Consumer Neutral

Sector Outlook

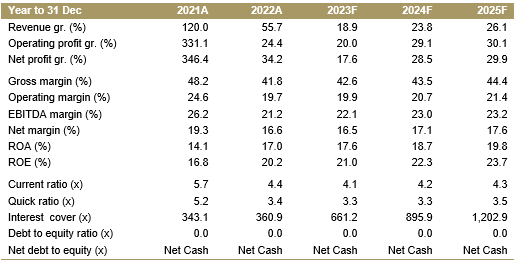

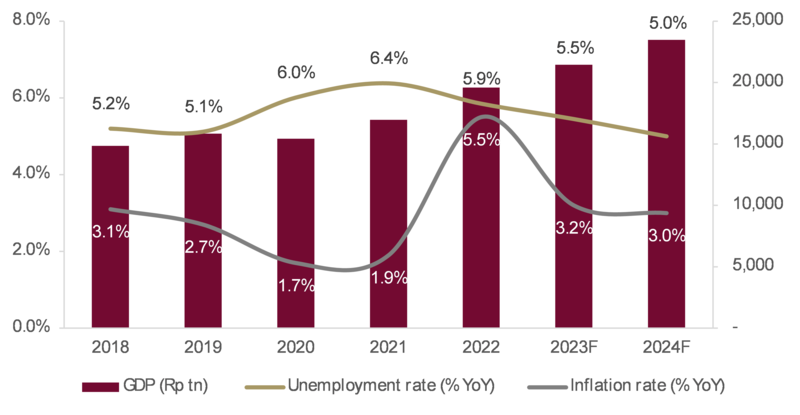

Exhibit 79: Indonesia’s economic growth to moderate in 2024

Source: BPS, Ciptadana Estimates

• Expect election year to aid consumption growth. Despite economic headwinds and pandemic of the past few year, but we held more optimistic outlook as we enter 2024 with inflation and unemployment rate figure are expected to continue decrease. This trend is supported by likely stability subsidized fuel price and the government’s ongoing efforts to improve human resources. This bodes well for consumption growth and indicates strong structural tailwinds. Furthermore, pre-election campaign spending in 4Q23 leading up to the Feb-Jun 2024 general elections, along with disbursement of social assistance budget in 2H23 will also stimulate consumption. Nonetheless, the recent price increases in non-subsidized fuel and spikes in food prices due to the El Nino effect are causing near-term concerns.

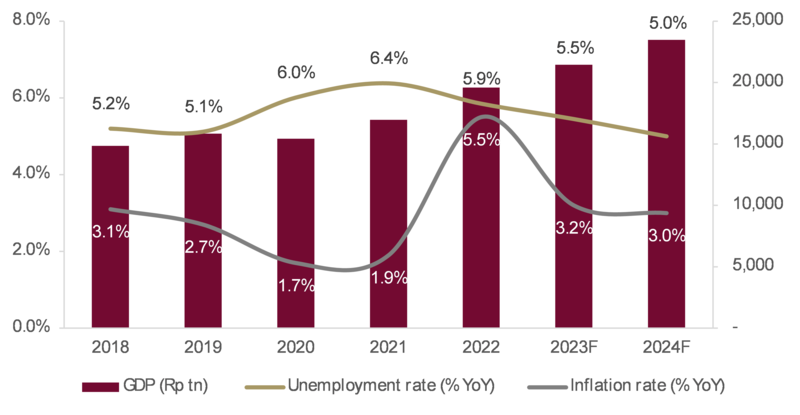

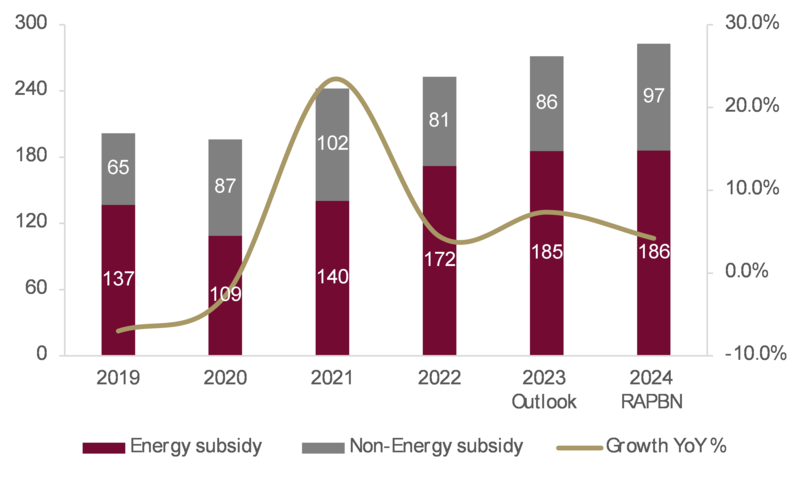

Exhibit 80: Trivial increase in social subsidy

Source: MOF, Ciptadana Sekuritas Asia

• Social subsidy grew merely at 4% in 2024F. The government social subsidy budgeted at Rp282.8 tn next year, increasing by 4.2% YoY in the 2024 draft budget. This trivial increase in subsidy budget largely driven by non-energy subsidy (ie. interest subsidy program, fertilizer). Energy subsidy appear flat compared to 2023 outlook with higher electricity tariff subsidy is expected to offset lower disbursement of 3Kg LPG subsidy. Thus far, we do not see any substantial changes in 2024 draft budget. The government will continue its ongoing program, which include: i) Family Assistance Programme (PKH) with a targeted 10mn household recipients, ii) Food assistance program (BPNT) for 18mn household recipients, iii) National health industry subsidies for 96.8mn citizens, iv) village fund intends to boost consumption among lower-income households.

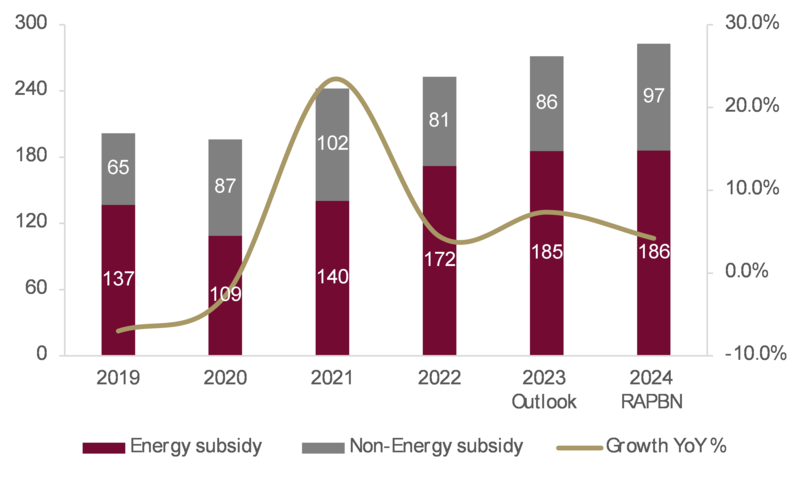

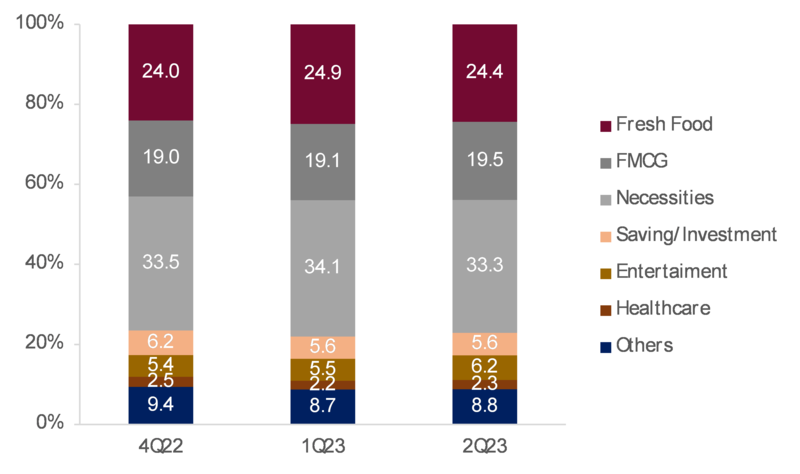

• Food and FMCG product have captured larger share of consumers wallet. The willingness to spend is reflected in Food and FMCG category, which has consistently gained a larger share of consumers’ wallet from 4Q22-2Q23 amid inflationary environment, according to Kantar’s survey. These categories are considered main priorities for consumers. However, we foresee that there is a possibility consumption patterns skew towards more discretionary staples such as housing, household amenities, fashion/clothing, dining out, and entertainment in the long run with the rising disposable income, middle-class segment, and better macro condition.

