Strategy Overweight

- Looking back on the first nine months: A roller coaster ride

The first nine months of 2023 have been one of a roller coaster ride first on the downside and then on the upside (Exhibit 23). Indonesia equity markets began 2023 on a weak note. In January, the JCI dropped by 0.2% MoM from 6,851 at the beginning of the year to 6,839. Foreign investors stayed as net sellers, racing to explore Chinese stock market with the nation emerging from Covid restrictions and pivots to pro-growth policies. The JCI slightly gained 0.1% MoM to 6,843 in February as foreigners returned to JCI (registering USD377 mn net buying) on its undemanding valuation and solid macro data. In March, JCI fell again by 0.6% to 6,805 on the back global market turbulence that followed the collapse of Silicon Valley Bank (SVB) in March. In April, JCI rebounded by 1.6% to 6,916 which is the highest monthly return as Indonesia’s 1Q23 economy grew a faster-than-expected 5.03% YoY while 1Q23 earnings have been solid. After posting positive return of 1.6% in April, JCI has seen a significant drop of 4.1% to 6,633 in May, the biggest monthly drop this year. This was mainly dented by i) global factors such as US debt ceiling drama and broad-based decline in commodity prices and ii) domestic factors, especially politics as the battle for power in the run up to the presidential election is heating up. Despite slight rebound in June by 0.4%, JCI closed 1H23 on a disappointing note, declining by 2.8% to 6,662. The Indonesian stock market rallied in July, gaining 4.1% to 6,931 (+1.1% YTD) after a slight rebound (+0.4% MoM) in June. In August, the JCI Index closed with a slight gain of 0.3% to 6,953, in line with our expectation that the market would continue its recovery mode. In September, the Indonesian stock market was weaker than expected with the JCI falling slightly by -0.2% to 6,940, however, it still rose by 1.3% in 9M23, outperformed MSCI Asia ex-Japan by 4.8%.

