Technology/Internet

Overweight

Sector Outlook

• Large and growing TAM of digital economy in Indonesia

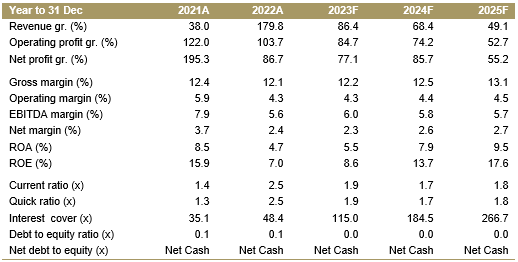

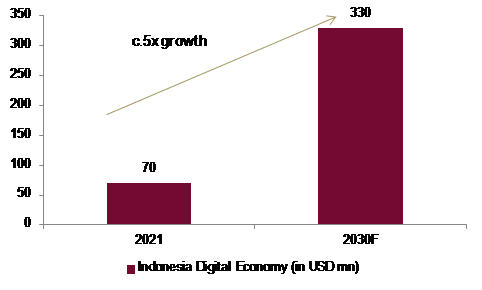

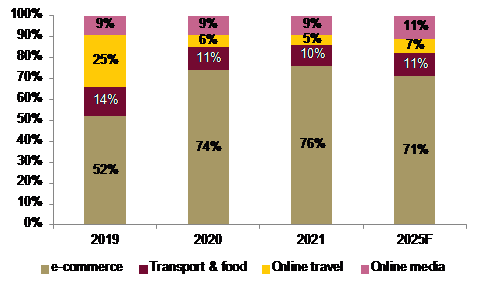

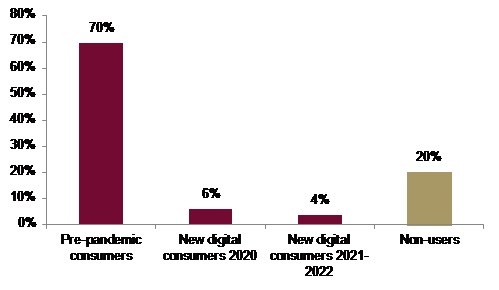

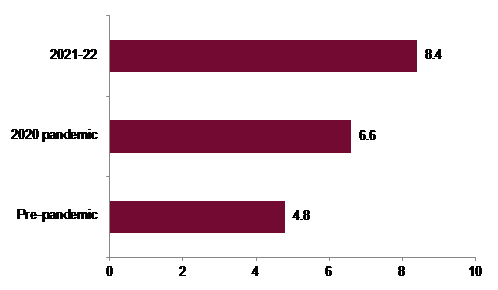

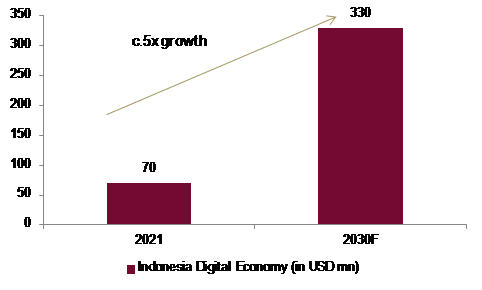

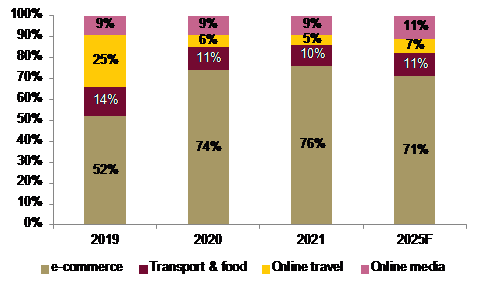

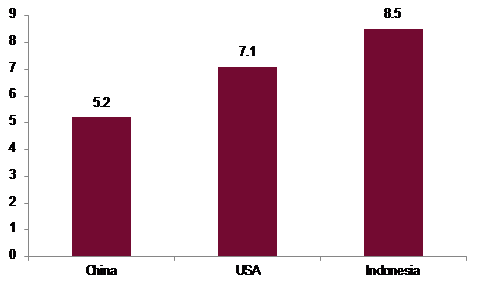

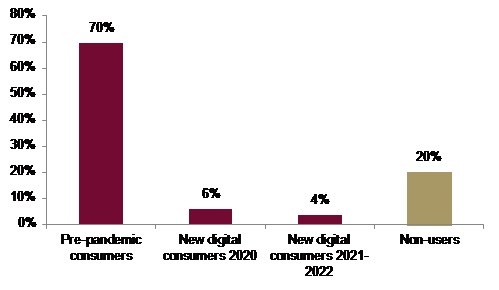

Indonesia digital economy value is expected to grow almost 5x from 2021-2030F from the value of USD70 mn in 2021 to USD330 mn in 2030F. Supported by its young demographic and rising smartphone penetration, Indonesia is the largest digital economy market in South East Asia with one of the fastest growths in the region. According to Red Seer, e-commerce, travel, media, transport, and food delivery are among the drivers of digital growth in the region. The pandemic surely help the acceleration of digital adoption with 21 mn new digital consumers reported since the pandemic; 96% of them are still using the services, and 99% intend to continue using them in the future. In addition, the number of internet users in Indonesia is to grow at CAGRs of 7.3%, outpacing that of other region such as South East