• Consumption behaviour trend. To battle cost inflation, FMCG companies have taken meaningful price increases or reduce pack sizes over the past two years. This poses more significant challenges for consumers in mid-low income brackets, prompting adjustment in their spending behaviour such as downsizing or downgrading. Conversely, higher-income consumers are likely to continue making premium purchases. Despite the trivial increase in social subsidy budget may provide some relief, but it’s unlikely to be sufficient to boost mass-market consumption and low-end discretionary spending. As such the prevailing consumption patterns are expected to persist in 2024.

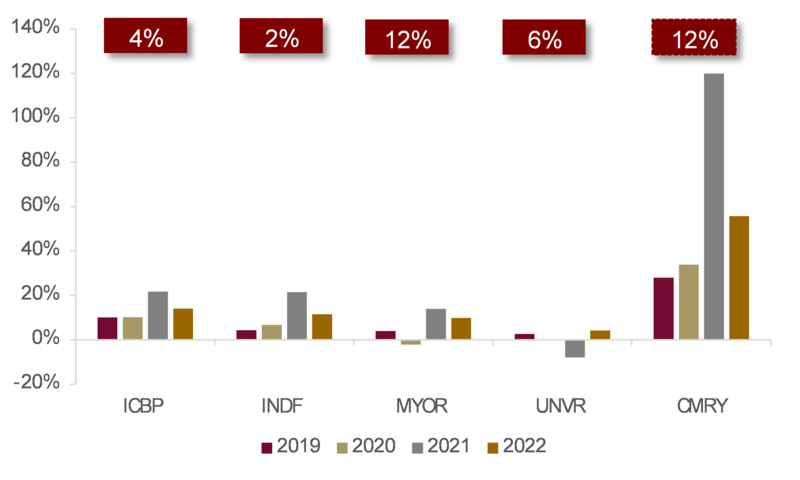

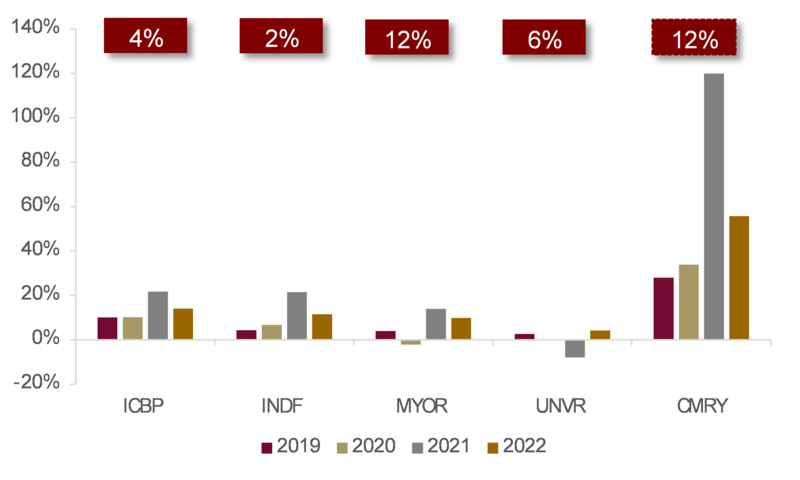

• A&P spend to capture consumers’ mind share. In light of the intensifying competition within the industry, we believe that brand investments aimed at capturing consumers' mindshare play crucial role. Among staple companies, CMRY and MYOR stand out with the highest average A&P/sales ratio, accounting for 12% as they have been aggressive in launching new product and are well-known with its creative and robust digital strategy. Meanwhile, UNVR has increased its A&P/sales ratio to ¬8% in 2023F, (vs. 4-yr average of 6%). This increase in A&P spending is in line with company's commitment to long-term brand equity investment and enhancing its competitiveness. ICBP and INDF have kept their A&P expenses as a proportion of sales lower, at 4% and 2%, respectively, due to their strong brand loyalty.

Exhibit 81: Indonesia household expenditure breakdown

Source: Kantar, Ciptadana Sekuritas Asia

Exhibit 82: Average ad/sales ratio and revenue growth of staples companies

Source: Company data, Ciptadana Sekuritas Asia

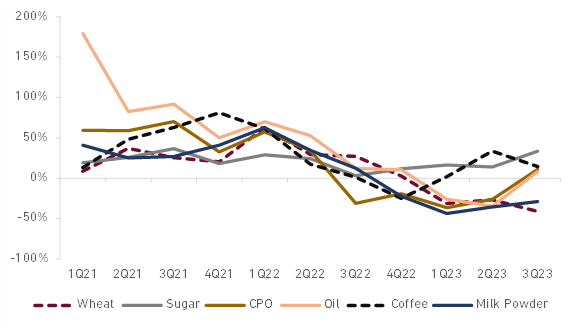

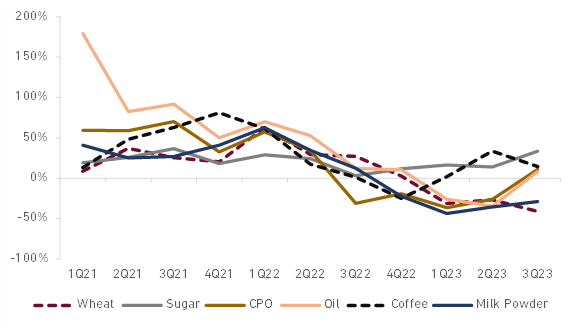

• Prepare for modest margin expansion next year. Staple companies performance is closely tied to global commodity price, with regard to raw materials. While most of commodities have witnessed significant correction from their peak levels on sequential basis as well as year on year basis, contributing to margin expansion in this year. It needs to be noted that since government has imposed trade restrictions of several soft commodities due to El Nino looms and ongoing geopolitical tension, there is a possibility that prices may stabilise or even rise over the next few months. We list out the outlook of each key raw materials as follows:

1) Wheat: the price has been pushed down by an exceptionally strong crop in Russia. According to the USDA, the 2023/2024 global wheat production is forecast down by 6 mn MT to 783 mn MT, with smaller harvest for Australia, Canada, Argentina, and the EU, which more than offsetting a higher forecast crop for Ukraine. Despite lower global supplies, world consumption remains unchanged. Thus, we assume wheat prices at USD6/ bu in 2023F/2024F. Our concern lies on renewed Black Sea escalation.

2) Coffee: robusta coffee prices have surged due to supply concerns. The reduced exports from the leading Robusta producer, Vietnam, stemmed from lower domestic inventories, resulting in shortages in the broader market. However, supplies from Brazil have helped alleviate some of the tightness in the market, causing the price of robusta coffee to decline to USD2,252/MT.

3) Crude Palm Oil: our plantation analyst projected CPO price will stay at MYR4,500/ton in 2023F/2024F, takes into account i) higher inventory levels in Malaysia, ii) slow economy activity in China. While the El Nino weather phenomenon has affected some annual crops in Indonesia, it has not had any significant impact on palm oil production thus far.

4) Oil: the ongoing armed conflict between Israel and Hamas is causing additional uncertainty and has the potential to disrupt oil output from the Middle East. Thus, coupled with Saudi Arabia and Russia's crude supply cuts, this situation introduces an upside risk to oil prices. Consequently, Brent oil is projected to move in the range of USD86-USD90/ bbl in 2023F/2024F.

5) Sugar: the price has experienced pressure due to ramped up sugar production in Brazil. The weaker Brazilian real has further encouraged export sales from Brazil's sugar producers. However, the extreme weather conditions in Thailand and India may lead to a potential reduction in global sugar supply, estimated at 10%-15% for the 2023/2024 season, which presents an upside risk to sugar prices.

6) Dairy: whole milk powder prices has dropped to USD2,7967/MT, according to Global Dairy Trade primarily as a result of reduced demand for it in China. The waning appetite for dairy products in China is closely tied to the recent economic challenges in the world's second-largest economy.

