Metal Mining

Overweight

Sector Outlook

• Nickel market to move into a surplus in the next two years

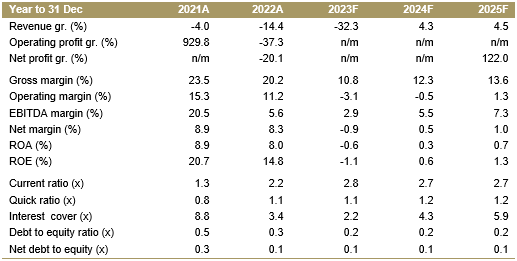

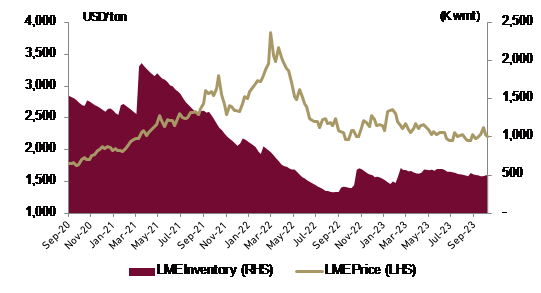

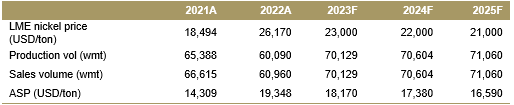

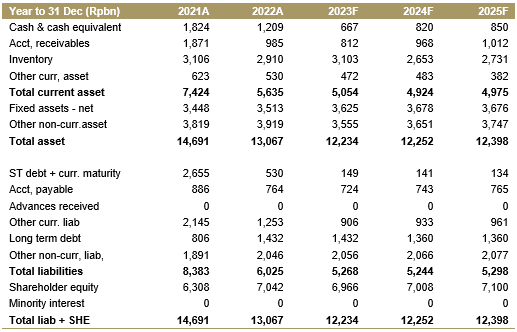

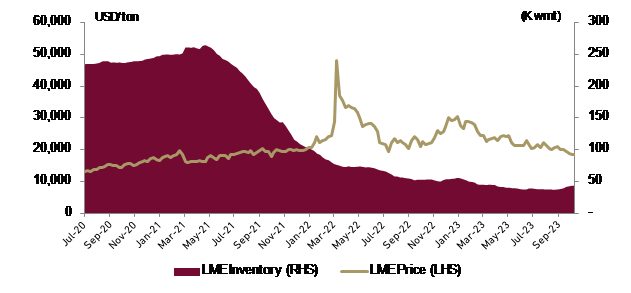

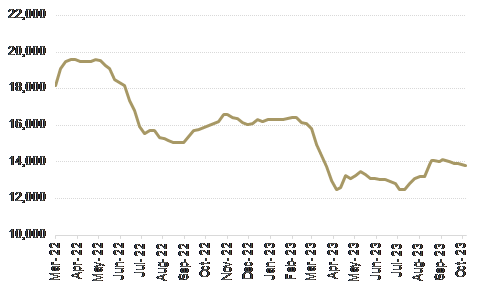

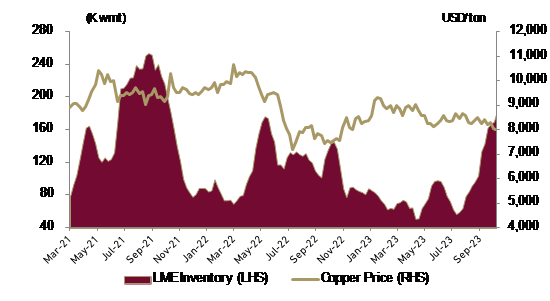

London Metal Exchange (LME) Nickel prices have steadily declined by 39.6% Ytd to USD18,450/ton, whilst China NpI prices have also declined 14.9% Ytd to USD13,830/ton. The price correction is driven by the abundance Indonesian and Chinese class II nickel products, outpacing strong Chinese demand for stainless steel and electric vehicles (EVs). For FY24-25F we still expect the nickel market to still be in the surplus, which typically leads to a decline in nickel prices. However we still anticipate LME prices to remain above USD20,000/ton, primarily driven by the continued tightness of the class I nickel market. As indicated by the still critically low inventory from LME warehouses, which has declined 22.3% to 43,086 ton year to date. Considering these factors, we have maintained our FY23-25F nickel benchmark at USD23,000, USD22,000, and USD21,000.

Exhibit 88: LME Nickel price and inventory

Source: Bloomberg

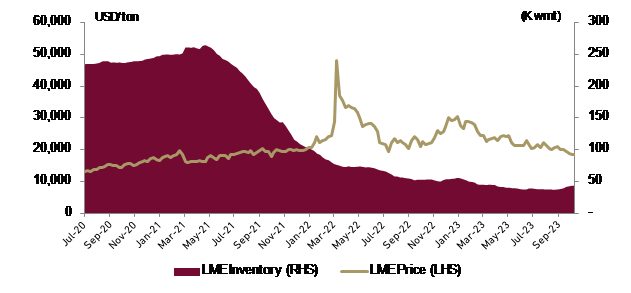

Exhibit 89: China NpI price

Source: Bloomberg

• Global nickel demand still slated to grow despite slowing China economy

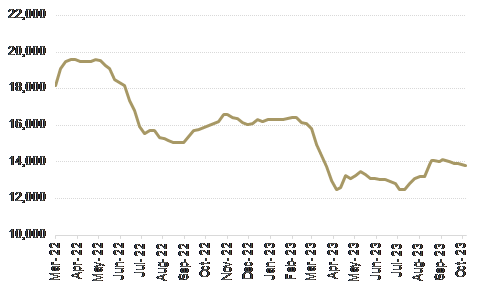

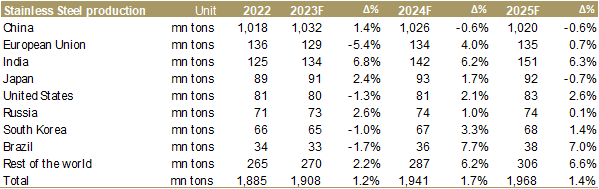

Global refined nickel consumption is slated to grow by 3.2% YoY in FY23F, according to According to the Department of Industry, Science, and Resources of Australia. The driving force behind this was primarily due to the remarkable resurgence in nickel utilization within China, where consumption experienced a remarkable 12% YoY surge in 1H23, primarily fueled by China's stimulus measures. Despite slower than expected China's economic recovery, several factors still played a role in the substantial rise in nickel consumption. Notably, there was an increase in China stainless steel production, which is projected to grow by 1.4% YoY in FY23F. Additionally, the electric vehicle sector in China witnessed significant growth, with sales skyrocketing by more than 30% during the same period.