Asia, China, and the US at the rate of 5.3%, 4.5%, and 1.4%, respectively for the period of 2020-25F, as per Euromonitor report. RedSeer also reported that Indonesia is among the world's most digitally engaged populations, spending an average of 8.5 hours a day on the internet in 2020, which is 63% higher than the hours per day spent by the populations in China and the U.S, respectively.

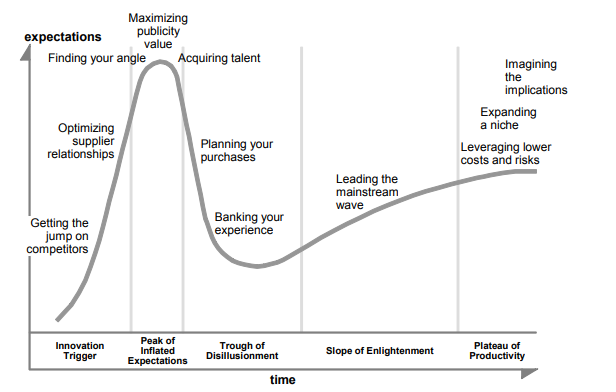

• Despite the over-hyped, tech is here to stay

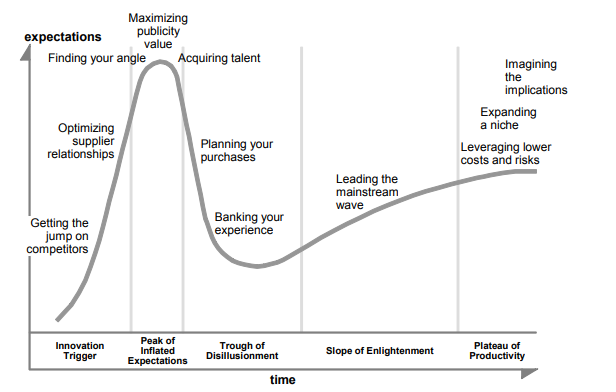

With all the aforementioned, we believe that tech is here to stay. We are about to see more digital disruptions coming to every aspect of our life. Nevertheless, in the past couple of years, especially during the Covid-19 era, there tends to be an overestimation on the growth potential, and hence, the valuation that splashed into digital companies. Moreover, abundant and cheap liquidity also play a part to exacerbate this trend. Therefore, at the current tightening cycle, the sector is hit the most. If we base the cycle on the “Gartner Hype Cycle”, we believe we are yet to reach “the trough of disillusionment” point. We estimate the trough to arrive next year once the rate hikes and QT has reached their peak.

Exhibit 204: Indonesia Digital Economy Value (in USD mn)