Exhibit 83: Key soft commodity historical price YoY (%)

Source: Bloomberg, Ciptadana Sekuritas

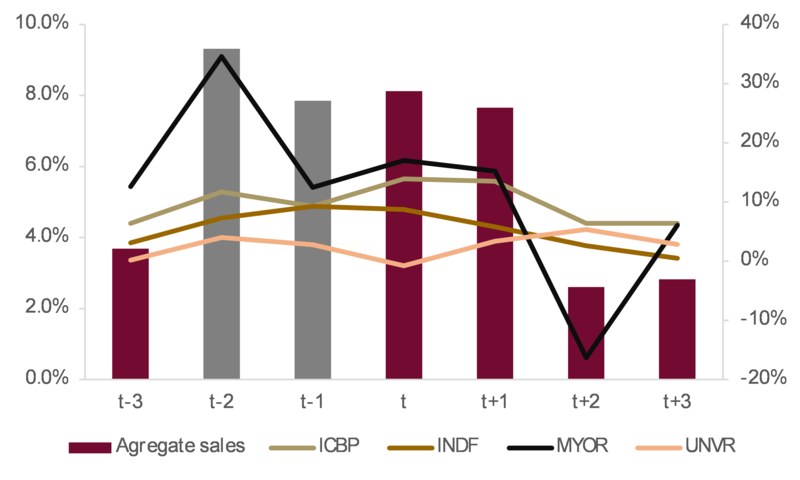

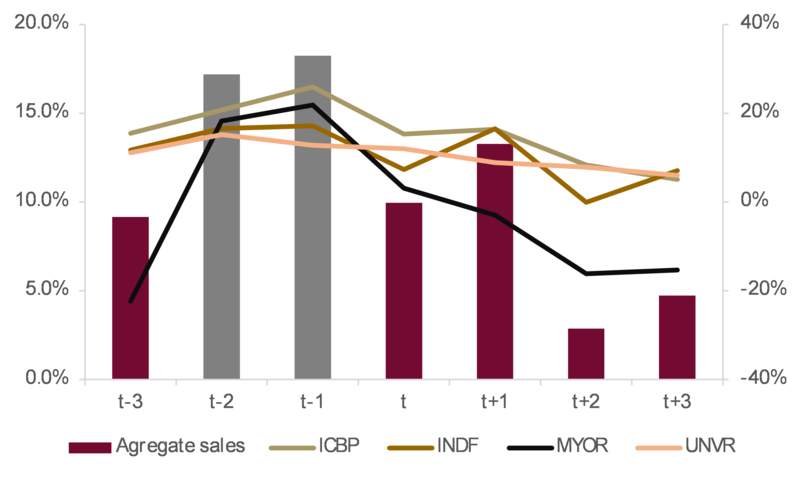

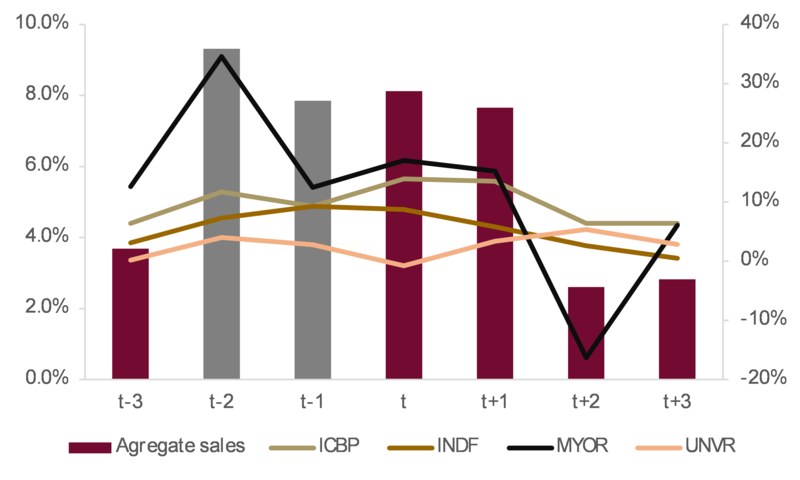

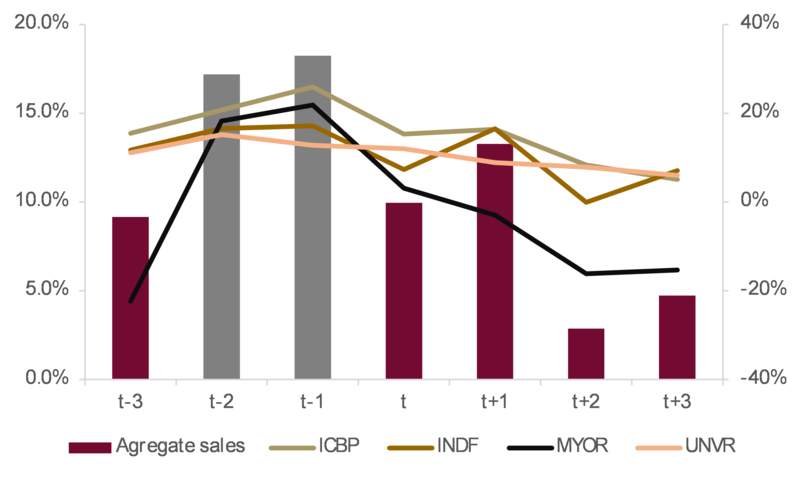

• Consumer staple sales trend during election period. As the general election is drawing nearer, election-related spending and better macro conditions are expected to bolster mass market purchasing power. According to Minister for Economic Affairs, election money injection could amount to 0.6% of GDP, which could potentially spur private consumption growth to 5.3% YoY in 2024F (vs. 5.2% YoY in 2023F). With this current situation, we have observed the topline growth of staple companies within our coverage during the political elections of 2014 and 2019. The trend indicates that aggregate revenue growth tends to moderate in the two quarters leading up to the election quarter, which likely propelled by election-related activity and festive spending. When these catalysts pass, demand likely to normalize. Among the staple companies, we have seen an acceleration in sales growth for ICBP during the pre-election period, attributed to their products like instant noodles and snacks targeting middle to low-income consumers, while MYOR recorded positive growth in local sales in the two quarters preceding the election. In 2024F, we expect consumer staples companies under our coverage to deliver 8.5% YoY topline growth next year.

• Excise risk on packaged sweetened beverages. As per the Draft State Revenue and Expenditure Budget for 2024, the Ministry of Finance is targeting Rp246 tn in excise revenue, representing an 8.3% YoY. We believe the government recognizes the necessity of diversifying its excise tax revenue sources apart from relying heavily on revenue from tobacco industry. As part of this diversification effort, packaged sweetened beverages are being considered as a potential revenue stream. A single tariff scheme has been established for RTD format beverages, set at Rp650/ liter based on sugar content. The government also set 3 categories for products that could potentially be subject to this tax: 1) beverages with sugar content of >6gr/100ml, 2) beverages with natural sweeteners without content limitations, and 3) beverages with artificial sweeteners without content limitations. We think that the excise tax implementation poses risk of ASP increase for ICBP (c.2.3%-4.5%), CMRY (c.0.7%-2.7%), UNVR (1.9%). There should be no impact to MYOR as the company does not have RTD beverage.

Exhibit 84: Staples topline growth trend around elections in 2019 (YoY)

Source: Company, Ciptadana Sekuritas Asia

Exhibit 85: Staples topline growth trend around elections in 2014 (YoY)

