Banking Overweight

Sector Outlook

• Solid earnings growth post-pandemic

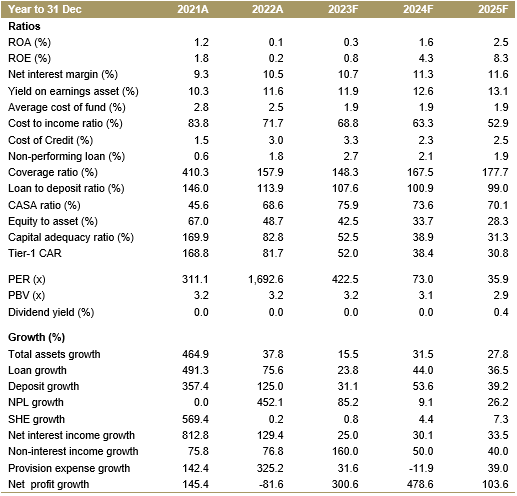

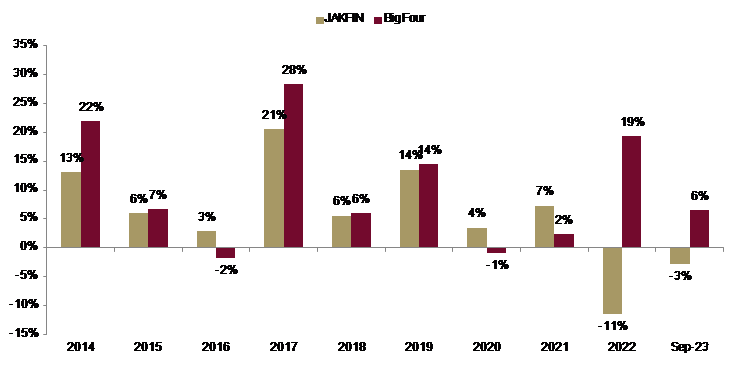

Banking industries have continued to deliver compelling profitability, with earnings growing by 14% annually since the pre-pandemic period. This is supported by a robust Net Interest Margin (NIM) that has outperformed pre-pandemic levels, despite challenges posed by higher interest rates. This is followed by the normalization of the Cost of Credit (CoC) from a high-based period in 2020-2022. With such achievement in the past, we project banks under or coverage to continue deliver admirable profitability and earnings to still grow by 11% in 2024F, following the achievement of 20% earnings growth in 2023F.

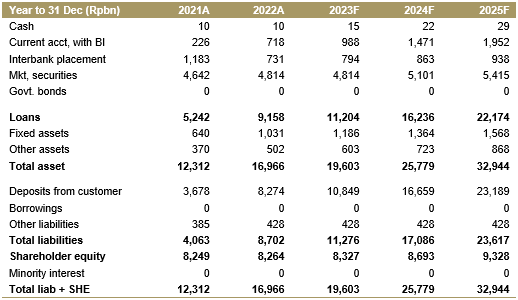

Exhibit 34: Earnings growth for banks under our coverage

Source : Companies and Ciptadana Sekuritas Asia

• JAKFIN still underperformed, but big four outperformed the JCI

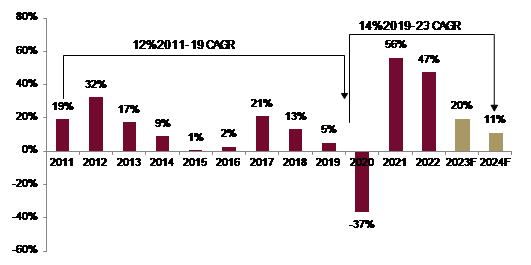

Despite these admirable earnings performances, as of Sep-23, banks represented by IDXFINANCE were still underperforming the Jakarta Composite Index (JCI) by -3% Ytd. This continued underperformance is

primarily due to the correction in digital banks, which have underperformed the JCI by -34% YTD on an equal-weighted basis, continuing the trend in FY22. This trend has been driven by multiple downward earnings revisions for digital banks, as their execution often fell short of both our projections and consensus estimates. In contrast, the big four banks have maintained its outperformance, despite by a relatively narrow scale at 6% Ytd. We believe banking stock as represented by IDXFINANCE performance will outperform the market in 2024F, especially as digital banking stock has de-rated and now valuation has been close to traditional banks. Also, if history is any guide, banking stocks as represented by IDXFINANCE and the big four banks have almost always outperformed the market in the year leading up to the election and the election year (2004, 2014, and 2019).

Exhibit 35: Banking sector performance relative to JCI

Source : Bloomberg and Ciptadana Sekuritas Asia

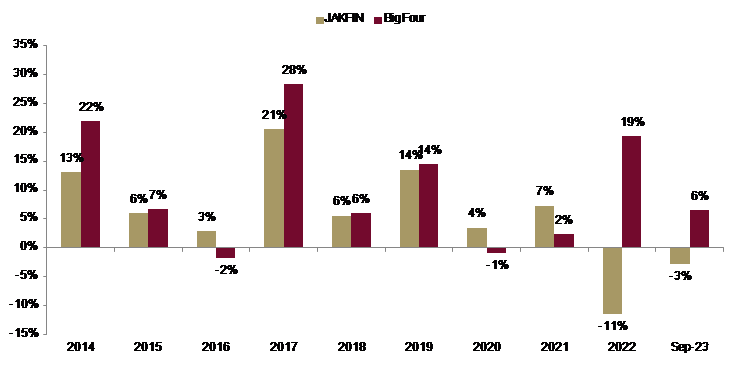

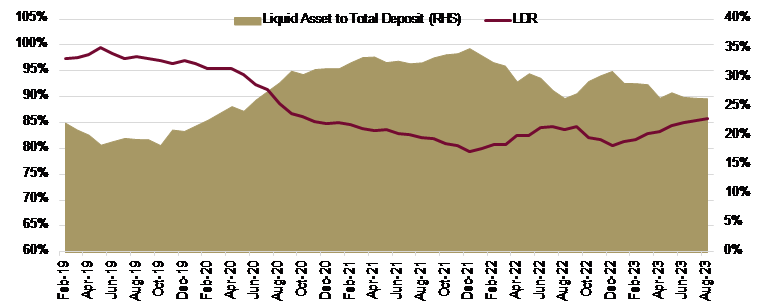

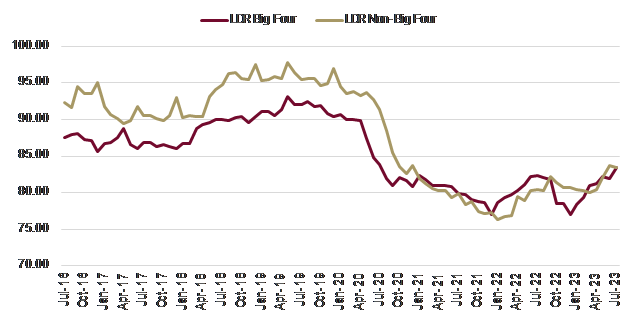

• The perks of pandemic: abundant of liquidity for three years and still continue

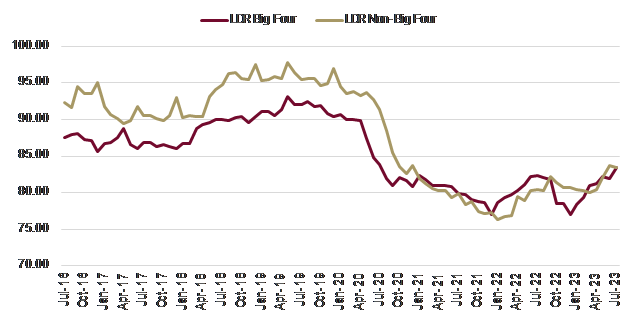

Banks have experienced strong deposit inflows since the early days of pandemic. This trend is not limited to dominant banks; it is also observed among medium-sized banks, as indicated by their ample liquid asset ratios and loan-to-deposit ratios (LDR). The deposit inflows were majority taken by the big banks (especially BBCA). However, these big banks also experienced faster loan growth compared to smaller banks, resulting in similar LDR dynamics for both big and small banks. As we approach the end of 2023 and loan growth track higher, LDR and liquid asset ratio figures are only marginally higher in 2023 compared to 2022 and still far below pre-pandemic. The current level of liquid assets also remains healthy and provides a buffer against funding pressures. These abundant liquidities have effectively reduced the pressure to compete for deposits, supporting the banks' net interest margin (NIM) and profitability in 2023F. With loan growth expected to outpace deposit growth, LDR will likely rise further in 2024 but not yet achieving the pre-pandemic level.

Exhibit 36: LDR and liquid asset ratio in the system

Source : BI and Ciptadana Sekuritas Asia

Exhibit 37: LDR trends in big four and non big four banks

Source : Companies, OJK, and Ciptadana Sekuritas Asia

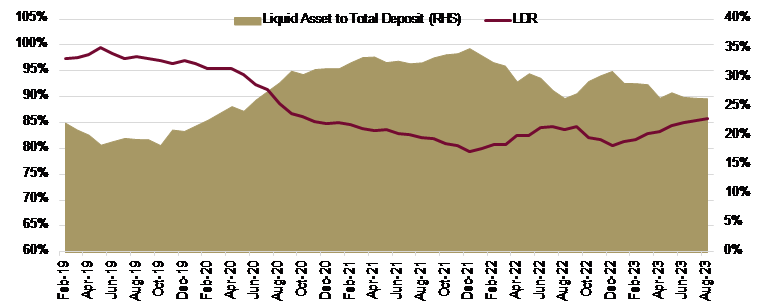

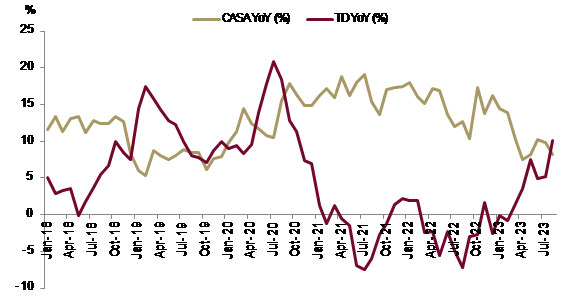

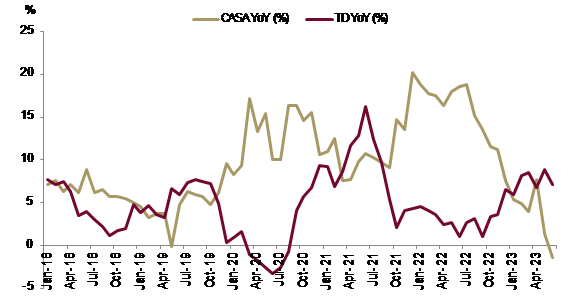

• Inflection point in CASA ratio trend

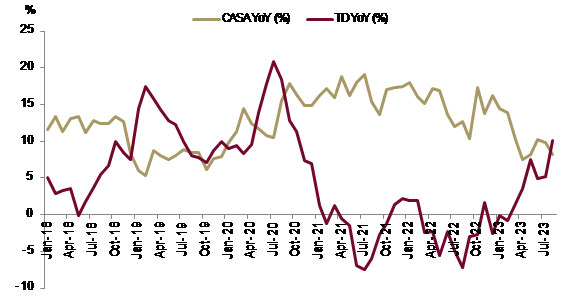

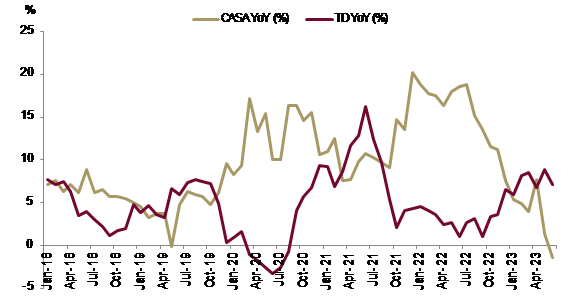

Thanks to abundant liquidity, TD rate increases were very limited among the big four banks during 2023. Hence TD growth is also remained well managed at below the CASA growth, particularly given the good flow from the demand deposit side. However, we see inflection point approaching the end of 2023, in which time deposit (TD) growth started to outpace the cheap funding (CASA) growth in the big banks. This marked the shifting to TD from CASA. This trend has been seen in smaller bank since mid-2023, and resulting in higher TD rates for those banks. Overall, we expect CASA ratio to trend down moderately in 2024F after reaching its peak in 2023F.

