Telecommunication Overweight

Sector Outlook

• Healthy market conduct is here to stay, at least for a few more quarters

In YTD 2023, competition has been stabilizing for telecommunication (telco) industry and we foresee the trajectory to remain positive for at least a few more quarters. We arrive at this conclusion following our industry analysis from multiple perspectives. Firstly, our ground check reveals that telcos are in concert in raising data tariffs. All operators, including FREN, have been raising prices. Second reasoning to support our stable competition view is derived from studying the past episodes of price wars in Indonesian telcos. Based on historical episodes, we find out two main drivers of intense competition in the industry which are: unfavourable regulations and rapid declining revenue market share of Tsel. As such, judging from the current competitive landscape, we see no trigger for another price war in the near future. Thirdly, we think at the current industry setting, telcos need to maintain a healthy monetization in a bid to prepare for impending spectrum auction and more network rollouts amid more challenging macro backdrop. We will explain these three tenets in more details in further section. On top of these three drivers, we also note that the election had historically provided boons on telco service consumptions and boosted ARPU in quarters preceding election. While we are not betting too much on election tailwinds, it should provide support on the demand side, granting us more comfort on our constructive view on telco sectors.

• Data tariffs are continuously on the uptrend

Big three telcos have been raising tariffs since the start of the year. Though some more-for-more, tweaks and pullbacks do occur in the course of the year, we note the general trend is constructive. FREN is the latest to join the bandwagon. We note major price hikes from FREN are only arriving in the month of September with c.10% nationwide tariff increases across data packages. Moreover, our conversation with all telcos indicates that they are committed to maintaining rational pricing environment with more rooms to

further increase pricings. EXCL have mentioned that they see opportunity to raise tariffs in 4Q23 subject to market and macro condition. The strongest indication is coming from ISAT as it is targeting to reach Rp40 K ARPU by 2024F which in part should be driven by price increases. Indeed, based on our price survey, ISAT is the most aggressive in lifting tariffs this year. Its Tri brand has seen multiple price increases, which we believe is justified by improved network quality following its MOCN integration post merger so that Tri subscribers are now able to use ISAT’s spectrum.

Going forward, we see rooms for telcos to raising price further. Not only is data price per GB in Indonesia still lower than peers, but also the ratio of ARPU as % to GDP in Indonesia is still low and is on declining trend. Indonesia’s mobile ARPU was around 1.3% to GDP in 2013 and it fell to 0.68% in 2022. This is also lower compared to neighbouring countries such as Malaysia and Thailand that has the ratio of 0.93% and 0.95%, respectively and also lower than India’s 0.85%. As such, we see an opportunity for telcos to increase their ARPU, driven by the natural growth of data consumption on the back of increasing digitalization and also stronger monetization.

Exhibit 48: Indonesia ARPU/GDP ratio trend

Source : Companies, Bloomberg, CEIC, Ciptadana Sekuritas Asia

Exhibit 49: Telcos price tracker (jan-May 23)

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 50: Telcos price tracker (Jun-Sep 23)

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 51: Mobile ARPU comparison across country

Source : CEIC, Ciptadana

• Studying the past price wars in the Indonesian telco industry

In the past fifteen years, telco industry has faced four episodes of price war that lasted for approximately 3 to 6 quarters per incidence. At the conclusion of each price war, typically pricing repair would follow, lasting for at least one year. Longest post-price-war market stabilization occurred in the period of 2H11-3Q17 for around six and a half year when the market was also supported by one major consolidation with the acquisition of Axis by EXCL in 1Q14.

We analyze the historical industry trend and identify each price war in the industry. We also observe the revenue trend of the industry during each period. We sum up the revenue of TLKM, EXCL, and ISAT as proxy to industry revenue in our analysis. Note that we use TLKM revenue as proxy to Tsel due to data limitation on our side. Based on our analysis, the four episodes of price war in the industry are as follow:

1) One regulatory-driven price occurred in mid 2008 until 2009. This was triggered by MoCIT (Ministry of Communication and Information Technology) decision to cut interconnection rates, driving telcos to switch to high-volume, low-price strategy. This quickly stunted industry growth from 20-30% to single digit and even negative growth in 1Q19 as the aftermath impact. The market entered into stable competition for one year after the price war concluded.

