Property

Overweight

Sector Outlook

• Lack of new launching in response to soft demand

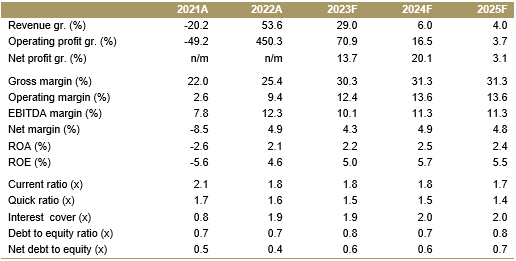

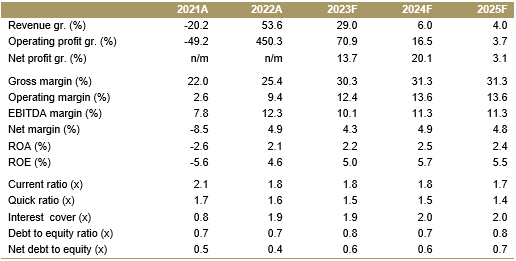

Demand for residential property remained soft in 1H23 where sales mainly were seen for the low to middle segment which offers affordable price units. Home purchase still mostly dominated by end users especially for landed housing. Meanwhile, individual investors whose targeting attractive capital gains and recurring income, continued to take a wait-and-see approach, waiting for the situation to become more suitable. In term of supply, competition has not increased significantly, as indicated by the absence of new project launches in the first quarter. The lack of new launches underscores the property market which remains stagnant. Some developers delayed the launch of new projects, preferring to focus on clearing unsold stocks. Residential prices remained essentially flat with developers focused more on boosting sales by offering attractive discounts and promotions than raising prices.

Exhibit 150: Residential sales growth based on size (%, YoY)

Source : BI

• End of era for low interest rates

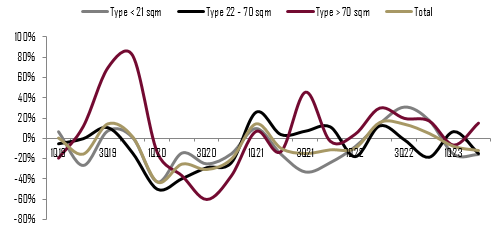

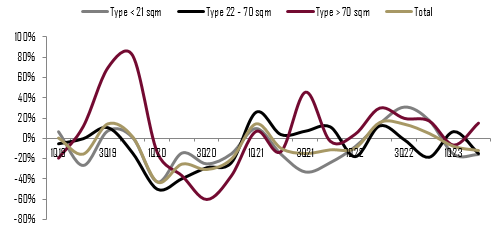

Indonesian Government maintained low interest rate to support property industry during the pandemic where only until August 2022, BI rate increased to 3.75%. Annually, growth of housing and apartment loans disbursed by the banking industry experienced a rebound since the beginning of 2021 (as shown in Exhibit 151). Unfortunately, shophouse and office loans growth still consistently negative for the last three years. We believe higher mortgage interest will weigh on demand for residential property in 2024. On the other hand, commercial segment will take longer time to recover.

Exhibit 151: Property loans growth by segment (%, YoY)

Source : BI and Ciptadana Estimates

• LPKR and BSDE lead marketing sales driven by landed residential

Many property developers reported sluggish marketing sales in 1Q23, declined by double digits on yearly basis, primarily due to weaker residential sales. On positive note, LPKR is still on track to meet its FY23 target, recorded flat +0.3% YoY marketing sales of Rp1.21 tn as of end of March, dominated by landed housing sales. BSDE is also on track, though lower by -13.2% YoY, the Rp2.15 tn marketing sales is accounting for 24.4% of its FY23 target, with 69% contribution from residential segment.

However other developers were lagging, with PWON delivered -21.6% YoY lower pre sales at Rp298 bn, generated from Surabaya’s landed residential projects and condominiums in Jakarta. Meanwhile, SMRA and ASRI each reported -54.4%% YoY and -48.8% YoY lower marketing sales of Rp655 bn and Rp294 bn respectively.

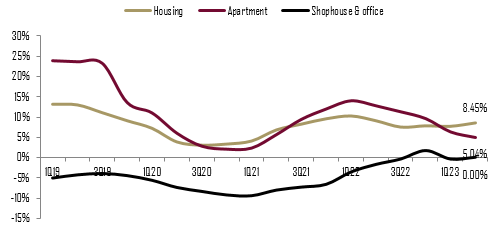

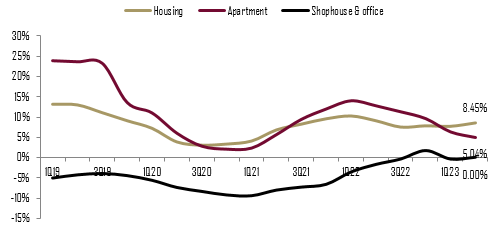

Exhibit 152: Mortgage rates on the downtrend, supporting home purchase

Source : BI

• Low mortgage rates attract home buyers in 1Q23

According to the latest BI survey, housing loans remained the preferred form of financing for residential property purchase, dominating 74.8% of the total, followed by cash installments (17.9%) and cash (7.3%). Payment by mortgage still popular in the first quarter this year as annual mortgage rate declined to 7.74% compared to 7.98% in previous quarter (see Exhibit 152).

The total value of housing and apartment loans which was disbursed by the banking industry continues to climb in 1Q23 (see Exhibit 4), increased by 7.2% YoY, though slightly decreased from 7.7% YoY in 4Q22. However on a quarterly basis, growth of housing and apartment loans moderated to 1.7% QoQ from 2.8% QoQ in previous quarter.

Meanwhile on the supply side, most property developers continue to rely on non-bank financing in the form of internal funds for residential property development, dominating 73.3% of total capital in 1Q23.

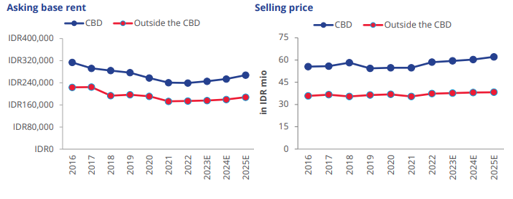

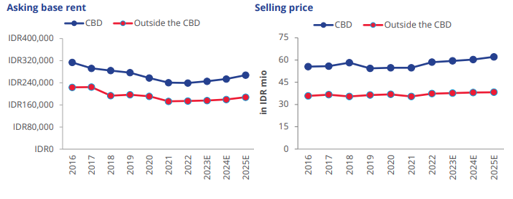

• Developers are not hurry to sell units unless offers are reasonable

The ASP in the Jakarta CBD remained at Rp55.7 mn/sqm. Vacant spaces for sale in the CBD are actually relatively limited and are mostly on the secondary market. The low sales volume has seen the ASP stabilize at a level expected to be remain up to the end of 2022 and we expect to continue in 2023. The same trend has been also seen in outside the CBD, where the ASP has currently been recorded at Rp36 mn/sqm.

Exhibit 153: Mortgage rates on t downtrend, supporting home purchase

Source : Colliers Indonesia

Sub-leasing becomes an attractive survival strategy during hard times in the strata-title market. Some strata-title offices set more competitive rents compared to office under lease scheme. This is intended to immediately fill the vacant spaces and help landlords or unit owners cover service charge costs.

Exhibit 154: Mortgage rates on the downtrend, supporting home purchase

Source : Colliers Indonesia

• Flat property sales recognition due to slow project handovers

Several property developers reported earnings beat in 1Q23, including BSDE (grew 154.1% YoY to Rp884 bn), PWON (increased 60.6% YoY to Rp595 bn), LPKR (turnaround to Rp1.14 tn vs. Rp568 bn net loss a year ago) and SMRA (rose 55.2% YoY to Rp272 bn). However, the strong earnings were primarily supported by higher non-operating income while property sales were somewhat stagnant.