Exhibit 38: Big Four banks: at inflection point with TD growth outpace CASA in Aug-23

Source : Companies, OJK and Ciptadana Sekuritas Asia

Exhibit 39: Non-Big Four banks: TD growth outpace CASA since early 2023

Source : Companies, OJK and Ciptadana Sekuritas Asia

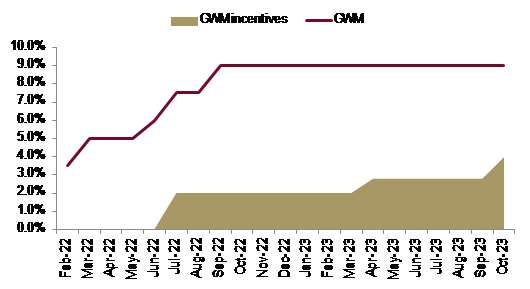

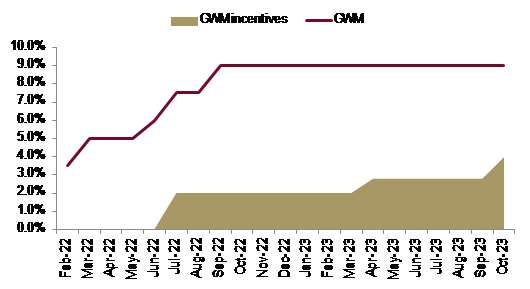

• We expect BI to use the GWM as easing monetary tools

This trend could be a challenge to Cost of Funding (CoF) through higher TD competition and worsening funding mix, especially in the early part of 2024F as benchmark rate could be hold for a longer period. But we see that central bank could come to rescue in the case the trend worsening in 2024F through reserve requirement ratio (RRR or GWM) policy. This is as we see many rooms left given the high record GWM, with GWM stood at 9% as of Oct-23 vs. pre-pandemic of 3.5%.

We project BI to reduce the GWM in 2024F, especially under difficult circumstances to reduce policy rates given the global hawkish stance. Early indication of easing monetary policy through GWM could be seen since early 2023 with BI for many times adjust up the relaxation on GWM from 2% to 2.8% and recently to 4.0%. Thus, going into 2024, it is not yet time for us to overly concern on liquidity of the banking sector.

Exhibit 40: Reserve requirement ratio (GWM)

Source : BI and Ciptadana Sekuritas Asia

• Cautiously expects NIM to inched up in 2024F

This year was a pleasant NIM performance, with NIM expected to slightly adjust up (by ~10bps for banks under our coverage) despite the challenge from higher interest rates. For 2024F, we expect benchmark rate will peak and 7DRR rate to adjust lower by 100bps by the end of 2024F. This aligns with our economist’ view of the policy rate being maintained at 6.00% in 2023F and followed by rate cuts to 5.00% by 2024F.

Beneficiary of peaking interest rate will be BBRI among the big banks, along with BBTN, BNGA, and BTPS, in our view. We expect BBRI to enjoy ~20bps NIM expansion given their focus on micro, which provides them with protection against declining interest rate and hence upsides on NIM. The same holds for BBTN, as they also have very sticky yield on mortgages, while a considerable reliance on funding from interest rate sensitive-TD and wholesale funding. BBCA NIM could adjust down in 2024F as its asset yield are more sensitive compares to its CASA-funded cost of funding (CoF). BMRI and BBNI also negatively affected on NIM from this lower rate, as they also holds substantial amount of variable-rates asset on the corporate book.

Overall, we expect banks under our coverage will only expand by a mere 2 bps in 2024F. Better-than-expected liquidity will give more upside to NIM in 2024F in our view, especially under downward interest rate trends, while risk could come from faster-than-expected shift to TD as funding mix worsen.

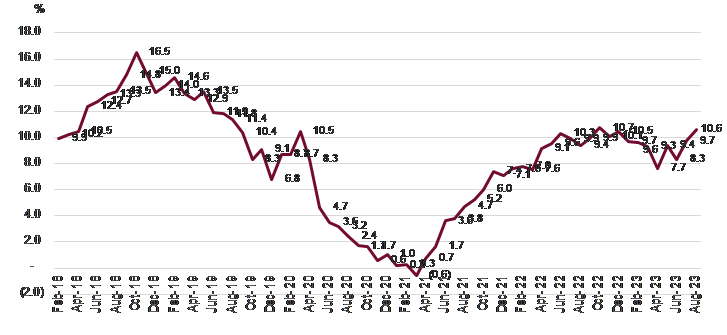

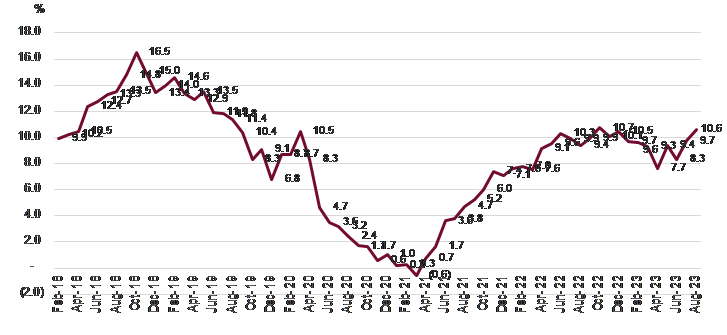

• Loan growth to remained at double digit for banks under our coverage

We expect loan growth will remain stable at 9.8% YoY by 2023F for banks under our coverage and 9% YoY for banking system overall. Looking ahead to 2024F, we expect the loan growth to tick higher to 10.1% YoY on the back of continued recovery in the economy. We are not expecting an overly aggressive loan growth by the end of 2024, as we expect that year-end 2023 will mark the peak of loan growth, coinciding with the presidential election quarter. For 2023F, loan growth has been strongly supported by corporate loan along with micro loan segment. For 2024F, we expect the

loan growth to be better distributed across various segments including corporate, medium, consumer, and retail segments.

Exhibit 41: Loan growth trends

Source : OJK and Ciptadana Sekuritas Asia

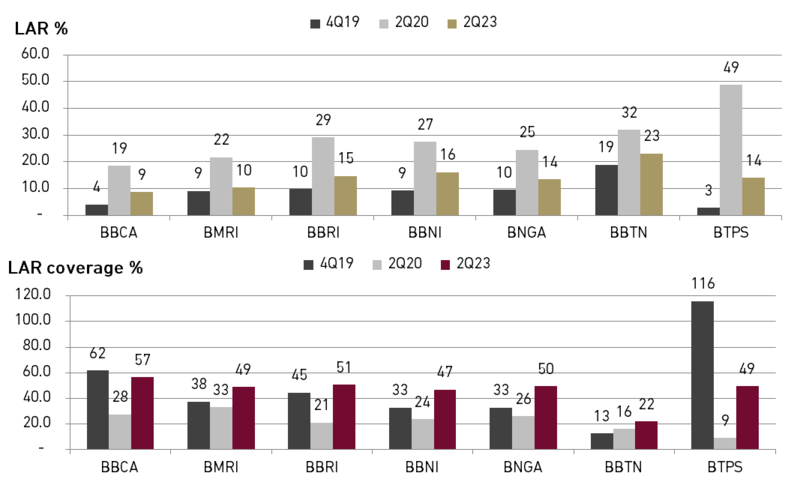

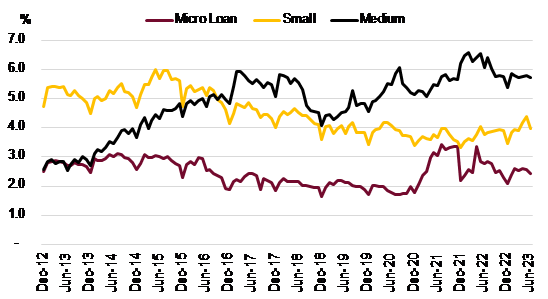

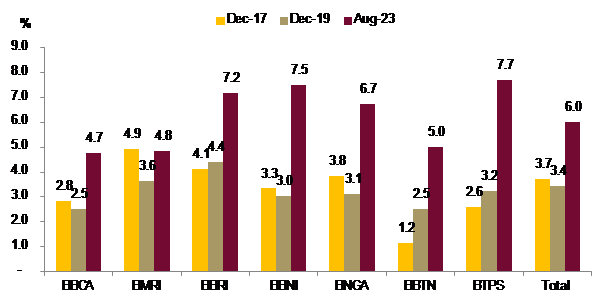

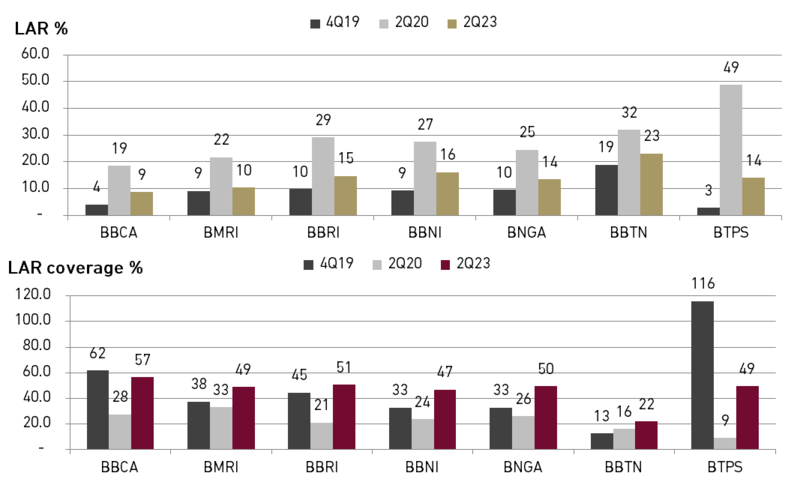

• Ample loan loss coverage; LAR to go back to pre-pandemic level

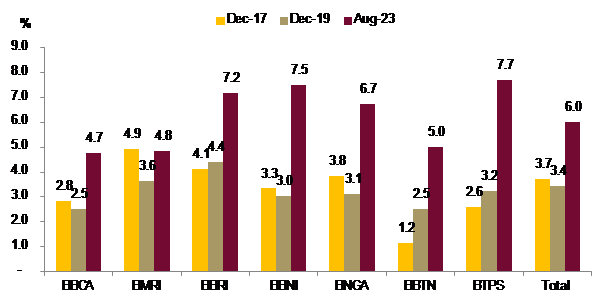

Coverage for bad loans has been quite thick, achieving 6.0% of total loans, which is almost double compared to the pre-IFRS 9 implementation and pre-pandemic. Meanwhile NPL and loan-at-risk (LAR) have shown consistent improvement, particularly as the economy strengthens in 2024F. Overall we believe LAR to go back to pre-pandemic level by 2024F.

