Coal Neutral

Thermal coal

• Coal price volatility to end, following China’s economic recovery

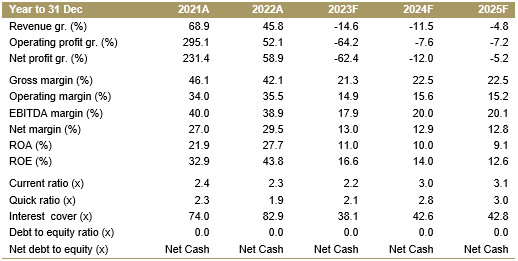

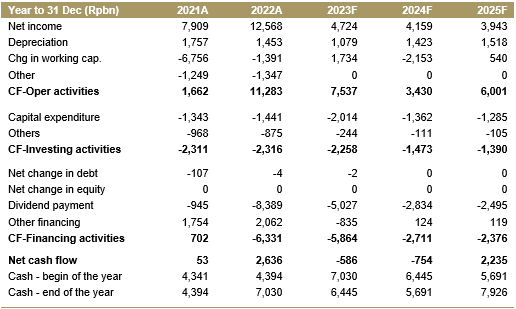

Thermal coal prices have disappointed investors so far this year, falling steadily before settling. At the time of writing, the benchmark Newcastle thermal coal price was down 65.6% YTD to USD 139.0/ton. The price correction can be attributed to increased coal supply from major producing countries such as Indonesia, China and India outpacing robust demand from China. However, in our view, the coal price volatility should end from 2Q23 as we have seen strong thermal coal imports from China in 8M23, with 44.3 million tons of thermal coal imported in August alone (+50.5% YoY). Nevertheless, we expect China's economic activity to improve steadily, leading to stronger power demand in the second half of the year, which will support coal prices.

Exhibit 98: Newcastle coal price

Source: Bloomberg

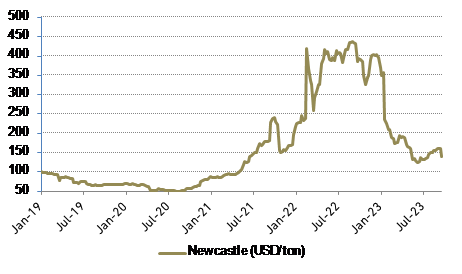

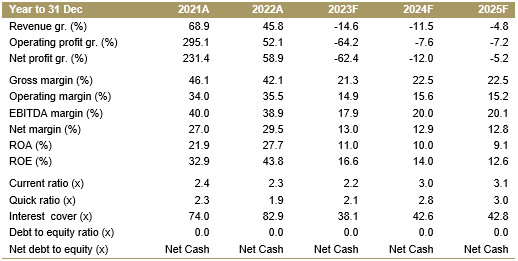

• China August coal import numbers still strong

Based on data from the China National Bureau of Statistics (NBS), coal imports in August reached 44.3 mn tons, marking a significant YoY increase of 50.5%. The cumulative imports for the first 8 months of 2023 amounted to 310 mn tons, reflecting a YoY growth of 82.0%. While we anticipate marginal growth for the remaining 2H23, our estimates suggest that coal imports will continue to exhibit strength throughout the remainder of the year.

Exhibit 99: Coal China August 2023 coal import

Source: China bureau of statistic

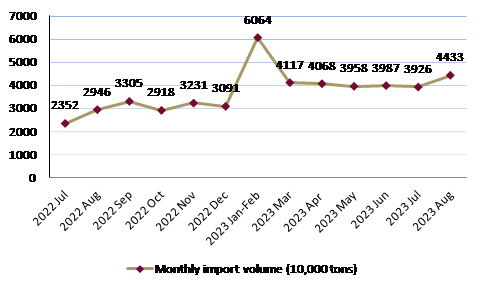

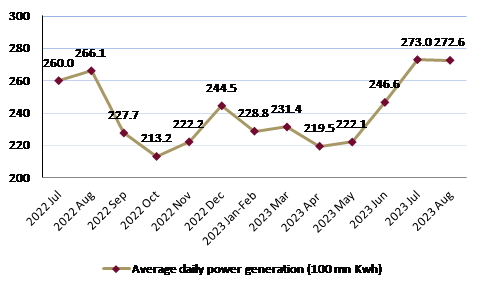

• China power generation growing steadily in 8M23

In July, the power generation for industrial usage is still robust, an increase of 1.1% YoY or -2.5% MoM to 845.0 billion kWh with an average daily power generation of 27.26 bn kWh. From January to August, the total power generation for the country was around 5.86 trillion kWh, up by 3.% YoY. We believe that China’s economic activity is likely to steadily improve which should translate into stronger power demand for the rest of the year, and likely to support seaborne thermal coal demand.

Exhibit 100: China industrial power generation

Source: China bureau of statistic

• India coal demand remains robust in 2H23 and in the long run

In the 1H23, India's domestic power demand surged by around 5%, continuing a longstanding growth trend in electricity consumption driven by an expanding power grid. Although heavy rains briefly tempered this growth, electricity demand is expected to accelerate further in the future. Moreover India’s power grid and infrastructure is renowned to be very unreliable further slowing down its transition to green energy, extending coal power usage in the long run.

• India sets an ambitious 1017 mn tons coal production in 2023

For the fiscal year 2023-24, the Indian government has set a target of achieving coal production totaling 1017 mn ton. To bolster domestic coal production, the government has undertaken initiatives involving Mining Developers cum Operators (MDOs). Here are the key steps in this endeavor:

1. Coal India Limited (CIL) has identified a portfolio of 15 projects with a combined project rated capacity of 168.58 mn tons for implementation through the MDO mode. Among these 15 projects, Letters of Award (LoA) have already been issued for nine projects with a cumulative capacity of 126.74 MTY.

2. NLC India Limited (NLCIL) is actively engaged in the execution of two MDO projects, with a combined capacity of 29 mn tons.