Exhibit 23: JCI performance in 9M23

Source: Bloomberg

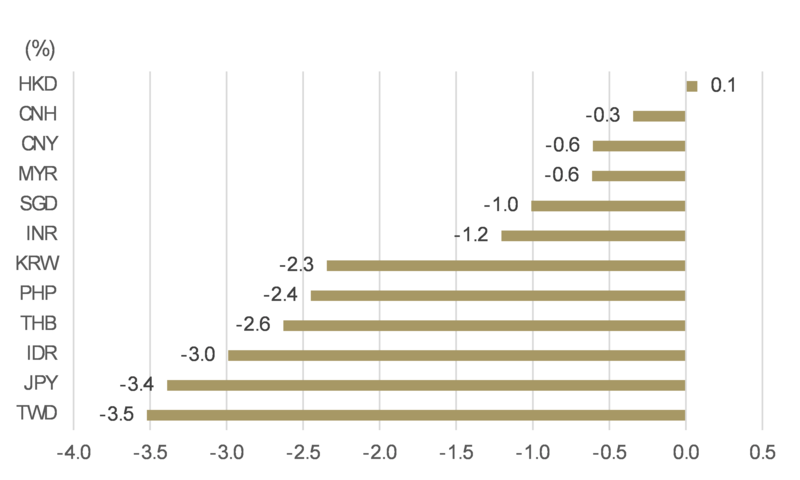

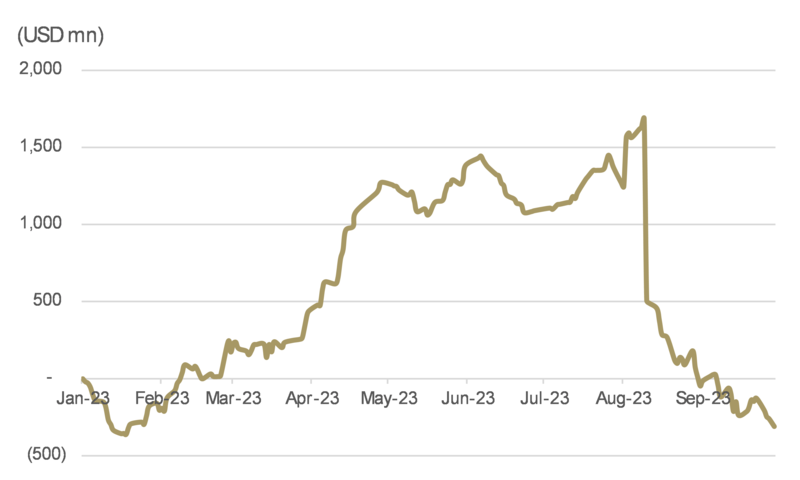

- Rupiah had a rough run, foreigners turn net seller of Indonesian equities

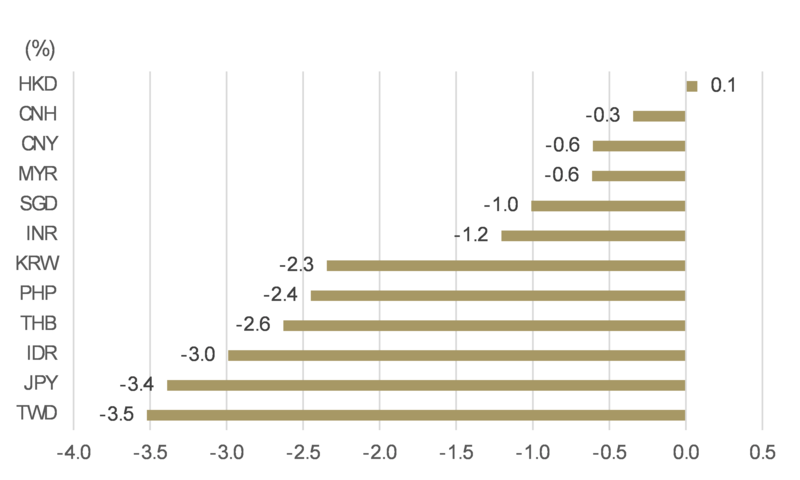

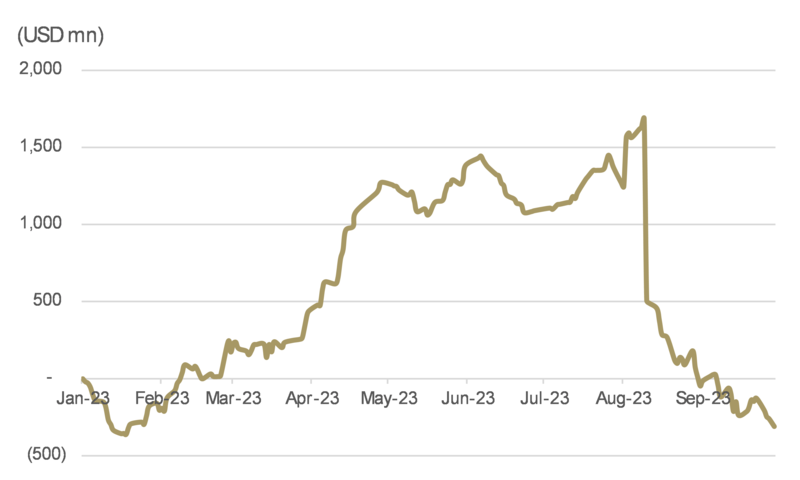

The Indonesian rupiah (IDR) depreciated by around 3% vs. 3Q23 to above 15,500 per US dollar, one of the worst performers among Asian currencies despite a relatively flat YTD. We see exogenous factors such as uncertainty over Fed rate hikes and weakness in China's economic growth as driving the rupiah's depreciation. The dollar index rising above 107 and the US 10-year bond yield at a 16-year high of 4.8% at the time of writing are major headwinds for the market as foreign investors are likely to continue selling Rupiah in response to the rising dollar, US bond yields. Foreign investors' net selling in

Indonesian equities and bonds also weighed on the rupiah's performance. Foreign Investors turn net sellers in Indonesian equities for the first time in six months since February. Foreigners have pulled out over USD1.6 bn in August and September as rising bond yields and a stronger US dollar prompts them to take some money off the table. The month of selling has come after foreigners were net buyers every month between February and July. Bloomberg data show that foreign investors had a cumulative net sale of USD309 mn worth of shares in 9M23, versus a net purchase of USD4.3 bn in 2022.