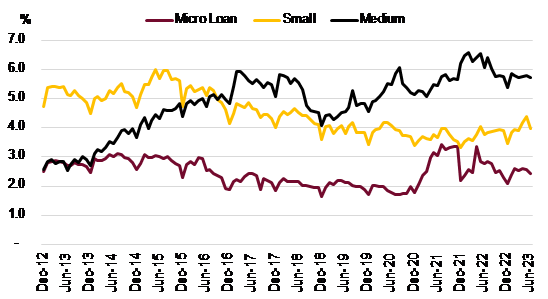

In terms of loan segmentation, we have observed significant improvement in the medium-sized loan segment's NPL, which suggests the potential for this segment to return to positive growth in 2024F. Medium segment has not seen any revival in loan growth since the early days of the pandemic. The micro loan segment, which also experienced a period of elevated NPLs for the first time in 2021-2022 due to the pandemic, is expected to improve over the time. This improvement is particularly expected under healthier expansion under commercial micro loans rather than government-driven subsidized micro loans (KUR).

Exhibit 42: NPL trends on MSME segment

Source : OJK and Ciptadana Sekuritas Asia

As for specific banks, BBNI followed by BBRI hold the thickest loan loss reserves-to-total loan ratio at 7.5/7.2% respectively. This is a result from aggressive provisioning strategy that both BBNI and BBRI have implemented over the past couple of years. Meanwhile, BBCA and BMRI hold 4.7/4.8% LLR-to-total loans, respectively, which are also deemed adequate given their better asset quality profile.

Exhibit 43: LLR to total loan (or financing)

Source : Companies and Ciptadana Sekuritas Asia

In terms of LAR coverage, BBCA still maintains the thickest LAR coverage. Apart from BBCA, LAR coverage is no longer as varied as it used to be in the past. Nearly all banks now have LAR coverage ranging from 47% to 50% as of 2Q23. The exception is BBTN, the only bank with lower LAR coverage at 22% as of 2Q23, which to its exposure to asset-backed loans, particularly in mortgages.

Exhibit 44: LAR approaching pre-pandemic level after restructuring end

Source : Companies and Ciptadana Sekuritas Asia

• Expects improvement in NPL but CoC to inched up on low base in 2023

With relatively limited challenges to NPL in the near future, we believe the worst of asset quality cycle has been behind and we expect NPL to further improve following better economy assumption. However, in terms of CoC, we anticipate that the aggregate CoC for banks under our coverage to tick up by 10bps to 1.1% in 2024F, as we think some of the big banks, namely BBCA and BMRI, have reached its lowest CoC level in 2023F. While for certain banks such as BBNI, BBRI, BBTN, and BTPS, we are still projecting improvement in the CoC level.

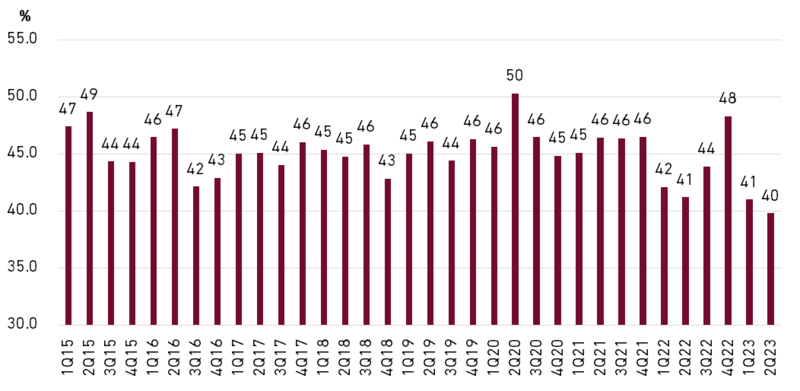

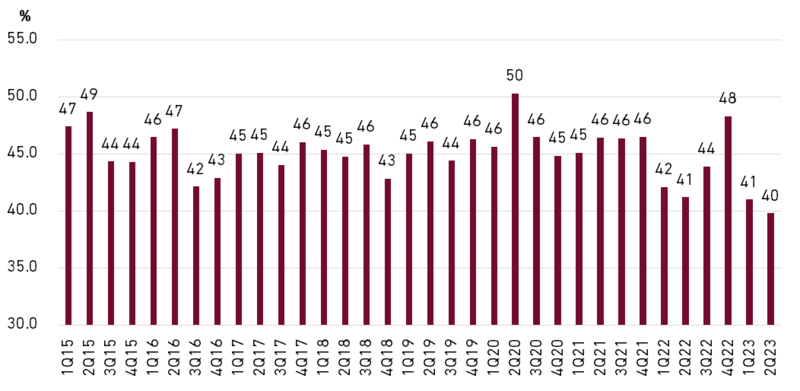

• CIR and cost efficiency at its best

We anticipate that the Cost-to-Income Ratio (CIR) will improve and surpass the pre-pandemic level by 2024F at <42% (vs. 44.0% pre-pandemic and the worst of 47.7% in 2020). This improvement is driven by robust revenue growth on both the Net Interest Income (NII) and non-interest income fronts. Additionally, with structural efficiency improvements in most banks, we believe the CIR will continue to improve in the long term.

Exhibit 45: CIR is yet to improve to pre-pandemic level by 2024F

Source : Companies and Ciptadana Sekuritas Asia

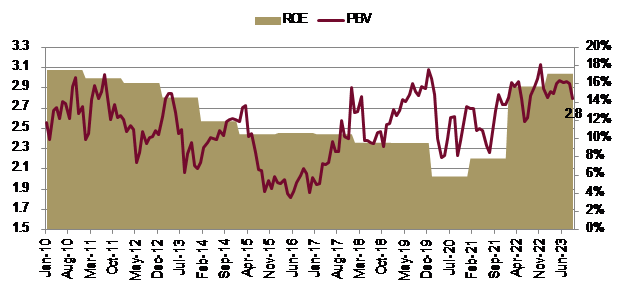

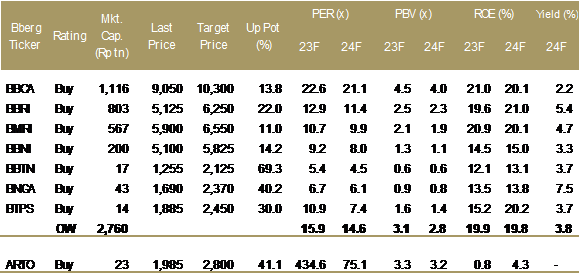

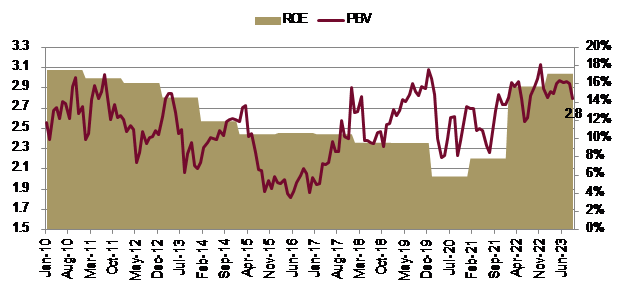

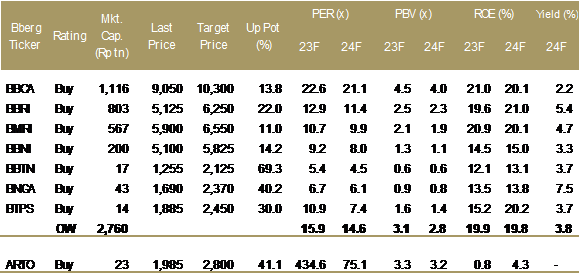

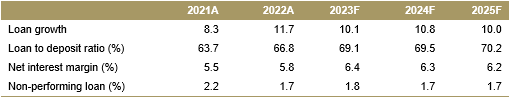

• Maintain Overweight for Indonesian Banking Sector, BBRI and BBNI as our top pick

Valuations for the Indonesia banking sector are compelling in our view considering its improving profitability trends with ROE trending upwards. Our top pick is BBRI, which stands to benefit the most from peaking interest rates. Additionally, it provides structural benefits from the soft landing of KUR and its shift to Kupedes. BBNI still has the most compelling valuation among the big banks while its ROE profile is trending up to mid-to-high single digit. Strong transformation strategy in BBNI has resulted in better credit profile. Their strategy to focus on lower-yielding asset would

negatively impact loan growth and NIM in the short term but should be well offset by lower CoC in long terms.

Key risks for banking sector would come from weaker-than-expected economy and much sharper-than-expected rise in interest rate and inflation.

Exhibit 46: Banking sector PBV vs. ROE (banks under our coverage)

Source : Bloomberg and Ciptadana Sekuritas Asia

Exhibit 47: Banking stocks rating and valuation

Source : Bloomberg and Ciptadana Sekuritas Asia

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

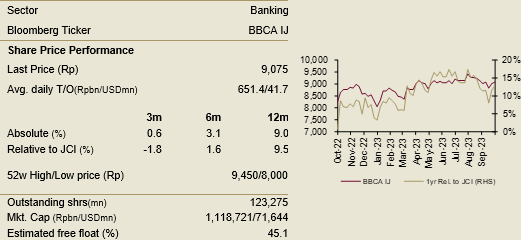

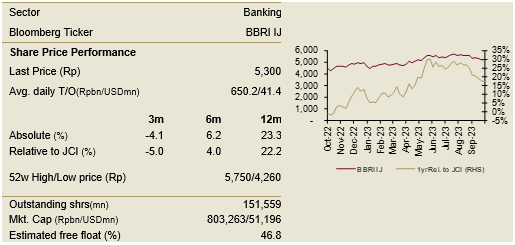

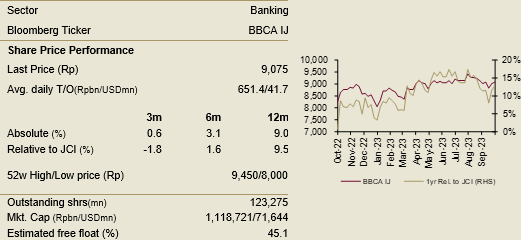

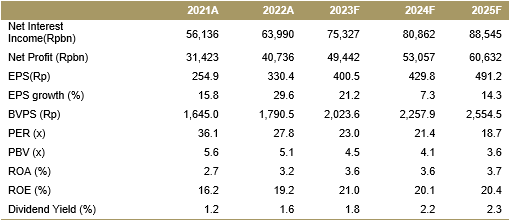

Bank Central Asia

BUY TP: 10,300 (+13.5%)

Company Profile

Bank Central Asia (BBCA) benefits a lot from large inflow of cheap funding (CASA) balance thanks to its dominance in transactional banking. The bank has the largest CASA market share (17.1% as of 1H22) among banks despite only being the third largest asset in Indonesia. The bank processed about Rp20k tn worth of transaction (ATM, internet, and mobile banking) annually, far larger than other big four banks at Rp2-5k tn. BBCA is controlled by Djarum Group.