Source : Coordinating Ministry for Economic Affairs, Ciptadana Sekuritas Asia

Exhibit 205: Indonesia Digital Economy Breakdown

Source : Google, Temasek, Bain, Ciptadana Sekuritas Asia

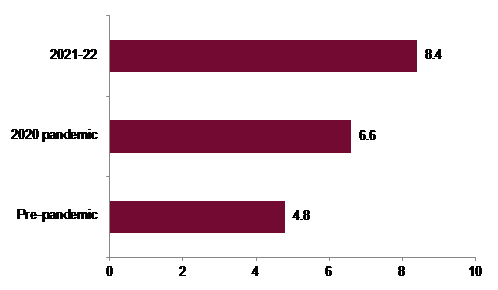

Exhibit 206: Average Hours per Day Spend on Internet

Source : RedSeer, Ciptadana Sekuritas Asia

Exhibit 207: Penetration Rate of Digital Services

Source : Google, Temasek, Bain, and Ciptadana Sekuritas Asia

Exhibit 208: Average Number of New Digital Services Used

Source : Google, Temasek, Bain, Ciptadana Sekuritas Asia

Exhibit 209: Gartner Hype Cycle Curve

Source : Gartner, Ciptadana Sekuritas Asia

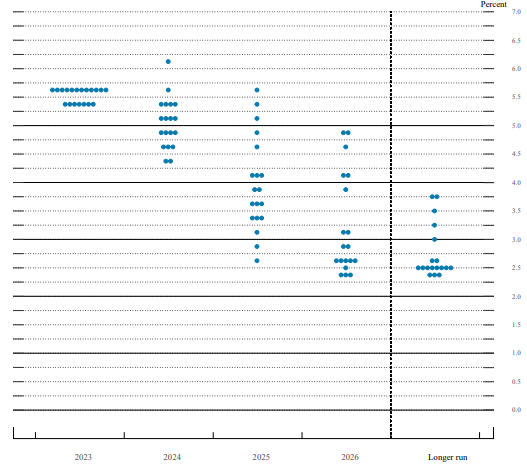

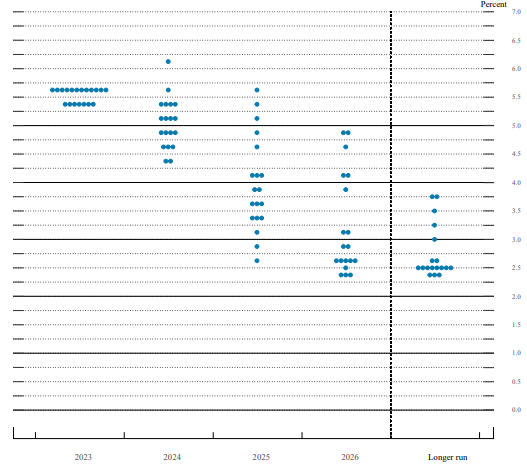

• Tech is the play for easing monetary policy

We reiterate our economist view on that the timing of The Fed’s pivot in monetary policy to occur in 2H24F. While we believe that a lot of VUCA factors might drive for the timeline to miss our previous estimation, we believe selective positioning in the tech sector at the current cycle might warrant some merits. We also note that global funding has slowed down dramatically for startup funding in 2023, both in Indonesia and globally. It is inevitable that investors are more selective and demanding clearer and faster path toward profitability before they place their funds.

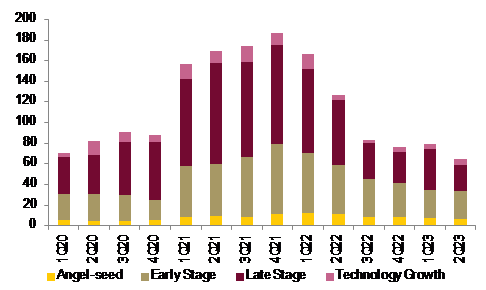

• Slowing start-up funding globally

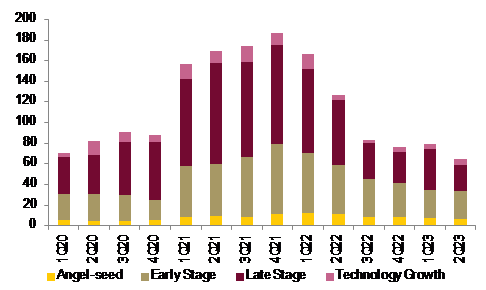

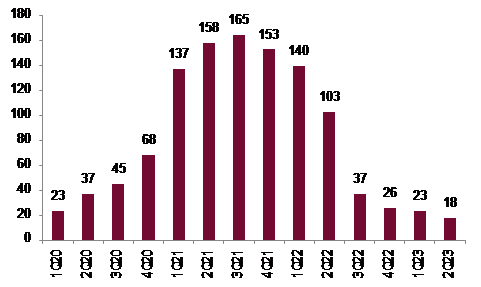

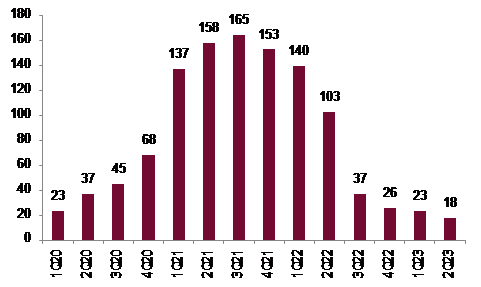

Venture and growth investors in private companies scaled back their investment pace dramatically as the slump in the public markets stretched into the third quarter. According to Crunchbase, venture funding for 2Q23 declined 49% YoY and % QoQ, continuing the QoQ declining trend since peaking in 4Q21. The number of company that achieved an unicorn status was also on a low of 18 companies, compared to the peak in 3Q21 of 165 companies. Based on the funding round, all type of companies are facing declines, however, angel and early stage funding fare relatively better than the late stage and technology growth funding.