Source: Company, Ciptadana Sekuritas Asia

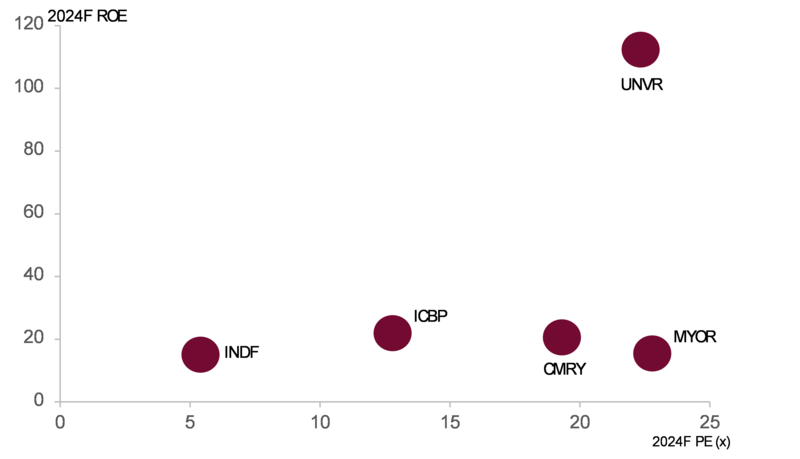

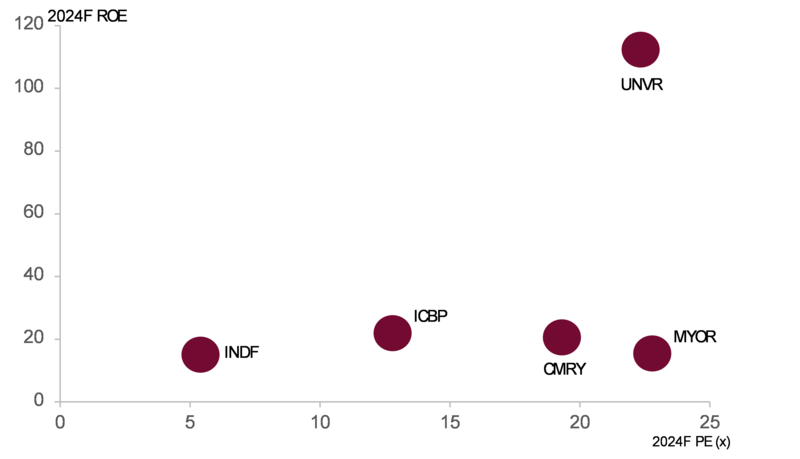

• Neutral rating on the sector with ICBP and MYOR as our top picks. We believe most of the expected improvement in fundamentals this year have well priced-in, leaving possible downside risks from post-election reforms, commodity price increases amid El Nino looms and ongoing geopolitical tension, and IDR depreciation. Most of the staples companies enjoyed robust topline growth, likely on the back of higher magnitude of ASP increases. Assuming raw material cost at current level, hence further modest margin expansion and volume growth is expected next year. We have neutral rating on the sector and see only select pockets of opportunities in the sector particularly companies that have strong price-volume dynamics, market leaderships, invests into new product amid intense competition. Our preference for next year is:

1) We prefer MYOR owing to its strong presence in all domestic business segment domestically and its underpenetrated export market, has been gaining market share amid tightening competition. The company’s strategy of diversifying its geographical location through exports (c. 40% of total sales), provides a natural hedge against exchange rate volatility. MYOR is trading at 19.2x 2024F PE, at -1 std. dev from its 3-year mean. Risk include weaker than expected sales growth and fluctuations in soft commodity prices.

2) ICBP is trading at 12.6x 2024F PE, our preferred pick due to its strong pricing power. The company is poised to benefit from potential election-related spending in the mass segment. ICBP may also see higher noodle growth from the expected 9.1% CAGR in 2021-2025F, backed by encouraging Indonesia macro and rising consumption per capita in Middle East. Risk include IDR depreciation, sharp uptick in soft commodity prices due to El nino and rising black sea tensions , and reduction in government fiscal stimulus.

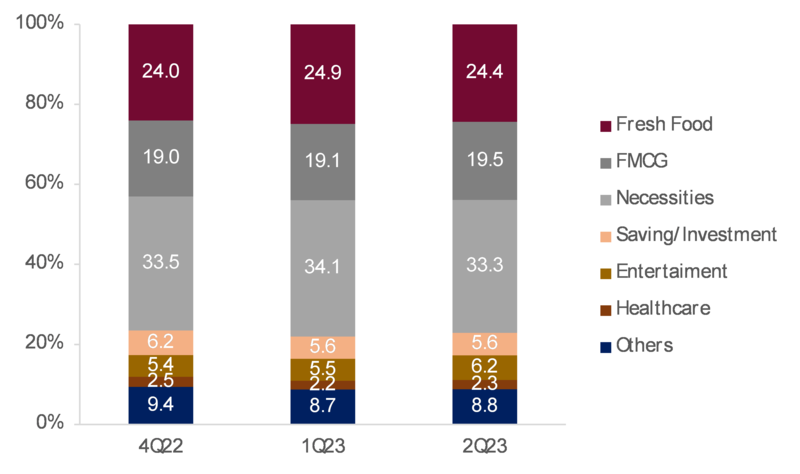

Exhibit 86: Consumer universe

Source: Ciptadana Estimates

Exhibit 87: Consumer stock rating and valuation

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

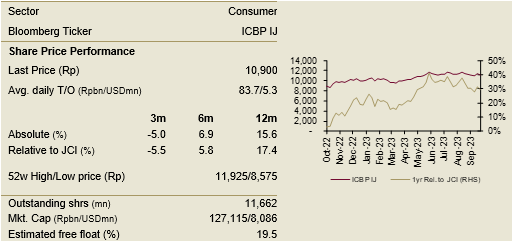

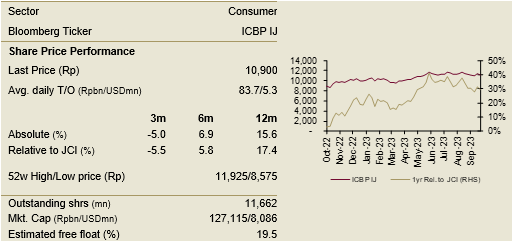

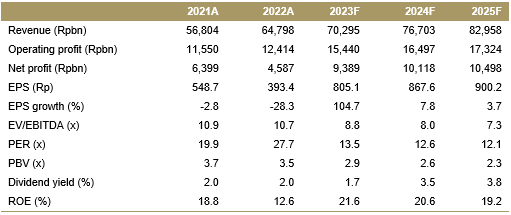

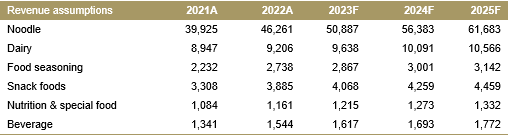

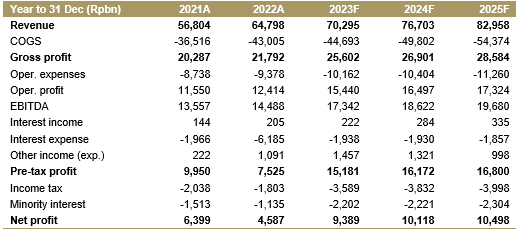

Indofood CBP

BUY TP: Rp14,500 (+33.0%)

Company Profile

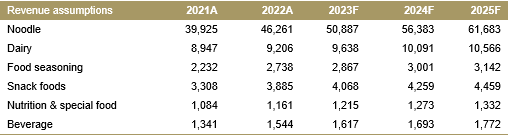

Established in 2019 under Indofood Sukses Makmur, Indofood CBP (ICBP) is a market-leading producer of consumer branded products. The business operation of ICBP comprises of noodles, dairy, snack foods, food seasoning, nutrition and special food as well as beverages. The major contributor for ICBP’s revenue comes from noodles and dairy, as they made up to 85% of the company’s total revenue.

Key Points

• Continues to roll out new product to push the growth. As inflation stays subdued and takes into account that noodle segment is mature category, the ability to raise selling price may be constrained. Thus, we only expect single digit volume/ASP growth in 2024F. To maintain brand loyalty, market share and drive volume, ICBP is continuously developing new product. The latest product innovation has gained positive tractions.

• Immense competition in dairy segment. Dairy business is considered very lucrative given the under penetration of dairy consumption, this bring the space is immensely competitive especially in liquid milk. We see competitive price strategy, product innovation with creative marketing strategy highly crucial for ICBP to navigate the challenges.

• Pinehill’s long term growth potential. Given that Pinehill has a consumer base in the Middle East and Nigeria that is four times larger than Indonesia, it is poised to be a significant volume growth driver in the long run. Currently there are some macro-headwinds in Turkey that could pose risk for the export sales growth, but these are expected to be compensated by resilience Saudi Arabia market.