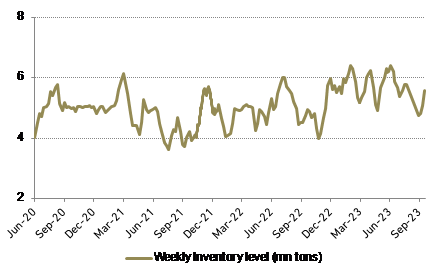

• Coal market to move into a surplus in 2023 and 2024

China is set to increase its coal supply by approximately 4% and another 3% in FY23-24F, reaching a volume of around 3.8 bn tons and 3.9 bn tons, respectively. This surge in production is a direct response to the urgent request from local authorities, who aim to prevent a repeat of the energy crisis witnessed in 2022. The crisis led to a significant build-up of coal inventory at the Qinhuangdao port, which has continued to grow steadily, reaching its highest point in June at 640 mn tons. Further compounded by a projected 5% and 14% increase in Indonesian and India coal production totaling 695 mn tons and 1017 mn tons respectively, we anticipate the coal market to shift from a deficit in FY22 to a surplus in FY23F and FY24F, as supply will slightly outpace the robust demand from China and India. As such we anticipate the coal market to shift from a deficit in FY22 to a surplus in FY23F and FY24F maintaining our coal benchmark price estimates for FY23-25F at USD170/ton, USD130/ton and USD110/ton.

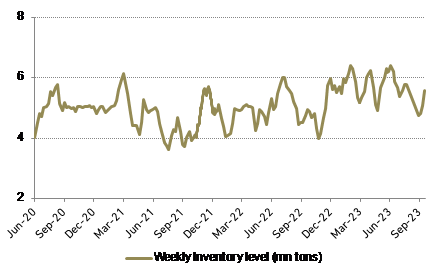

Exhibit 101: Qinhungdao port coal inventory

Source: Bloomberg

Metallurgical coal

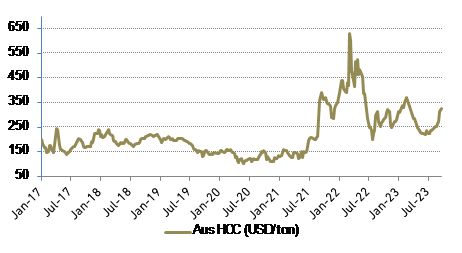

• Metcoal to face further pressure in the long term

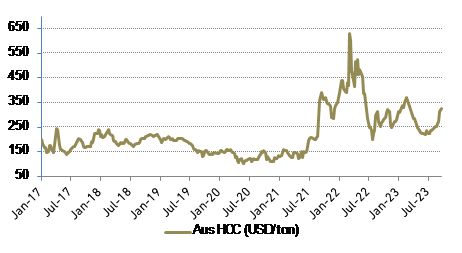

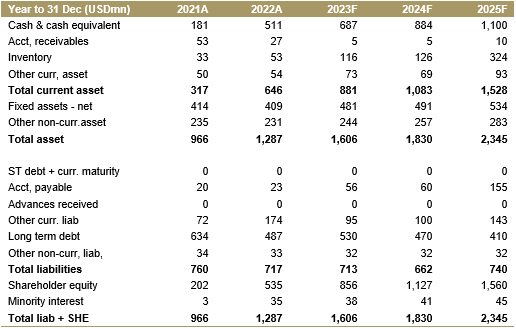

Metallurgical coal prices are still relatively volatile, with prices falling in recent quarters due to increased Australian supply, weaker global steelmaking demand, and limited post-COVID demand from China. Looking ahead, predicting Chinese demand comes with equal risks on both sides. There's a chance that China might move to restock due to low inventories, but potential mandatory cuts in steel output could exert downward pressure on prices. Indian demand is projected to remain robust unless prices surge rapidly. The monsoon season in India could coincide with a swift replenishment of coal supplies, and a growing real estate market in South Asia might further boost regional steel demand, potentially driving prices higher. On the supply side, Global supply remains slightly short due to the absence of Russian output. With that in mind we expect met coal price to still be above the USD200/ ton mark for the next two year, setting our price benchmark at USD230/ton in FY23F and USD210/ton in FY24F.

Exhibit 102: Australian high coking coal

Source: Bloomberg

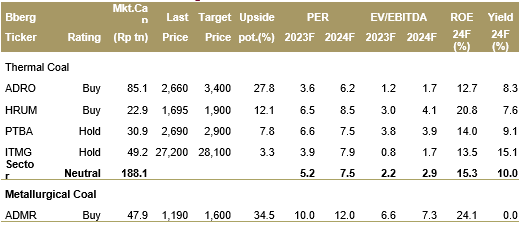

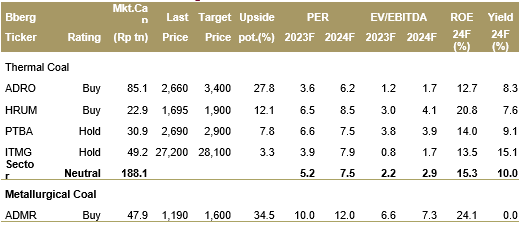

• Maintain Neutral rating with ADRO as our top pick

We believe that the ongoing high coal price environment should allow miners to generate robust cash flows over the next 1-2 years. As such, most coal miners such as PTBA (9.1%), ITMG (15.1%) and ADRO (8.3%) would still be able to generate attractive dividend yields in FY24F. Although we believe that coal price volatility has eased significantly in the past quarter, we still believe that coal prices are in a declining trend and will continue to do so in the long term, albeit at a much slower pace. We therefore maintain our Neutral rating on the sector, with ADRO (Buy, TP: Rp3,400) as our top pick.

Exhibit 103: Coal stocks rating and valuation

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

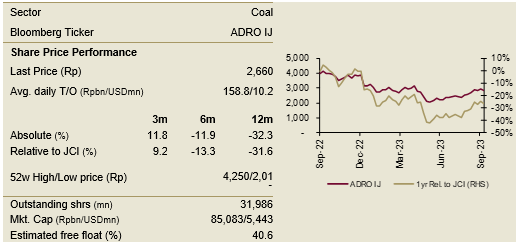

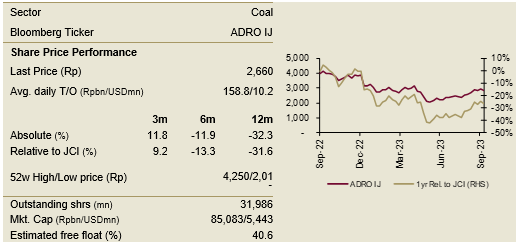

Adaro Energy

BUY TP: Rp3,400 (+27.8%)

Company Profile

ADRO is one of Indonesian largest integrated thermal and metallurgical coal mining through its subsidiaries. Its business activities include mining, barging, ship loading, dredging, port services, marketing and power generation. The company’s major mine site is located at Tabalong district, South Kalimantan province. The company is also making great strides to move away from its core coal business and venturing into energy business.