Exhibit 90: Global stainless steel production

Source: Department of Industry, Science, and Resources of Australia

In contrast, other major stainless steel producing regions such as European Union, United States, and Brazil encountered challenges in their production, leading to projected reductions in FY23F. This decrease in production can be attributed to the broader global trade environment's weakening throughout FY23F, which resulted in a deceleration of manufacturing activities in major industrial economies and stagnant conditions in crucial construction markets, particularly in Europe.

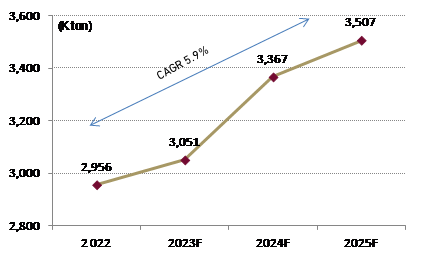

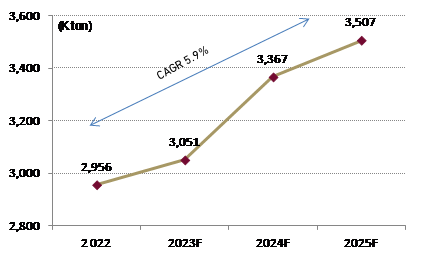

Looking ahead, we estimated that refined nickel consumption is poised to continue its upward trajectory, with an estimated reach of 3.5 mn tons by the year 2025. This expansion is expected to be characterized by a CAGR of 5.9% YoY. The driving force behind this surge in demand is anticipated to be the increasing production of Electric vehicle and stainless steel production from India plus emerging South East Asian countries

Exhibit 91: Global refined nickel consumption

Source: Department of Industry, Science, and Resources of Australia

• EV still the driver for nickel consumption demand

Although demand for electric vehicles (EVs) has remained resilient in China, there have other surprises in other countries. With surging EV sales in the United States and the European Union (EU), thus boosting global EV demand. We expect a decrease in battery pack prices starting in 2024, which could narrow the price difference between internal combustion engine vehicles (ICEVs) and EVs, consequently driving up EV demand and increasing the need for nickel. This trend is expected to result in EV sales growing from 11 million in 2022 to 23 million in 2025 according to the International Nickel Study Group. As a result, EV batteries are projected to contribute 20% of the total refined nickel usage by 2025.

• Global mined nickel production set to grow, spurred by Indonesia

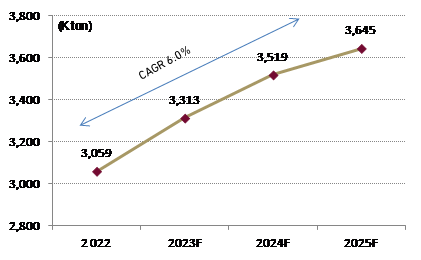

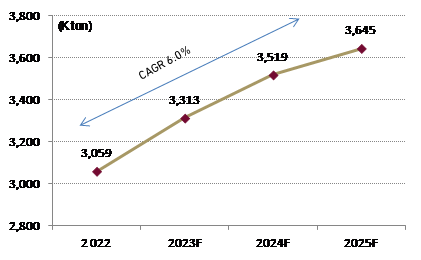

Projections for global mined nickel production, is pointing towards a sustained upward trajectory, with an annualized growth rate of 6.0% expected to persist until FY25F from FY22. This expansion is anticipated to propel the worldwide total to 3.65 mn tons. Notably, Indonesia's output is set to surge from 1.6 mn tons in FY22F to exceed 2.2 mn tons in FY25F, firmly establishing the nation as a dominant contributor, accounting for nearly 60% of the global refined nickel production in FY25F. This growth story is underpinned by substantial expansions underway at major mining operations from companies such as MDKA, HRUM, INCO and NCKL, which produces refined nickel products such as Nickel Pig Iron (NPI), nickel in matte (matte) and Nickel Mixed Hydroxide Precipitate (MHP).

Exhibit 92: Global refined nickel production

Source: Department of Industry, Science, and Resources of Australia

• China stimulus to work its magic for copper

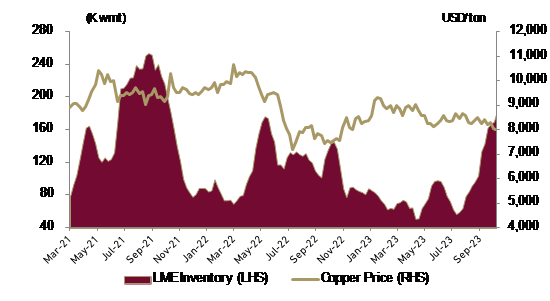

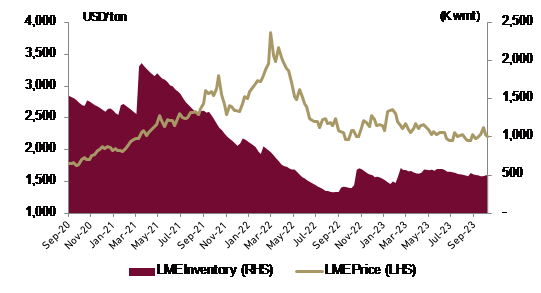

After an initial price increase driven by China's relaxation of strict COVID-19 containment measures, copper prices have cooled in recent months due to sluggish global manufacturing activity and central banks' tightening of monetary policies. Consequently, the LME Copper price has declined by 12.6% from its peak in January to USD 8,024 per ton at the time of writing. Expectations suggest a price recovery in the latter half of 2023 and early 1Q24, with Chinese policymakers are likely to enact a stimulus plan to jump-start economic activities and counteract the stagnating economy. Furthermore, the US dollar might weaken if the Federal Reserve pausing its tightening measures. On the supply side, Chile and Peru are increasing their copper production, leading to a doubling of LME inventory to 180,000 tons, surpassing higher-than-forecasted global copper consumption in FY23F. Shifting the market into a in FY23F. Nonetheless, we still anticipate the market to stabilize in FY24F before returning to a deficit in FY25F due to an expected increase in copper cable demand from the renewable energy sector and the electric vehicle (EV) market. Accordingly, we project an average copper price for FY23-25 at around USD 8,600 per ton, USD 8,800 per ton, and USD 9,000 per ton. Given the uncertain macroeconomic outlook, any major economic recessions could negatively impact copper demand.