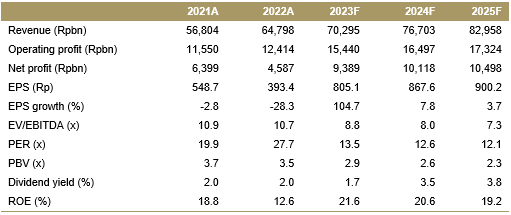

Financial Highlights

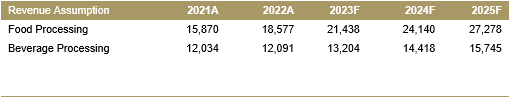

Assumptions

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

Indofood CBP

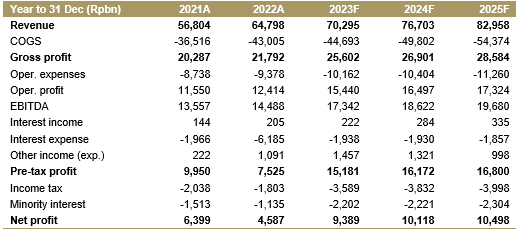

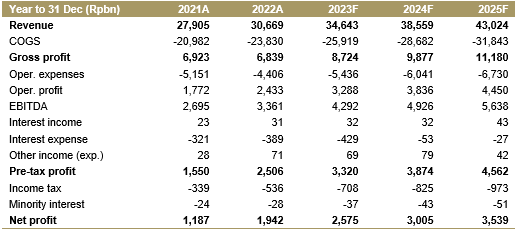

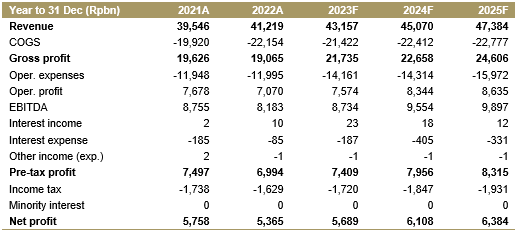

Income Statement

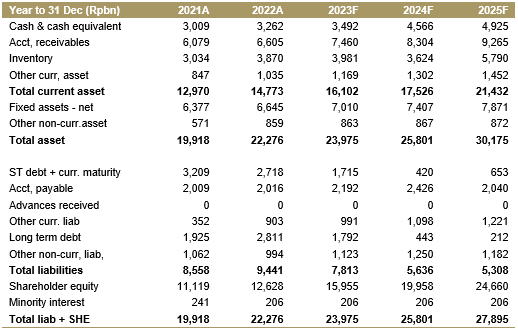

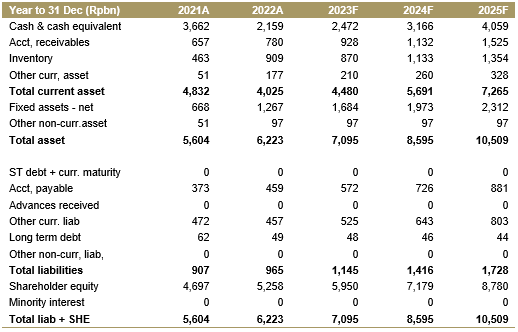

Balance Sheet

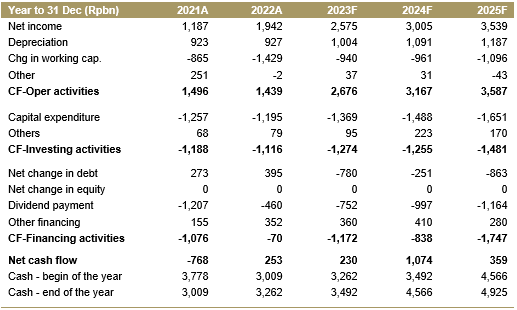

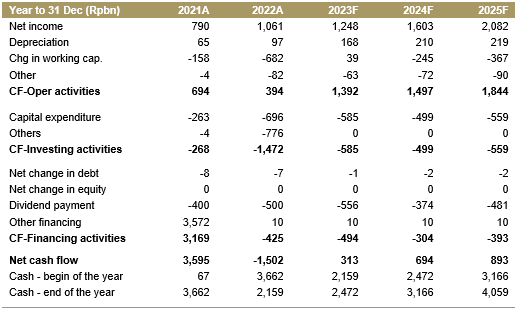

Cash Flow

Key Ratios

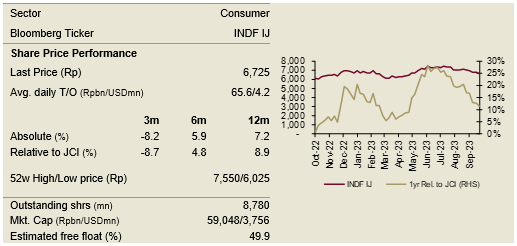

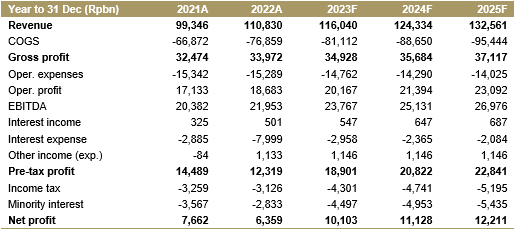

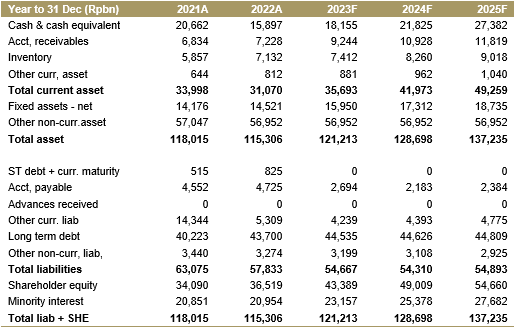

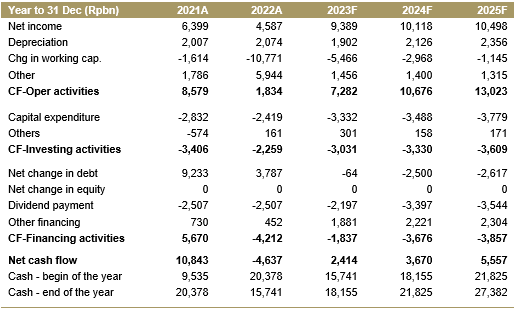

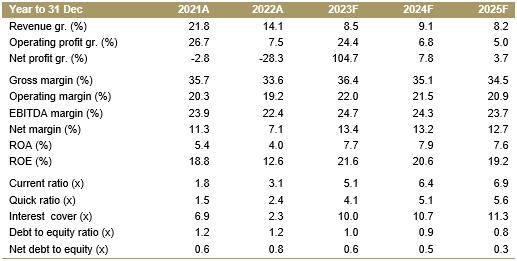

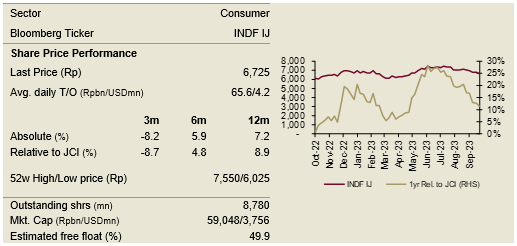

Indofood Sukses Makmur

BUY TP: Rp9,000 (+33.8%)

Company Profile

Founded in 1990, Indofood Sukses Makmur (INDF) is one of the largest food companies in Indonesia that operates through four divisions namely Consumer Branded Products (CBP), Bogasari (flour milling), Agribusiness (Indofood Agri Resources) and Distribution. In 2016, INDF discontinued its Cultivation (Minzhong) operation.

Key Points

• Beneficiary of rosy CBP outlook. We expect solid noodle segment performance will continue, driven by robust domestic consumption due to the election tailwind, ongoing product innovation, and demand from export markets base. ICBP's significant brand power positions it as a price mover as well as enable to maintain sales volume growth, making it least impacted of rising commodity prices. However, we do expect intense competition to potentially pose a risk to dairy sales growth.

• Lower wheat cost shadows Bogasari performance. With wheat prices currently stood at USD5.6/bu, driven by a strong crop in Russia, we expect Bogasari's price cuts will continue in 2H23, considering its cost-plus model. On the positive side, another price reduction from Bogasari could potentially expand margins in the noodle segment.

• Higher CPO inventory halt the price movement. Our plantation analyst expects flat CPO price at MYR4,500/ton in 2023F/2024, factoring in an increase CPO production. Meanwhile, the observations from plantation in East Kalimantan suggest that El nino has been relatively mid as the site has experienced light rainfall on mid-Sept. This could potentially impact Agribusiness segment’s revenue.