Key Points

• Moving away from coal. Expanding its portfolio beyond coal, the corporation is presently in the process of diversifying into the aluminum sector. This strategic move involves a substantial investment of USD 728 mn through Adaro Aluminium Indonesia, which is located within the emerging eco-friendly industrial hub, Kalimantan Industrial Park Indonesia (KIPI). Furthermore, the firm has ambitious plans for the future, aiming to potentially develop a total capacity of 12 GW in hydroelectric power and 5 GW in solar photovoltaic power within both KIPI and Kawasan Industri Kalimantan Indonesia (KIKI).

• Proxy to coking coal. ADRO stands to benefit immensely from its exposure to coking coal through its subsidiary ADMR, which plans to increase its coking coal production to 4.3 million tons and 4.5 million tons in FY23F/FY24F, respectively. Currently, prices are very favorable, averaging USD230/ton in FY23F, with cash costs around USD95/ton.

• Retain BUY rating with TP of Rp3,400/share. We maintained our BUY rating ADRO on the back of an 27.8% upside potential from current share price. Our TP of Rp3,400 is based on FY24F P/E target of 8.0x. We select ADRO as one of our top picks on coal sector, with the company having ample reserve life, diverse portfolio, an integrated mining system and an attractive FY24F dividend yield of 8.3%.