• Similar trend in Indonesian startups

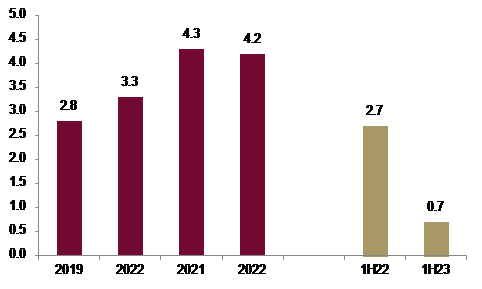

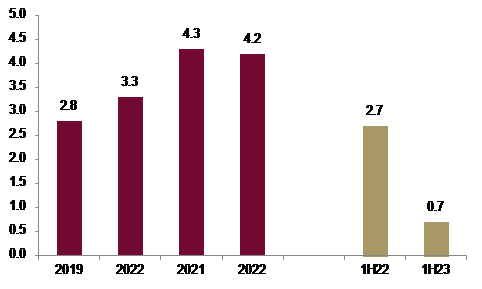

Indonesia is not immune to the global funding slowdown. Daily Social reported start-up funding in Indonesia reached USD0.7 bn in 1H23, declining 74% YoY, deeper than the global. This is perhaps due to lack of investable startups in Indonesia and investors’ preference to invest in more mature market amid global uncertainties. By the same token with the global trend, this condition has driven Indonesian startups to switch priority from growth at all cost to achieve profitability to sustain their operations. As a result, many startups were pivoting, doing massive lay-offs, cost-cutting, downscaling, or even closing their operations.

Exhibit 210: The Fed’s Dot Plot

Source : The Fed, Ciptadana Sekuritas Asia

Exhibit 211: Global Venture Funding (in USD bn)

Source : Crunch Base, Ciptadana Sekuritas Asia

Exhibit 212: Number of Global New Unicorns per Quarter

Source : Crunch Base, Ciptadana Sekuritas Asia

Exhibit 213: Indonesia Startup Funding Value (in USD bn)

Source : Daily Social, Ciptadana Sekuritas Asia

• Shifting priority in Indonesian tech companies

As a result of the aforementioned, we observe a shift of demand from investors. As the cost of fund increasing, investors are demanding more profitability or clear path toward profitability. In responding to such investors’ demand, we have observed that many companies have moved away from growth-at-all-cost strategy to be more conscious on profitability at least in CM or EBITDA level. In doing so, many companies are improving monetization or doing cost rationalization. Downsizing and employee lay-offs is a common theme in startup newsflow this year, with ecommurz reporting around 7,064 startup employees were let go. As such, apart from company in early stage that is still early with a relatively fresh or untested idea that could still secure funding, company that are operating in relatively mature industry/market or companies that have already listed in IDX might need to be more mindful on profitability. This, to some extents, might accelerate the natural selection, as the fittest company that the customers would still stick into, even with fewer incentives, will be the winner. Further, this might be a more structural theme going forward, as profitability will continue to be important even though the monetary policy will again ease in the future.