Key Points

• BBCA shares have underperformed its big four bank peers by 10/16/6% over the Sep-23/2022/2021 period, respectively. This is quite a long period of underperformance. The stock currently trades at PBV of 4.0x or at its 5-year historical average, while PE has fallen to 21x or at -1 st.dev. Therefore, we believe that the stock is no longer fully valued and still offers upside potential despite the challenge of lower benchmark rates next year.

• Despite not benefiting from lower interest rate, we expect BBCA to maintain its NIM at 6.3% in 2024F (-10 bps YoY). This is because we believe the bank will prioritize optimizing its LDR in 2024F. The bank's LDR currently stands at 67% as of 2Q23, which is significantly lower than its pre-pandemic level of 84% in 2019. We expect BBCA's LDR to increase to >70% by 2025F.

• We also foresee BBCA to still be on track to seize aggressive loan growth given its huge room on liquidity. The bank still has the lowest cost of funds among banks and will therefore act as a price leader in lending conditions. We believe BBCA will still gain market share in loans in 2024F by delivering low double-digit loan growth.

• We maintain our Buy recommendation on BBCA with a target price at Rp10,300 /share.

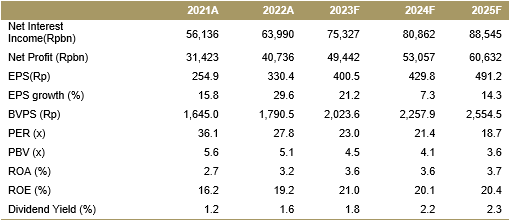

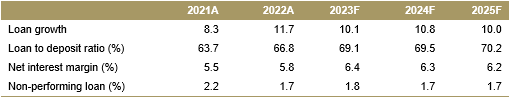

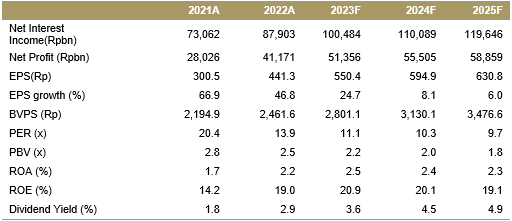

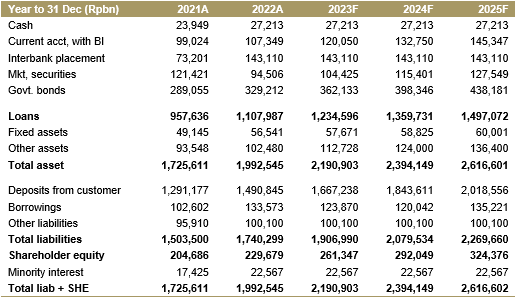

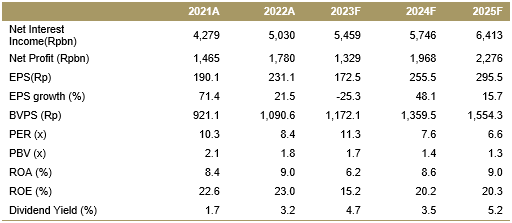

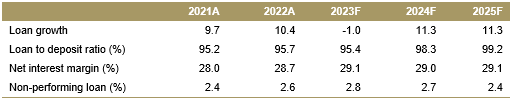

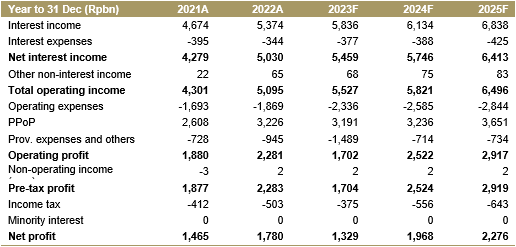

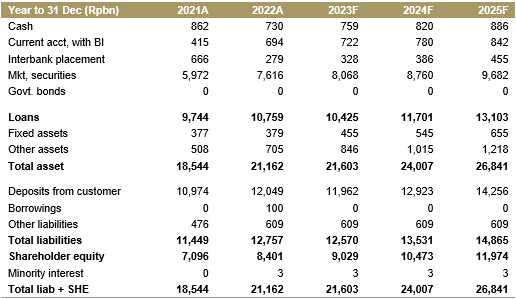

Financial Highlights

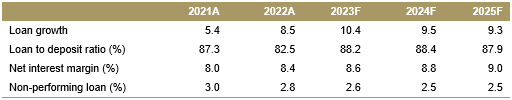

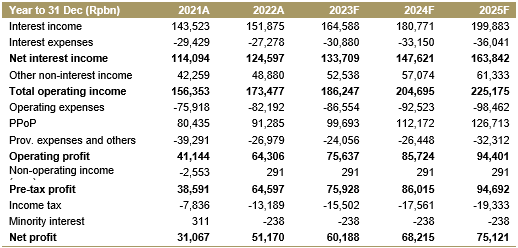

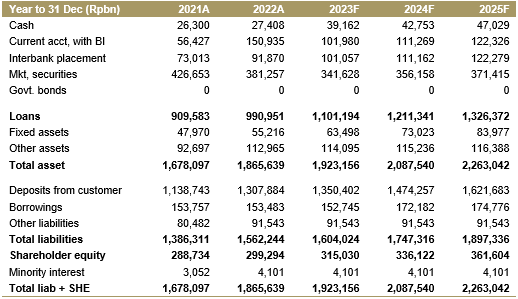

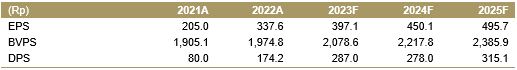

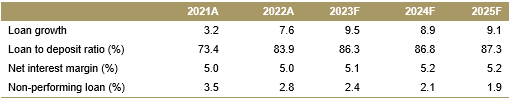

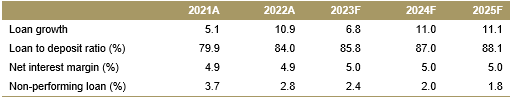

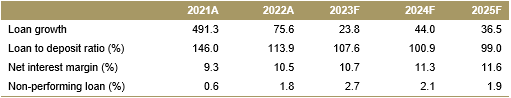

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

Bank Central Asia

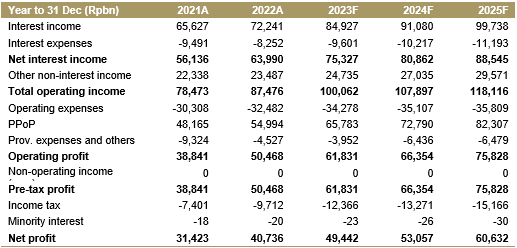

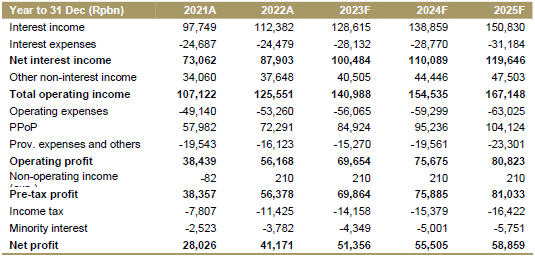

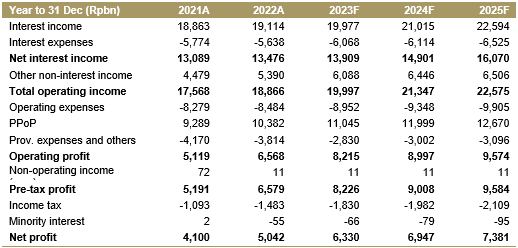

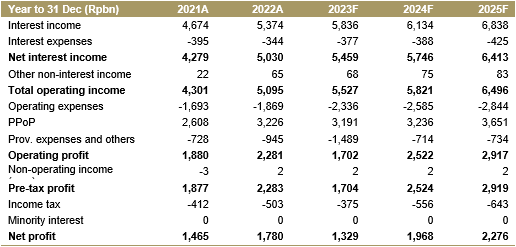

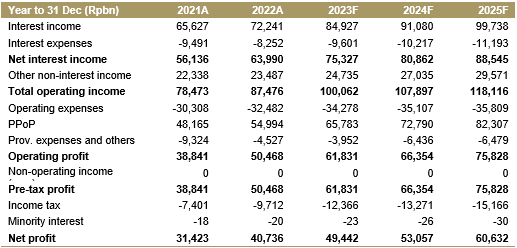

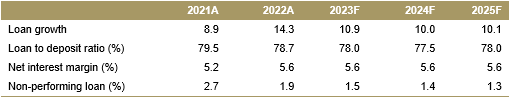

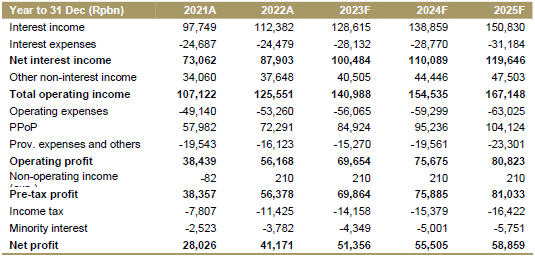

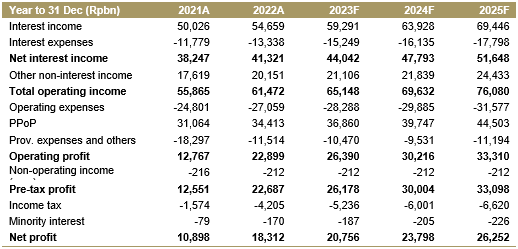

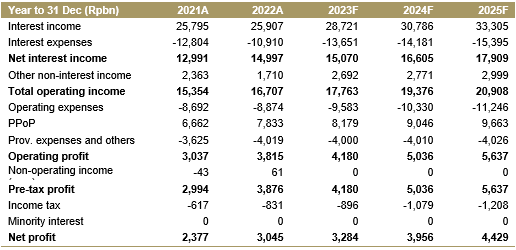

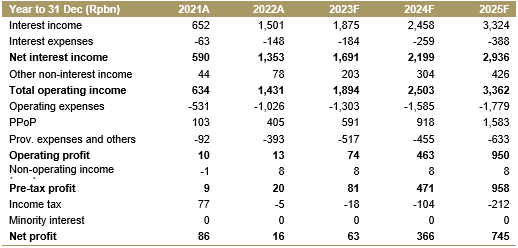

Income Statement

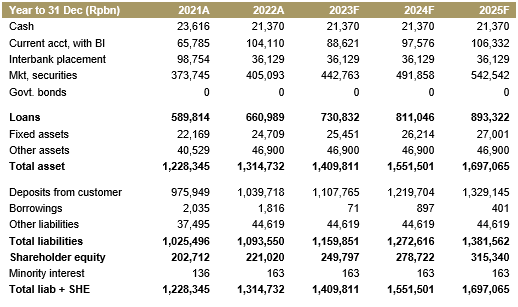

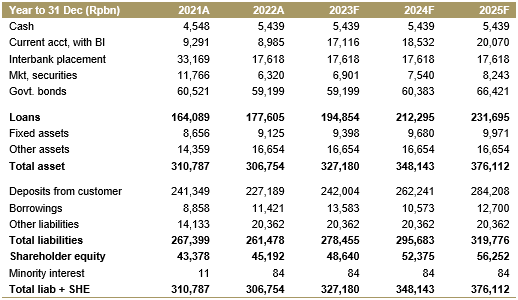

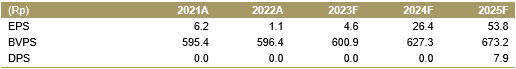

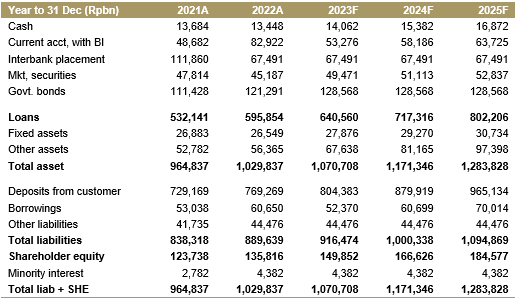

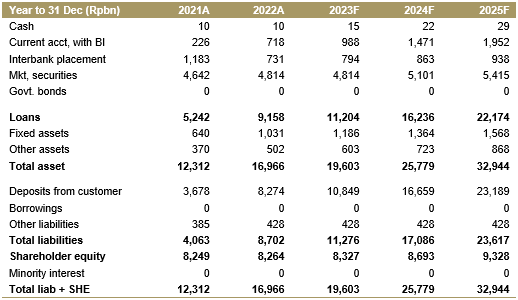

Balance Sheet

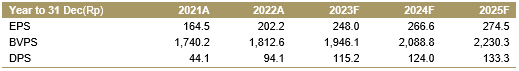

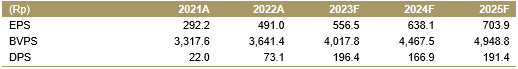

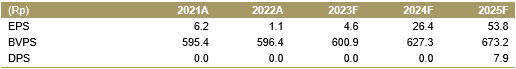

Per Share Data

Key Ratios

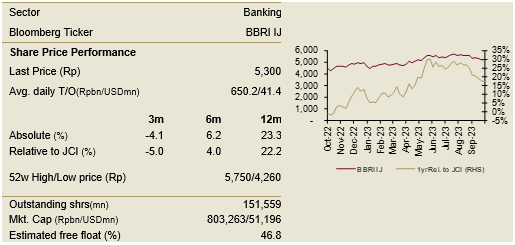

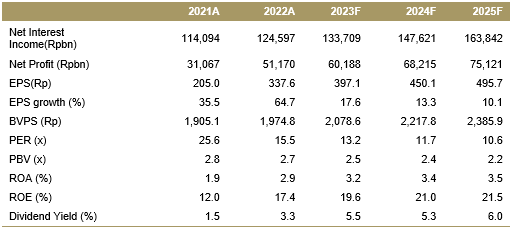

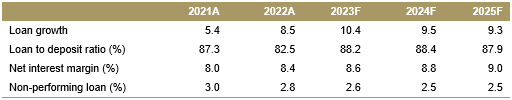

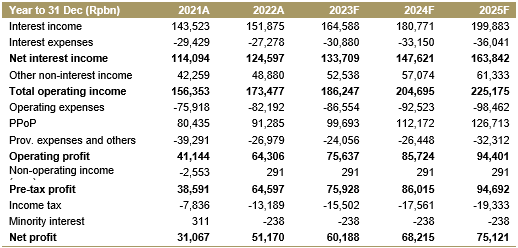

Bank Rakyat Indonesia

BUY TP: 6,250 (+17.9%)

Company Profile

Bank Rakyat Indonesia (BBRI) is the largest bank in Indonesia as well as the most dominant micro loan lender. The bank has the most extensive and largest network across every area of Indonesia with its 8.8k outlets, 22k ATMs and more than >570k branchless banking agents. BBRI has both non-subsidized micro (Kupedes) and subsidized micro/ultra-micro (KUR) as its loan growth driver. Micro lending is the main profit driver for BBRI, accounting for around half of its consolidated revenue.