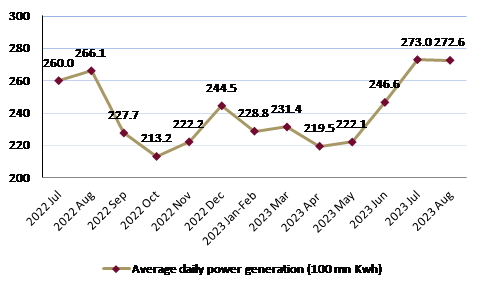

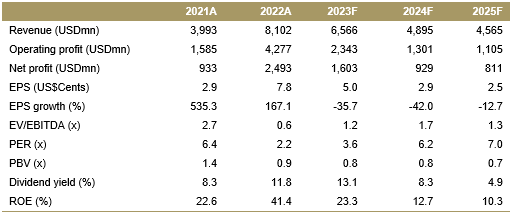

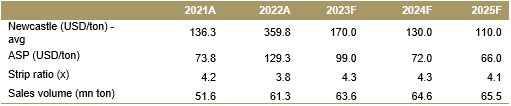

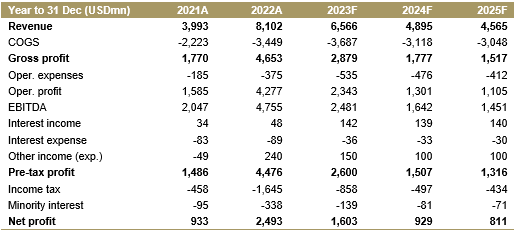

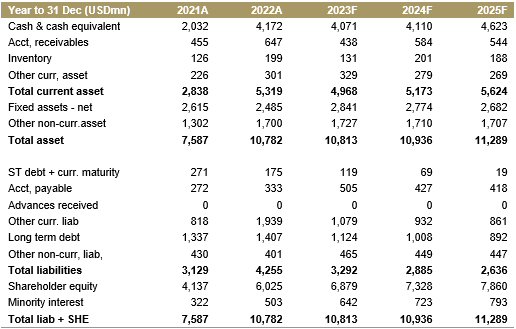

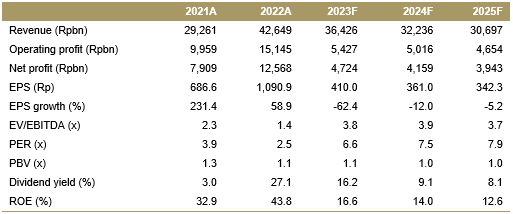

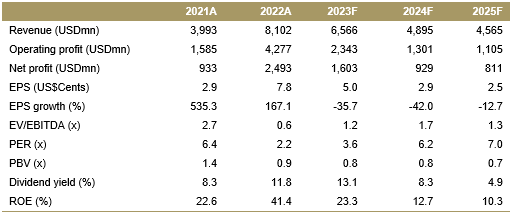

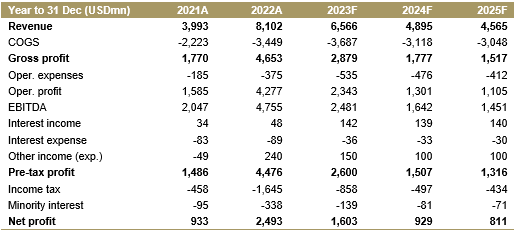

Financial Highlights

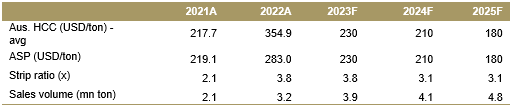

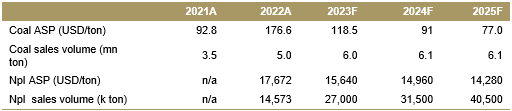

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

Adaro Energy

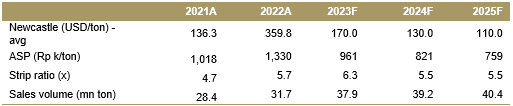

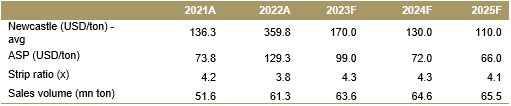

Income Statement

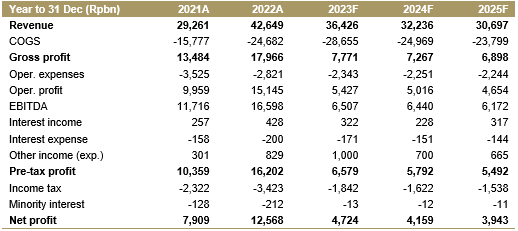

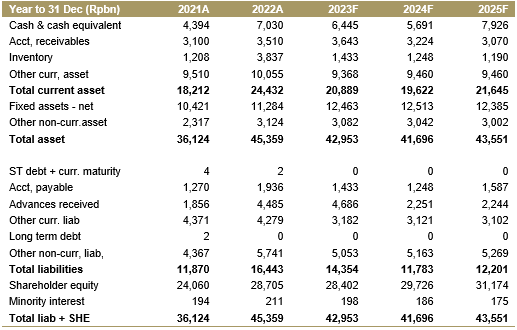

Balance Sheet

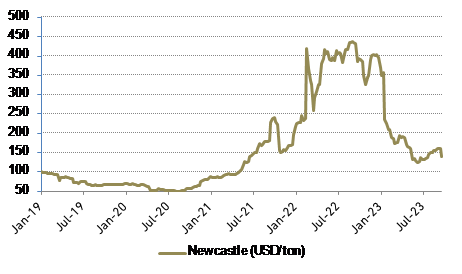

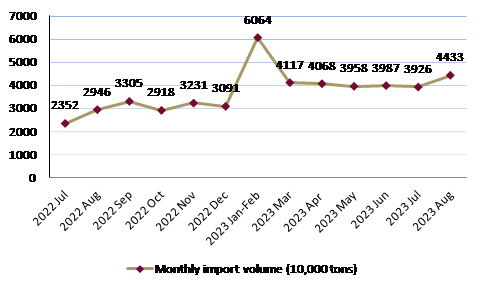

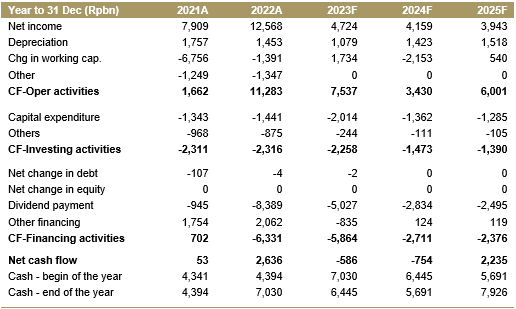

Cash Flow

Key Ratios

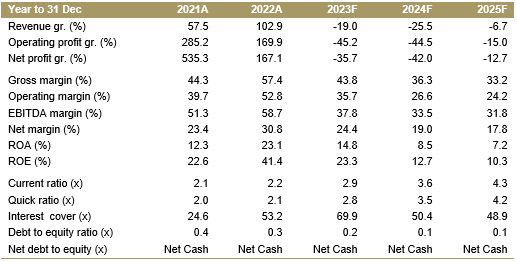

Adaro Minerals Indonesia

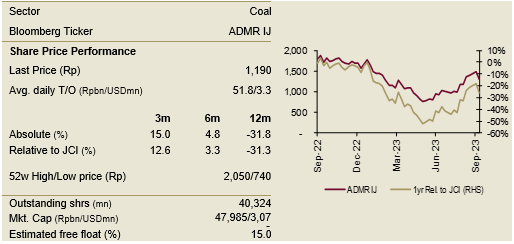

BUY TP: Rp1,600 (+34.5%)

Company Profile

Adaro Minerals Indonesia is a subsidiary of Adaro Energy (ADRO) that engages in metallurgical coal mining (met coal). The company has 5 CCOWs mining concessions located in East Kalimantan and Central Kalimantan with a total area of up to 146,579 ha. The company also plans to produces aluminium in the future.

Key Points

• Expecting greater production numbers in the medium term and low strip ratio. ADMR is focusing its development of its MC and SBC concession while doing exploration activities for its KC dan JC concession. Management has provided a medium-term guidance of 6 mn tons of coal production. Aligning with the management guidance, we expect the company to gradually improve their production rate to 6 mn tons by 2027, with a low life-of-mine strip ratio at around 3.1x.

• Slated to be one the biggest aluminum producers in the country ADMR through Adaro Aluminium Indonesia, has signed a letter of intent to carry out the Green Aluminium (GA) project located in Kaltara Industrial Park with an initial investment of USD728 mn and operational activities starting early 2025, producing an initial output of 500 k tons generating revenue of around USD962.5 mn in FY25. We estimate that progressively over the next 10 years after 2025, production capacity will gradually improve to around 1.5 mn tons.

• Retain BUY rating with TP of Rp1,600/share We maintained our BUY rating ADMR on the back of an 34.5% upside potential from current share price. Possible downside risk to our call is 1) met coal and aluminium price volatility 2) delay on Aluminium project 3) changes in government regulations and 4) higher-than-expected Aluminium project cash cost.