2) In 2010-mid 2021 the industry saw another price war. This time it was initiated by Tsel who was trying to win back revenue market share and enacted pricing discipline in the industry. Tsel launched aggressive promotion on ‘Kartu As’ for its voice service after smaller telcos gobbled its revenue market share from the tune of 68% in 1Q09 to 65% in 1Q10 and even lower to 63% in 4Q10. The price war ended after Tsel regained some of its revenue share (64-65%).

Following this period, the market saw the longest post-war market stabilization that lasted for six and a half years. Consolidation played a part for the mild competition as one major M&A occurred after EXCL acquired Axis. BTEL, with its Esia brand, also ceased operation in 2016, further supporting the industry health.

3) MoCIT instituted a mandatory SIM registration in late 2017, triggering another round of price war, albeit rather short, as telcos were striving to keep subscribers in their respective network. At its worst, industry revenue declined sharply by 8% YoY. After the program completed, market repair once again occurred. From this point until the next price war, competition had remained stable but quite intense as smaller telcos were expanding to ex-Java aggressively, gradually eating up Tsel’s market share.

4) The latest price war started in mid 2020 triggered by the introduction of Tsel’s Unlimited Max plan. This was again to fight the revenue market share declines as subscribers down-traded to cheaper package amid weak purchasing power impacted by Covid-19 pandemic. This lasted for around one year before Tsel and later followed by other telcos withdrew or tweaked their unlimited offering. Along with the economy recovery, EXCL begun to lift tariffs and followed by other telcos in 4Q21-2Q22, resulting in healthier industry condition.

Exhibit 52: Telco industry’s revenue growth (price wars periods are circled)

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 53: Declines in TLKM’s Revenue Market Share Led to Price War

Source : Companies, Ciptadana Sekuritas Asia

• Low risk of price war in the near future based on historical triggers

Looking from the past episodes, we identify Government regulations and rapid falls in Tsel’s revenue market share as the two main triggers of telco industry price war. At this juncture, we see low risk of price war to ensue in the near future.

1) On the regulatory side, we currently do not see any potential regulatory developments that could trigger a price war. The Government might continue to push telcos to beef-up network roll-out in a bid to reduce coverage deficit, especially in remote areas. However, this would not trigger intense competition as it is typically part of USO program that is not economically feasible, hence low revenue potential. Another regulation that has circulated in the past but lack visibility is about the floor-cap data price and about the removal of exclusivity on indoor coverage. The former, if tread carefully, will actually help to regulate a healthier competition in the industry, rather than exacerbate competition, in our view. As we are only entering the first year of increasing tariffs with data prices are still generally low, there is no urgency from the Government to intervene, in our view. However, we see risks from Government to regulate data tariffs if the prices keep going up for two or three more years. On the latter, details are still lacking, and we believe it might be difficult to implement as this involves B-to-B agreement with the property owner and the telcos. One that could potentially increase industry competitiveness, albeit indirectly, is the permit for active infrastructure/spectrum sharing policy among telcos. This could accelerate smaller telcos expansion to ex-Java. Nevertheless, the regulation will only permit new technology (5G) roll out for technology sharing, which we believe would not be roll-out aggressively in the near future. On the fixed broadband side, there is a talk on SpaceX’s Starlink that is actively entering new markets including South East Asia. Nevertheless, to date, the MoCIT has only granted Starlink to work with telcos on a B-to-B basis to support their backhaul infrastructure and we expect the Government will not issue B-to-C license to Starlink anytime soon. On top of that, as a comparison, the entry price of Starlink in Malaysia is MYR220 per month (Rp730 K in rupiah term), far higher than Indonesia’s fixed broadband ARPU of Rp250K.