Exhibit 24: Asian currencies performance in 3Q23

Source: Bloomberg

Exhibit 25: Accumulated net foreign inflow

Source: Bloomberg

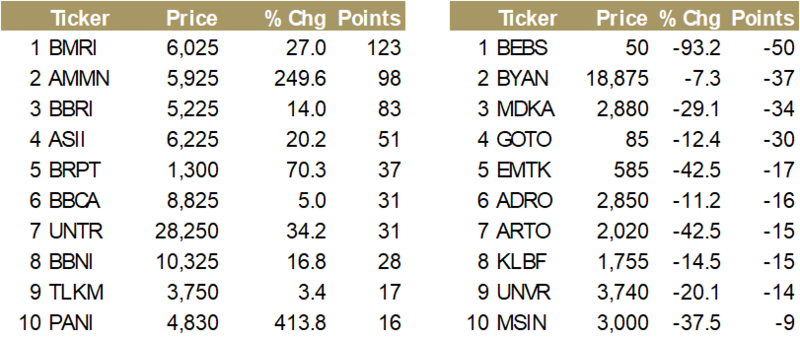

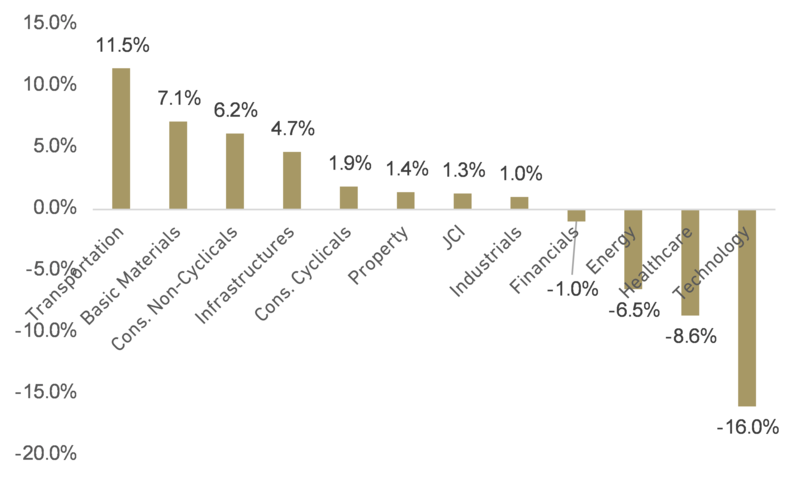

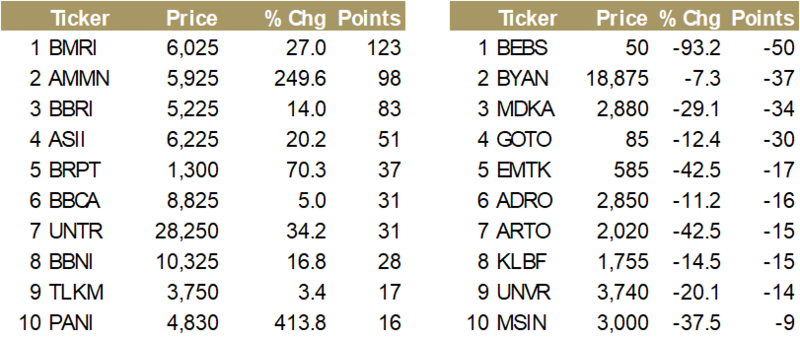

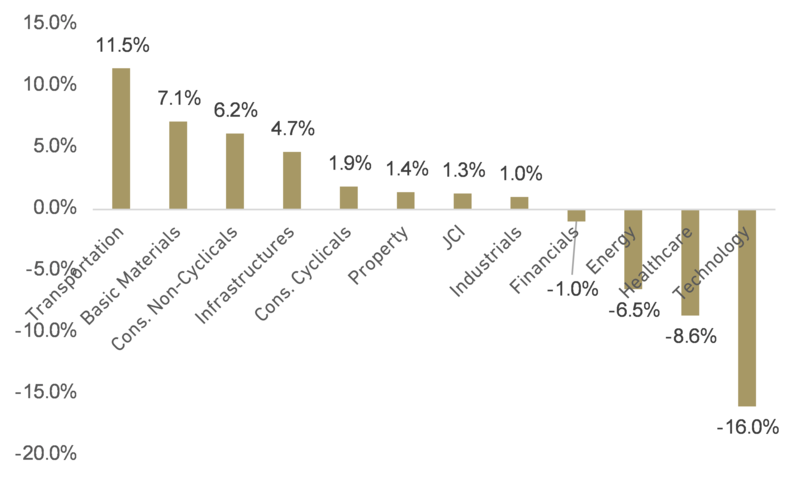

- The top leaders and laggards

Despite a slight gain of 1.3% in 9M23, the JCI Index was among the best performing markets in Southeast Asia as it outperformed Thailand's SET of -13.8%, Malaysia's KLCI of -5.3%, the Philippines' PSE of -4.6% and Singapore's STI of -2.7%. On the sectoral front, Transportation & Logistics was the best performing sector in the Indonesian stock market with a return of 11.5%. The other sectors that outperformed the JCI were basic materials (+7.1%), consumer non-cyclicals (+6.2%), infrastructure (+4.7%) and consumer cyclical (+1.9%). The sectors that underperformed the JCI were industrials (+1.0%), financials (-1.0%), energy (-6.5%), healthcare (-6.5%) and technology (-16.0%). Among the JCI constituents that contributed most to the rally (top leaders) were: 1. BMRI, which gained 27% and contributed 123 points, followed by AMMN (+250%, 98 points), BBRI (+14%, 83 points), ASII (20%, 51 points) and BRPT (+70%, 37 points).

Exhibit 26: Top leaders and laggards stocks

Source: Bloomberg

Exhibit 27: JCI and sectoral performance

Source: Bloomberg

2024: A good time to be optimistic, but cautiously so

• Look for three-horse, two-round race in 2024 general election

Voting in next year's general election is scheduled for February 14, and three candidates have so far registered with the general elections commission to run for the presidency , namely : i) former Central Java Governor Ganjar Pranowo and running mate Mahfud MD (Coordinating minister for security) , ii) Defense Minister Prabowo Subianto and running mate Gibran Rakabuming (the eldest son of current president Mr Widodo) and iii) and former Jakarta Governor Anies Baswedan and running mate Muhaimin Iskandar (the chairman of the National Awakening Party).