On the bright side, overall rental segment booked double digits growth, signaling ongoing recovery in retail space post pandemic. Office space and industrial land had not shown significant improvement in the beginning of the year. Office occupancy rate in 1Q23 suppressed at around 70% - 71% for CBD and non-CBD area, due to balanced supply-demand dynamics. We expect the occupancy rate to stay under pressure with limited demand and upcoming supply.

• Land and industrial building rental tariff

It is still not the time for estates that focus on leasing to introduce new tariffs, despite the rise in leasing activity. Current rental tariffs for land and buildings will hold steady at least until the end of the year. The fundamental basis for tariff increases does not exist at this time.

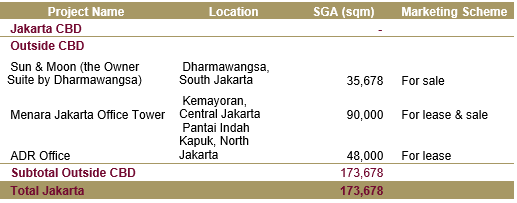

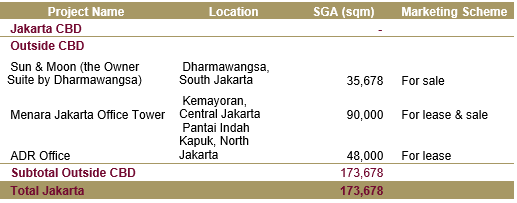

Exhibit 155: Real estate FDI still on negative growth in 1Q22

Source: BPKM, Ciptadana Estimates

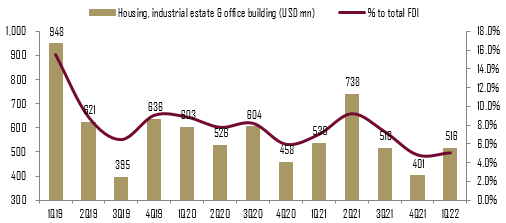

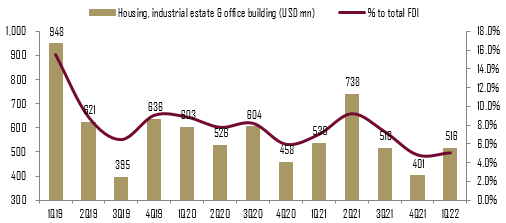

• Top picks

We believe that Indonesian economy continues to show resilience. We expect residential sales and rental segment to pick up speed while commercial space and industrial estate take longer time to recover. We maintain OVERWEIGHT on Property Sector with our top picks including BSDE, LPKR, PWON and SMRA.

Exhibit 156: Property stock rating and valuation

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

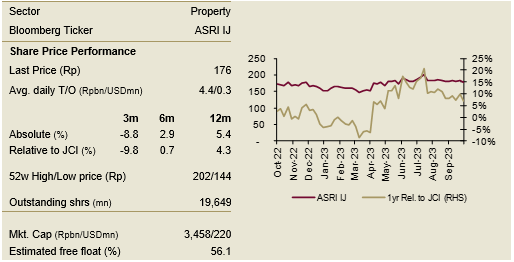

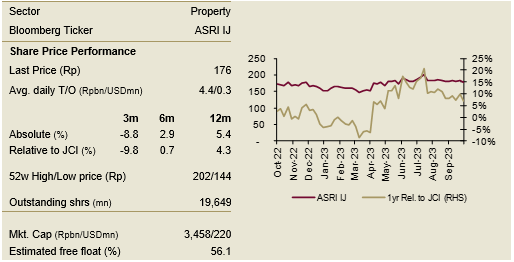

Alam Sutera Realty

BUY TP: Rp210 (+19.3%)

Company Profile

Following Alam Sutera, Alam Sutera Realty (ASRI) further develops 2,600 ha Suverna Sutera in Tangerang. The Company has completed the Prominence office building and Paddington Heights apartment, both located in Alam Sutera township. Project located in the business district of Jakarta is the Tower. Meanwhile, the Company also has a project in Bali named Taman Garuda Wisnu Kencana (GWK).

Key Points

• Remains focus on mid to high segment in Greater Jakarta

ASRI’s projects are mainly targeting the middle to high segment customers, generated from its two townships, Alam Sutera Township and Suvarna Sutera Township, located in Tangerang, Greater Jakarta. As of end of March 2023, the Elevee Penthouses and Residences in Alam Sutera Township managed to accumulate a total of Rp909 bn marketing sales since it was launched in 1Q21. Other main projects, including landed residential named Winona Cluster, located also in Alam Sutera Township.

• Healthier debt profile through currency hedging

ASRI has refinanced its 2024 bonds through tender offer resulting in an improved debt maturity profile and a more balance debt structure. As of December 2022, the remaining bond is the 2025 bonds amounting to USD251 mn with coupon rate of 6.25% p.a. ASRI also has entered into a total of USD120 mn Non Deliverable USD Call Spread Option with various USD/IDR spread from 14.250 up to 16.500. Going forward, the Company is planning to add more hedges.

• Upgrade to BUY with TP of Rp210/sh

We apply last 4-year mean discount to RNAV of 83% resulting to 2024F TP of Rp210/sh. Our TP offers more than 10% upside from last closing price therefore we upgrade to BUY rating.