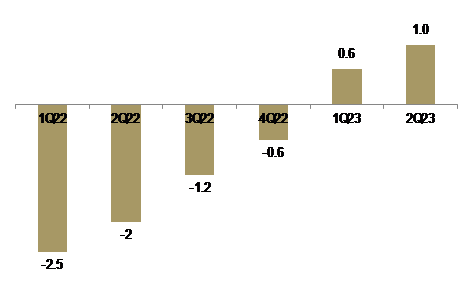

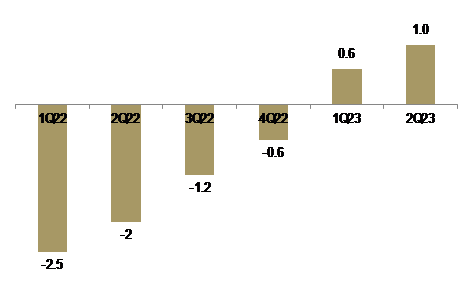

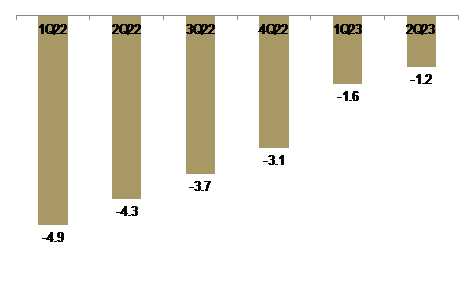

• Tactical play on technology sector, we rate BUY on GOTO and WIRG

As argued above, we believe that picking a company that is the leader in the business it operates in and has a clear path to achieve profitability is imperative at the current cycle. We view GOTO as the market leader in all verticals that it operates in and supported by cross-pollination across its ecosystem tick the box for this criterion. We have noted that GOTO have managed to reduce losses in CM and EBITDA level and will continue to do so while maintaining its market leadership. We are of the view that GOTO will manage to reach adjusted EBITDA breakeven within 4Q23F as targeted, and full quarter adjusted EBITDA positive in 1Q24F. We also like WIRG thanks to its innovative AR/VR solution with strong innovative capability. In addition, WIRG is already a profitable company, lowering the funding risks going forward.

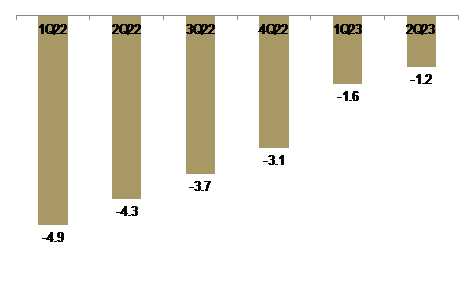

Exhibit 214: GOTO’s CM turning positive in 1Q23 (in Rpt n)

Source : GOTO, Ciptadana Sekuritas Asia

Exhibit 215: GOTO’s Narrowing EBITDA losses (in Rpt n)

Source : GOTO, Ciptadana Sekuritas Asia

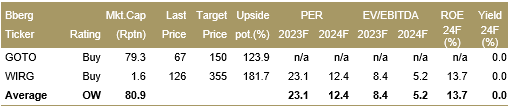

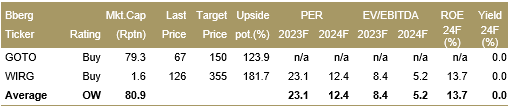

Exhibit 216: Technology Company Stocks Rating and Valuation

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

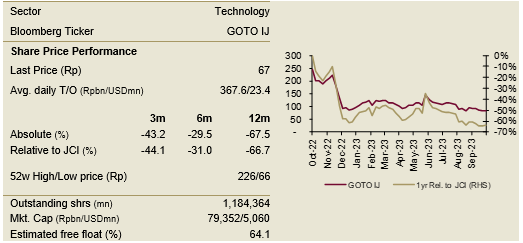

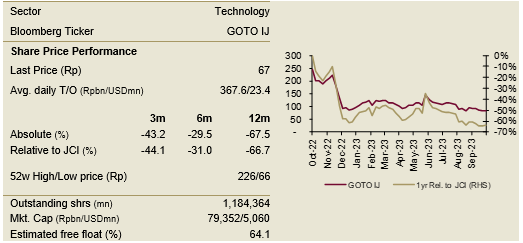

GoTo

BUY TP: Rp150 (+123.9%)

Company Profile

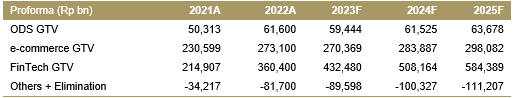

GoTo Gojek Tokopedia (GoTo) is the leading on-demand platforms that have various products and services including mobility, food delivery, logistics and many more. GoTo comprises of three verticals, namely on-demand services, e-commerce, and fintech with #1 market share in all verticals. With such leading position, GoTo boast the largest ecosystem in Indonesia with more than 2.5mn driver-partners, 12mn merchants, and 100mn Tokopedia MAUs.

Key Points

• ‘Mode Hemat’ to rekindle growth. After achieving positive adjusted EBITDA in 4Q23F, GOTO’s next aim is to deliver sustainable and profitable growth. The slowdown in growth has been on investors' minds over the past few quarters, especially amid cost/incentive cutting period and intensifying competition. To rekindle growth, management brief that they intend to achieve this by enlarging TAM through releasing a more affordable/economical product to cater to the lower-end/budget customers.

• Fintech and logistic as the next investment focal point. In e-commerce, GOTO will tap the low-end customers by offering more affordable shipping services which would be enable by GoTo Logistics, and also curate relevant product assortments at the right price for the users. 3) in fintech, GOTO will continue to accelerate its loan growth, working together with Bank Jago. GOTO has already launched cash loan products into Tokopedia and is in the process to be rolled out in GoPay independent app

• Maintaining target EBITDA breakeven. GOTO is retaining to achieve adjusted EBITDA brakeven within 4Q23F and achieve a full quarter of adjusted EBITDA positive in 1Q24F. We believe cost cutting would contribute more in achieving the target, rather than monetization as competition recently intensifies.