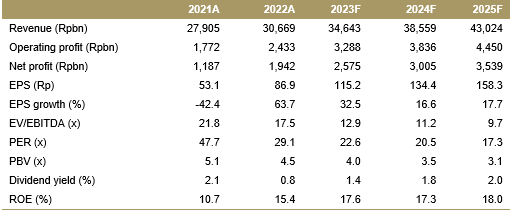

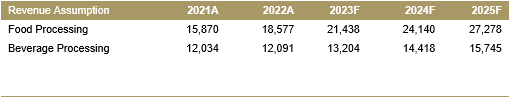

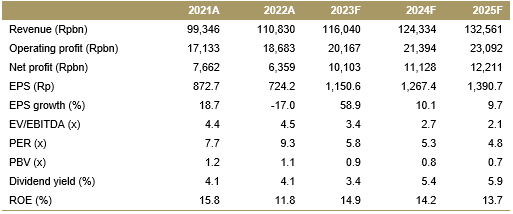

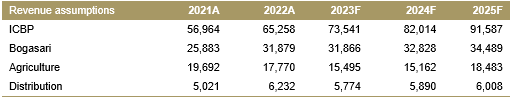

Financial Highlights

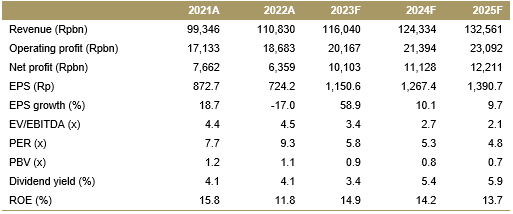

Assumptions

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

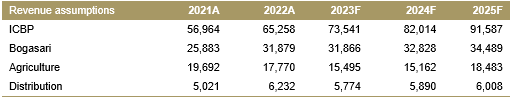

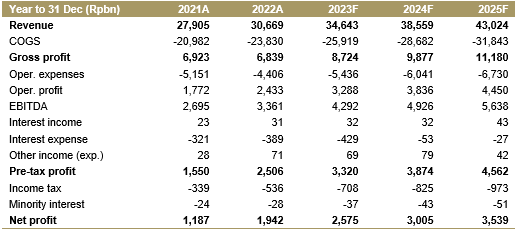

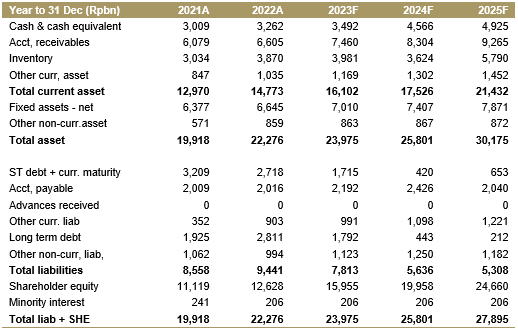

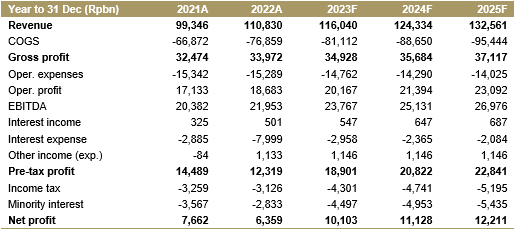

Indofood Sukses Makmur

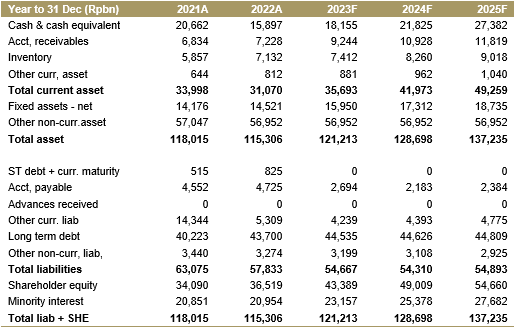

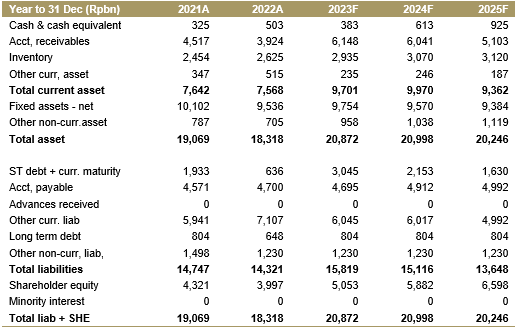

Income Statement

Balance Sheet

Cash Flow

Key Ratios

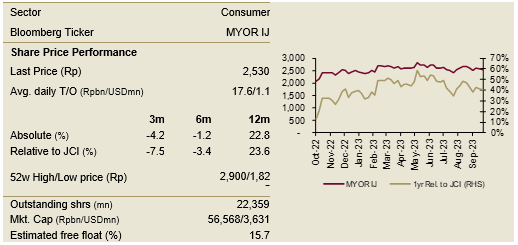

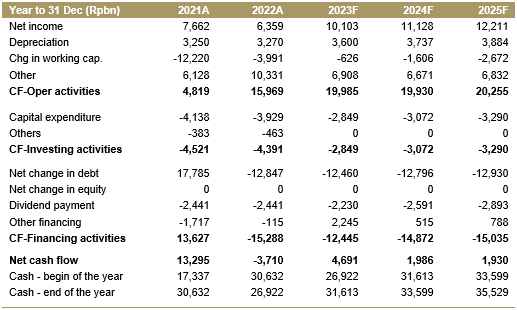

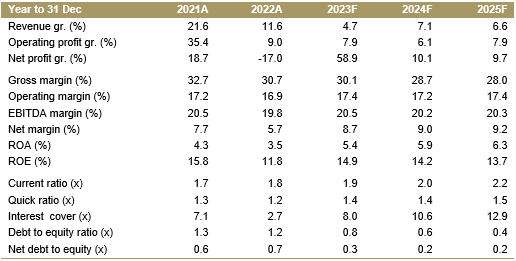

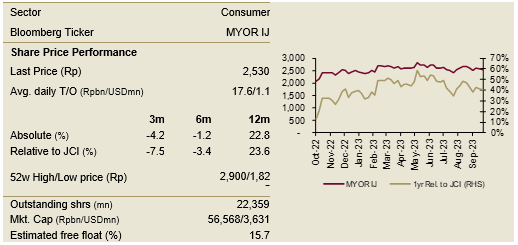

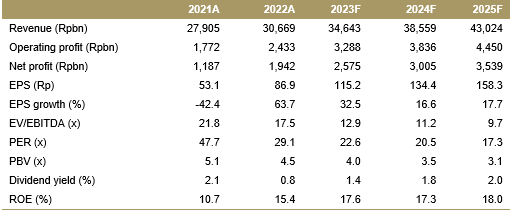

Mayora Indah

BUY TP: Rp3,400 (+34.4%)

Company Profile

Mayora Indah is well-known FMCG company in Indonesia with strong brands marketed in Indonesia and abroad. MYOR product portfolio is balanced between Food which includes Coffee & Cocoa processing deriving (53% of total revenues) and the rest 47% in confectionaries, biscuits, wafer, candy. MYOR exports to ASEAN countries, China, United States, and Middle East accounting to 45% of total revenues, differentiates its competitor.

Key Points

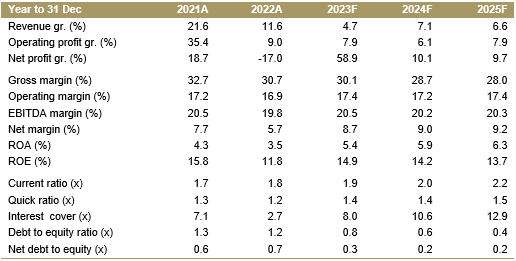

• Prudent and creative marketing strategy. MYOR’s A&P cost to revenue hovered a 9%-11% to total sales in 2023F (vs. 10%-15% in 2018-2022) which allocates selectively towards newly launched and winning product. Moreover, their innovative Korean wave campaign has proven to be fruitful in increasing their presence in local and global markets, further bolstered sales growth.

• Expecting more product innovation with additional capacity. The largest factory, Jayanti 3, has been commissioned in 2H23. This factory will produce the same categories as the existing ones. The initial production capacity to reach c.20%, and it can nearly double the current capacity when its fully operation and should be sufficient to support sales growth and continuous development of new products.

• Continuous efforts to explore potential export market. MYOR has proven track record in overseas market and currently has expanding its regional footprint to Africa and Middle East. The company also plans to introduce daily consumption products in addition its seasonal products.

• Achievable double digit sales growth. We believe MYOR is still on track to deliver solid revenue and earnings in 2023F/2024F, driven by robust domestic consumption- related election, seasonal export sales, possible forex gain due to rupiah depreciation, and less margin pressure.