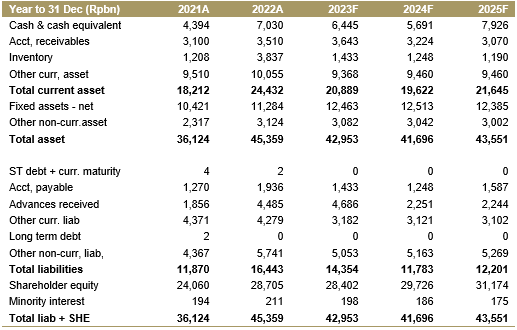

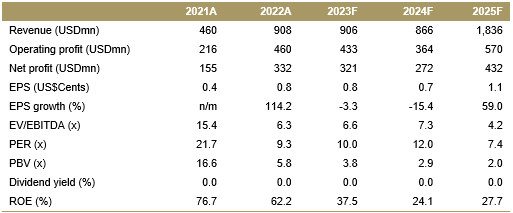

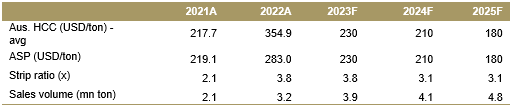

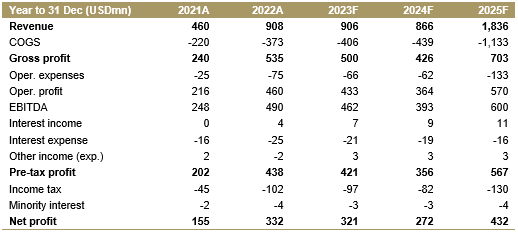

Financial Highlights

Assumptions

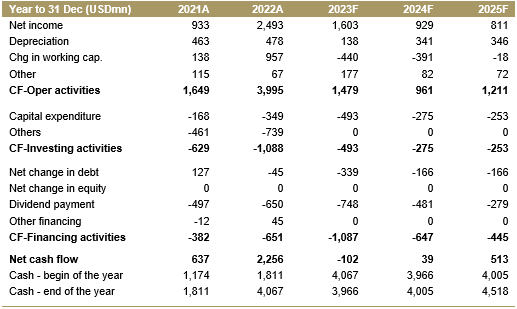

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

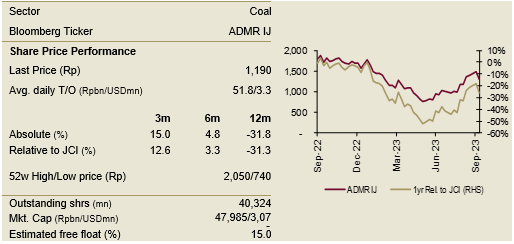

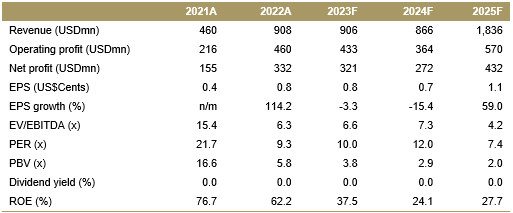

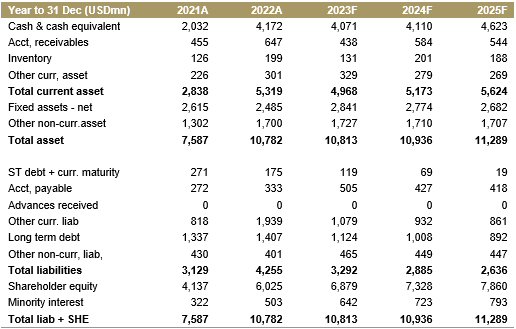

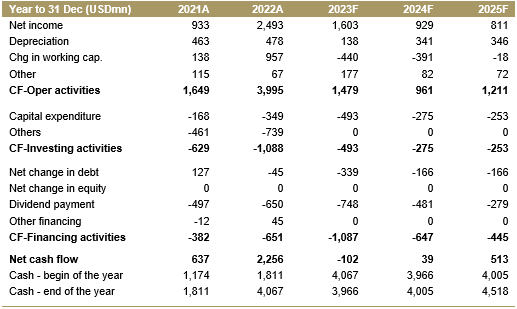

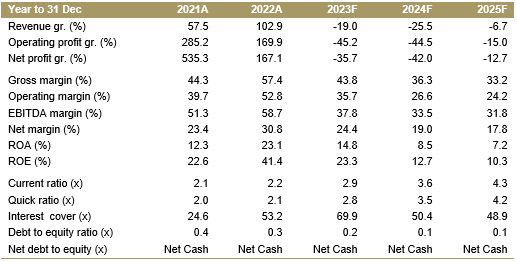

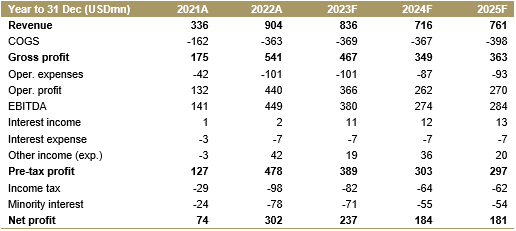

Adaro Minerals Indonesia

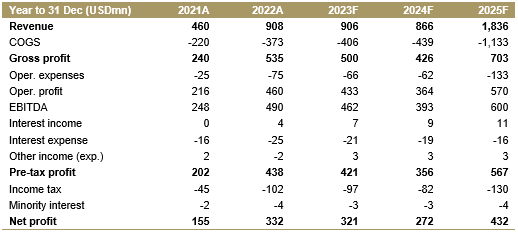

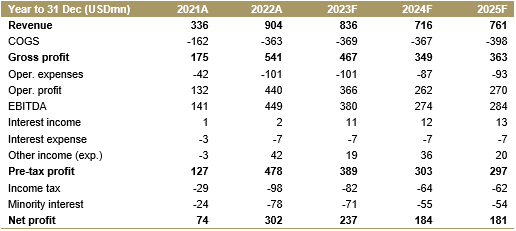

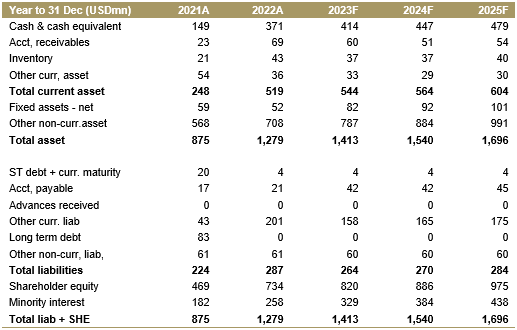

Income Statement

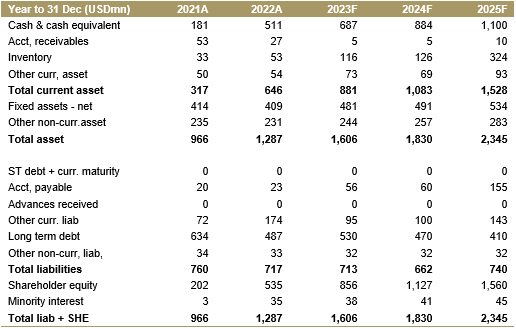

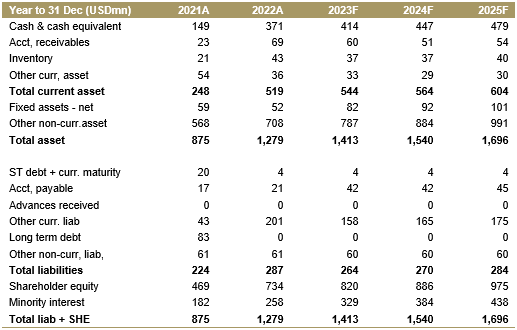

Balance Sheet

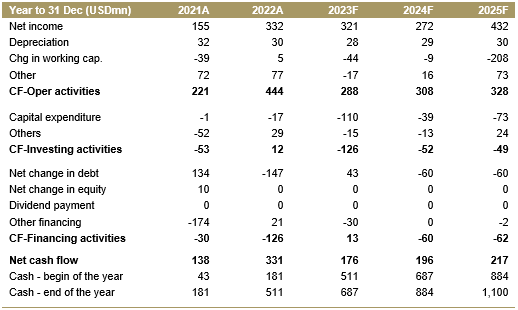

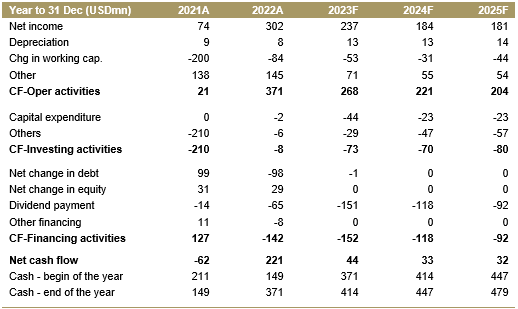

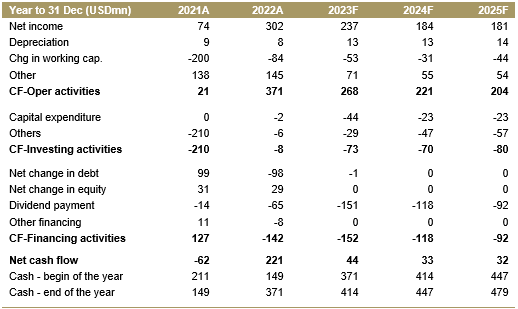

Cash Flow

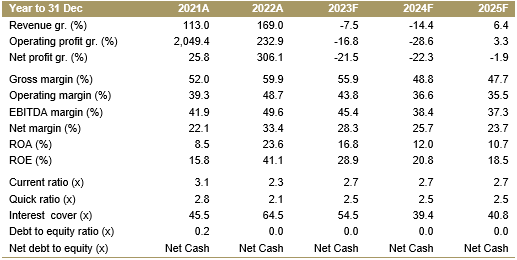

Key Ratios

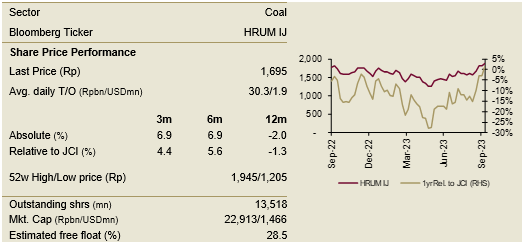

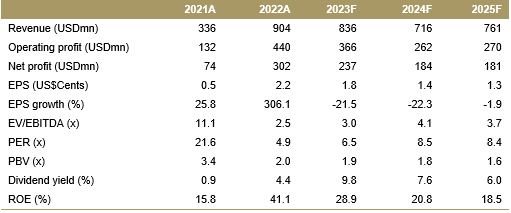

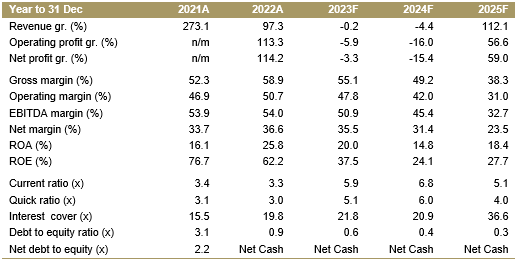

Harum

BUY TP: Rp1,900 (+12.1%)

Company Profile

Harum Energy (HRUM) is an Indonesia-based holding company which owns several subsidiaries engaged in coal and nickel mining and logistic activities. It operates a vertically integrated supply chain linking from its mine-sites to the offshore ship loading. The company owns its infrastructure, such as hauling roads, ports, coal and nickel processing plants, fleet of tugboats and barges and has preferential access to floating cranes.

Key Points

• Nickel Segment to play a bigger part in FY24F onwards. The company purchased equity stakes in several nickel mining companies; including 51% of Infei Metal Industry (IMI) and 51% of Position (POS). With that in mind, the companies nickel segment is slated to contribute heavily to the company’s bottom-line FY24 onward. We expect nickel segment to contribute USD50.7 mn (28%) in FY24F and USD85.5 mn (47%) in FY25F.

• HRUM to invest USD500 mn in HPAL plant. The company and its subsidiary Tanito Harum Nickel (THN) have provided a loan of USD500 mn to Blue Sparking Energy (BSE). This loan will be used for the development of a high-pressure acid leaching project at BSE, including refinancing existing debt and general corporate purposes. The project is designed to produce nickel-cobalt hydroxide intermediate products, with an annual installed capacity of approximately 67,000 mtons of nickel equivalent and about 7,500 mtons of cobalt, including its supporting facilities and infrastructure. We have not received any definitive timeline for the project and included the project into our valuation

• Maintain BUY rating with TP of Rp1,900/share. We retain our BUY rating for HRUM as our TP offers 12.1% upside potential.