Ganjar Pranowo is backed by his own Indonesian Democratic Party of Struggle (PDI-P) and the Islamist United Development Party (PPP). Prabowo Subianto is supported by Gerindra, a secular-nationalist party that he founded and leads; Golkar, also a secular-nationalist party; and the National Mandate Party (PAN), a semi-Islamist party. Anies Baswedan is backed by a coalition of the secular-nationalist National Democratic Party (NasDem), the Islamist Prosperous Justice Party (PKS) and the National Awakening Party (PKB), which relies on support from members of Nahdlatul Ulama, Electoral law restricts admission by setting a high threshold of 20% of the vote in the previous election and we see the three candidates have met the threshold.

The constitution mandated that a presidential and vice-presidential candidate pair must win at least 50% of votes nationwide and at least 20% in each province to win the race. If no candidate garners over 50% of the votes, the race continues between the top two pairs. Based on the average results of the latest polls, Prabowo and Gibran are leading with 35.8%, followed by Ganjar and Mahfud with 30.9%, and in third place are Anies and Muhaimin, whose popularity rating is 19.7%, no candidate seems set to win the election by a comfortable margin. Therefore, we believe that none of the three candidates will win more than 50% of the vote in the first round and that the 2024 presidential election will go to a second round. Indonesia has only had one presidential election that went to a second round, the 2004 election.

