cut back too many data consumption. Hence, we expect telcos revenue trend should remain solid with potential ARPU uplift despite the more challenging macro backdrop.

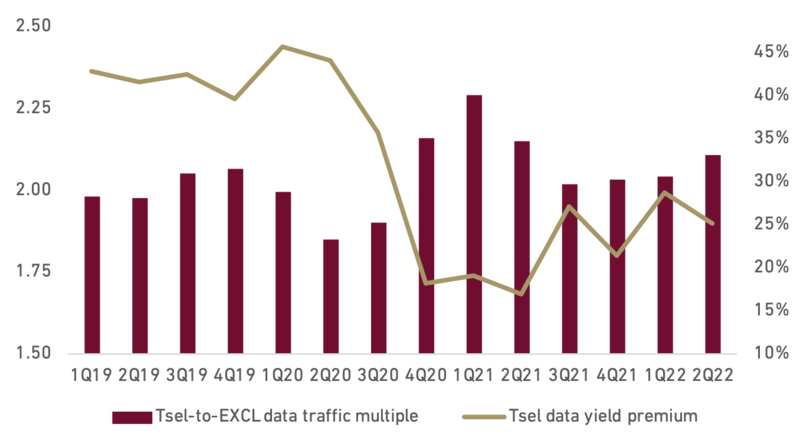

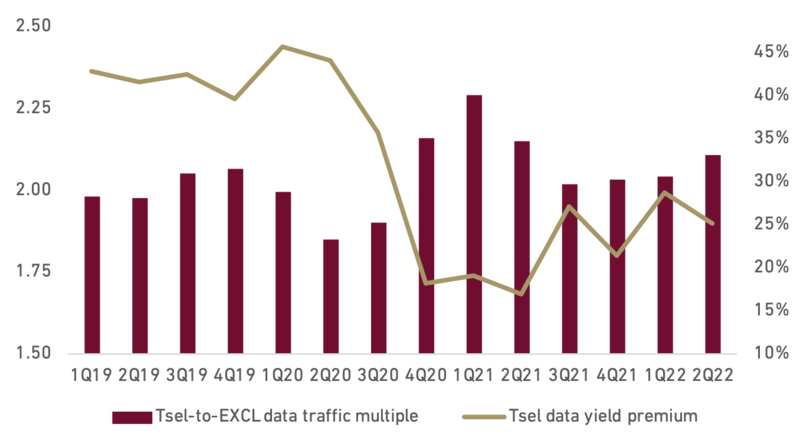

- Stabilizing Tsel data traffic market share and yield

Another data point that we would like to point out is Tsel data traffic market share movement. As the ISAT-H3I merger skews its data traffic vs. historical, we analyse Tsel-to-EXCL data traffic multiple as a proxy to measure Tsel’s data traffic market share. We also observe Tsel’s data yield premium and compare it to the market share movement. These data reveal that Tsel has been able to maintain its comfortable level of 25-30% of yield premium compare to the industry without too much compromising on market share, an indication of stable competition level shares due to its ex-Java expansion. On the other hand, smaller telcos are still having room to further raise tariffs as they usually monitor pricing differential with Tsel before increasing tariffs.

Exhibit 60: Example of the Price Differential in Low vs. High Volume Packages

Source : Companies, Ciptadana

Exhibit 61: Tsel-to-EXCL Data Traffic Multiplier vs. Yield Premium

Source : Companies, Ciptadana

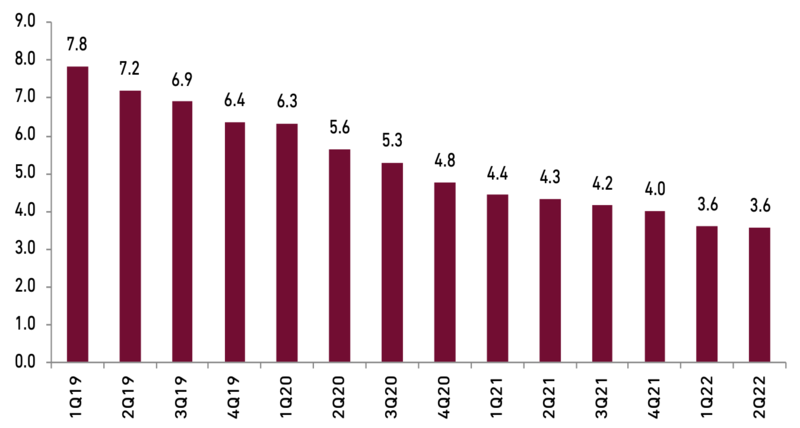

Exhibit 62: Industry Data Yield (in Rp/MB)