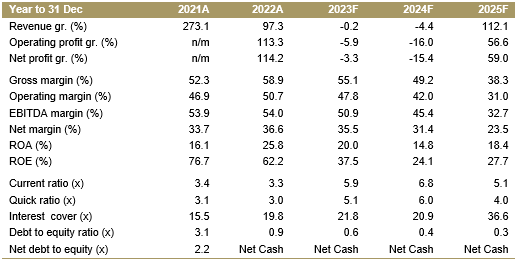

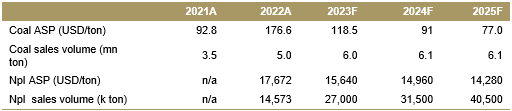

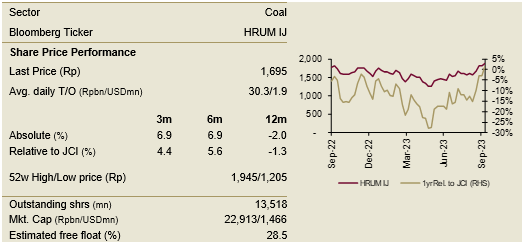

Financial Highlights

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

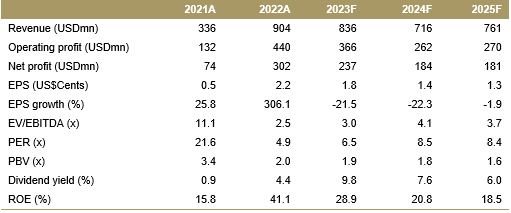

Harum Energy

Income Statement

Balance Sheet

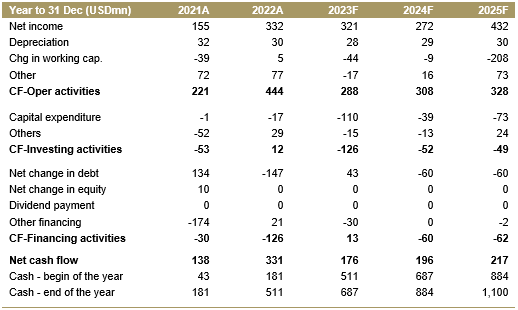

Cash Flow

Key Ratios

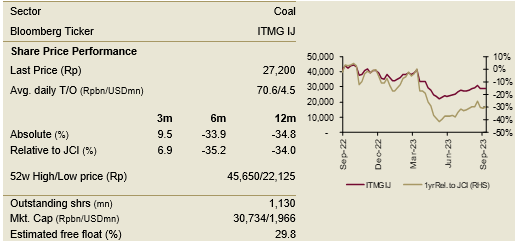

Indo Tambangraya

Hold TP: Rp28,100 (+3.3%)

Company Profile

ITMG is one of leading coal mining companies in Indonesia. The company operates several mining concessions in Kalimantan Island. Through its subsidiary, the company also operates a coal terminal and power plant in East Kalimantan. ITMG is majority owned by Thailand-based company, Banpu.

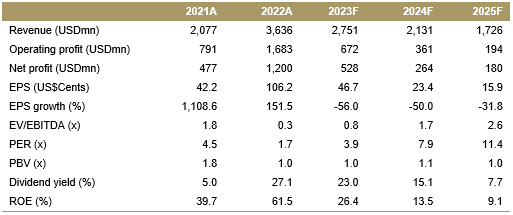

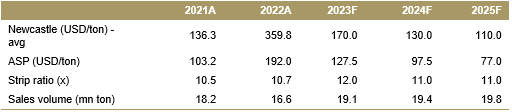

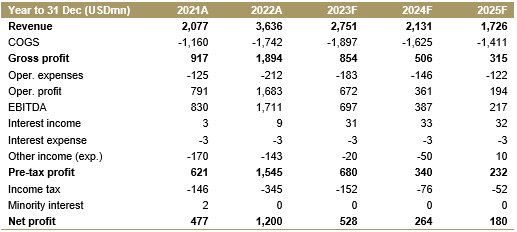

Key Points

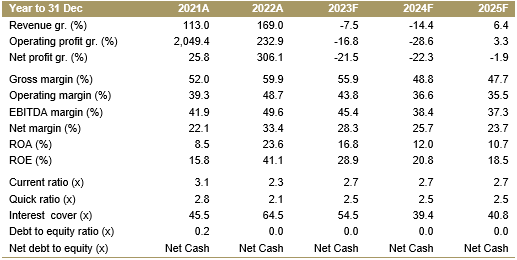

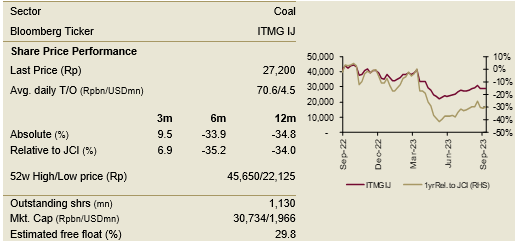

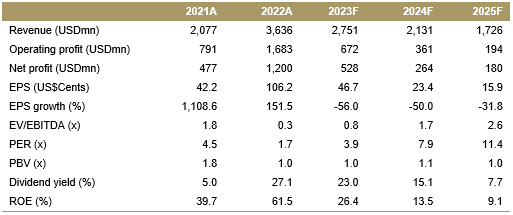

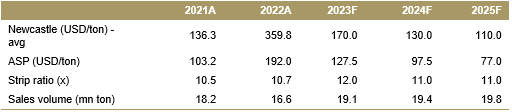

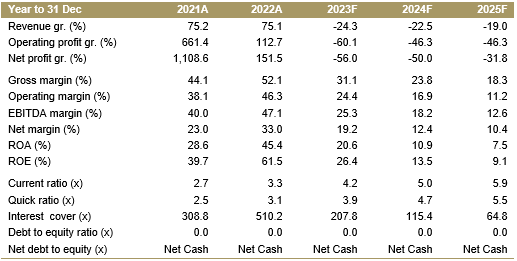

• Still generating strong profitability amidst declining coal price. In the midst of declining coal price environment, averaging USD187.6/ton Ytd. The company stands to still benefit massively from this predicament, with estimated FY23-24F earnings of USD528 mn and USD264 mn, respectively.

• High dividend payout policy to remain. In our view ITMG’s high dividend pay-out policy will most likely remain. Given, the historically high pay-out ratio and strong cash level, this should translate to an attractive FY24-25 pay-out based on a still strong 2023 and 2024 earnings performance. Translating to an attractive FY24-25F dividend yield of 15.1% and 7.7%, respectively.

• Maintain our HOLD rating at Rp28,100 per share. We maintain our HOLD rating as our TP only offers a 3.3% upside potential. We continue to like ITMG, as the company continues to maintain its high DPO rate and possesses a positive earnings outlook. Downside risk to our call would be: 1) coal price volatility 2) disruption on its productivity 3) lower than expected DPO rate and 4) regulatory changes.