Key Points

• BBRI is the main beneficiary of lower benchmark interest rates in 2024F. We expect BBRI to enjoy ~20bps NIM expansion given their focus on micro, which provides them with protection against declining interest rate and hence upsides on NIM. Aside of that, BBRI also will benefit from easing monetary policy by BI (Bank Indonesia), such as lower RRR.

• BBRI stands to benefit significantly from the substantial growth in Kupedes loans, coupled with a reduction in KUR disbursements. Kupedes loans grew by 43% YoY in 2Q23, and we anticipate the contribution of Kupedes to BBRI's micro loan will exceed the contribution of KUR by the end of 2023. The contribution of Kupedes is expected to increase to 43% of total micro loan in 4Q23 (vs. 29% in 4Q22), while KUR decreases to 42% (vs. 56% in 4Q22). This shift is expected to have a positive impact on the bank's Net Interest Margin (NIM).

• Cleaner loan book entering 2024F. BBRI performed a quite large write-off at close to ~Rp29tn for 2023F (vs. Rp22 tn in FY22). This is majority as the result of pandemic, and this will result in cleaner loan book in 2024F. Hence we expect both NPL and CoC to improve in 2024F.

• BBRI is currently trading at PBV of 2.5x for 2024F, slightly above +1 standard deviation at 2.4x.

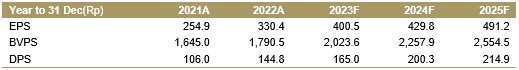

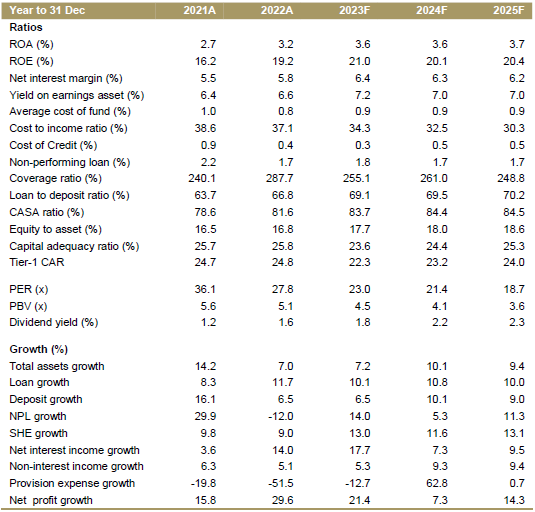

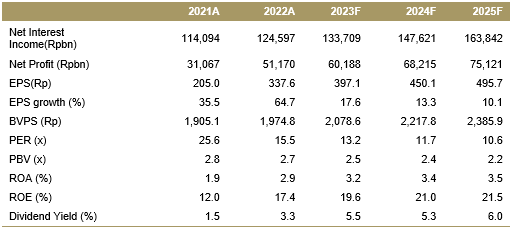

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

Bank Rakyat Indonesia

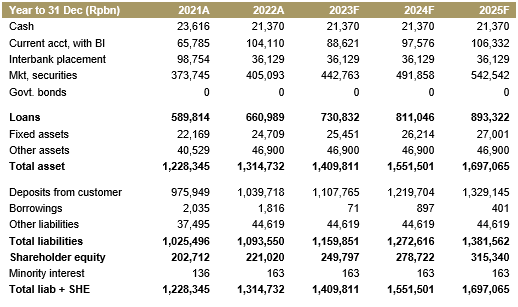

Income Statement

Balance Sheet

Per Share Data

Key Ratios

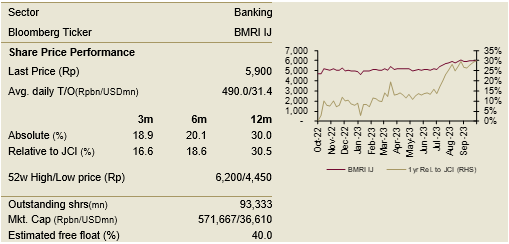

Bank Mandiri

BUY TP: 6,550 (+11.0%)

Company Profile

Bank Mandiri (BMRI) is now the largest bank in Indonesia in terms of total assets, post the consolidation of Bank Syariah Indonesia (BRIS) to its balance sheet. The bank was formed in 1998 and the result of the merger of four government-owned banks. Bank Mandiri is majority-owned by government of Indonesia and has the most diversified loan exposure among big four banks, with loan mix come from corporate (45%), middle (21%), MSME (24%), and consumer (11%) loan segment.

Key Points

• We believe BMRI will be the bank with the strongest achievement in CoC at 0.9% in 2023F. This marks the lowest level for BMRI in the past ten years. However, we expect that CoC will ticked up for BMRI entering 2024F, as we see the loan loss coverage-to-total loan that BMRI has is currently lower compared to BBRI and BBNI.

• BMRI shares have outperformed its big four bank peers by 7-15% Ytd, mainly due to re-rating on the back of its improved funding franchise with CASA ratio expansion of 320bps YoY as of Aug-23 (vs. big four bank peers contraction of 30-240bps YoY). However, we believe this is more driven by demand deposit growth as savings growth remains moderate. We also expect NIM to be muted for BMRI in 2024F.

• BMRI has the most complex subsidiaries among the banks, contributing 23-24% of its consolidated assets. One of its largest subsidiaries, BRIS, is poised for strong growth as the only SOE Sharia bank in Indonesia, in our view.

• All in all, we maintain our Buy recommendation on BMRI with a target price of Rp6,550/share, representing 2.1x 2024F PBV or slightly above its +1 st.dev of 2.0x.