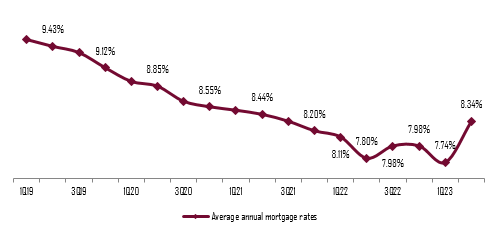

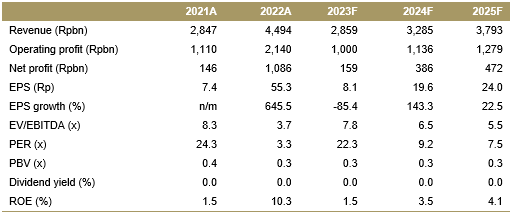

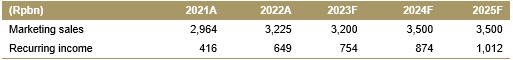

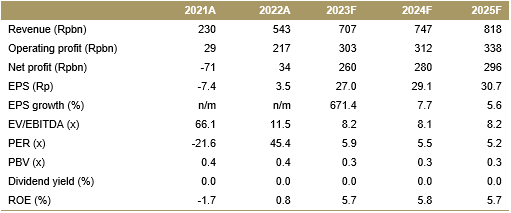

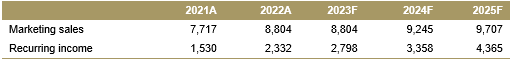

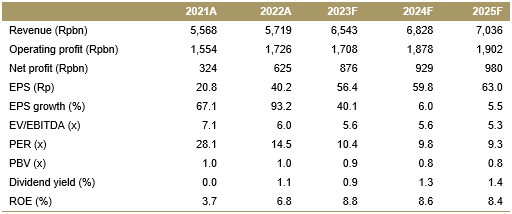

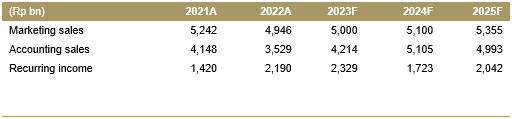

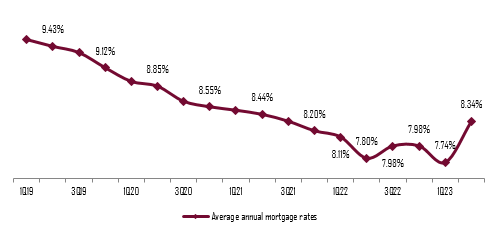

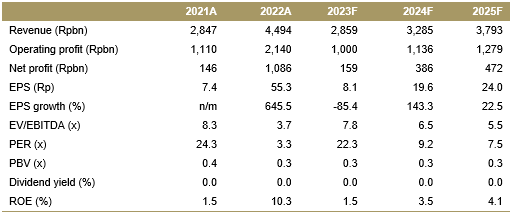

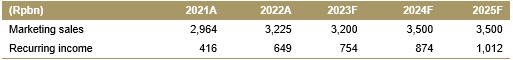

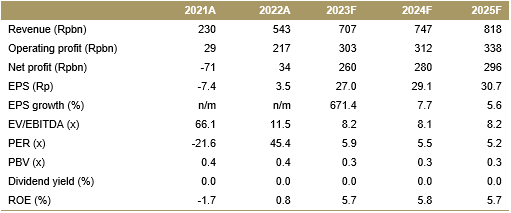

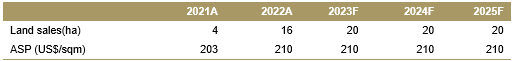

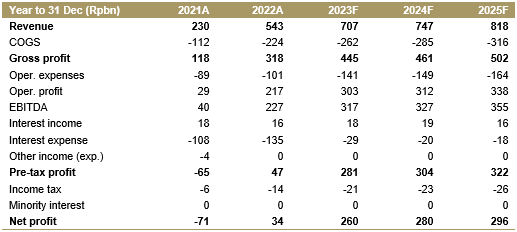

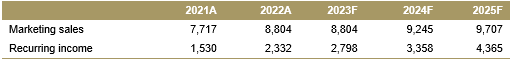

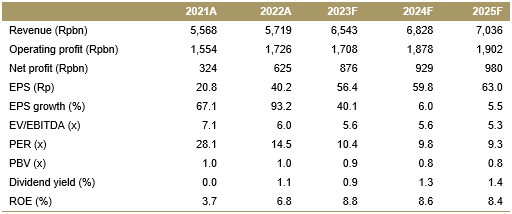

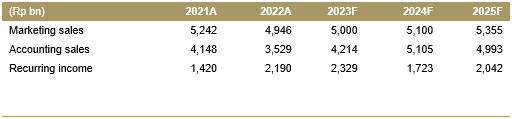

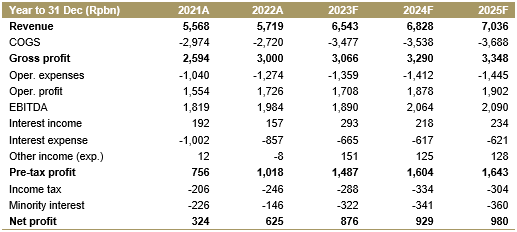

Financial Highlights

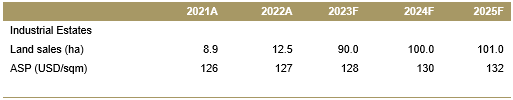

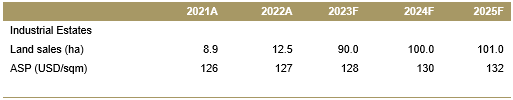

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

Alam Sutera Realty

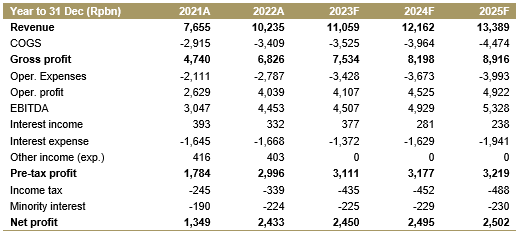

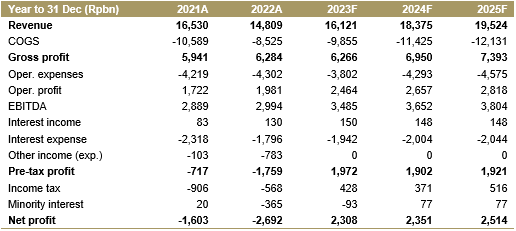

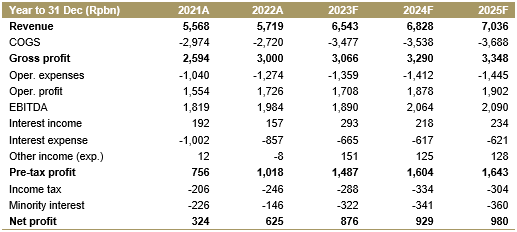

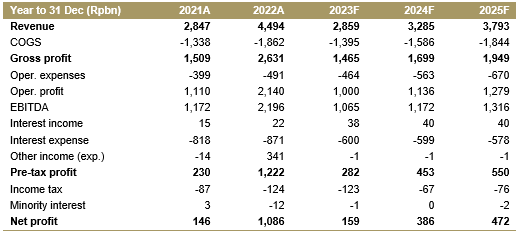

Income Statement

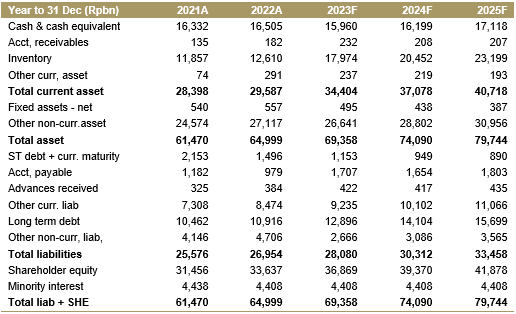

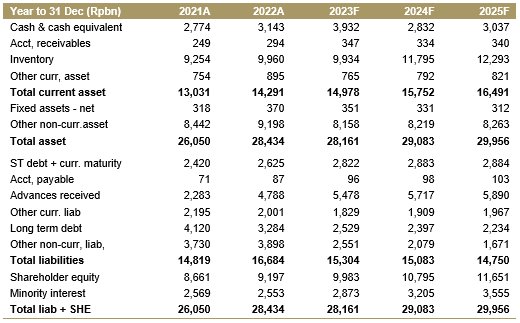

Balance Sheet

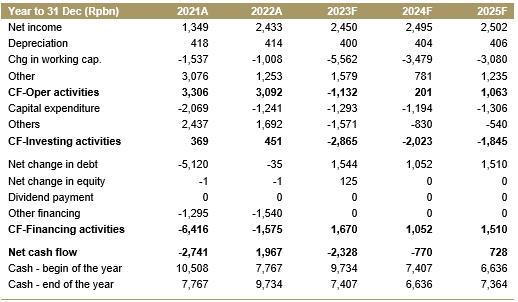

Cash Flow

Key Ratios

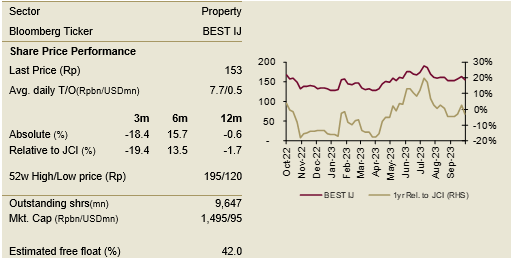

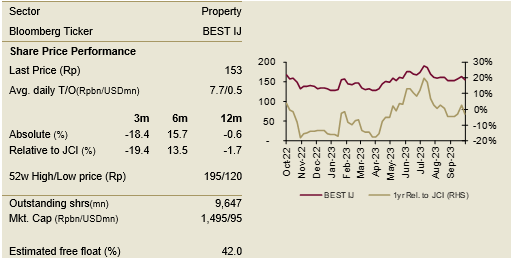

Bekasi Fajar Industrial Estate

BUY TP: Rp210 (+37.3%)

Company Profile

Bekasi Fajar Industrial Estate (BEST) is a developer and operator of MM2100 Industrial Town located in Greater Jakarta. MM2100 offers a limited number of industrial land lots for purchase and ready-to-use Standard Factory Buildings (SFB) that are suitable for light and medium industry needs with average size of around 1,000m2 per unit.