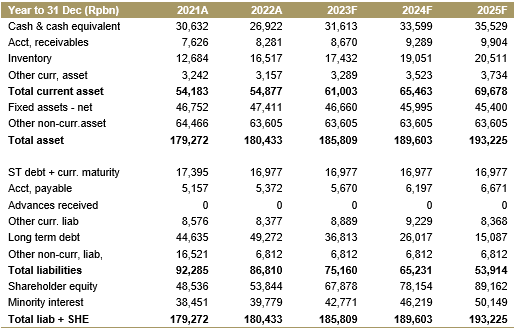

Financial Highlights

Assumptions

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

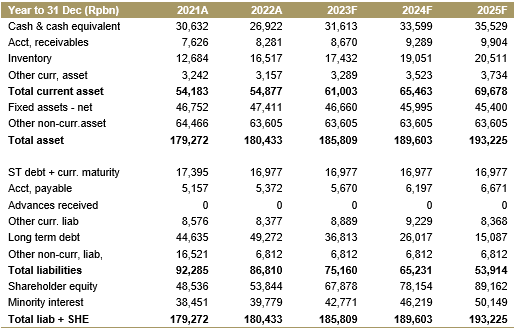

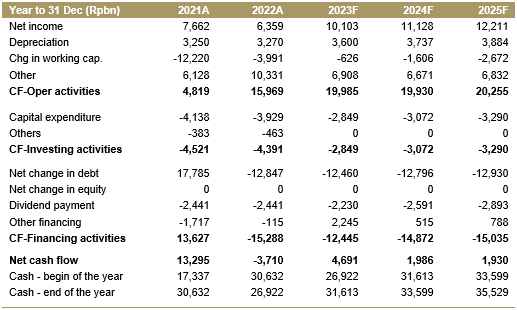

Mayora Indah

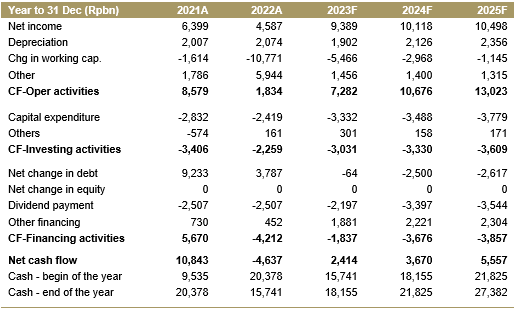

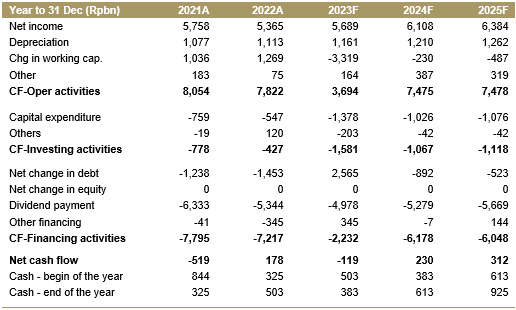

Income Statement

Balance Sheet

Cash Flow

Key Ratios

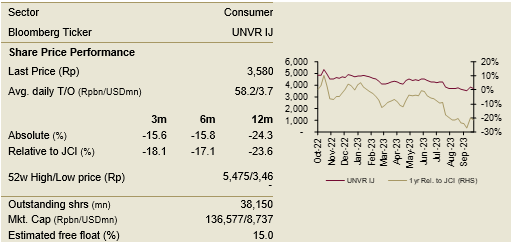

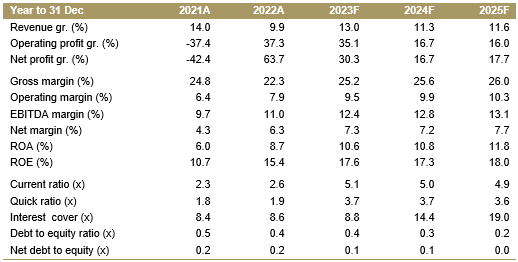

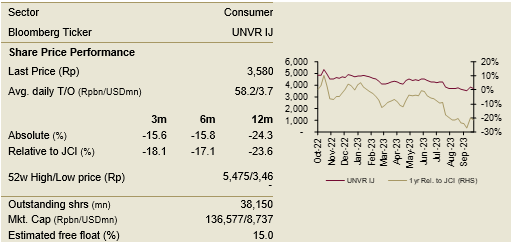

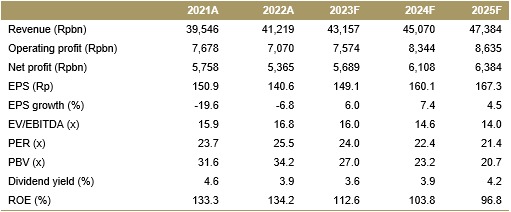

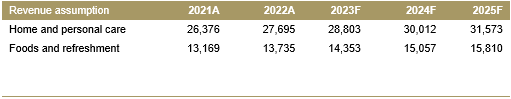

Unilever Indonesia

Hold TP: Rp3,900 (+8.9%)

Company Profile

Unilever Indonesia (UNVR) one of Indonesia’s leading Fast Moving Consumer Goods (FMCG) companies with business in two buckets (1) Food and Refreshment (F&R), (2) Home and Personal Care (HPC). Many of the company’s brands are Indonesian consumers’ first choice for home and personal care products which include Pepsodent, Lux, Lifebuoy, Dove, Sunsilk, Clear, Rexona, Vaseline, Rinso, Molto, Bango, and more

Key Points

• Focus on improving competitiveness. Management’s excellent executions of four strategic priorities and channel transformation have increase its competitiveness in volume share particularly in home care segment. According to Nielsen survey, competitiveness improved to 31.3% in volume (vs.30.8% in 1H22), while value share slightly declined to 37.5% due to price reductions in 1H23. We believe the price reduction in 2H23 onwards will be inevitable taken by company to further gain company’s market shares

• Adopt an agile approach to innovation. In the light of greater opportunities within middle upper class, UNVR has launched several innovative products under premium segment which has performed well with the contribution increased to 27% of domestic sales (vs. <25% in the last year). While, the new value segment products continue received positive traction. UNVR also has plans to strengthen its market development through, i) more users for low-penetration categories, ii) more usage for penetrated categories, iii) more benefits.

• Competition landscape remains fluid. We see the downward trading trend and intensifying competition given difficulties for the company to thrive, despite numerous initiatives executed by management. This resulted in softer revenue growth profile.