Source : Companies, Ciptadana

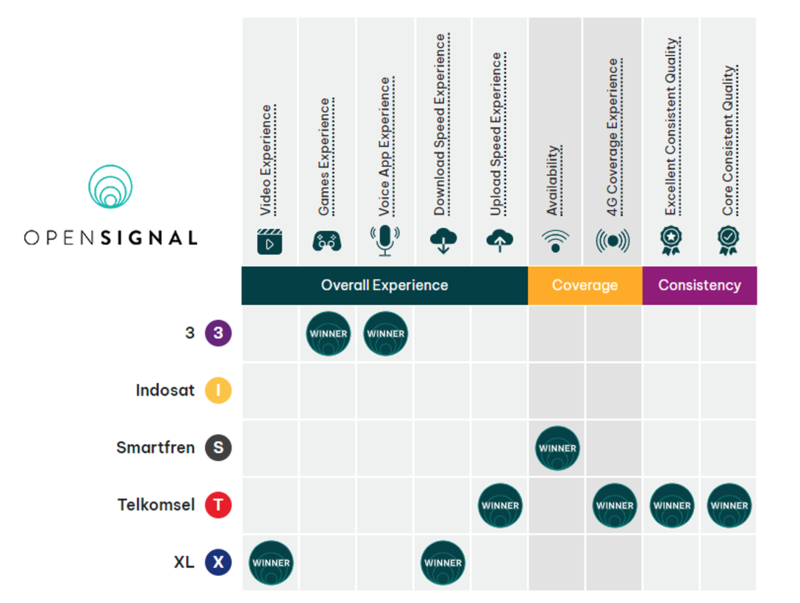

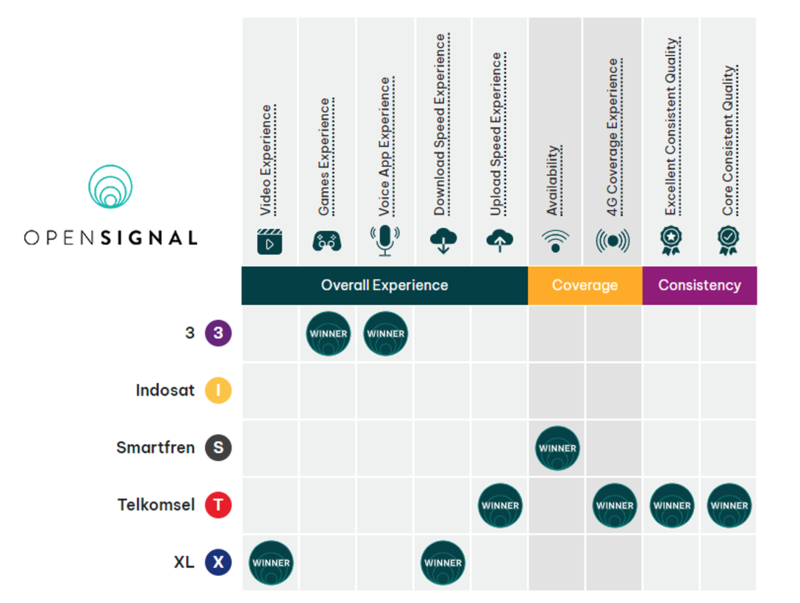

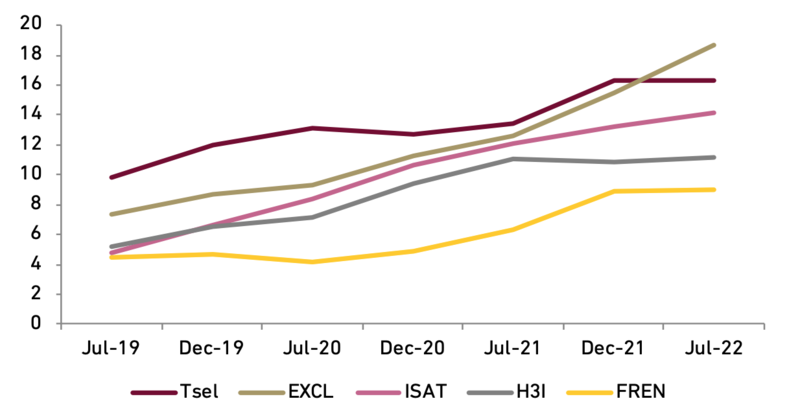

- EXCL’s download speed was faster than Tsel for the first time ever

Based on the latest OpenSignal report, we observe that telcos have been investing adequately to maintain/improve their network performance. Tsel’s network improvements, however, are lagging peers due to its aspiration to regain data traffic market share, we believe. We saw significant improvement in EXCL as the Company recorded faster download speed than Tsel for the first time since the 4G service launched. This is positive for EXCL as data is not fully behaving like commodity. There is a brand value associated with each provider with network quality as one of the key differentiators. Nevertheless, EXCL would need to maintain the number one position for a few more quarters and perhaps improve on its network consistency parameters before it could be perceived as the telcos with the best network quality in Indonesia (currently it is still Tsel as per Top Brand Indonesia).

It is also noteworthy that FREN’s 4G download speed lags peers significantly and despite the positive trend, its deficit to peers is still large. As FREN continues with its unlimited data plan and MiFi products, we believe FREN’s network capacity will continue to be under pressure. We expect telcos will continue with their capex spending going forward to maintain their networks quality. Plenty spectrum auctions on the horizon will also help with network quality improvement. We believe under-investing is not an option for telcos as continuous network quality deterioration may result in revenue loss as reflected in ISAT’s case before its sizeable capex cycle in 2018-2020. Fortunately, telcos are currently in better position now, and as we argued previously, this should incentivize telcos further to maintain a healthy conduct of the industry.