Exhibit 93: LME copper price and inventory

Source: Bloomberg

• Aluminium demand growth may slow in the short run

Moderate demand for primary aluminium in Europe and stringent monetary conditions in major economies has exerted more influence on aluminium prices than supply disruptions in China's Yunnan province. The LME spot price for primary aluminium has decreased by 3.5% Ytd, reaching USD2,215 per tonne. LME stock adjustments mirror the sluggish demand for primary aluminium outside of China, climbing 15.0% Ytd from 428 k tons to 493 k tons at the time of writing. Slower global economic growth is expected to play a substantial role in pushing aluminium prices lower. The addition of new alumina capacity in China, totaling 3.4 mn tons in the first half of 2023 is likely to exacerbate the situation further and put an added downward pressure on alumina prices. Looking ahead, the LME aluminium price is expected to increase beyond FY23F (USD2,500/ton), averaging USD2,600 and USD2,700 per ton in FY24F and FY25F, respectively. This rise is attributed to the growing global demand for energy-efficient vehicles and technologies, which will bolster aluminium usage.

Exhibit 94: LME aluminum price and inventory

Source: Bloomberg

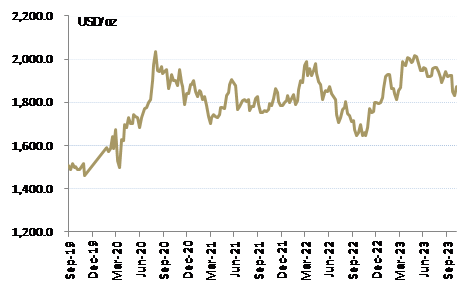

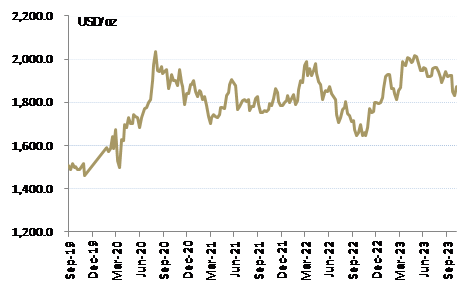

• Gold facing short term headwind

To date gold prices has enjoyed a strong and stable performance averaging USD1928/oz. Behind the gold performance was a combination of factors: 1) a relatively stable US dollar and interest rates 2) event risk hedging 3) strong and continued central banks demand. However, recent upward movement of bond yields, slowing of rates and the strength of the US dollar have exerted downward pressure on gold prices over the past few months. While continued headwinds should persist in the short term, we are still bullish for gold price in the long run as uncertainty surrounding the US economy and uncertain geopolitical conditions should give support for gold price averaging USD1,900/oz in FY23F and FY24F.

Exhibit 95: gold price

Source: Bloomberg

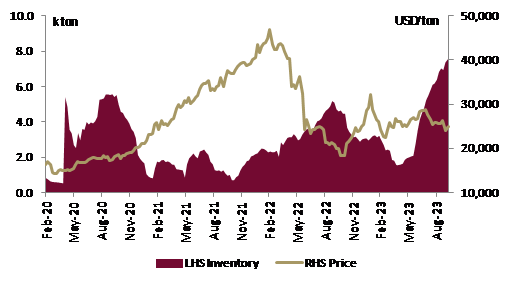

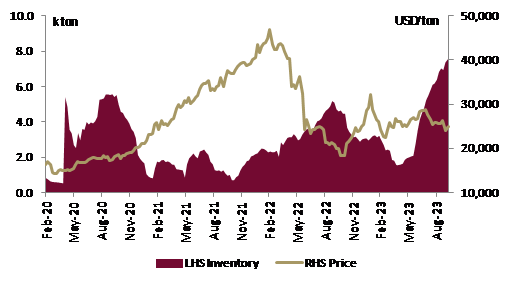

• Tin heading for a surplus

After a nearly two yearlong bullish trends in the market, in which tin prices rose to a record high of USD47,450/ton in March 2022 fed by the pandemic. Tin price has now narrowed down and settled averaging USD26,249/ton for the year. Furthermore, limited demand growth for electronic products from Korea and limited manufacturing output from EU and China has suppressed demand in the short run putting added pressure towards tin price. On the supply side LME inventory has steadily build up by 149% to 7.5 mn tons, as increased shipments in the month of September from Indonesia has slowly build up refined tin supply. As such, we note that the combination of improved supply and lukewarm demand should narrow down the deficit in tin in 2023 and should further normalize in 2024. With that in mind, we forecasted tin price to average USD24,000/ton in FY23F and USD24,500 in FY24F

Exhibit 96: LME tin price and inventory

Source: Bloomberg

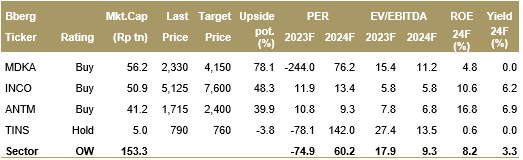

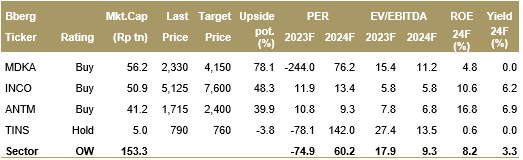

• Maintaining overweight rating

We maintain our overweight rating for metal sector on account of bullish long term nickel price outlook, sparked by rising nickel consumption from the EV market. We select MDKA and INCO as our top pick with a TP of Rp4,100/share and Rp8,100/share. We continue to like MDKA due to the company’s gold, nickel and copper producing capabilities and its prized projects namely Nickel, Copper, AIM and Pani. We also like INCO due to its nickel production capabilities and its ongoing partnership with Huayou Cobalt and Huali Nickel Indonesia ensuring the continuity of its HPAL project.