Key Points

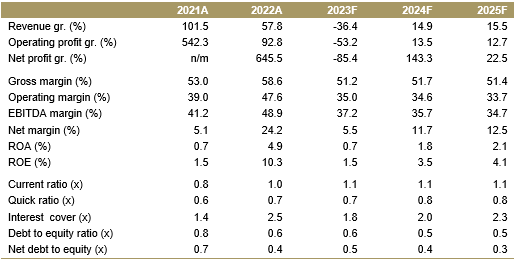

• Higher profitability from hotel segment

Revenue from land sales rose in 1Q23, accounting for 79% of total consolidated revenues. In line with higher land sales, maintenance fee (including service charge, water and rental) segment also increased while hotel revenues improved.

• Slow marketing sales in 1Q23 however land inquiry remains high

BEST booked slow marketing sales in 1Q23, below-than-expectation, as it was only representing 7.8% of FY23 target of Rp651 bn. The company generated the land sales from warehouse/logistics and automotive sectors with ASP of Rp2.9 mn/sqm. Nevertheless, we believe land sales should pick up in subsequent quarters judging from high level of land inquiry which reached 77 ha as of end of March 2023, signalling persistent demand in industrial estate sector. As of end of the 1Q23, BEST’s land bank amounted to 688 ha (declining from 699 ha net a year ago).

• Maintain BUY with TP of Rp210/sh

We applied 67% discount (last 5-year average) to our NAV and arrived at 2024F TP of Rp210/sh. Our TP offers more than 25% upside from last closing price therefore we maintain BUY rating.