• Retain BUY recommendation GOTO at Rp150/share TP derived from SOTP valuation. Current valuation is attractive as it already in-line with peers.

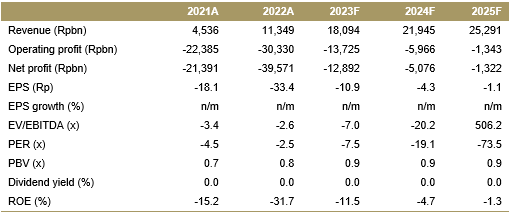

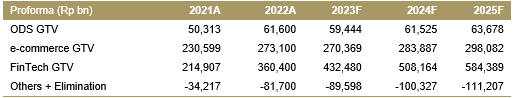

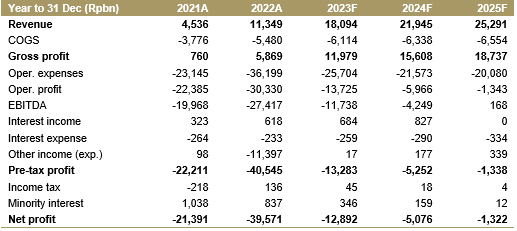

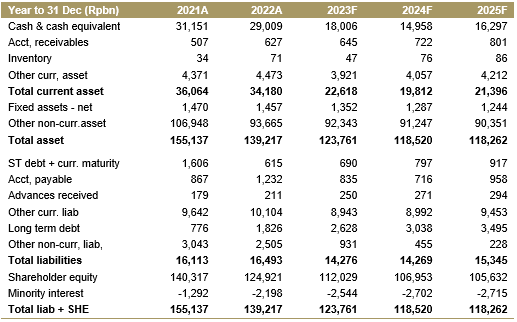

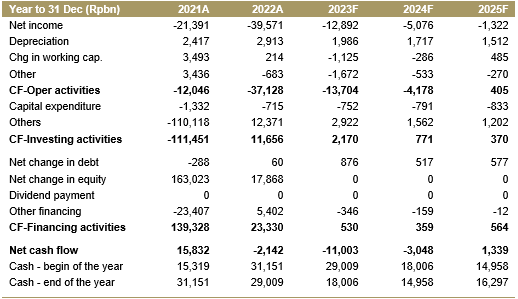

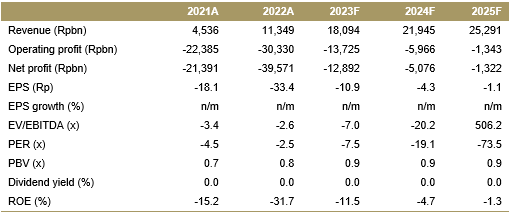

Financial Highlights

Assumptions

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

GoTo

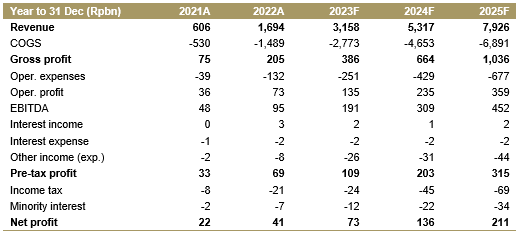

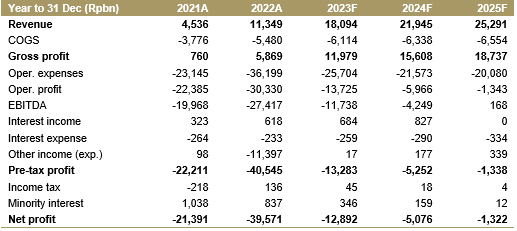

Income Statement

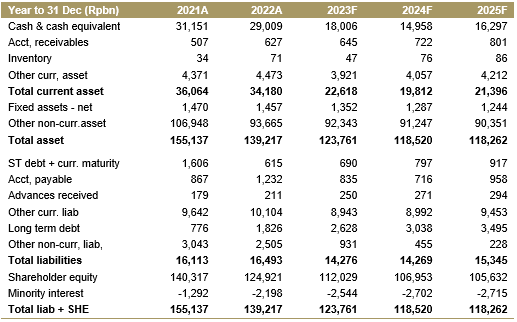

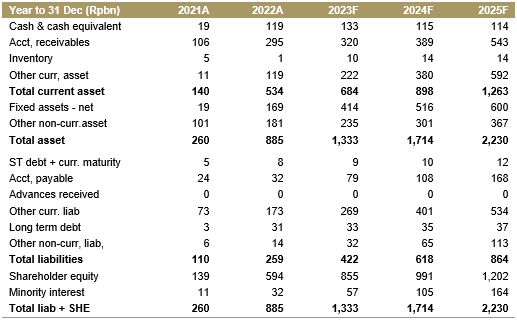

Balance Sheet

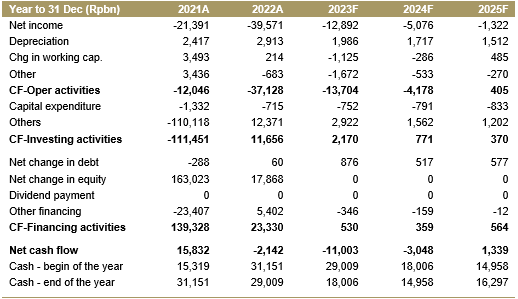

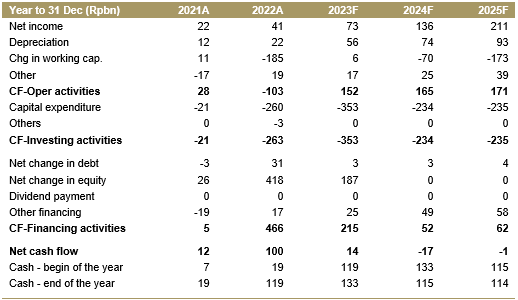

Cash Flow

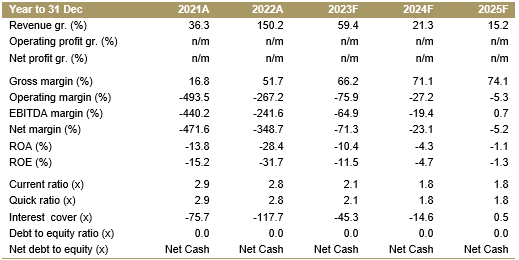

Key Ratios

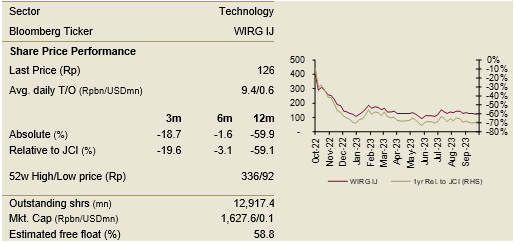

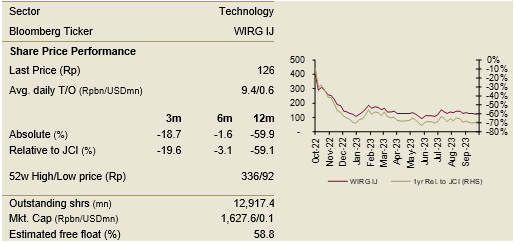

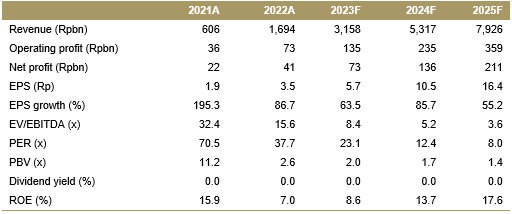

WIR Asia

BUY TP: Rp355 (+181.7%)

Company Profile

Established in 2009, PT WIR Asia (WIRG) has come a long way since its inception. It has established itself as one of the best digital reality players in Indonesia. Its unit, AR&Co, has developed itself as the technology backbone of the Company