Exhibit 28: President candidates and latest election parties’ vote

Source: Various sources

• Impact of election results on key sectors

Regardless of which side wins, we believe the new president will launch consumption stimulus, energy saving, human resource development through healthcare and education, enforcing the rule of law and green initiatives. The specific programs of the Jokowi administration that are expected to be continued by Ganjar or Prabowo are downstream industries, digitalization, connectivity, omnibus law and the development of the new capital city (IKN). If Anies wins the election, it is likely that he will review or change the programs. The market will be concerned about the continuity of the program and the decisions. This may lead to negative sentiment for sectors related to i) the downstream commodity program such as the metals sector as Anies may partially lift the mineral export ban to increase government revenue and ii) the infrastructure sector such as toll roads, cement and construction as we expect slower infrastructure development as Anies will reduce debt utilization in government spending.

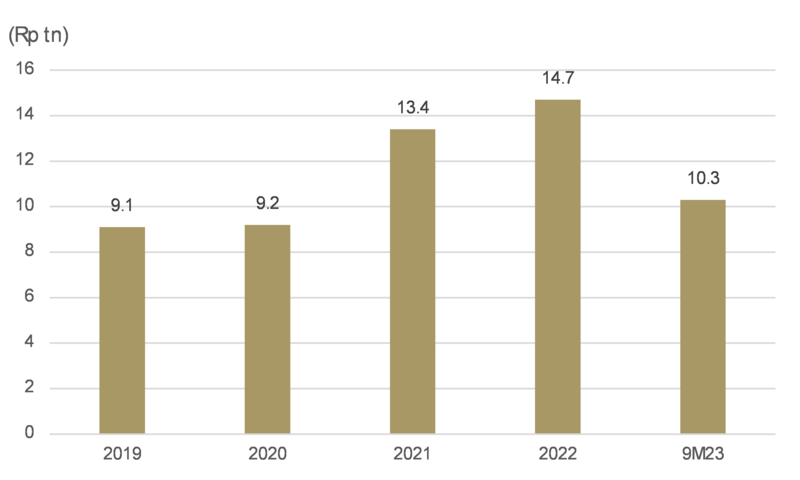

• Expecting market stability after election

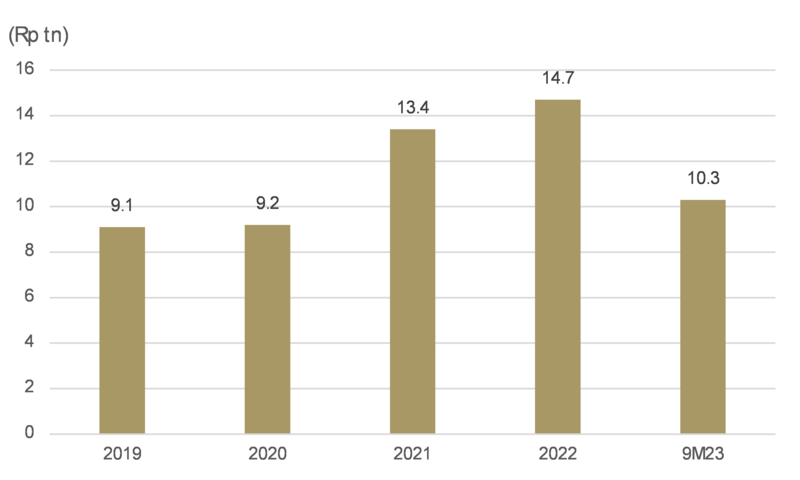

We believe the 2024 elections will not have a significant impact on domestic macroeconomic variables such as growth and inflation, but will make a difference in terms of sentiment, confidence and policy certainty. Elections also have an impact on business confidence, which tends to weaken before elections but improves afterwards as policy uncertainty diminishes and normal government operations resume. On the external side, exchange rate movements during elections are more volatile and are driven and influenced by economic conditions at the time. However, foreign portfolio investment and transaction value have generally declined in the run-up to elections as most investors may adopt a wait-and-see approach. During 9M23, the average daily trading value (ADTV) of the Indonesian stock market declined significantly by around 30% to Rp10.3 tn in 9M23 compared to Rp14.7 tn in 2022. This is partly influenced by the political situation in Indonesia, which remained fluid as we still need to shed light on the trajectories of the leading potential presidential and vice-presidential candidates as well as the possibilities of coalitions of political parties during this period.