Exhibit 63: OpenSignal Network Quality Results

Source : OpenSignal, Ciptadana

Exhibit 64: Download Speed (in Mbps)

Source : OpenSignal, Ciptadana

- 5G is just a hype for now

The rollout of 5G networks in Indonesia might take years to materialize. There are a lot of things to prepare, including the network design and architecture, technological aspect, infrastructure upgrade, use case development, and regulatory issue. From spectrum perspective, we believe it requires a few more years before adequate 5G spectrum could be available. Rolling-out 5G nationwide would require a broad range of spectrum, spanning from the low-, mid-, and high- band spectrum to achieve the balance of capacity and coverage. However, those spectrums are not readily available at the moment. The ideal low band spectrum (700 MHz) is currently on the process of clean-up from analogue TV. This could only be freed-up after the process of analogue switch-off (ASO) has been completed. The Government targets ASO to complete by the end of this year and the spectrum might be auctioned out later in 2023F. Meanwhile the high band of 3.5GHz is currently used for satellite services in Indonesia, including Telkom, and BRI Satellite. The contract expiry for those satellites varies but they run a long term contract until 2031-2034. We believe it would require a lot of efforts and negotiation time to clean up and optimally utilize the 3.5GHz for 5G rollout. While the mid band spectrum, currently the 2.6GHz is already awarded to IPTV to run its DTH TV service under Indovision brand. The spectrum rights will expire in 2024.

- Telcos are pursuing for FMC; positive but not a game changer

Lastly, another theme that the telcos are embarking in right now is the fixed-mobile convergence (FMC). Telcos are pursuing FMC to streamline the fixed and mobile broadband offerings in a bid to improve network efficiency and potential cross-sell to increase stickiness and productivity of subscriber. TLKM is planning to transfer IndiHome to Tsel, potentially in 1H23F to achieve the full scale of FMC with potential asset transfer of its fiber infrastructures to a separate entity. EXCL has acquired LINK to also beef-up its effort on FMC and has begun the cross-selling through XL Satu product. Meanwhile, ISAT just recently launched its brand new FTTH product, called HiFi, after The Indosat GIG was closed following the IM2. Overall, our view is positive for the FMC move, however, it is not a game changer, in our view. While there might be benefits from cost efficiency, we believe it might be challenging to lay fiber directly to home and the nature of subscription business has been proven not suitable for most of Indonesians given high proportion of daily earners.

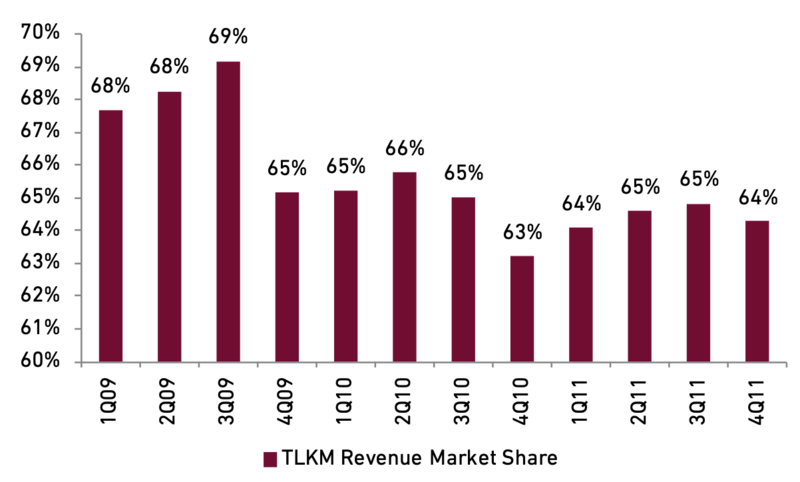

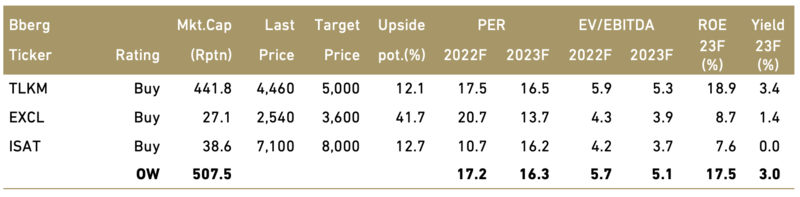

- OVEWEIGHT rating on the sector with TLKM and EXCL as our top pick

At the moment, we rate all telcos BUY. As the industry is moving on the right direction, we expect to see revenue growth/profitability improvement from the sector. We also think that telco sector is a defensive pick that is well-sheltered from recession, in our view. We like TLKM as we expect revenue recovery from Tsel and its plan to unlock value from its subsidiaries and digital assets as potential kicker for TLKM’s share price. We like EXCL as we see decent growth and potential fixed broadband growth acceleration post LINK acquisition.

Exhibit 65: Telecom stocks rating and valuation