Exhibit 97: Metal Mining stock rating and valuation

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

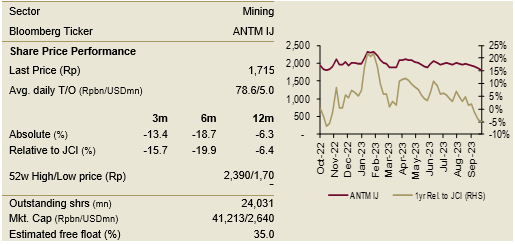

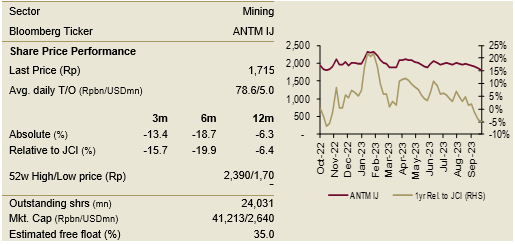

ANTAM

BUY TP: Rp2,400 (+39.9%)

Company Profile

The state-owned Aneka Tambang (ANTM) is one of the largest nickel miners in Indonesia and it has an installed capacity of about 28,500 tons. Its business segment is classified into nickel segment, gold, refinery segment and others operating segment. ANTM also has 25% equity interest in Nusa Halmahera Minerals, which currently operates Gosowong and Cibaliung goldmines.

Key Points

• Halmahera smelter starts commission in 4Q23. The nickel smelter in East Halmahera, currently designed for an annual production capacity of 13.5 k tons Tni, has reached 99.9% completion. With the smelter virtually finishing its construction stage, the company has successfully resolved its electricity supply challenges and secured an agreement with the State Electricity Company (PLN) to power the smelter. The company anticipates that the smelter will be fully operational by 4Q23.

• Update on SMGAR project. The company is making significant strides on the development of the Smelter Grade Alumina Refinery (SGAR) project in Mempawah with a capacity of 1 mn tons of Alumina/annum. Developed in partnership with Indonesia Asahan Aluminium (Inalum), the construction phase has reached about 40%, and commercial production is targeted for 1H25. Valued at USD830 mn, the project is both managed by Inalum (60%) and ANTM (40%).

• Maintain BUY rating with TP of RP2,400/share. We maintained our Buy rating and TP for ANTM at Rp2,400/share as our TP offers an attractive 39.9% upside. We select ANTM as one of our top picks due to due to its ongoing partnership with IBC and CATL to develop EV battery and its diversified metal portfolio.

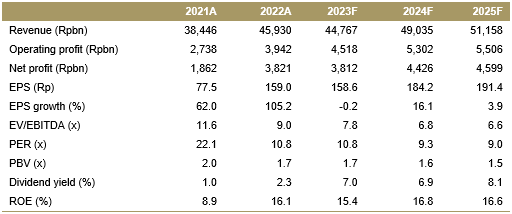

Financial Highlights

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

ANTAM

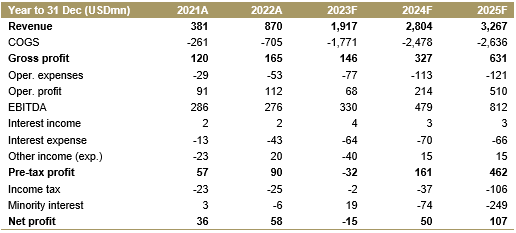

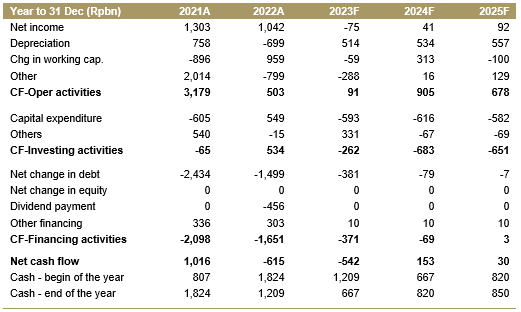

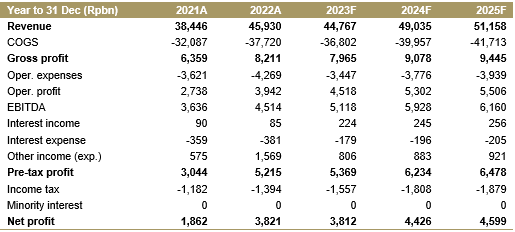

Income Statement

Balance Sheet

Cash Flow

Key Ratios

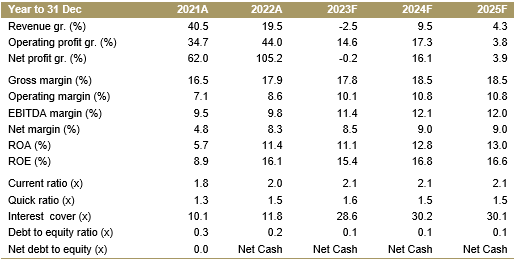

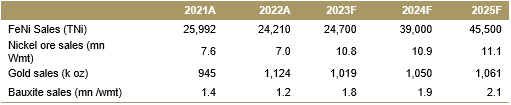

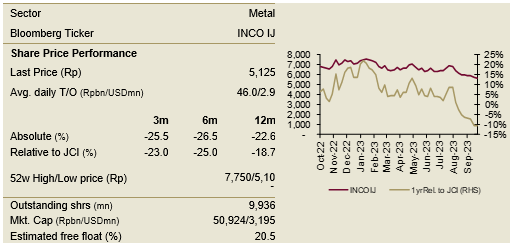

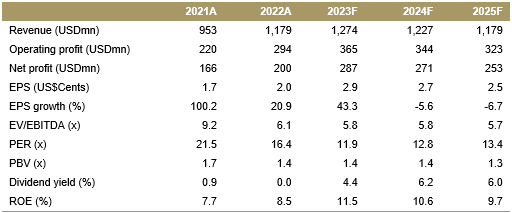

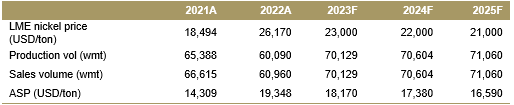

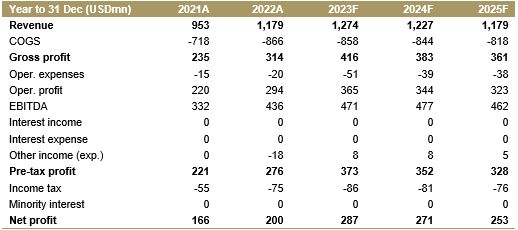

Vale Indonesia

BUY TP: Rp7,600 (+48.3%)