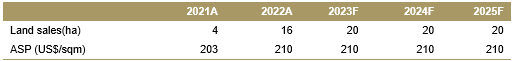

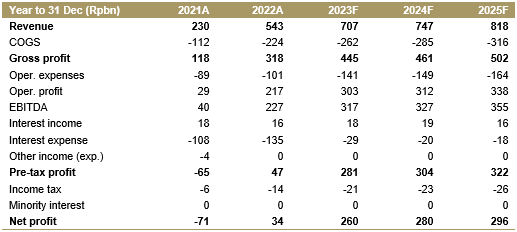

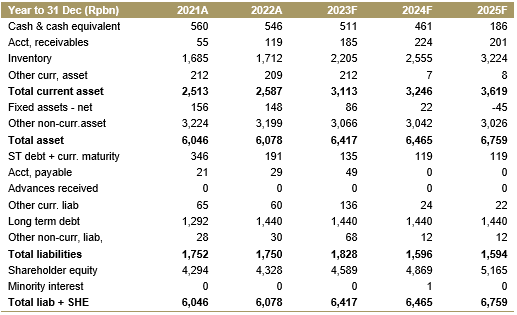

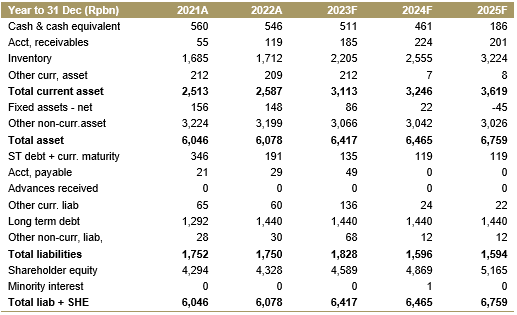

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

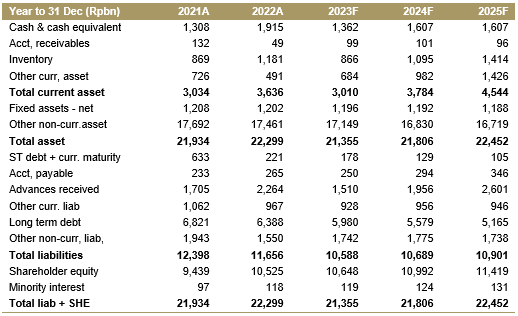

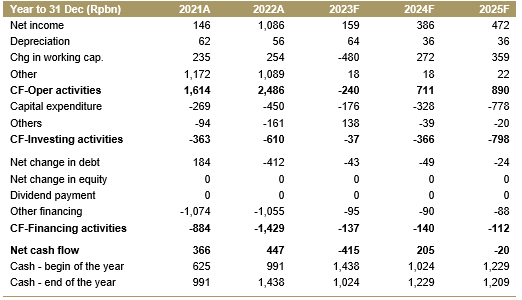

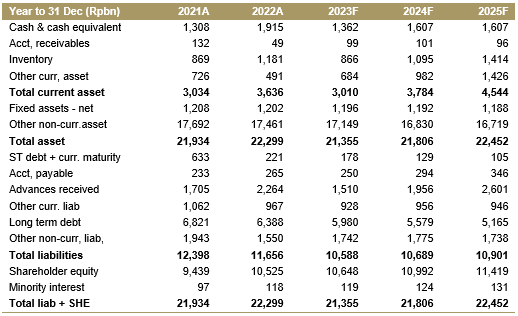

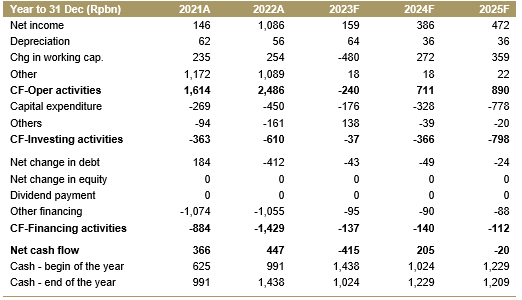

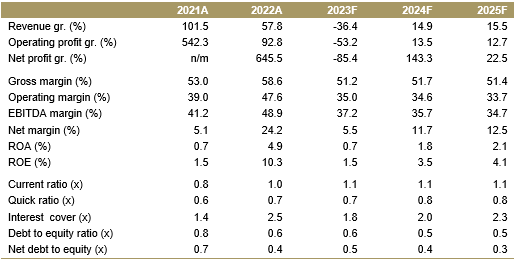

Bekasi Fajar Industrial Estate

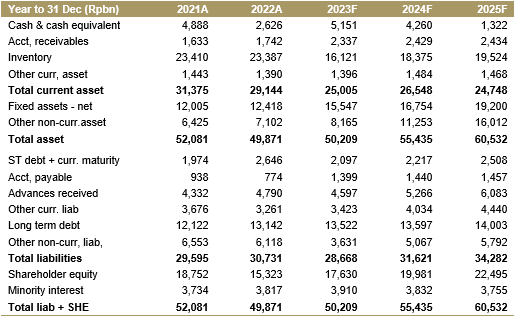

Income Statement

Balance Sheet

Cash Flow

Key Ratios

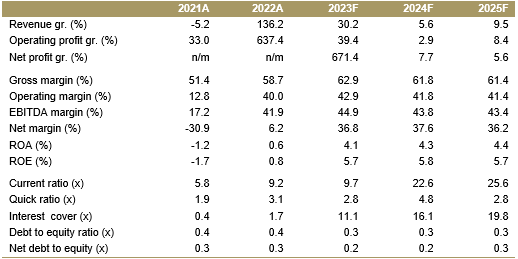

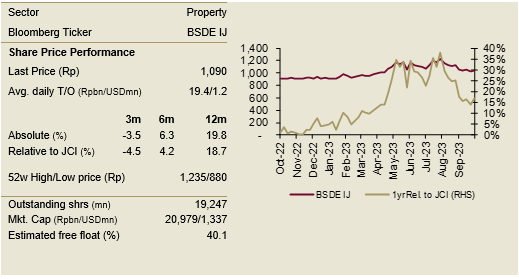

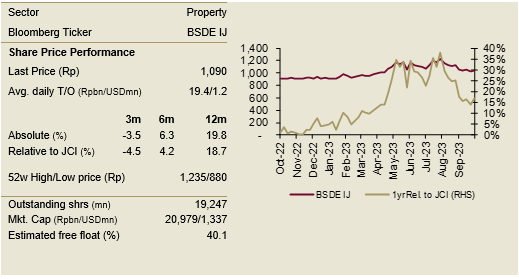

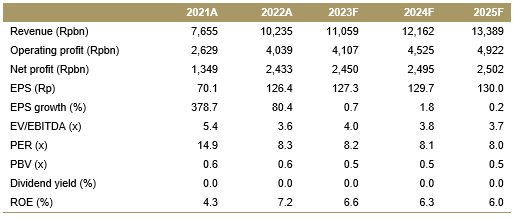

Bumi Serpong Damai

BUY TP: Rp1,380 (+26.6%)

Company Profile

BSDE is one of the largest developers in Indonesia with total area of 5,950 ha. The main portfolio is situated in Greater Jakarta, Jakarta CBD and East Jakarta. BSDE has diversified its portfolio into other major cities throughout Indonesia such as Surabaya, Kalimantan, Manado, Palembang, and Semarang.

Key Points

• Stronger property sales mainly supported by residential products

Property sales segment mainly contributed by residential products due to handover seasonality. Revenues from landed houses were mainly coming from BSD City, in addition to other major township projects such as Grand Wisata Bekasi and Kota Wisata Cibubur. The second largest revenues came from commercial products (apartments and shop houses), mainly due to solid result of shop houses sales.

• Marketing sales on track in 2023

BSDE booked excellent marketing sales in 2Q23. Landed house sales contributed the most in 2Q23 (around 58% proportions), while commercial lot and shop house showed a significant jump. As such, the 1H23 cumulative marketing sales improved by 2.6% YoY and equal to 54% of company’s FY23 target of Rp8.80 tn, set. In 1H23, the residential products generated Rp3.02 tn marketing sales, or 63% contribution to total achieved while commercial projects (including commercial lots, apartments and shop houses), contributed as much as Rp1.78 tn, representing 37% contribution to total marketing sales.

• Maintain BUY with 2024F TP of Rp1,380/sh

We apply 72% (+0.5 SD of 5-year mean) discount to RNAV and arrive at 2024F TP of Rp1,380/sh. Our TP currently offers more than 25% upside therefore we maintain BUY rating.

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

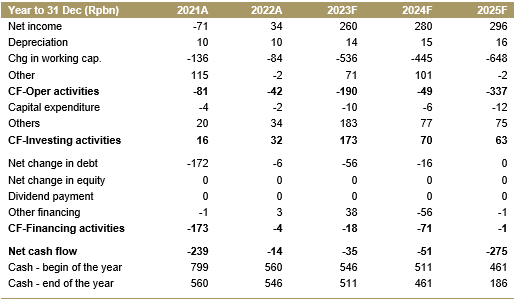

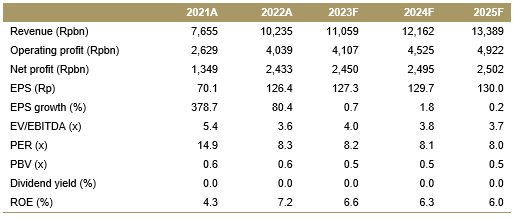

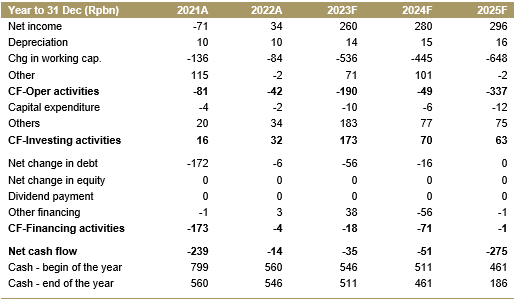

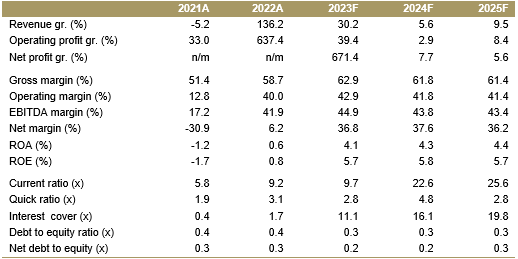

Bumi Serpong Damai

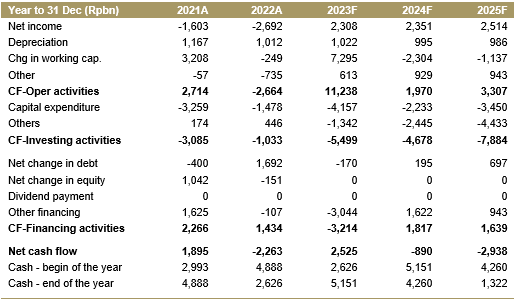

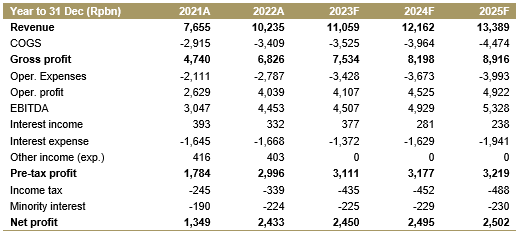

Income Statement

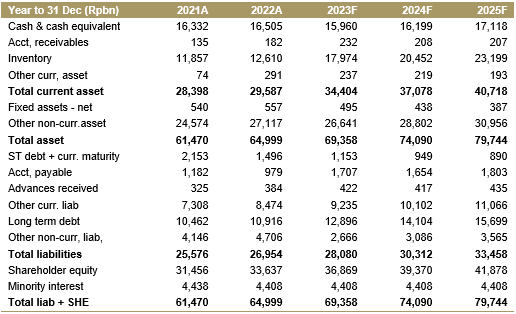

Balance Sheet

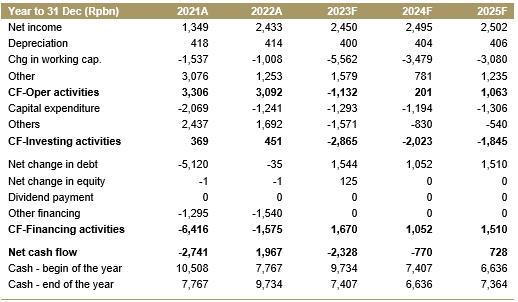

Cash Flow

Key Ratios

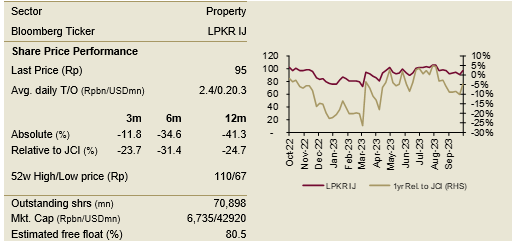

Lippo Karawaci

BUY TP: Rp150 (+56.3%)

Company Profile

Lippo Karawaci (LPKR) is Indonesia’s largest listed property company by total assets and revenue. It operates a hospital group and a retail property developer. LPKR’s portfolio comprises Residential and Urban Development, Hospitals, Malls, Hotels & Leisure and Asset Management.