Financial Highlights

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

Indo Tambangraya

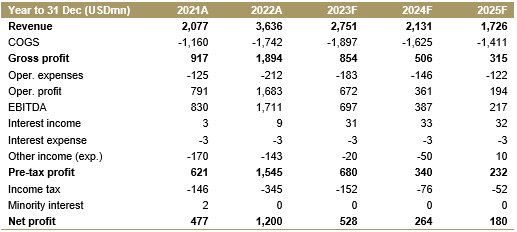

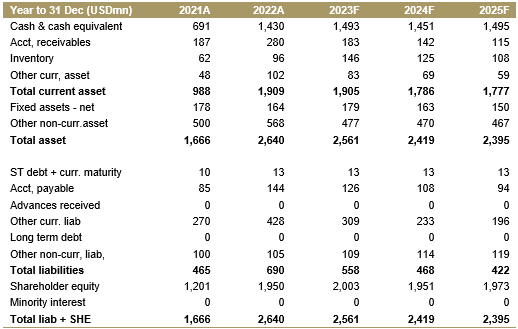

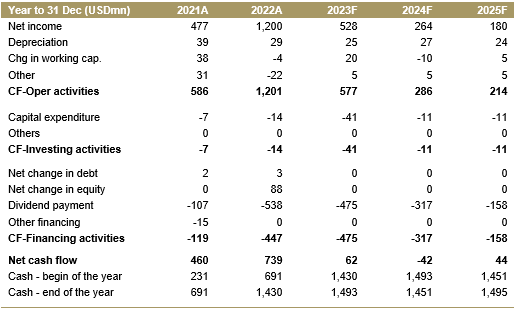

Income Statement

Balance Sheet

Cash Flow

Key Ratios

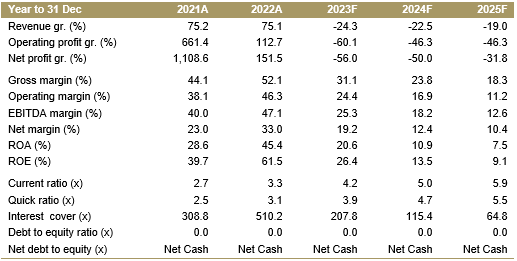

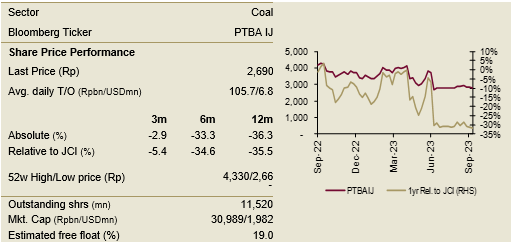

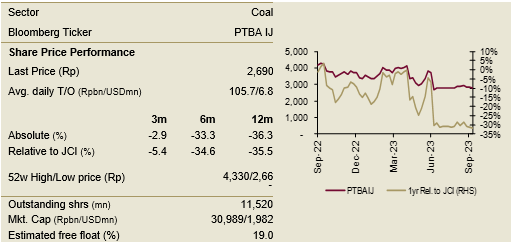

Bukit Asam

HOLD TP: Rp2,900 (+7.8%)

Company Profile

PTBA is a state-owned coal mining company with 1.99 bn tons of reserves. Its business activities include conducting coal mining operation, coal trading, coal-based power generation, and investment business. Its main coal-mining concession is located in Tanjung Enim, South Sumatra. It is a state-owned company, with the government as its major shareholder.

Key Points

• New dividend player on the market PTBA distributed dividends of Rp 12.57 tn or equivalent to 99% dividend payout rate or Rp1,094/share last June 2023. Though it would be hard to repeat the feat in 2024 we still expect the company’s high dividend pay-out policy (around 60%,) will most likely remain. This should translate to an attractive FY24-25 pay-out based on a still strong 2023 and 2024 earnings performance. Translating to an attractive FY24-25F dividend yield of 9.1% and 8.1%, respectively.

• Moving into the energy sector Expanding its portfolio, the company is presently in the process of diversifying into the energy sector. With the Sumsel 8 coal power plant starting operational activitiew September 2023, Pelabuhan Ratu coal power plant acquisition on the way and numerous solar projects. The company is starting to venture away from coal and into the energy business

• Retain Hold rating at TP of Rp2,900/share. We maintain our Hold rating for PTBA as our TP offers a 7.8% upside from current share price. Our TP of Rp2,900 is based on FY23F P/E target of 8.0x. We continue to like PTBA, as the company holds ample reserve life, diverse portfolio, an integrated mining system and an attractive FY24F dividend yield of 9.1%.

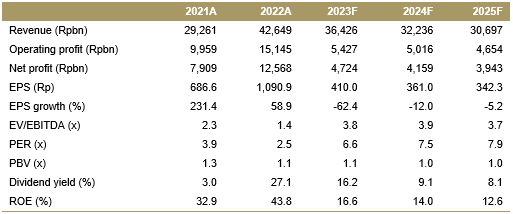

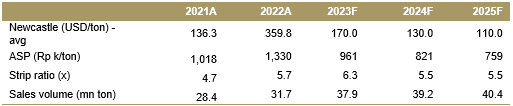

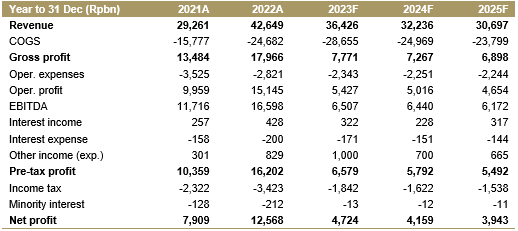

Financial Highlights

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

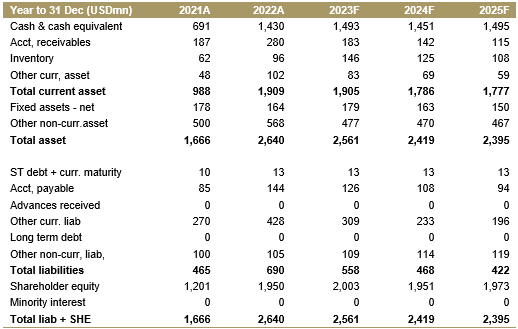

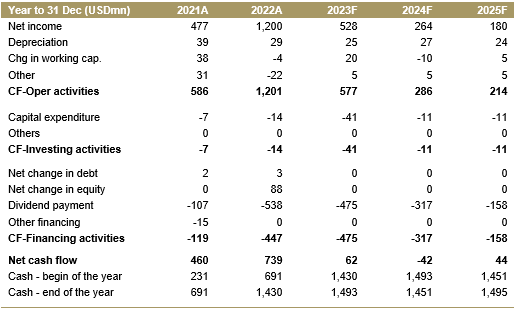

Bukit Asam

Income Statement

Balance Sheet

Cash Flow

Key Ratios