Exhibit 29: Average daily transaction

Source: BEI and Bloomberg

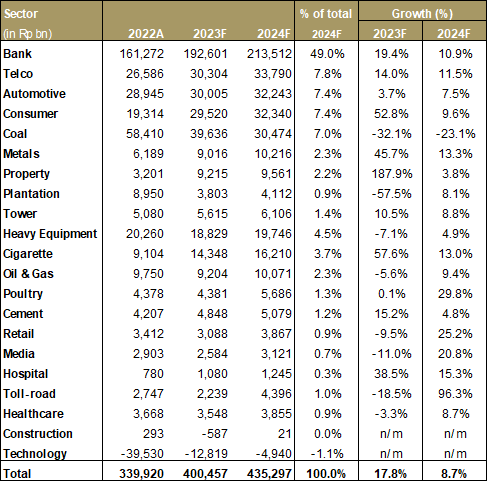

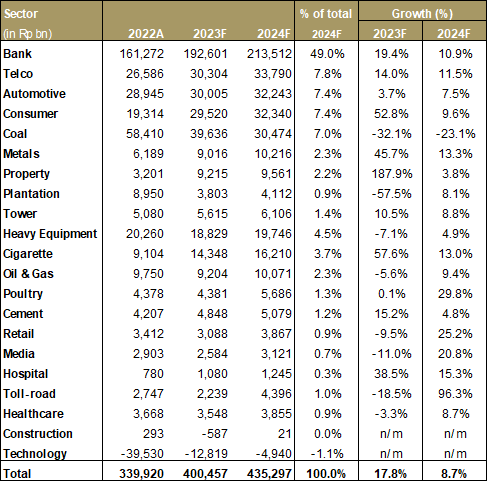

• Earnings growth moderates to high single digits

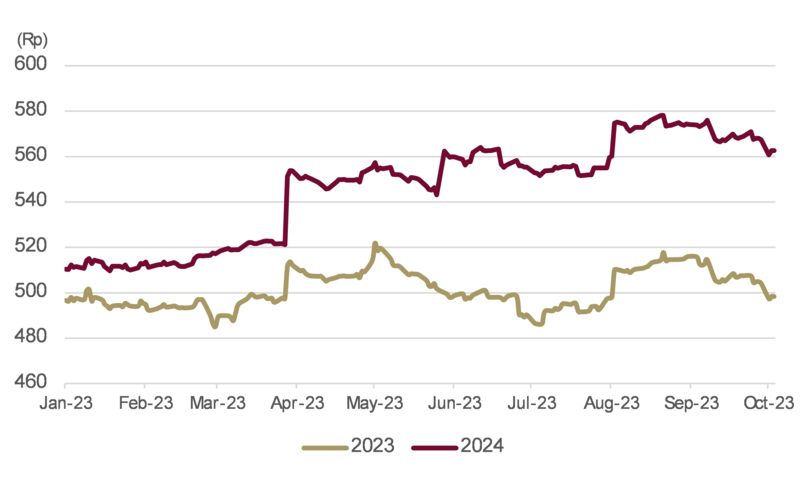

Earnings growth in our coverage universe is moderating to 8.7% in 2024F vs. 17.8% in 2023F, mainly due to the continued normalization of commodity (coal and metal) prices and following the forecast adjustments after earnings results. Excluding commodity sector, earnings growth would remain at 12.1% in 2024F. The banking sector is also still expected to post decent growth of 10.9% from a high base of 19.4% in 2023F and 47.3% in 2022F. In 2024, banking earnings will account for 49.0% of total corporate earnings in our coverage, up from 46% in 2023, as the contribution of commodity-related earnings declines from 13.1% to 9.3%. We believe Indonesia's economic outlook for 2024 is broadly positive, with GDP growth expected to reach 5.2%. Coupled with a resilient banking sector, a diverse range of industries and it is climbing up the metals value chain (e.g., nickel, copper, bauxite) for EV production, we believe this will support positive corporate earnings growth. Moreover, market consensus EPS for 2024F has been on an upward trend since the beginning of the year, while the EPS for 2023 is relatively stable.