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

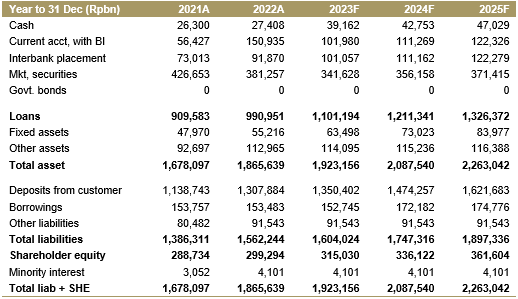

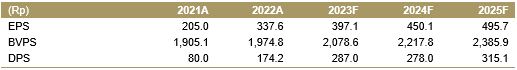

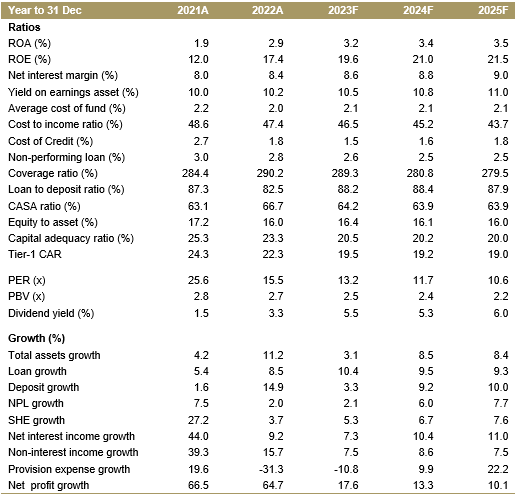

Bank Mandiri

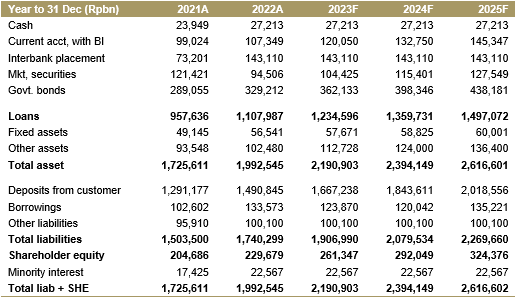

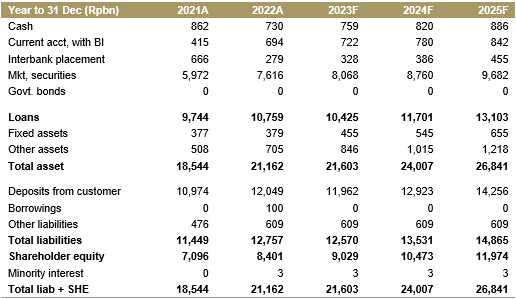

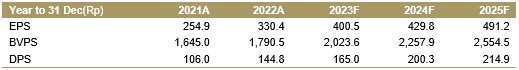

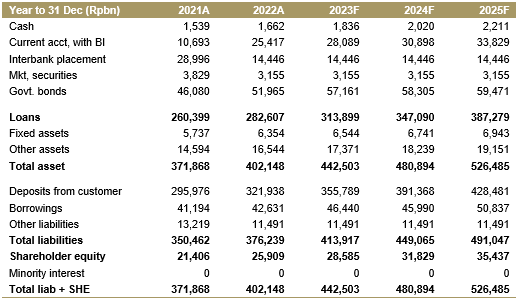

Income Statement

Balance Sheet

Per Share Data

Key Ratios

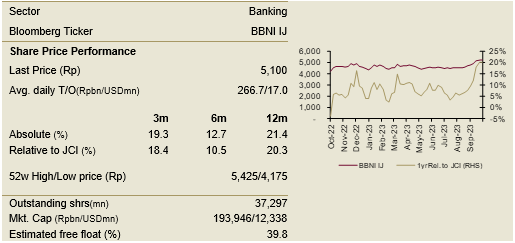

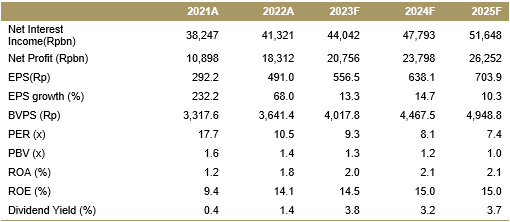

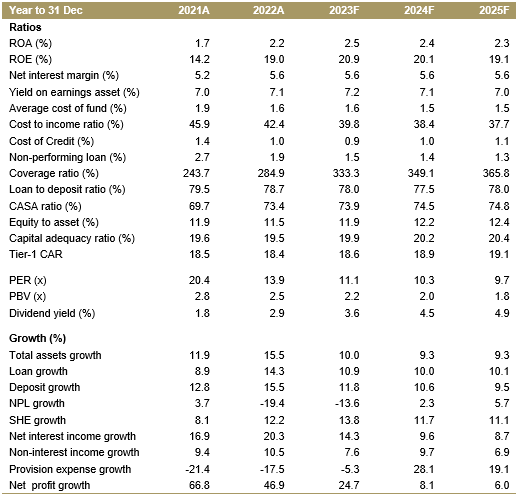

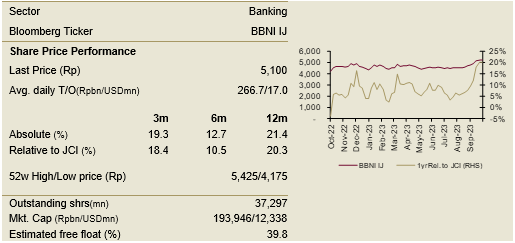

Bank Negara Indonesia

BUY TP: 5,825 (+14.2%)

Company Profile

Bank Negara Indonesia (BBNI) is the fourth largest bank in Indonesia and the third largest among SOE banks. Established in 1946, the bank is the first bank formed and owned by Government of Indonesia with 60% of the stake is owned by government. The bank mainly focused on corporate loan segment both private and SOEs (50% of total loan), with the rest of the portfolio consisted of small and medium segment loan (32% of total loan) followed by consumer loan (17%).

Key Points

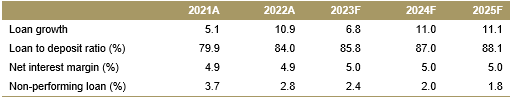

• We think it's time for the bank to enjoy a lower CoC, banking on its strategy to move to the lower risk segment. Currently, the proportion of corporate-private loans has increased significantly to 37% of total loans in 2Q23 (vs. 29% in 2Q20). In contrast, the share of the SOE corporate and SME segments declined to 15/16% of total loans in 2Q23 (vs. 26/18% in 2Q20). As a result of this transformation, BBNI has set a long-term target of reducing the cost of credit (CoC) to 1.0% in 2025F, well below the 5-year pre-pandemic average of 1.9%.

• On the other hand, we also believe that loan growth will have bottomed out at 7% in 2023F and should trend upwards to 11% in 2024F. This is driven by more balanced growth across the segment ( vs. selective segments in 2021-23F).

• The bank also opens up room for higher dividend payout ratio at 50%, compared to its historical DPO of 20-30%. This is possible as CAR is at a healthy level of 19% as of 2Q23.

• BBNI has the most compelling valuation among the big banks, while its ROE profiles are trending up to normal levels at >13% in 2023F. Valuations at 1.2x PBV (vs. +1 st.dev at 1.4x) still look cheap relative to peers and historical trends.

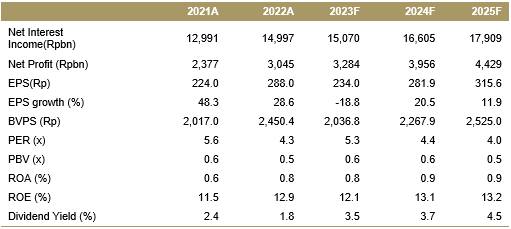

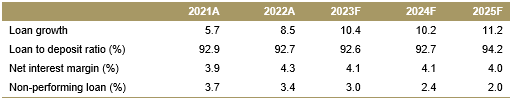

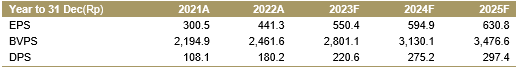

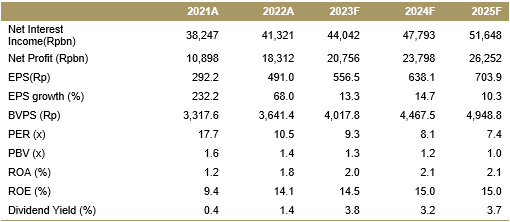

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

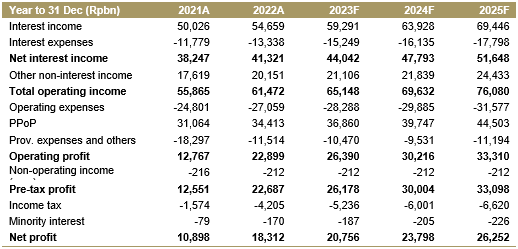

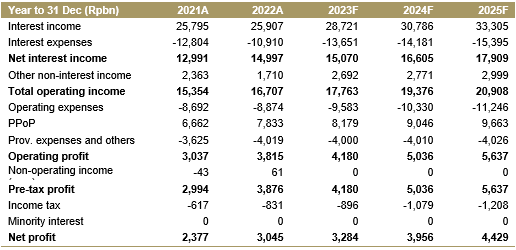

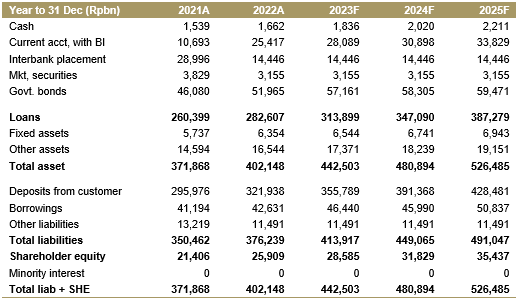

Bank Negara Indonesia

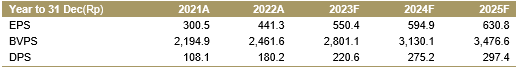

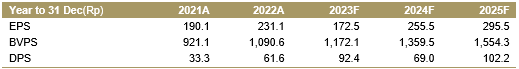

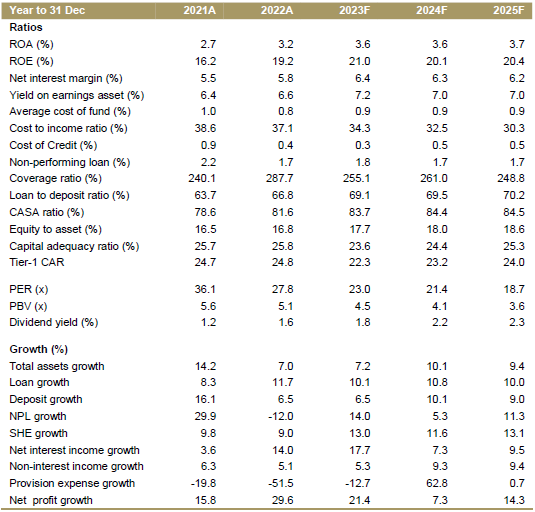

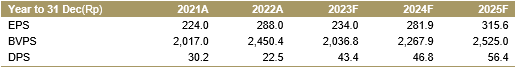

Income Statement

Balance Sheet

Per Share Data

Key Ratios

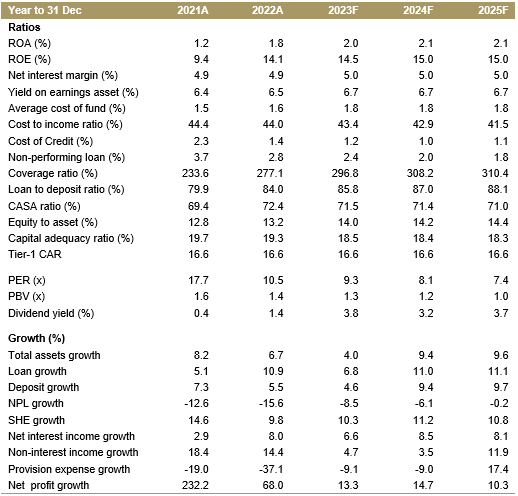

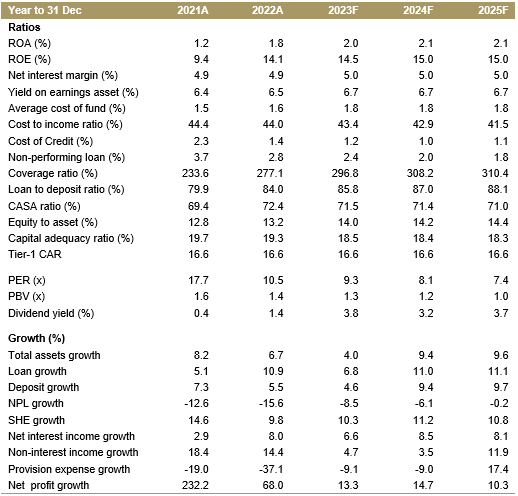

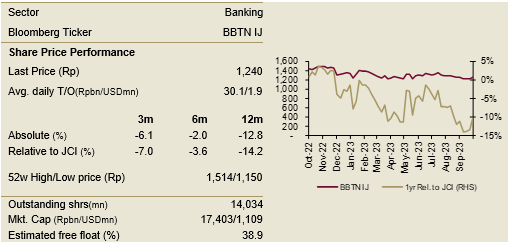

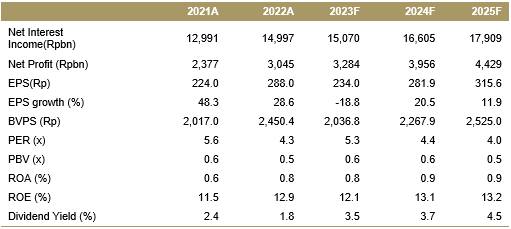

Bank Tabungan Negara

BUY TP: 2,125 (+71.4%)