Company Profile

Vale Indonesia (INCO) is engaged in nickel mining and production. It has nickel mining concessions in several areas in Sulawesi and produces nickel in matte from lateritic ores at its integrated mining and processing facilities near Sorowako, Indonesia. INCO is an integral part of its parent’s operations and sells all of its production to its largest shareholders, Vale Canada (80% of output) and Sumitomo Metal Mining (20%) under long-term contracts.

Key Points

• Update on HPAL Pomalaa project. Currently the company has started field activities, such as land clearing and construction of supporting infrastructure (e.g. site office, camp), with AMDAL permit still on the works. Projected capex for the project is estimated to be in the area of USD2.0-2.5 bn, with operational activities to start in 2025 and a projected capacity of up to 120ktpa of nickel-in MHP.

• Update on Bahadopi project. Early works for the project, which also cover the office and other infrastructure, were in progress and expected to be completed by September 2023. The project is slated to finish in 2026 and have a production capacity of around 73k tons/annum.

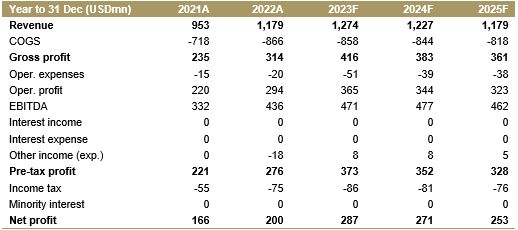

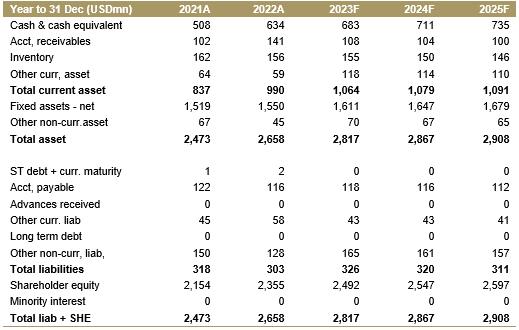

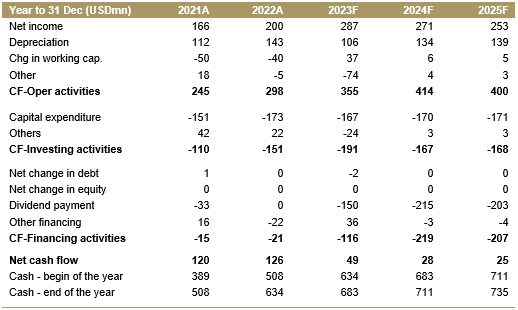

• Maintain BUY rating with a TP of Rp7,600/share. We maintain our TP at Rp7,600/share derived from 2024F 9.2x EV/EBITDA. Hence, we reiterate our Buy rating on INCO as our TP still offers 48.3% upside to the current share price. Possible downside risks to our call are 1) nickel price volatility 2) delays in the HPAL, Pomalaa, Morowali and Sorowako project and 3) government regulations.