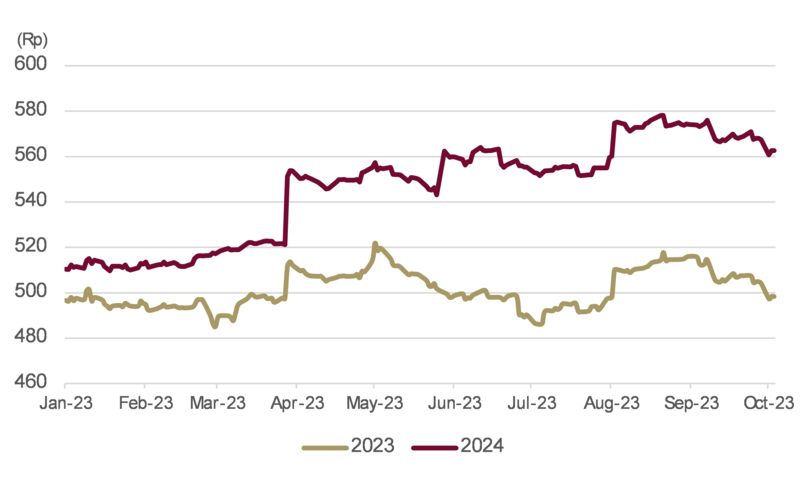

Exhibit 30: Market consensus EPS

Source: Bloomberg

Exhibit 31: Sectoral earnings

Source: Listed companies and Ciptadana estimates

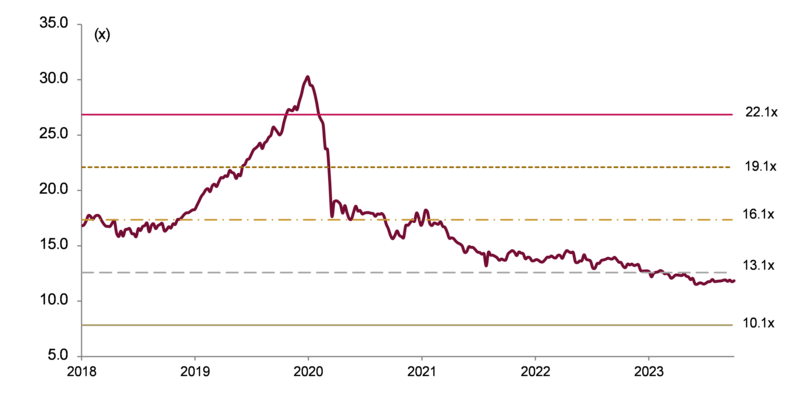

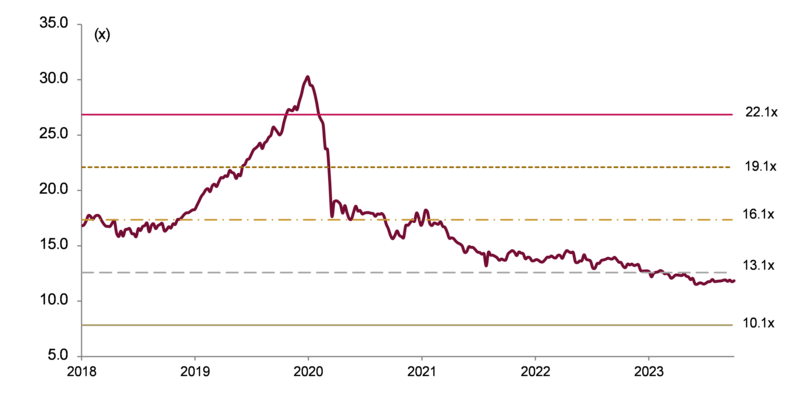

• Valuation and index target

We set year-end 2024 JCI target of 7,493 (rounded up to 7,500) which is based on PER of 13.1x ( -1stdev of mean) and 2024F market EPS of 572. This implies a gain of 10% from current JCI level vs. our earnings growth expectation of 8.7%. We expect Indonesian stock market is showing resilience and scaling new highs amid positive corporate earnings, domestic macroeconomics revival. The JCI is trading at 11.9x 2024F PER vs. Southeast Asia peers’ average valuation of 12.8x. We believe attractive valuations provide a good opportunity for value investors to enter Indonesia equities, while the solid dividend yield of 3.1% should also build up the total return for investors.