Exhibit 54: Starlink offering in Malaysia

Source : Starlink, Ciptadana Sekuritas Asia

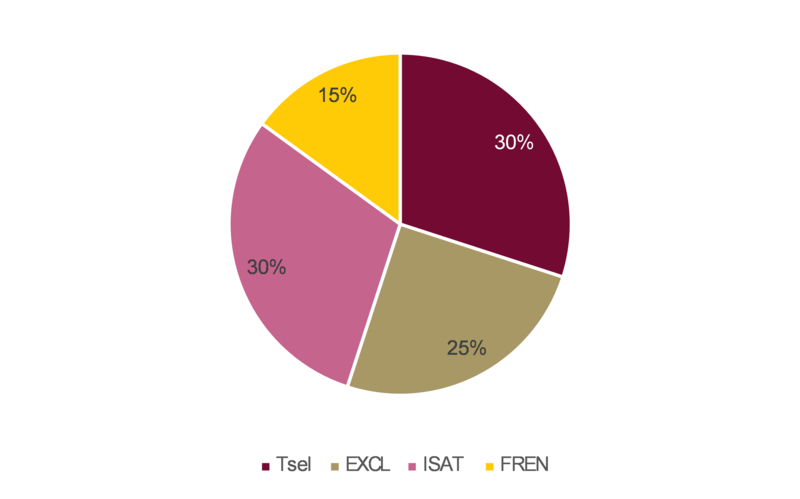

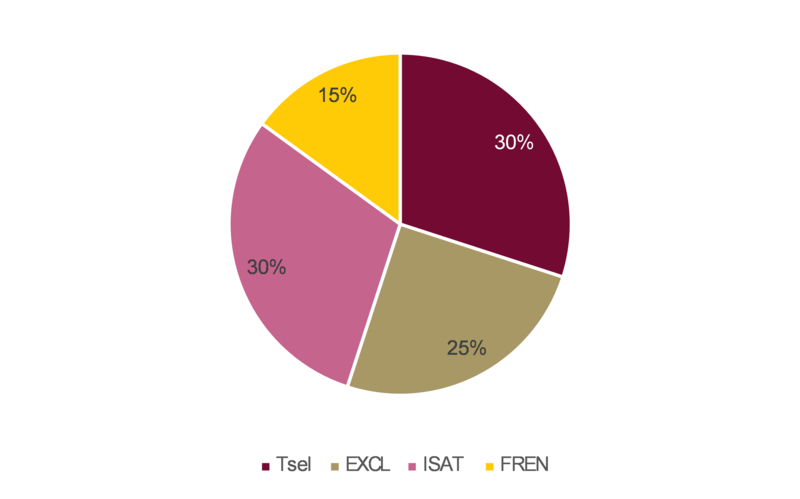

2) On Tsel side, we also see low odds of aggressive price actions by Tsel in the near future. While Tsel’s mobile service revenue will continue to grow slower than smaller peers (as they gradually gaining market share in ex-Java), the market share declines will be more manageable compared to previously. This will also be supported by less drags from the structural legacy revenue declines, which we estimate would have dropped to 13% of Tsel’s mobile service revenue in 2023F (vs. 19%/22%/28% in 2022/21/20). Moreover, Tsel is now able to grab most of the industry’s data revenue growths in absolute term despite losing some subscribers and have lower data traffic growths. As such, Tsel has no incentive to be aggressive and would love to maintain the current stable competitive environment for longer, in our view.

With low impending risk on both regulatory and Tsel’s side, we think it is possible that mobile market competition to remain stable for longer than two years as happened in previous M&A.

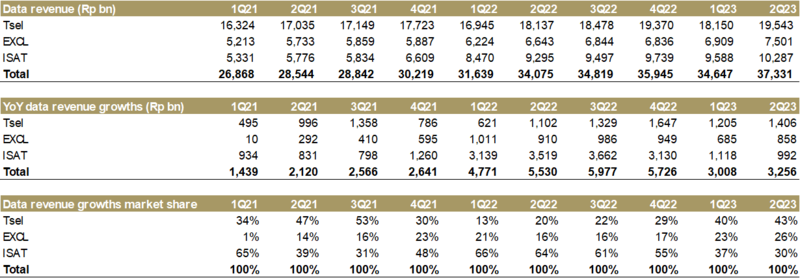

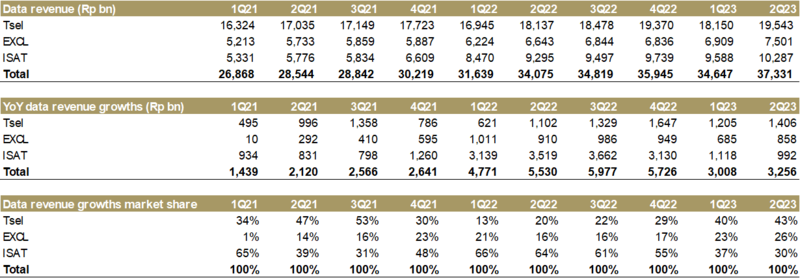

Exhibit 55: Industry data revenue, data revenue growth, and market share

Source : Companies, Ciptadana

Exhibit 56: Tsel’s Revenue Changes YoY (in Rp bn)