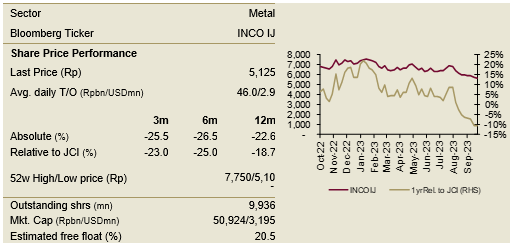

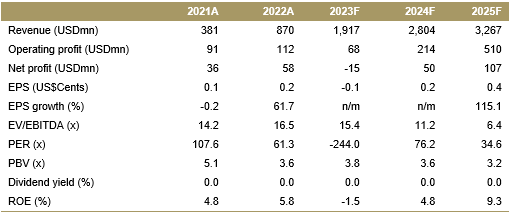

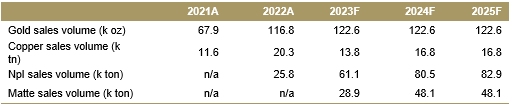

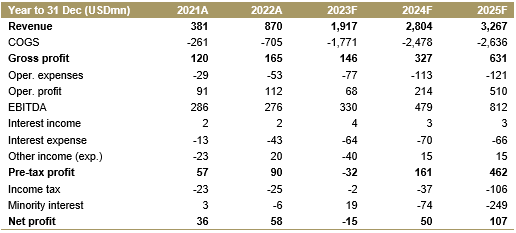

Financial Highlights

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

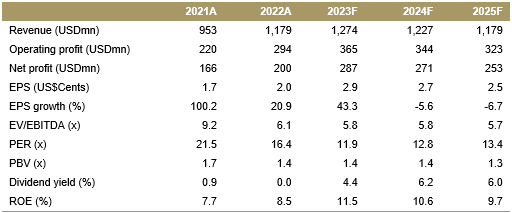

Vale

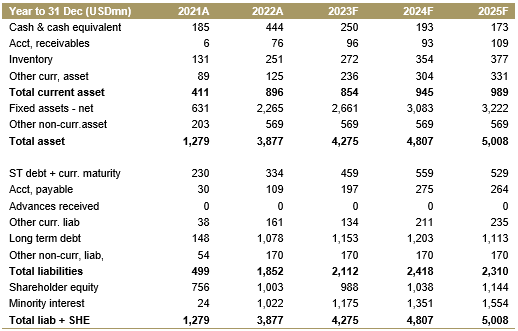

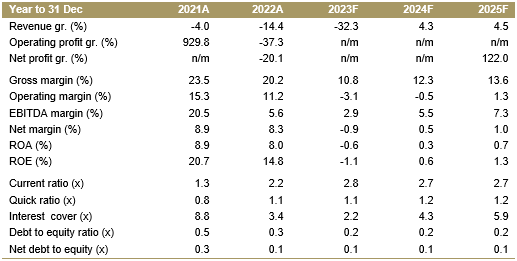

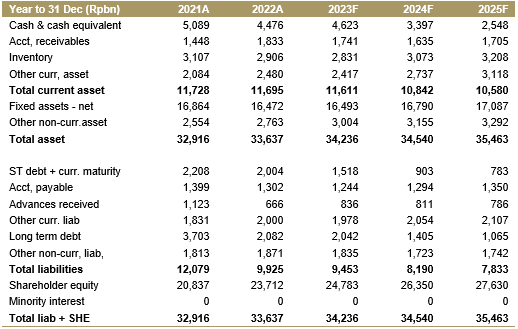

Income Statement

Balance Sheet

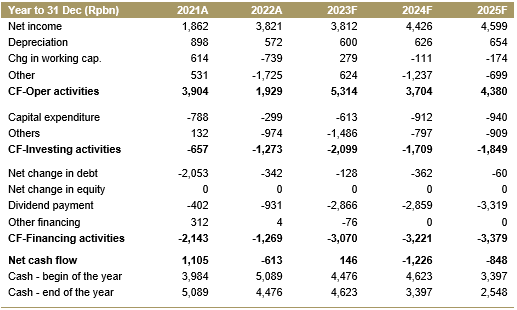

Cash Flow

Key Ratios

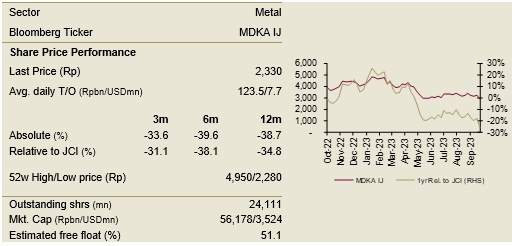

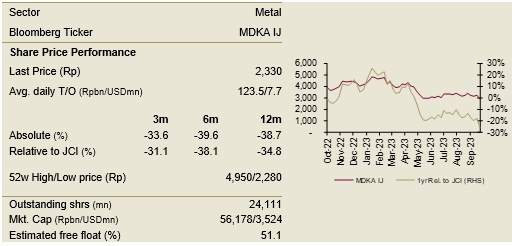

Merdeka Copper Gold

BUY TP: Rp4,150 (+54.7%)

Company Profile

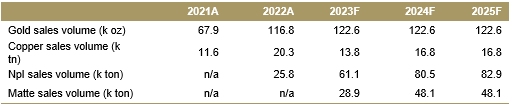

Founded in 2012, Merdeka Copper Gold (MDKA) is a holding company with operating subsidiaries that are engaged in the mining business, encompassing the exploration and future production of nickel, gold, silver, copper and other related minerals. It currently runs three producing assets, yielding nickel, copper, gold and silver.

Key Points

• Pani project is on the way Located in Gorontalo, Indonesia, the Pani Gold Project stands as a substantial low-sulfidation epithermal gold deposit, boasting a Mineral Resource Estimate (MRE) of 275.8 mn ton at a gold grade of 0.75 g/t, equating to a total of 6.63 mn oz of gold. This MRE encompasses the combined resources from both Pani IUP and Pani CoW within the Baganite Zone. Currently, a Feasibility Study is in progress, and it is anticipated that the results will be unveiled in the 4Q24. Furthermore, the development of essential infrastructure is actively underway, with a target completion date set for the third quarter of 2023.

• Slated to become another nickel mining giant The company has set an ambitious target of achieving NpI production capacity of 88k tons and 50k tons of Nickel in Matte by 2025F. Moreover MDKA, in partnership with Tsingshan and other strategic allies, plans to construct a 120,000ton per year, featuring HPAL technology to produce MHP nickel for EV battery cathodes. The project will unfold in two phases: Phase I, with a 60,000ton HPAL capacity, in collaboration with CATL, followed by Phases II and III in 2026.

• BUY rating with TP of Rp4,100/share. We select MDKA as our top pick in the metal sector. We maintain our rating at BUY for MDKA with a 54.7% upside potential to our TP.