Key Points

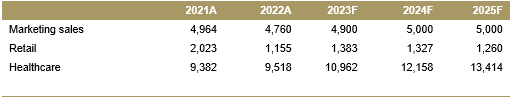

• Real Estate and Healthcare deliver double digits revenues’ growth

Real estate revenue mainly driven by timely project handovers, including Cendana Parc North, Cendana Parc, Cendana Icon Premier, the Hive Parc, the Hive Himalaya, Brava Himalaya, HVDHC Manado, Waterfront Estates in Lippo Cikarang and residential projects in Tanjung Bunga, Makassar.

• The room for further earnings improvement in Healthcare remained open given: 1) company focus on the top craft groups which consistently being the growth machine, 2) company focus on high intensity cases resulting in higher margin, 3) larger digital processing and digital channels for customers, and 4) improving economies of scales along with growing traffic.

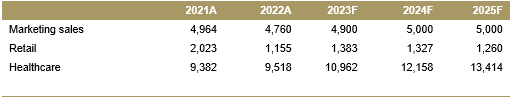

• LPKR reports strong 1H23 marketing sales

Residential sales remain the major contributor to overall marketing sales, supported by several product launches including a new designer home product named The Colony at Himalaya and additional clusters of Cendana Homes in Lippo Village.

• Maintain BUY with 2024F TP of Rp150/sh

We apply 78% discount (-0.5 SD of 5-year mean) to NAV and arrive at TP of Rp150/sh for the 2024F. Our TP offers more than 40% upside from last closing price therefore we maintain BUY rating.

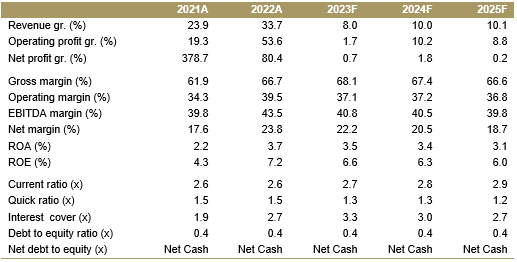

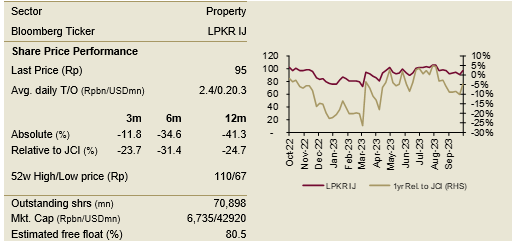

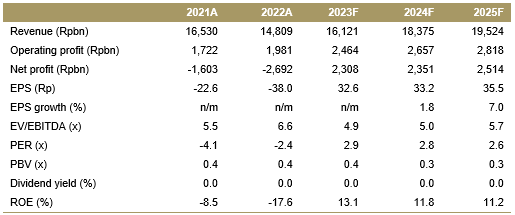

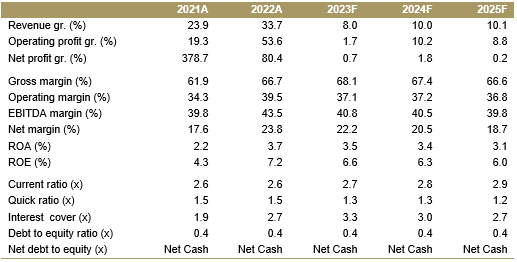

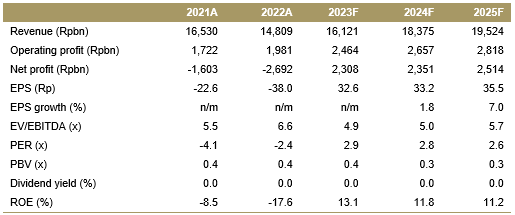

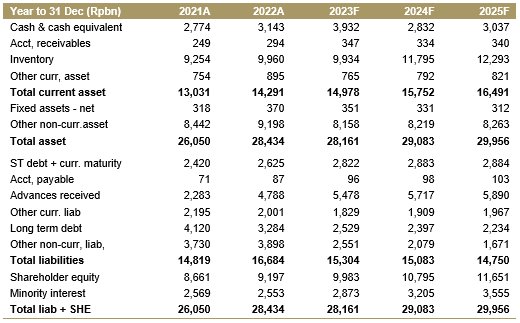

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

Lippo Karawaci

Income Statement

Balance Sheet

Cash Flow

Key Ratios

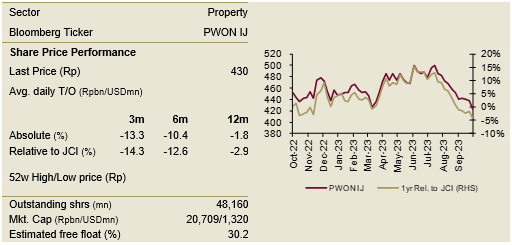

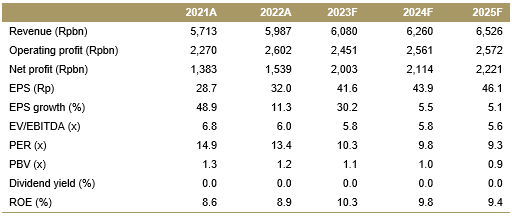

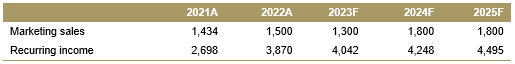

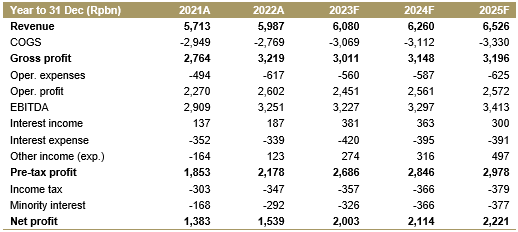

Pakuwon Jati

BUY TP: Rp560 (+30.2%)

Company Profile

Pakuwon (PWON) targets 50/50 recurring/development revenue mix over the long term with growth strategies including: a) Leveraging its strength in retail malls and superblock developments; b) Continue to dominate Surabaya property sales while expand Greater Jakarta portfolio; and c) 467.4 ha of land bank to sustain growth and high margins.

Key Points

• Marketing sales improve in 2Q23 but still far from target

Marketing sales have been challenging in 2023. For 2H23, PWON has planned to launch three new condominium projects, namely Bella Tower and Dolce Vita in Pakuwon Residence Bekasi, Greater Jakarta, and Lancaster Tower in Superblock Pakuwon Mall, Surabaya, all scheduled for completion by 2027.

• Maintains organic growth in recurring income

PWON has a strong rental income base and records excellent growth during the postpandemic recovery period. The Company is targeting to increase its NLA from the current 784 k sqm to 884 k sqm by 2027 (+12.8% growth) from the expansion of Pakuwon City Mall 3 in Surabaya, Pakuwon Mall Bekasi and Kota Kasablanka Phase 4 in South Jakarta. For its office space, the company projected a 7.1% area growth from currently 155 k sqm to 166 k sqm in 2027, coming from Gandaria Office 2 in South Jakarta. Meanwhile, from the hotel segment, room addition will come from the operation of Aloft Surabaya 4-star hotel, Four Points and Fairfield Bekasi 4-star hotel and Kota Kasablanka 5-star and 4-star hotel.