Source : TLKM, Ciptadana Sekuritas Asia

• Telcos need healthy pricing environment ahead of spectrum auction

We think at the current industry setting, telcos need to maintain a healthy conduct in a bid to prepare for impending spectrum auction and more network rollouts amid more challenging macro backdrop. While telcos are currently having healthier balance sheet (thanks to asset divestments and cost rationalization), they would welcome further pricing discipline in the industry. Telcos are currently spending 10-12% of their revenues for spectrum fees and the subsequent spectrum auctions could potentially increase spending portion by c.15pps by 2025F. Therefore, any improvements in data monetization are imperative to sustain profitability

From Government’s perspective, healthier industry landscape would ensure telcos’ commitment for network expansion to meet Government’s aspiration of equal internet access in the country. Further, with stronger telcos, it is more likely that the Government could garner greater auction proceeds. We note that spectrum licensing fees in Indonesia are one of the cheapest in the world both in perspective of cost per MHz and cost per MHz per population. Government would certainly welcome any potential increase in fiscal revenue from spectrum fees which is more feasible to take place in a better industry landscape.

We estimate the spectrum capex spree could cost Indo telcos Rp41.9 tn in spectrum acquisition price (including 1-year prepayment of annual spectrum fees) and Rp20.9 tn in additional annual spectrum fees if all of the planned spectrum are auctioned according to the plan.

Exhibit 57: Spectrum Fees Across Countries

Source : Multiple Sources, Ciptadana Sekuritas Asia

Exhibit 58: Potential Spectrum Auction in upcoming years

Source : Multiple Sources, Ciptadana Sekuritas Asia

• Another M&A, maybe?

Many news outlets, including Bloomberg, have reported that Axiata and Sinarmas Group are in talks on potential collaboration, possibly leading to another telcos merger. We see a decent chance of this to happening as post ISAT-H31 merger, each EXCL and FREN will find it difficult to compete with Tsel and ISAT. An EXCL-FREN merger will form a telcos with c.100 mn subscribers that bode well for its operating scale as most of the costs are fixed. More importantly, a merger will make EXCL-FREN’s spectrum holding competitive with other telcos. EXCL and FREN each holds 90MHz and 62MHz, respectively. If these two merges, the merged company will be sitting om 152MHz, comparable with Tsel’s spectrum holding of 155MHz. This is 34% of spectrum market share there are available for telco operators at the moment. Further, according to AT Kearney report, only two telcos in any given landscape can deliver consistent returns above WACC. In Indonesia, we think Tsel is a sure winner, and if uncontested, ISAT-H3I will become the runner-up. EXCL and FREN need to combine if they would have any chances to compete, we believe.

Exhibit 59: A&T Kearney Report on Telcos Profitability Profile

Source : AT Kearney, Ciptadana Sekuritas Asia

Exhibit 60: Telcos Pre-merger Stats

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 61: Telcos Post-merger Stats

Source : Companies, Ciptadana Sekuritas Asia

- Stable outlook for telcos in 2024F

The sector is still in a structural transition stage from legacy services (voice and SMS) to data services. The phase of the transition, however, is different from one telcos to another. The silver lining is that the level of competition has been stabilizing of late. From this point onward, we believe competition will still be intense but manageable. Telcos may have their own agendas; however, none would benefit from a severe price war. The most recent one is the ‘Unilimited Max’ introduced by Tsel to enact pricing discipline to the industry, stamping its authority as the telcos with unparallel network quality. With ISAT-H3I is at the latter half of its network integration, and FREN has followed the industry tend to raise tariff, we see the bigger odds of data tariffs repair that will translate to higher data yield and ARPU uplift. This will benefit telcos given that data traffic is still expected to continue to grow strongly. Another key driver is cost discipline which in turn befits into another important lever to cash flow generation.