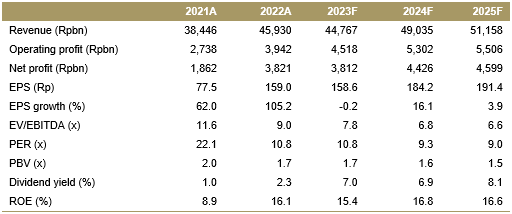

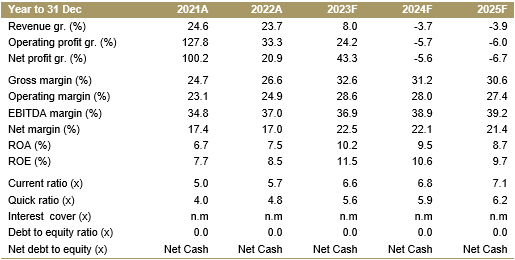

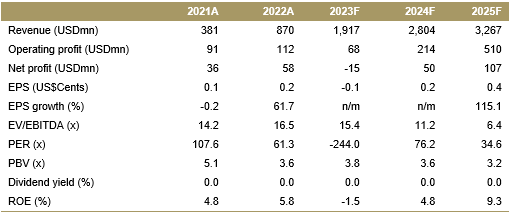

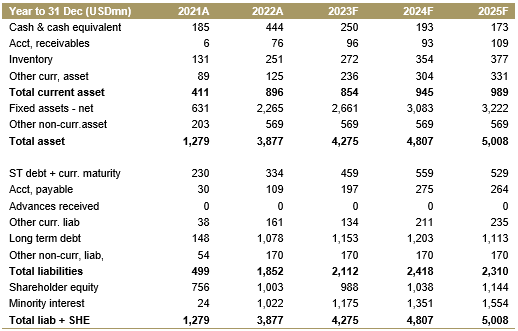

Financial Highlights

Assumptions

Arief Budiman +62 21 2557 4800 ext. 819 budimanarief@ciptadana.com

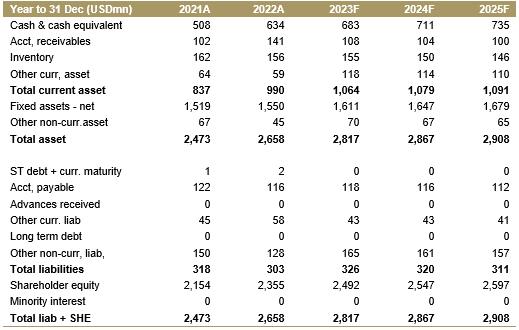

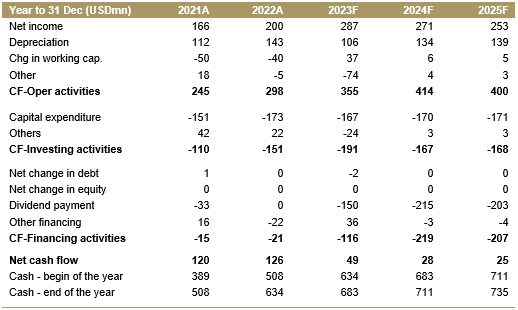

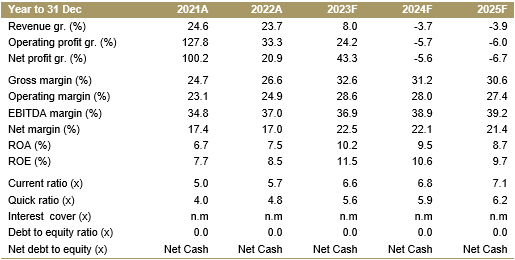

MDKA

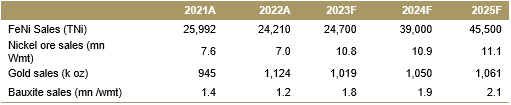

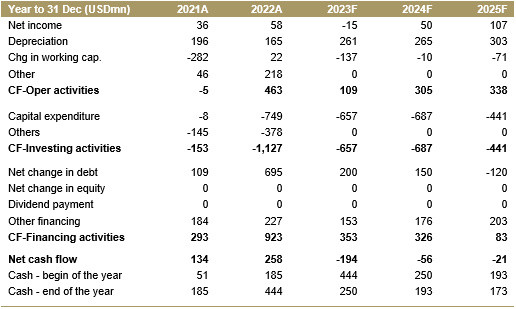

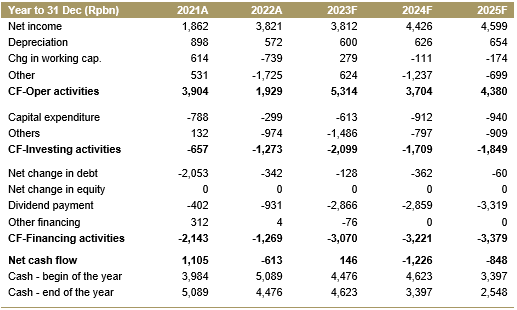

Income Statement

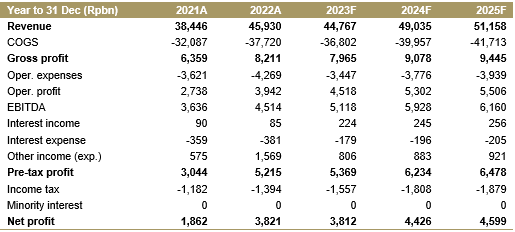

Balance Sheet

Cash Flow

Key Ratios

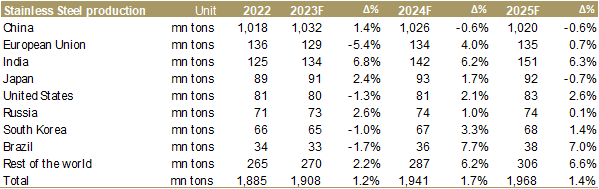

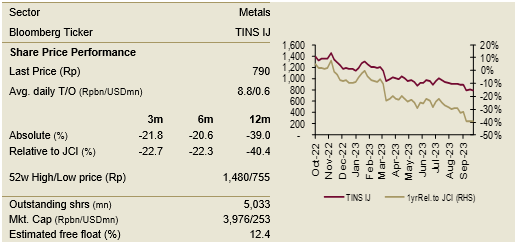

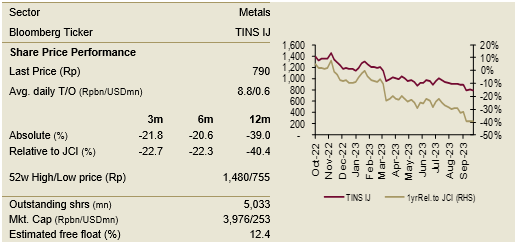

Timah

HOLD TP: Rp760 (-3.8%)

Company Profile

Timah became a listed company in 1995 with the government of Indonesia owning a 65.0% share. Timah is the second largest tin producer in the world after Yunnan Tin from China. Its mining sites are located in Bangka and Belitung islands, West Indonesia. TINS operate as a holding company, through its subsidiaries, it also diversifies into property, shipping dockyard and R&D services.

Key Points

• Ausmelt Furnace to be fully operational late FY23 Management commented that the Ausmelt furnace will be fully operational by late FY23, where the smelter can process up to 40 thousand tons of tin, with the capability to melt tin ore with lower purity levels.

• Continuing to operate on efficiency going forward Management indicated that going forward the company is aiming to continue its rigorous efficiency measures in every line of business, while maximizing its production and sales performance in order to optimize its cash flow performance. Furthermore, TINS is also utilizing a backlog or semi-finished tin inventory to be melted back into metal tin with LME standard specifications further maximizing its efficiency.