• Maintain BUY with 2024F TP of Rp560/sh

We apply a 75% (last 5 years average) discount to NAV to arrive at 2024F TP of Rp560/sh. Our TP offers more than 30% upside from the last closing price, therefore we maintain our BUY rating.

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 7999 soulisayasmin@ciptadana.com

Pakuwon Jati

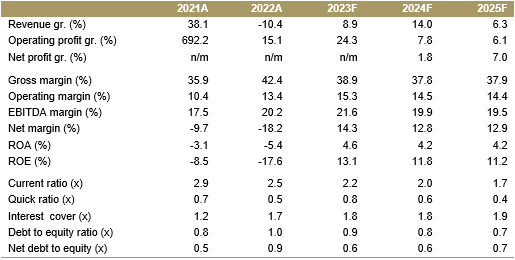

Income Statement

Balance Sheet

Cash Flow

Key Ratios

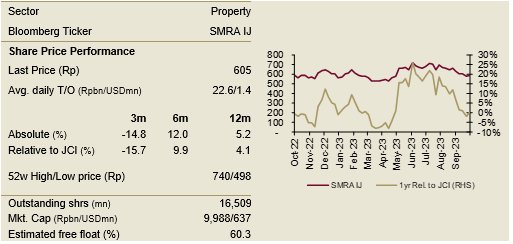

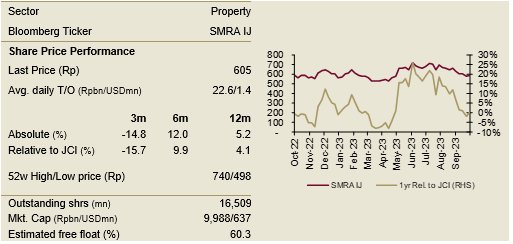

Summarecon Agung

BUY TP: Rp1,010 (+66.9%)

Company Profile

Summarecon Agung (SMRA) is the developer of one of the first and successful integrated residential townships in Jakarta, namely Summarecon Kelapa Gading. Currently company’s portfolio comprises of townships located at Greater Jakarta, West Java and outside Java, such as Bali and Makassar.

Key Points

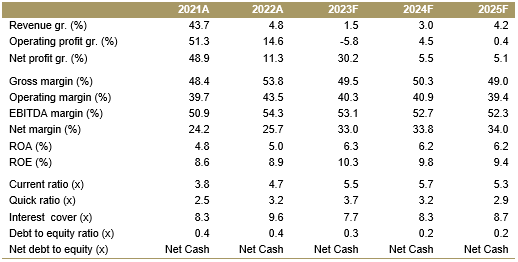

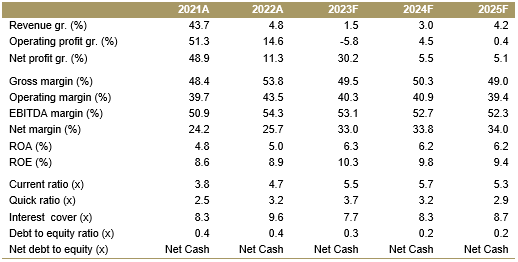

• Recurring incomes continue to drive revenue growth

Portion of property sales/recurring income portion shifted to 59/41 in 1H23, compared to 64/36 in 1H22. Contribution from recurring income increased as investment properties segment grew 23.7% YoY to Rp1.22 tn, while leisure & hospitality jumped 63.7% YoY to Rp212 bn and other recurring incomes improved by 7.3% YoY to Rp187 bn.

• Slow marketing sales in 1H23

SMRA marketing sales showed significant improvement in 2Q23, increasing 46.6% QoQ and 9.0% YoY to Rp960 bn. The strong quarterly performance is mostly contributed by sales of landed housing and shop houses, including the launching of Cluster Strozzi in Summarecon Serpong. However by cumulative, the 1H23 marketing sales still decreased by -30.3% YoY to Rp1.61 tn, achieving only 32% of the FY23 target. As such, we are less optimistic that the company will meet its marketing sales target of Rp5.0 tn this year. Summarecon Serpong remains the breadwinner, contributing as much as 40% to total pre-sales.

• Maintain BUY rating with new 2024F TP of Rp1,010/sh

We apply 72% (last 5-year mean) discount to RNAV which arrive at 2024F TP of Rp1,010/sh. Our TP offers more than 50% from last closing price therefore we maintain BUY rating for SMRA.

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

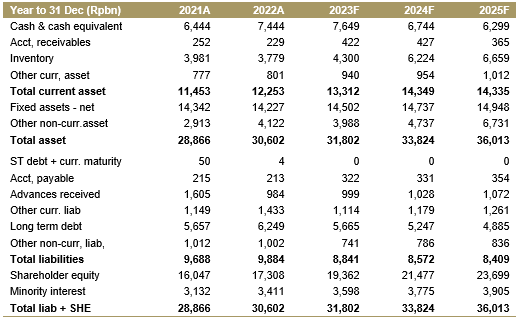

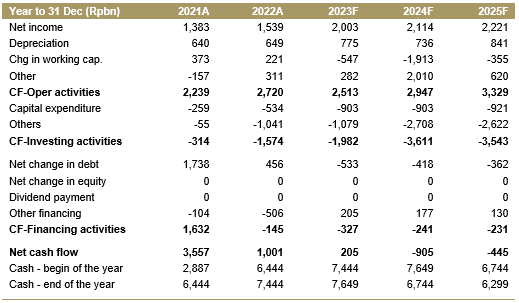

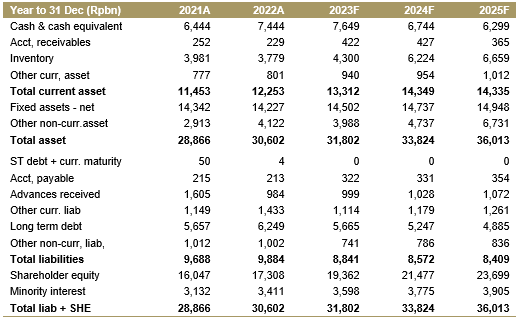

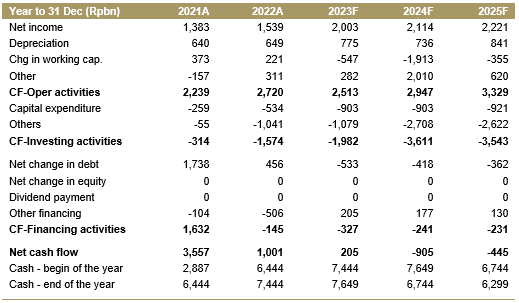

Summarecon Agung

Income Statement

Balance Sheet

Cash Flow

Key Ratios

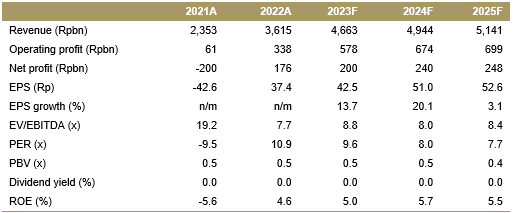

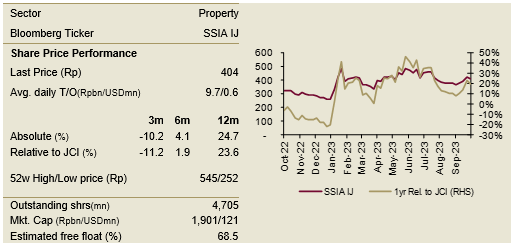

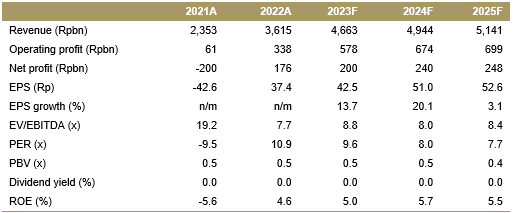

Surya Semesta Internusa

BUY TP: Rp630 (+55.9%)

Company Profile

Surya Semesta Internusa (SSIA) established and commenced operations in 1971 with primary businesses are construction, property and hospitality sectors. SSIA most recent development is Subang Smartpolitan, an integrated industrial area close to Patimban Port.