- Industry data traffic growth is set for further growth

Since the beginning of 4G roll-out in 2015, data consumption has witnessed a tremendous growth. Data traffic (from the top-3 operators) grew at 13.3% compounded quarterly rate in 1Q15-2Q22 with 2Q22’s figure is at 62.3x of that in 1Q15. Notwithstanding the explosive growth, we believe Indonesia is still in the earlier phase of mobile data adoption. Indonesia’s smartphone penetration picked-up rapidly in the last few years due to the rise of cheaper handsets especially the Chinese brands. However, Indonesia’s smartphone penetration rate of 78% in 2023F is still low compared to neighbouring countries (Thailand: 85-90%, Malaysia: 80-85%, Philippines: 75-80%). Furthermore, monthly data-consumption-per-subscriber number also suggests ample further growth potential as the average from top-3 telcos is currently at c.10GB, far lower than that of other South East Asian countries (Malaysia at 15GB/subscriber/month, Thailand at 16GB/subscriber/month) or India (11-12GB). Having a young demographic profile, coupled with the acceleration of digitalization trend, we estimate data traffic could still post 20% CAGR in 2022-25F.

Exhibit 62: Smartphone Penetration in Indonesia

Source : Statista, Ciptadana

Exhibit 63: Data Consumption per Subscriber per Month (in GB)

Source : Companies, Ciptadana Sekuritas Asia

• Smaller telcos are expanding to ex-Java…

Competition landscape in telcos sector is dynamic and intricate. Differences in ex-Java presence, economic of scale, and legacy/data revenue mix are complicating the competition dynamics. For instance, apart from the incumbent Telkomsel (Tsel), smaller telcos are expanding their ex-Java coverage as a greenfield revenue opportunity. EXCL as the early mover, started its ex-Java expansion in 2H16 and has managed to reach >90% population coverage in key islands with current estimated ex-Java market share at c.15%. ISAT and H3I (before merger) have also started expanding to ex-java in 2018/2019 with ex-Java population coverage at around 90%. FREN, while also has initiated ex-java expansions, is more focused to cover more sites in Java and gain more subscribers. We believe EXCL has already achieved the appropriate scale in some of its early ex-Java investments. It now needs to balance out between monetizing and filling-in more subscribers to its networks. On the other hand, ISAT and to some extend FREN will continue to expand their coverage into new areas over the next few years and customers’ acquisitions will be their focal points for a while.

• … taking Tsel market share for a while

Tsel is the network leader in Indonesia and is the incumbent operator in ex-Java with nationwide coverage of >95%. At the same time, Tsel is the latter in term of legacy transition to data/digital services as 19% of revenue is still derived from legacy services in 2022F. Before smaller telcos rolled out ex-Java expansions intensively, Tsel could maintain its legacy revenue while growing data business at the same time. As digital adoption accelerates throughout the country, in some part thanks to smaller telcos expansions, Tsel currently suffers the highest revenue decline from legacy services. Furthermore, its relatively low data engagement compared to peers and some market share losses resulting in slower revenue growth. This situation is exacerbated in 2020. As Covid-19 struck, economy deteriorated and people’s purchasing power shrank materially, especially those in the lower income bracket. Downtrading trend occurred during this period, driving subscribers to switch away from Tsel and switch to other telcos. Nevertheless, in-line with the economy reopening the sector is recovering as explained previously.

Exhibit 64: Estimated Java Market Share

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 65: Estimated ex-Java Market Share

Source : Companies, Ciptadana Sekuritas Asia

• ARPU is on the uptrend, while data yield is stabilizing

Another data point that we would like to point out is the uptrend of industry ARPU. The ARPU uptrend arrives as a function of still growing data traffic and stabilizing data yield. We also note that the election had historically provided boons on telco service consumptions and boosted ARPU in quarters preceding election. Based on our observation, ARPU historically rose by Rp2 K QoQ in quarter preceding presidential election. Lebaran is also giving similar impact based on our observation. As such, we highlight, 1H24 might be a great opportunity for telcos to record a strong performance as the Jan-Feb election period is followed by Mar-Apr Ramadhan and Lebaran festive. While we are not betting too much on election tailwinds, it should provide support on the demand side, granting us more comfort on our positive view on telco sectors.