that no other Indonesian companies to our knowledge have comparable depth in AR technology. This has enabled the other business units, DAV and Mindstores, to offer customized branding/advertising services to a wide array of clients, ranging from education, publishing, gaming, consumer goods and even political campaigns. Altogether, WIRG has completed more than 1,000 projects, owns 5 technology patents, and has received multiple accolades and awards. WIR has also extended its footprint abroad by delivering solutions to global clientele from more than 20 countries across the globe.

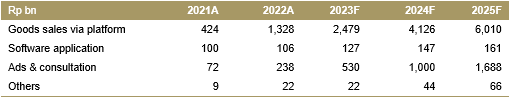

Key Points

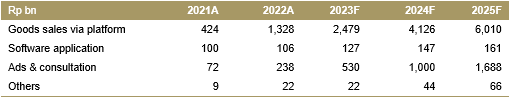

• Strong growth from DAV. WIRG managed to install 2,500 DAV machines in 2022, bringing a total of installed machines to 3,500, rising from 1,000 installed DAV machines in 2021. Of the 3,500 installed DAV machines, 1,826 (52%) machines are already operational and generating revenue, while the remaining are still in configuration or set-up process in which WIRG is installing modules to cater to the clients’ needs. WIRG is currently sitting on backlog contracts to install 7,500 more DAV machines to reach a total of 10,000 installations which WIRG expect to complete by this year.

