Plantations

Neutral

Sector Outlook

• Palm oil : the world’s largest consumed vegetable oil

The global palm oil market size is expected to reach USD100 bn by 2030, expanding at 5.1% CAGR from 2023 to 2030.The growth is driven by increasing demand for food applications and eco-friendly, organic, and sustainable products. Personal care products and cosmetic industries are also major sectors accountable for the growth of the palm oil industry. Asia Pacific region is the largest consumer of palm oil owing to its key application for food preparation in the region.

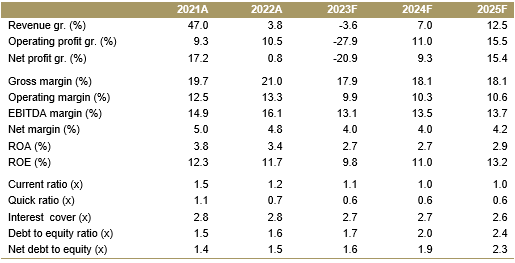

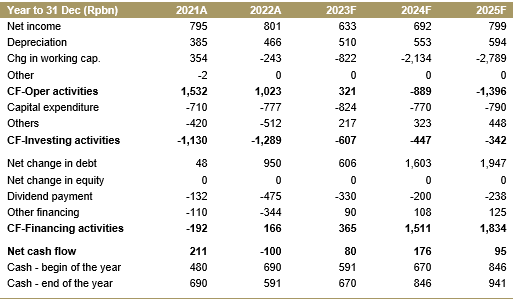

Exhibit 157: Palm oil global consumption percentage reaches 35% in 2022

Source : USDA, Ciptadana Estimates

Palm oil remains the most popular due to its easy economic availability worldwide and manufacturing ease and is expected to expand over the forecast period owing to its extensive utilization by the people.

• Higher palm oil demand from biodiesel usage

Biofuel and energy end-use of palm oil are expected to grow rapidly with a CAGR of 5.3% from 2023 to 2030. This is owed to the increasing consumption of palm oil for the production of biofuel which is expanding its product portfolio through advancement in technology through research and development. As of 2023, Indonesian Government mandated 35% of blending (B35) with expectation to increase gradually.

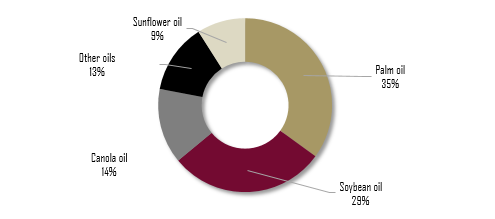

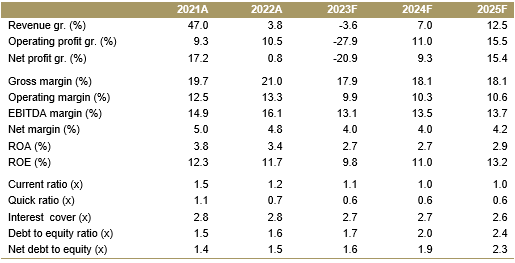

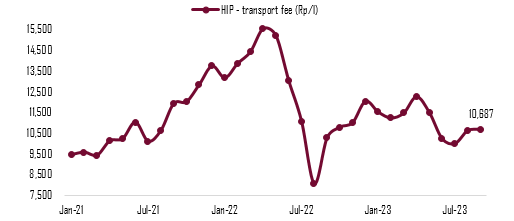

Exhibit 158: Indonesia’s biodiesel index price

Source : EBTKE, Ciptadana Estimates

• CPO fund to offset biodiesel premium over crude oil

To subsidize the gap between cheaper fossil fuel and the biodiesel price, Indonesian Government set up Indonesian Palm Oil Plantation Fund Management Policy (BPDPKS) or CPO fund. The CPO fund is committed to support the oil palm plantation sector as one of the national strategic commodities. After peaked in mid-2022, the biodiesel index price (HIP) has stabilized in 2023 in line with global CPO price, which helped relieved the burden of CPO fund.

The Biodiesel Index Price (HIP) is calculated by adding USD85/ton to local CPO price plus transport fee. For September 2023, HIP was set at Rp10,687/l + transport fee.