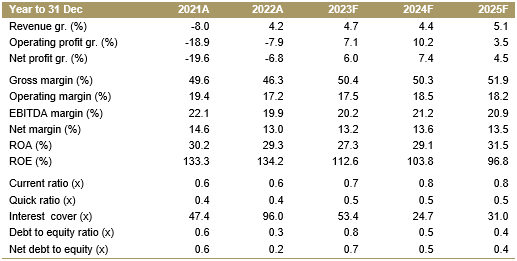

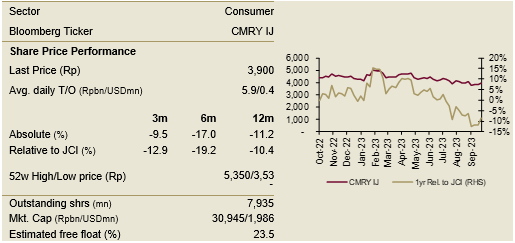

Financial Highlights

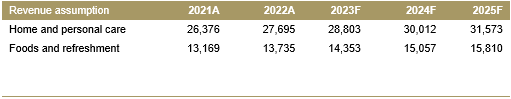

Assumptions

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

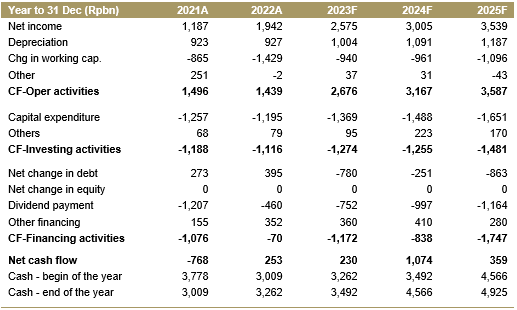

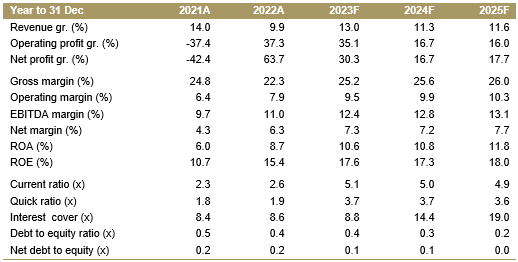

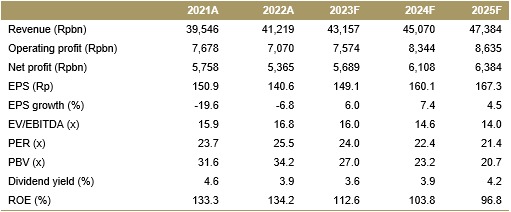

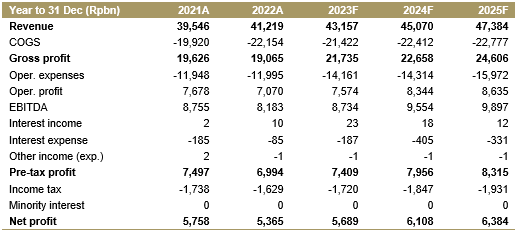

Unilever Indonesia

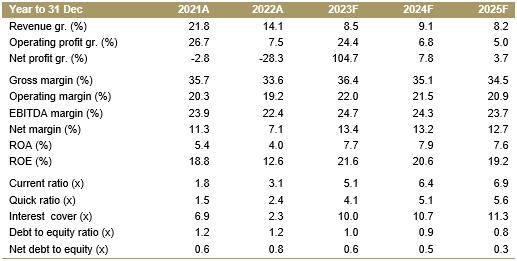

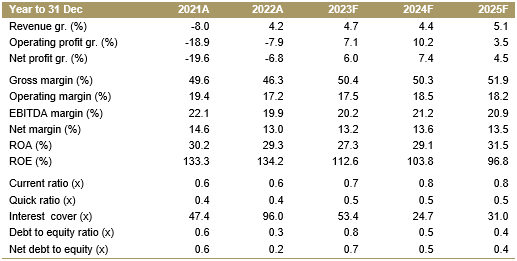

Income Statement

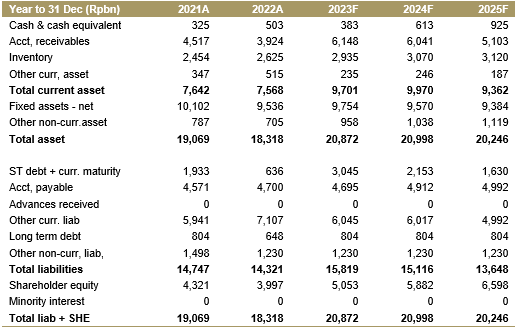

Balance Sheet

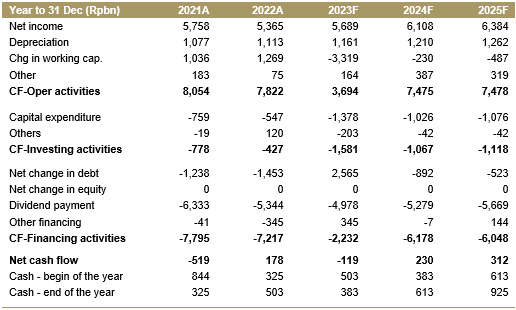

Cash Flow

Key Ratios

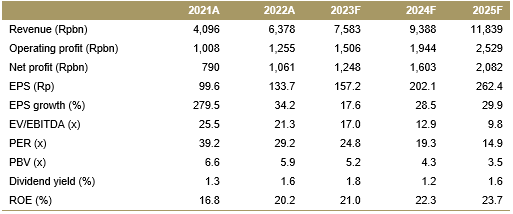

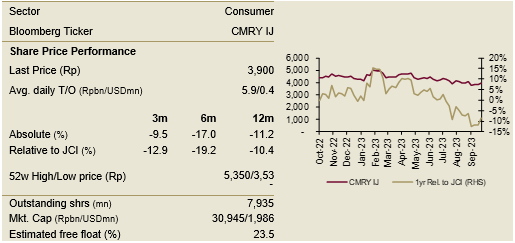

Cisarua Mountain Dairy

BUY TP: Rp5,300 (+35.9%)

Company Profile

Cisarua Mountain Dairy (CMRY) is a leading producer of (1) premium dairy and (2) premium consumer products. CMRY was established in 2003 and was listed in 2021. CMRY has strong track record of delivering product innovation and digital marketing strategy. Their well-known products under “Kanzler” and “Cimory” brands are easily found in Modern Trade channels and general trade channels, as well as through their exclusive direct-to-consumer distribution channel – Miss Cimory (MCM).

Key Points

• Excellent product innovation. CMRY's recent product launches, including RTE sausage and yogurt sticks, have been well received by consumers amid a growing preference for convenience products. The company expects new product launches to contribute approximately 5% to total sales.

• Solid distribution footprint and productivity improvement. CMRY's strategy to capture broader mass market, potential growth and improved productivity seems to be well with accelerated expansion in MCM centers to 229 and GT outlets to 109k in 1H23. Meanwhile, the MT channel has been fully penetrated.

• Capturing consumers’ mindshare through digital A&P. We believe the company’s adoption of digital marketing approach have significant bearing on its positioning in the mind of consumers, especially within its target of audience of millennial. This is evident in the strong demand and growth in both existing and new product category.

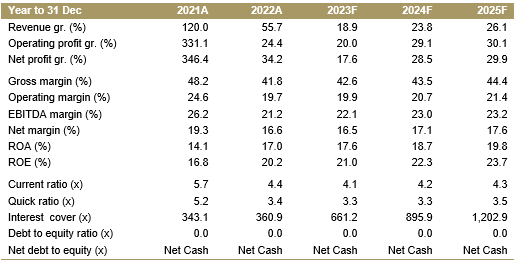

• Growth momentum intact. We expect CMRY could still deliver strong 28.5% EPS growth next year as the company will benefit from growing demand in yogurt and consumer foods categories, its resilient of consumer buying power, and higher distribution penetration.

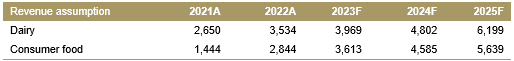

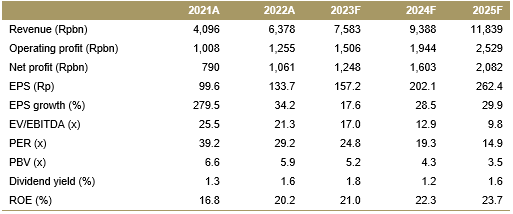

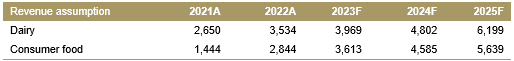

Financial Highlights

Assumptions

Putu Chantika Putri +62 21 2557 4800 ext. 740 putriputu@ciptadana.com

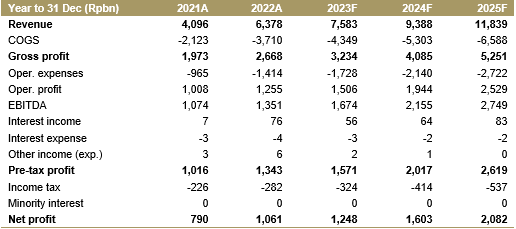

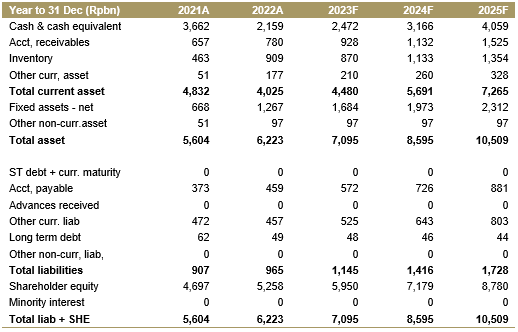

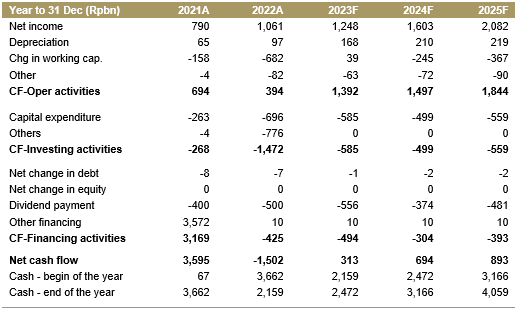

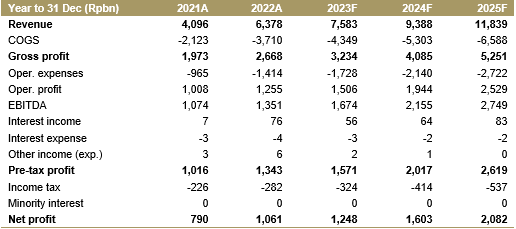

Cisarua Mountain Dairy

Income Statement

Balance Sheet

Cash Flow

Key Ratios