• Maintain HOLD rating with TP of Rp760. We maintained our Hold rating and TP for TINS at Rp710/share as our TP only offers -3.8% downside. Further downside risk to our call 1) tin price volatility 3) changes in government policy 3) illegal tin mining returns and 4) disruption on its operational activities.

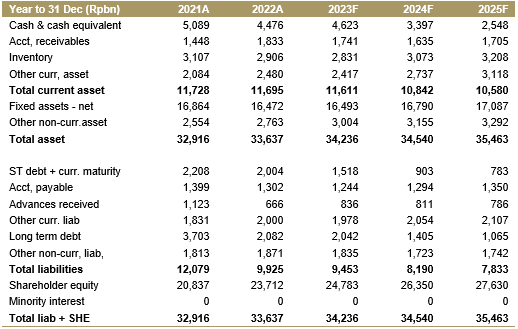

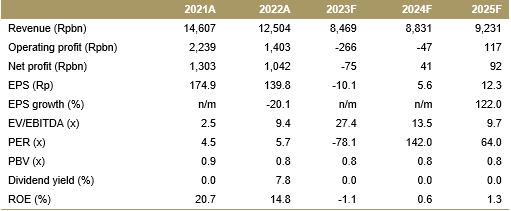

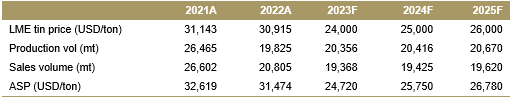

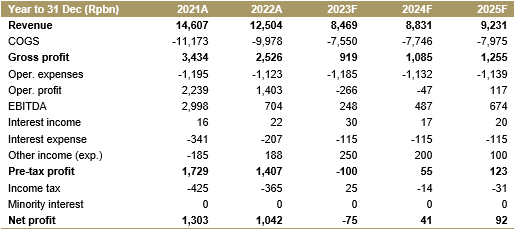

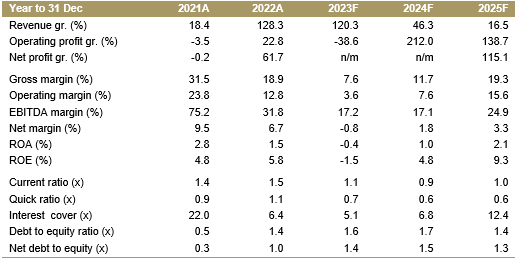

Financial Highlights

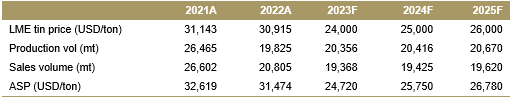

Assumptions

Thomas Radityo +62 21 2557 4800 ext. 795 radityothomas@ciptadana.com

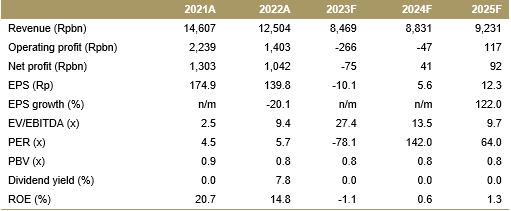

Timah

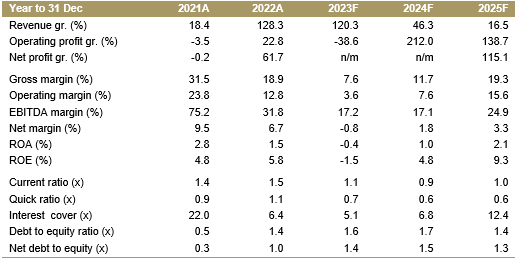

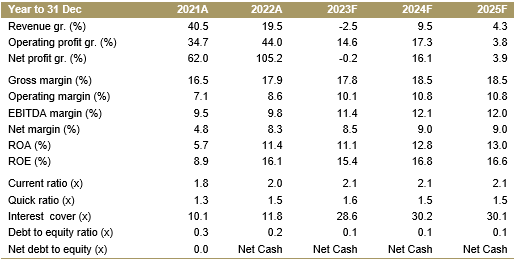

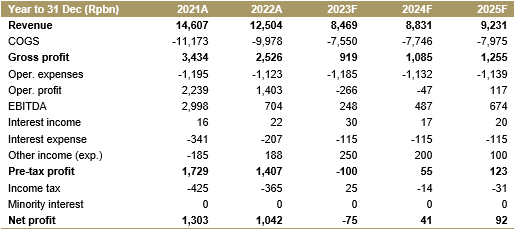

Income Statement

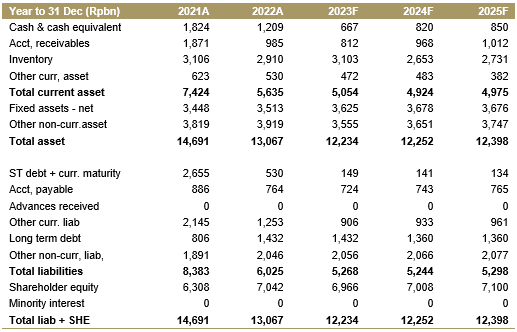

Balance Sheet

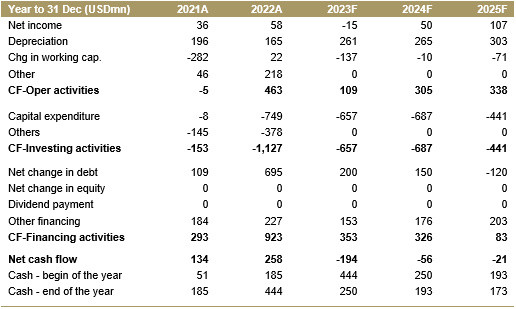

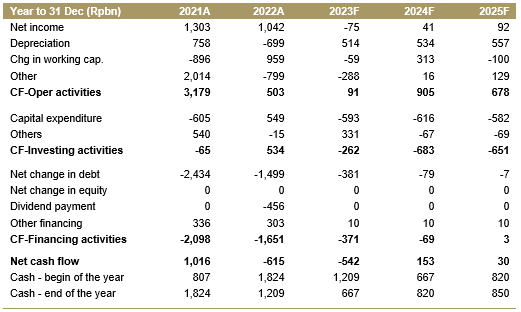

Cash Flow

Key Ratios