Company Profile

Bank Tabungan Negara (BBTN) was established in 1897 under the name of “Postspaarbank” and is the only bank in Indonesia focusing on mortgage, especially the subsidized mortgage. As an SOE, BBTN enjoys government support in terms of cheap housing subsidy hence enable them to stand as the biggest mortgage market share at 38.3% as of 2Q22. Cheap housing is BBTN’s niche market with >85% market share domination. BBTN has complete offering of both conventional and sharia bank to its customer.

Key Points

• BBTN's main catalyst for 2024F will come from lower interest rates, as the bank has the most sensitive NIM among the banks we cover. This is because: 1) the bank has a relatively fixed return on assets given its large mortgage book, 2) the large contribution of time deposits to its funding (55% of total deposits), not to mention wholesale deposits.

• High exposure to government initiatives and/or regulations. With 50% of their loan is coming from subsidized mortgage segment, the bank will be subject to government initiatives regarding housing. Hence loan growth and loan yield in the future will affect a lot from the subsidized mortgage scheme post the election. This is as subsidized mortgage from BP Tapera still hold a small portion as compared to the government funded.

• BBTN will also be subject to OJK Regulation No. 12 dated July 2023 regarding the separation of Sharia business unit as its Sharia total asset stood at Rp46.3 tn as of 1H23 or approaching the maximum requirement of Rp50 tn in the OJK regulation. BBTN Sharia business unit's total assets currently stood at 11.5% of the bank's total assets.

• BBTN trades at a very compelling valuation of 0.6x 2024F PBV, the lowest among banks in our coverage. We maintain our Buy rating on BBTN with a target price of Rp2,125/share, implying 0.9x 24F PBV.

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

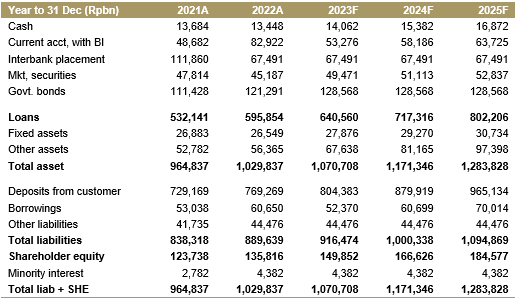

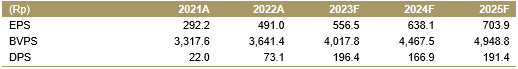

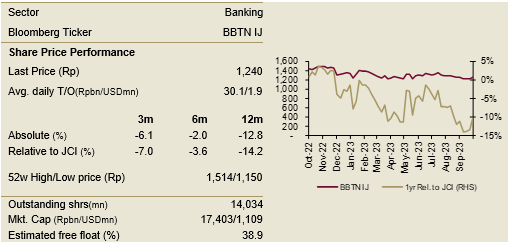

Bank Tabungan Negara

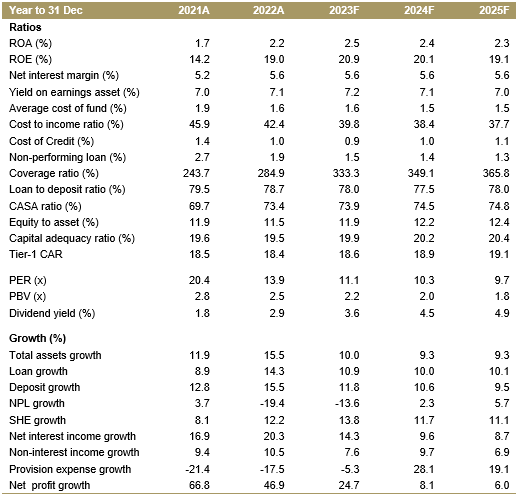

Income Statement

Balance Sheet

Per Share Data

Key Ratios

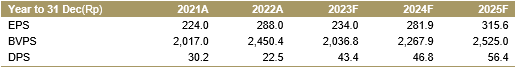

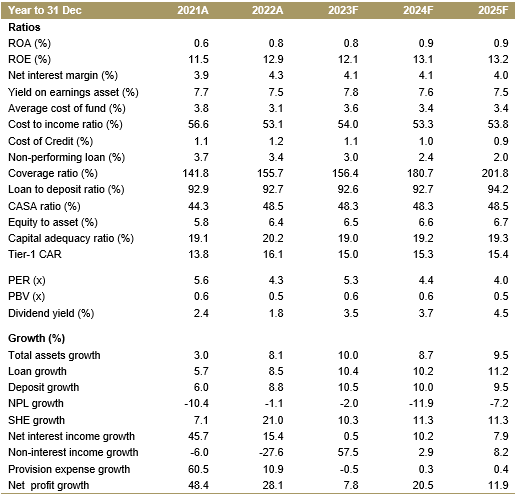

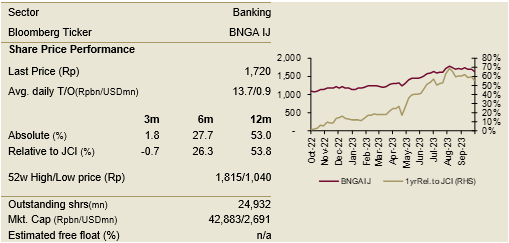

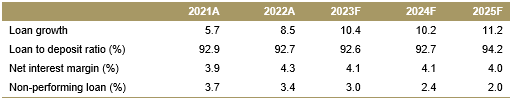

Bank CIMB Niaga

BUY TP: 2,370 (+37.8%)

Company Profile

Bank CIMB Niaga (BNGA) is the second largest private bank in Indonesia after BBCA. The bank is a local subsidiary of the Malaysian investment bank CIMB Group Holdings Berhad (91.48% ownership). The bank has been operating since 1955 under the name Bank Niaga, which merged with Lippo Bank in 2007. BNGA offers a range of retail and commercial banking products. Its loan book is currently dominated by corporate & commercial (55% of total loans) and consumer loans (34%) as of 1H23.

Key Points

• The bank is expected to see a rebound in loan growth. For the first time since 2015, loan growth reached high single digits at 9.4% YoY in 2Q22 (vs. 5.4% YoY in 1Q22) and 3.8% q/q or the highest quarterly growth in the past few years. We see this as the early upswing in loan growth, with the enabler coming from a solid balance sheet with manageable NPLs and ample liquidity (LDR at 83% as of 8M23 vs. >90% pre-pandemic).

• BNGA will benefit from lower interest rates. Given the high proportion of consumer loans (with a stickier lending rate) and funding exposure to both term deposits and wholesale funding, BNGA is expected to benefit from lower interest rates in 2024F. We expect NIM to widen by 10bps in 2024F.

• The bank is currently well positioned in terms of liquidity and capital. As a result, we believe the bank will continue to maintain a dividend payout ratio (DPO) above 50%. This should provide investors with the potential for a high single-digit dividend yield.

• As the bank has consistently delivered double-digit ROE over the past two years, along with a highly attractive dividend yield, we believe this would secure a further re-rating for the stock. BNGA currently trades at 0.8x 2024F PBV with a ROE of >13%.