• Mind Stores to grow revenue intensity and RGUs. On Mindstores, WIRG is looking to expand the solution to other industries. Management sees education and healthcare as a prospective target and they are discussing relevant solutions to cater to these industries. In the meantime, the Company continues to work with Alfamart, Mindstores’ key client, to keep developing its virtual stores to improve user experience and to be able to sell more items. With such development, revenue per monthly RGU rose 49.4% YoY to reach Rp55.9 mn/RGU. Mind Stores is aiming to increase both productivity and number of RGU in its Alfamind and Mili products.

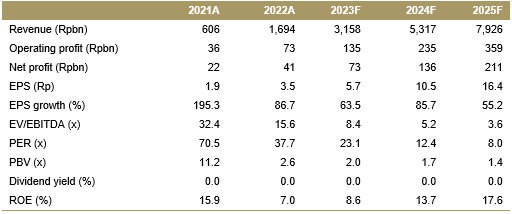

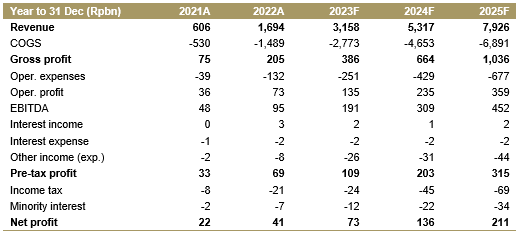

Financial Highlights

Assumptions

Gani +62 21 2557 4800 ext. 734 gani@ciptadana.com

WIR Asia

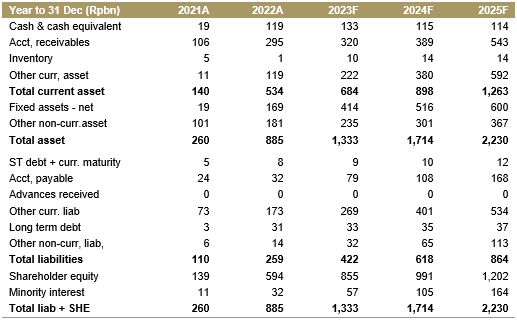

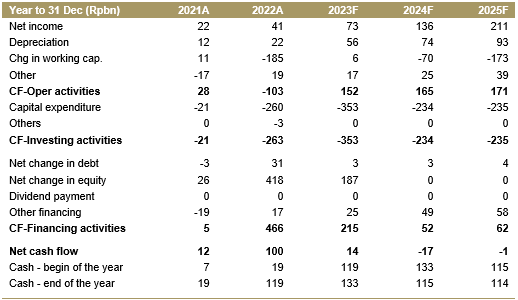

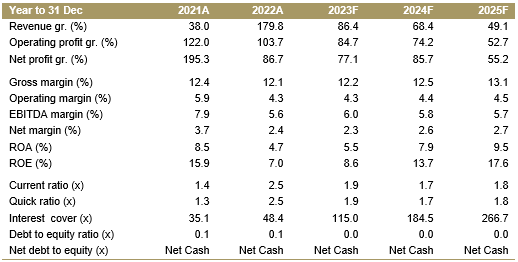

Income Statement

Balance Sheet

Cash Flow

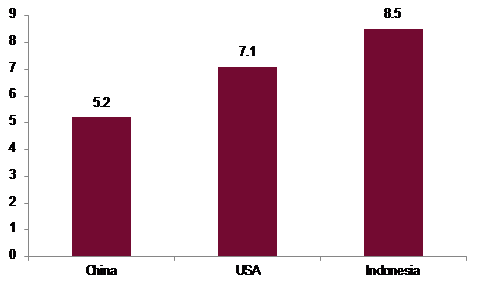

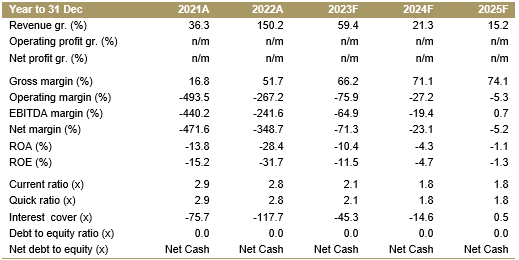

Key Ratios