Exhibit 66: Tsel-to-EXCL Data Traffic Multiplier vs. Yield Premium

Source : Companies, Ciptadana Sekuritas Asia

Exhibit 67: Industry Data Yield (in Rp/MB)

Source : Companies, Ciptadana Sekuritas Asia

• EXCL’s download speed was faster than Tsel for the first time ever

Based on the latest OpenSignal report, we observe that telcos have been investing adequately to maintain/improve their network performance. Tsel’s retook its first place which was momentarily taken by EXCL last year. We saw significant improvement in Tsel as the Company recorded the fastest download in the industry. This is positive for Tsel to continue to command premium vs competitors. We believe data is not fully behaving like commodity; there is a brand value associated with each provider with network quality as one of the key differentiators. Another key observation is that H3I’s download speed is now the same as ISAT as it has completed spectrum integration. This, we believe, would enable H3I brand to raise prices closer to that of ISAT’s.

It is also noteworthy that FREN’s 4G download speed lags peers significantly and despite the positive trend, its deficit to peers is still large. As FREN continues with its unlimited data plan and MiFi products, we believe FREN’s network capacity will continue to be under pressure. We expect telcos will continue with their capex spending going forward to maintain their networks quality. Plenty spectrum auctions on the horizon will also help with network quality improvement. We believe under-investing is not an option for telcos as continuous network quality deterioration may result in revenue loss as reflected in ISAT’s case before its sizeable capex cycle in 2018-2020. Fortunately, telcos are currently in better position now, and as we argued previously, this should incentivize telcos further to maintain a healthy conduct of the industry.

Exhibit 68: Download Speed (in Mbps)

Source : OpenSignal, Ciptadana Sekuritas Asia

• 5G is just a hype for now

The rollout of 5G networks in Indonesia might take years to materialize. There are a lot of things to prepare, including the network design and architecture, technological aspect, infrastructure upgrade, use case development, and regulatory issue. From spectrum perspective, we believe it requires a few more years before adequate 5G spectrum could be available. Rolling-out 5G nationwide would require a broad range of spectrum, spanning from the low-, mid-, and high- band spectrum to achieve the balance of capacity and coverage. However, those spectrums are not readily available at the moment. The ideal low band spectrum (700 MHz) is currently on the process of clean-up from analogue TV. This could only be freed-up after the process of analogue switch-off (ASO) has been completed. The Government targets ASO to complete by the end of this year and the spectrum might be auctioned out later in 2023F. Meanwhile the high band of 3.5GHz is currently used for satellite services in Indonesia, including Telkom, and BRI Satellite. The contract expiry for those satellites varies but they run a long term contract until 2031-2034. We believe it would require a lot of efforts and negotiation time to clean up and optimally utilize the 3.5GHz for 5G rollout. While the mid band spectrum, currently the 2.6GHz is already awarded to IPTV to run its DTH TV service under Indovision brand. The spectrum rights will expire in 2024.

• Telcos are pursuing for FMC; positive but not a game changer

Lastly, another theme that the telcos are embarking in right now is the fixed-mobile convergence (FMC). Telcos are pursuing FMC to streamline the fixed and mobile broadband offerings in a bid to improve network efficiency and potential cross-sell to increase stickiness and productivity of subsciber. TLKM has completed the transfer of IndiHome to Tsel in Jul-23 to achieve the full scale of FMC. EXCL has acquired LINK to also beef-up its effort on FMC and has begun the cross-selling through XL Satu product. Meanwhile, ISAT has its brand new FTTH product, called HiFi, after The Indosat GIG was closed following the IM2. Overall, our view is positive for the FMC move, however, it is not a game changer, in our view. While there might be benefits from cost efficiency, we believe it might be challenging to lay fiber directly to home and the nature of subscription business has been proven not suitable for most of Indonesians given high proportion of daily earners.

• OVEWEIGHT rating on the sector with TLKM and EXCL as our top pick

At this juncture, we rate all telcos BUY. As the industry is moving on the right direction, we expect to see revenue growth/profitability improvement from the sector. ISAT will continue to deliver the strongest EBITDA growth; however major pushback might be from its valuation. We like TLKM as we expect revenue recovery from Tsel and its plan to unlock value from its subsidiaries and digital assets as potential kicker for TLKM’s share price. We like EXCL as we see decent growth and potential fixed broadband growth acceleration, while its valuation is still attractive.

Exhibit 69: Telecom stocks rating and valuation

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

Telkom

BUY TP: Rp4,800 (+24.7%)

Company Profile

TLKM Indonesia is the largest telecommunication and network provider in Indonesia. It offers local and domestic long distance telephone services. TLKM operates the largest nationwide fixed-line telephony and broadband internet services, as well as other telco-related services and certain valued-added services such as satellite, fixed broadband services either directly or indirectly through its affiliates.