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

Bank CIMB Niaga

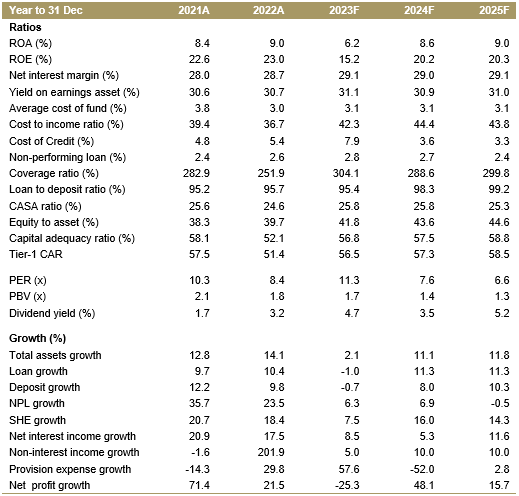

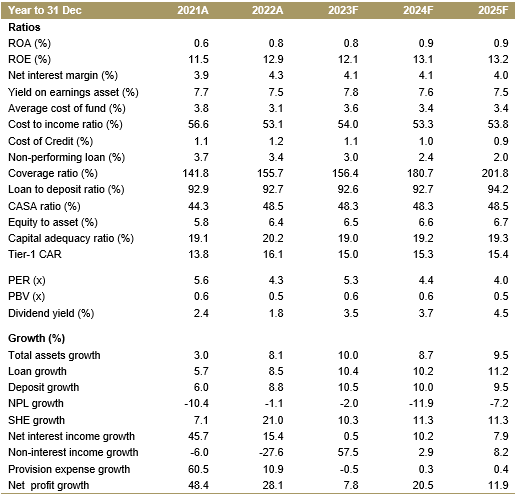

Income Statement

Balance Sheet

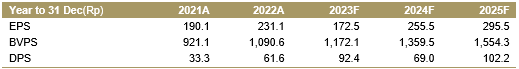

Per Share Data

Key Ratios

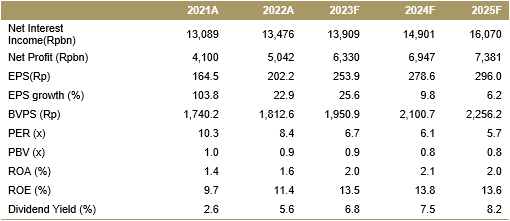

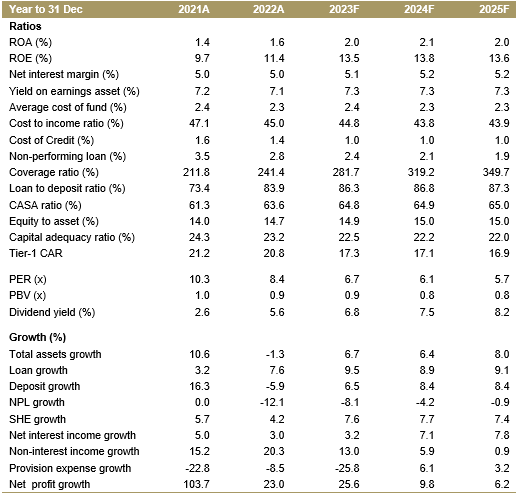

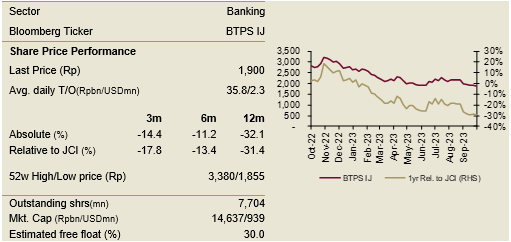

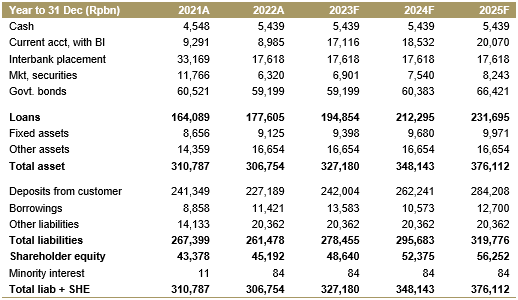

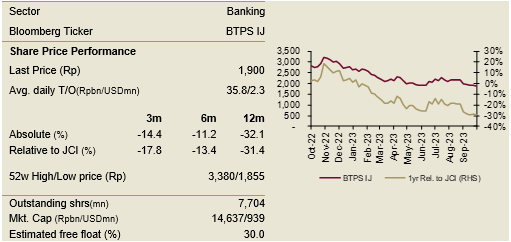

BTPN Syariah

BUY TP: 2,450 (+28.9%)

Company Profile

BTPN Syariah (BTPS) is the only commercial bank in Indonesia that is 100% focused on ultra-micro financing (average ticket size of Rp2.7 mn). Its target market is group lending consisting of productive poor women borrowers. The bank currently operates mainly in rural areas in 23 provinces in Indonesia. It is majority owned by PT Bank Tabungan Pensiunan Nasional, Tbk (70%).

Key Points

• The bank is still struggling with the slow recovery of the productive poor segment, but the condition is aggravated by the difficulties in restoring the discipline of the clients through the attendance of bi-weekly meetings. Previously, customers were relaxed by attending bi-weekly meetings during the pandemic to prevent outbreak. However, this practice has become a disruption to customer's habit and improvement came only from new customer.

• Management has taken some initiatives to address this by introducing some 'reward and discipline' based on customer attendance rate, such as cash back program for disciplined group/customers and on the other hand prohibiting top up loans for less disciplined customers. However, up to 8M23, the attendance rate is still not optimal at 71% in Aug-23 (vs. 2023F target of 80-85%).

• We believe 2024F will be the turnaround for BTPS, and we expect financing growth to rebound to 11% YoY in 2024F (vs. -1% YoY in 2023F).

• We reiterate our Buy rating on BTPS as we believe the stock still has a compelling valuation with ROE bottoming out at 15% in 2023F. Our price target is 1.8x 2024F PBV. The stock currently trades at 1.4x 2024F PBV (vs. historical average of 3.2x).

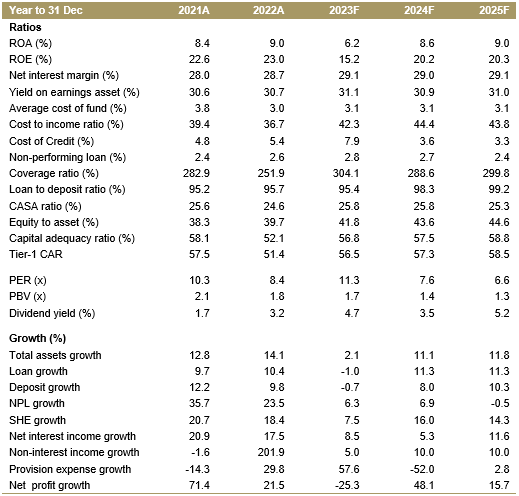

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

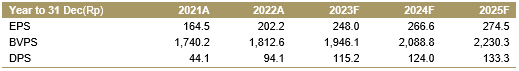

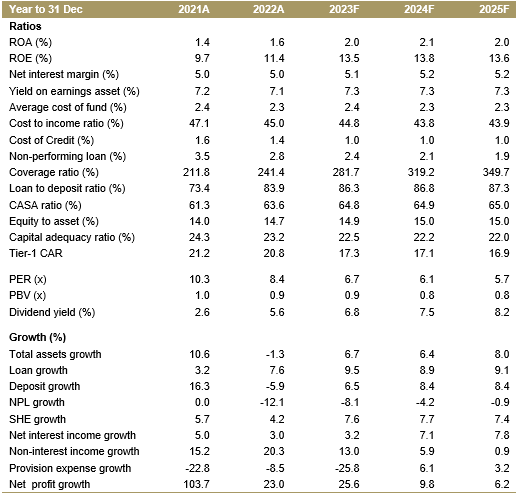

BTPN Syariah

Income Statement

Balance Sheet

Per Share Data

Key Ratios

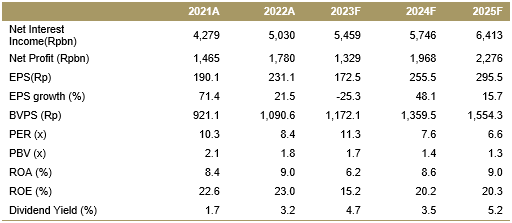

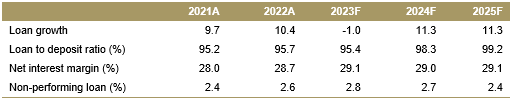

Bank Jago

BUY TP: 2,800 (+45.1%)

Company Profile

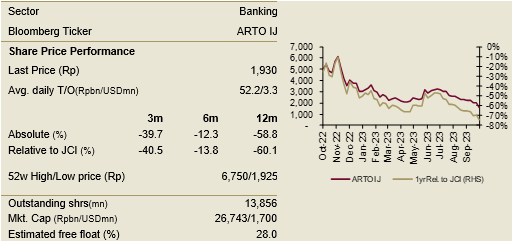

Bank Jago (ARTO) is one of the first movers of pure digital banks in Indonesia with large ecosystem coming from its shareholder GoTo group, or Indonesia's largest digital ride-hailing, e-commerce, and fintech ecosystem. The bank would focus on both consumer and MSME by leveraging on its ecosystem. Its BoC is led by Mr. Jerry Ng, a seasoned banker who previously succeeded bring many well-known successful innovations in banking sector.

Key Points

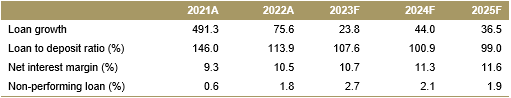

• Loan growth has been disappointing since 2023F, mainly due to slow growth from key strategic partner and much bigger than expected challenges from Sharia unit under Amaan. We expect 2024F to be a better year for ARTO, as loans from the strategic partner under GTF should be more on balance sheet, while the negative impact from Amaan should be almost fully loaded in 2023F.

• We maintain our expectation of double-digit NIM for ARTO, especially considering the abundant liquidity (assuring a manageable CoF) and no meaningful change in asset yield assumption despite the exit from Sharia financing under Amaan.

• The catalyst for ARTO would be stronger than expected loan growth, which would increase asset size and optimize the loan to asset ratio to a more optimal level.

• We have lowered our earnings estimates for ARTO in 2023-25F by 16-36% mainly due to this balance sheet underperformance. Our target price has now been revised to Rp 2,800/share (from Rp 3,800/share previously). The main risks to ARTO remain higher-than-expected competition and execution risk, as well as the stock's sensitivity to foreign outflows and global yield volatility.

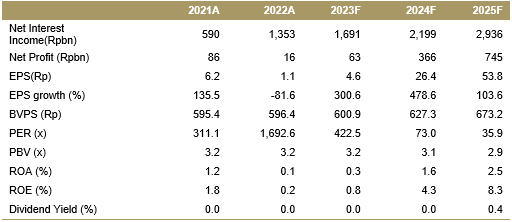

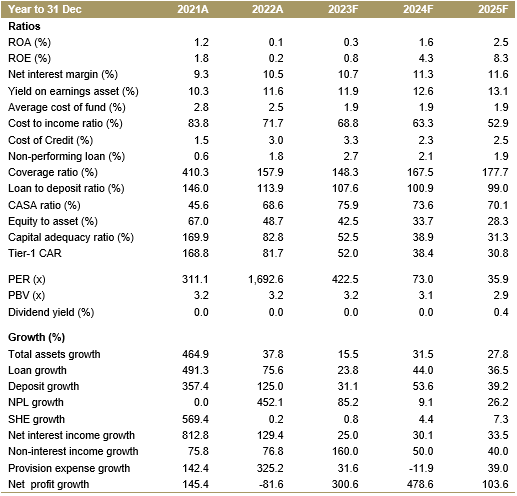

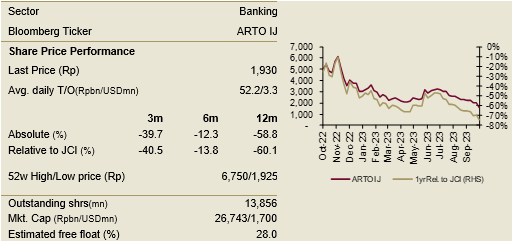

Financial Highlights

Assumptions

Erni Marsella Siahaan, CFA +62 21 2557 4800 ext. 919 siahaanerni@ciptadana.com

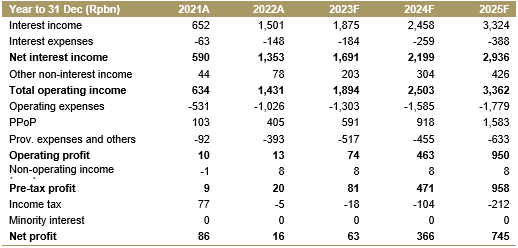

Bank Jago

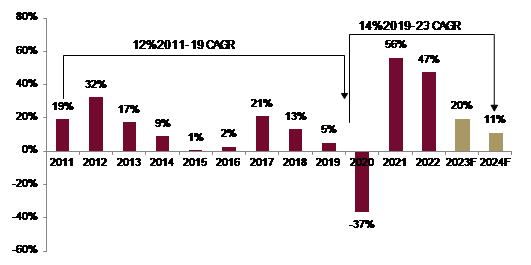

Income Statement

Balance Sheet

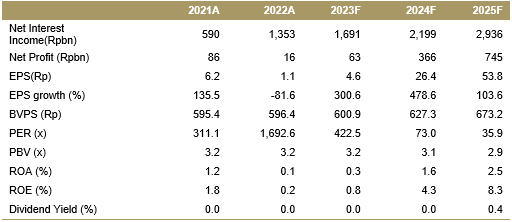

Per Share Data

Key Ratios