Exhibit 32: JCI forward PER band

Source: Bloomberg and Ciptadana estimates

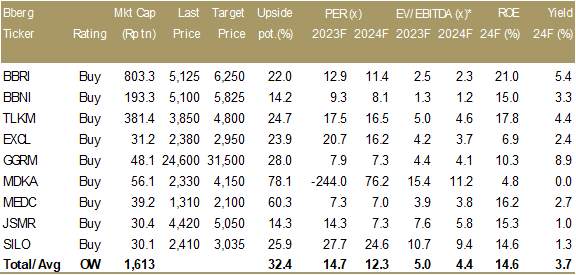

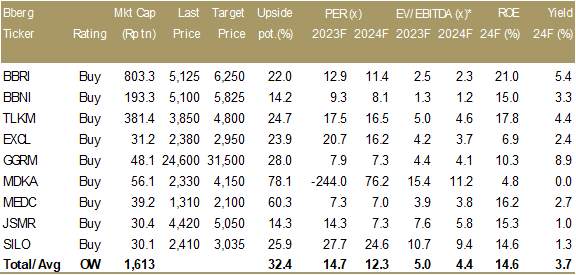

• Stock selection

Our stock selection for 2024 uses a combination of top-down and bottom-up approaches, with a focus on selecting a mix of stocks with solid fundamentals, future growth, defensive characteristics and attractive valuations. Our top picks reflect an overweight position in banking, telecom, cigarettes, metals, oil & gas, toll roads and healthcare. We also overweight on automotive, heavy equipment, cement, technology, media, metals, retail and property sectors. We are neutral on cigarette, consumer, poultry, coal and plantation sectors. Meanwhile, we are underweight on construction sectors.

i) Banking: supported by accelerating loan growth of 10.1% coupled with resilient NIM under a favourable policy rate outlook. Our stock picks in the banking sector are BBRI and BBNI.

ii) Telecommunications: We believe telco will benefit from Indonesia's long-term digitization trend and improving mobile landscape. We see the industry moving in the right direction, we expect to see revenue growth/profitability improvement due to growth in subscribers and price increases. The telecom industry is expected to remain stable due to its defensive nature. TLKM and EXCL are our top picks in this theme.

iii) Cigarette: We expect the government to maintain a more favorable excise policy amid sluggish excise revenues and accelerate the simplification of tobacco excise structures, while the sector also benefits from election spending. Timely ASP hikes would ensure earnings visibility and could also more than offset excise hikes. GGRM is our top pick in the sector.

iv) Metals: The current market correction has presented investors with an opportunity to establish core positions in mining companies that is well-positioned to capture this next wave of growth in the EV downstream sector. We like MDKA on this theme.

v) Oil & Gas: The global balance sheet suggests that the oil market will remain in deficit by 0.7 mb/d through 2024. We expect oil demand to increase by a further 1.8 mb/d to 103.9 mb/d as the global economy is expected to improve in 2024. MEDC is our top pick in the oil & gas sector.

vi) Toll road: Massive toll road development during Jokowi's presidency has increased the attractiveness of Indonesia's investment climate. We like Jasa Marga (JSMR), which has a 50% stake in Indonesia toll road and is entering its harvest period after a heavy investment cycle during the development of the Trans-Java Toll Road (TJT). GIC and INA are reportedly set to acquire a 35% stake in PT Jasamarga Transjawa Tol (JTT), the operator of TJT, at an attractive valuation of 2-2.2x PBV.

vii) Healthcare: We expect the new healthcare law to bring structural reforms, which will allow the healthcare industry to flourish as it will benefit hospitals by improving the availability of medical talent in all regions of Indonesia. SILO is our top pick in the healthcare sector.

Exhibit 33: Our top picks

Source: Bloomberg and Ciptadana estimates *PBV for bank

Arief Budiman +62 21 2557 4800 ext. 819 budimanarief@ciptadana.com