Key Points

• Accelerating mobile business in 2H22-2023F. After facing stunted growth in the past couple of years, we expect mobile (Tsel) revenue to return to positive territory in 2022F. We expect Tsel could record low-single-digit revenue growth in 2022-23F. As the playing field is getting better, Tsel will focus on improving data monetization while at the same increasing data engagement among its customer base by offering relevant video content, gaming, and other additional services.

• 5-bold moves. TLKM recently announced its 5-bold moves as a part of business and organization transformation. They include: FMC, establishing infra company, unlock value in data center, focusing on B2B digital IT service, and setup a digicos to build and scale new digital businesses and capture synergy value. Overall, we think all the moves are positive to restore growth and unlocking value for TLKM.

• BUY on TLKM with Rp5,000/share TP, one of our top picks for the sector. We continue to like TLKM on the back of growth recovery in mobile and asset values unlock. The most imminent one might be Telkom Data Center (DC) which the Company expects to go for IPO or to receive investments from strategic investors.

Financial Highlights

Assumptions

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

Telkom

Income Statement

Balance Sheet

Cash Flow

Key Ratios

XL Axiata

BUY TP: Rp2,950 (+23.9%)

Company Profile

EXCL provides a wide range of mobile telecommunication services in Indonesia. EXCL is owned by Axiata Group Berhad through Axiata Investments (Indonesia) Sdn Bhd (61.2%) and the public (38.3%). XL Axiata is the third largest cellular provider in Indonesia in terms of revenue with 57.2 mn subscribers. It owns a nationwide cellular network covering all major cities in Java, Bali and Sumatra, as well as populated cities in Sulawesi and Kalimantan. Axiata and EXCL just recently completed LINK acquisition that will spearhead their FMC aspiration.

Key Points

• Transform into ServeCo. EXCL is planning to transfer its fiber assets to LINK while the Company will receive LINK’s FTTH business in return. The transaction will be done before the end of the year. Post-transaction, EXCL will focus to provide FMC telco service as a ServeCo, while LINK will be an infrastructure Company as an InfraCo. Transaction will be done in arm-length manner and would require minority shareholder approval at EGM before prevailed.

• FMC ramp-up. Upside from FMC could be achieved through: new customer acquisitions, lower churn rate, and capex/opex efficiency. EXCL plans to roll out 8mn additional home-passes within the next 5 years with around 2mn home passes to be realized in the first two years, while the rest will be in year 3-5. We see potential ARPU downtrend in FTTH business, albeit gradually, as competition intensifies and as the next leg of growth will come from tier-2 and tier-3 cities.

• BUY EXCL. EXCL would still deliver a decent EBITDA growth and currently is trading at an attractive 3.7x 2024F EV/EBITDA.

Financial Highlights

Assumptions

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

XL Axiata

Income Statement

Balance Sheet

Cash Flow

Key Ratios

Indosat Ooredoo Hutchison

BUY TP: Rp11,000 (+4.5%)

Company Profile

Indosat provides telecommunications networks, telecommunications services, as well as information technology (IT) and/or convergence technology services. The company operates through three segments: cellular, fixed telecommunications and Multimedia, Data Communication, Internet (MIDI). After acquiring H3I, the company cements its position as the country's second largest cellular operator by revenue and subscriber base.

Key Points

• Realizing synergy after merging with H3I. ISAT is on the second year to realize synergy value worth USD300-400 mn, to be realized in the next 3-5 years. Most of the synergy value would be derived from capex/opex efficiencies, especially from network integration. Management is confident that they could decommission around 20-25% of its existing sites. Apart from that, ISAT is also aiming cost saving from non-network side, for instance: shut down of duplicative retail/customer center footprints, rightsizing, and more efficiency in G&A and marketing. As of 1H23, the synergy realization has been ahead of schedule and we are confident that ISAT could achieve the targeted synergy based on the historical track record of the management.

• Divesting non-core assets. ISAT is planning to sell some of its fiber assets to focus on telecom service for Rp2-3 tn. If the deal materialized, we expect another special dividend to come from ISAT.

• ISAT is still a BUY on the back of the strongest EBITDA growth among top-3 telcos.

Financial Highlights

Assumptions

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

Indosat Ooredoo Hutchison

Income Statement

Balance Sheet

Cash Flow

Key Ratios