Key Points

• Bullish marketing sales target of 90 ha in FY24

We aimed an optimistic marketing sales target of 90 ha in FY24, in line with infrastructure development in the area. In 1Q23, land inquiries for Karawang and Subang increased significantly therefore SSIA expected land sales recognition to grow 50% YoY by the end of this year. The Company is focusing on Subang Smartpolitan’s land and infrastructure development in order to begin operations in 3Q24. Last year, SSIA sold 15 units of landed house in Edenhaus Township Simatupang, South Jakarta, while the rest of the 7 units are expected to be sold in FY23.

• Consortium 4 state owned companies for Patimban Access Toll Road

On 24 January 2023, SSIA’s construction arm, PT Nusa Raya Cipta Tbk (NRCA), together with PT Jasa Marga Tbk, PT Adhi Karya Tbk, PT PP Tbk, PT Wijaya Karya Tbk and PT Subang Sejahtera under PT Jasamarga Akses Patimban (Toll Road Business Entity/consortium) signed a Toll Road Concession Agreement with the Toll Road Regulatory Agency of the Public Works Ministry to build and operate Patimban Access Toll Road.

• Maintain BUY, higher TP Rp630/sh

We applied 70% (5-yr mean) discount to NAV which resulted to 2024F TP of Rp630/sh. Our TP still offers more than 80% upside from last closing price therefore we maintain BUY rating.

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

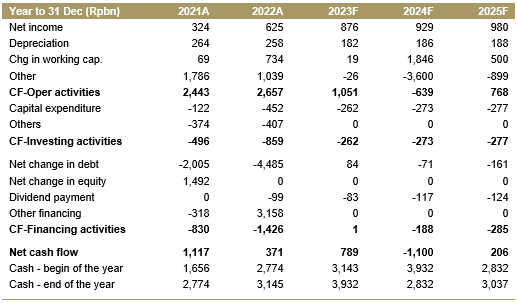

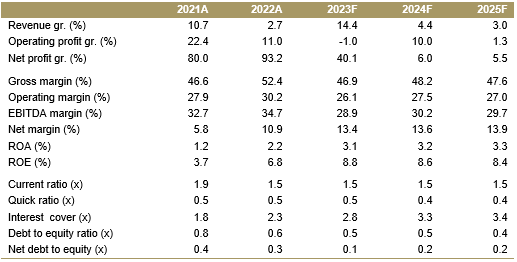

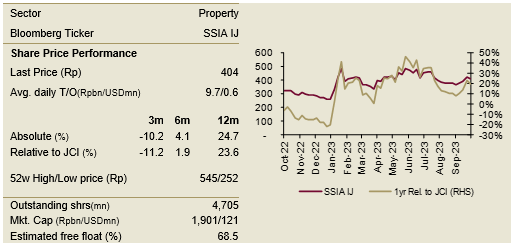

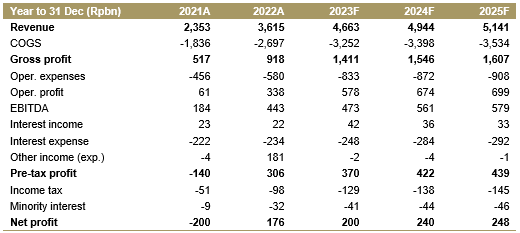

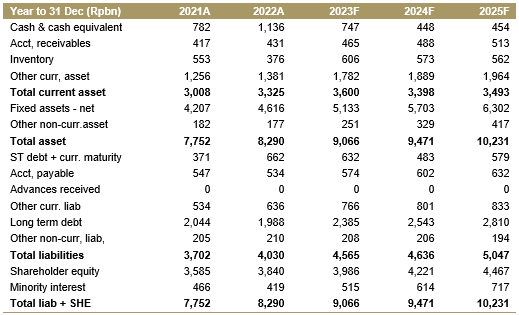

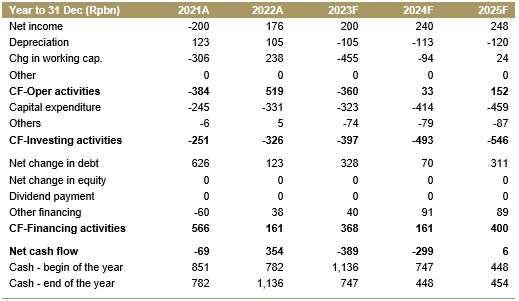

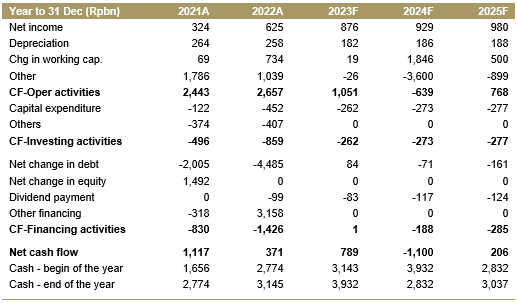

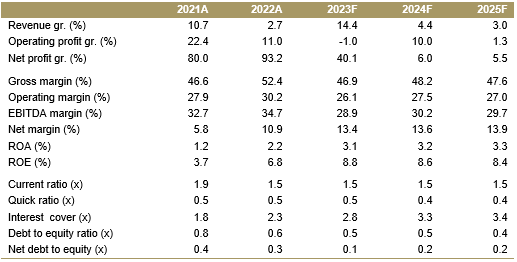

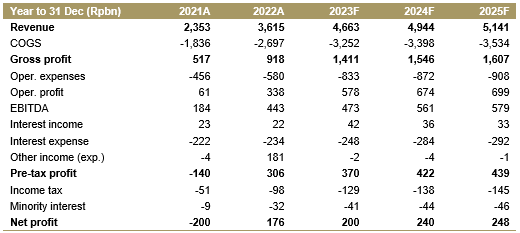

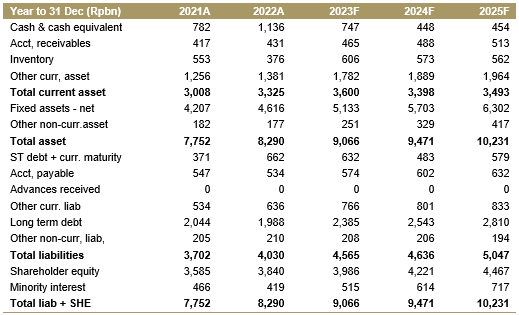

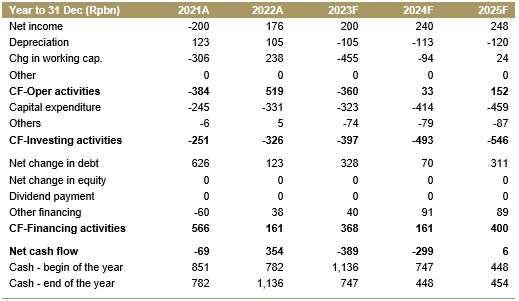

Surya Semesta Internusa

Income Statement

Balance Sheet

Cash Flow

Key Ratios