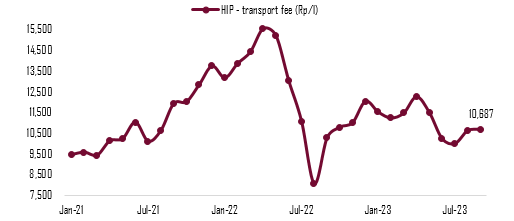

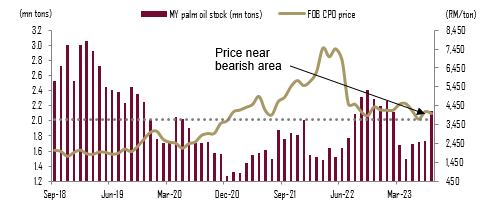

• Domestic demand still needs a boost as production and export recover

According to Malaysian Palm Oil Board (MPOB), CPO production in 8M23 amounted to 11.4 mn tons, declined -1.1% YoY, signaling further yield recovery. Post pandemic, palm oil exports slightly decreased -1.4% YoY to 9.66 mn tons up to end of August 2023. Lower domestic demand in Malaysia also contributed to higher palm oil inventory. As of end of August 2023, Malaysian palm oil closing stock soared 22.5% YoY higher at 2.12 mn tons which pinned the commodity price as shown in Exhibit 159. Growing inventory level posted a threat against CPO price to climb to higher level.

Exhibit 159: Malaysia palm oil statistics

Source : MPOB, Ciptadana Estimates

• Global CPO price stay at average RM4,500/ton in 2024

Monthly palm oil inventory levels in Malaysia throughout 2023 mostly higher than the 5-year average of 1.98 mn tons. Therefore, we believe global CPO price will remain at bearish area in 2023 and 2024. We projected that edible oil prices likely to decelerate in the 2H23 as production increases and start to normalize in the beginning of 2024 post the peak harvest. We forecast global CPO price in 2024 will stay at average RM4,500/ton, increased 15% compared to the 2023F of RM3,900/ton, however lower than the average price in 2022. Risks to our call include: i) extreme weather in 2023/24, ii) higher-than-expected production recovery and iii) changes in palm oil regulation.

Exhibit 160: Indonesian palm oil statistics

Source : GAPKI, Ciptadana Estimates

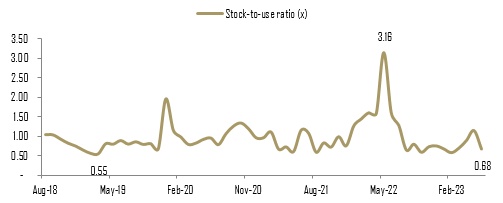

• Temporary export ban causes inventory build up

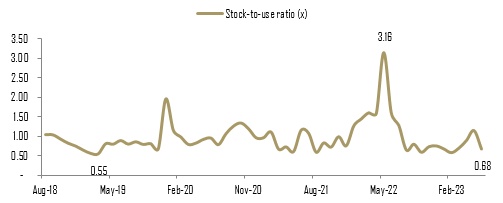

Due to rising supply in mid-2022 and a month-long export ban, Indonesia palm oil stocks-to-use ratio increased dramatically to highest record of 3.16x by May 2022. Fortunately, following the reverse of the export ban, the ratio retreated to 0.68x as of June 2023 which hopefully would stabilize the price volatility. We expect the ratio of inventory to overall consumption will remain at <0.80x in 2023 and 2024 with no more extreme government intervention to the palm oil open market.

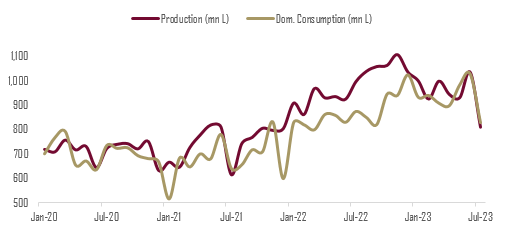

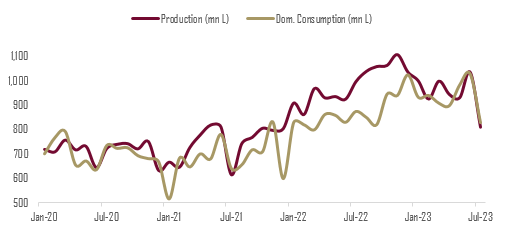

• Uptrend in biodiesel usage

Until end of July 2023, Indonesian biodiesel domestic consumption has increased by 26.4% YoY to 5.86 mn L while exports jumped 76.6% YoY to 74 kL, in line with 28.8% YoY higher national biodiesel production to 6.52 mn L. As shown in Exhibit 160, parallel to higher mandatory blending, the biodiesel usage has continued to increase in recent years. We expect the uptrend will remain in 2023 as fossil fuels become less and less favorable with biodiesel gains popularity. Other than reduces carbon emissions, the use of biodiesel also brings positive impact on Indonesian foreign exchange reserves. Currently Indonesia is poised for the B40 implementation.

In Exhibit 162 we can see biodiesel statistic of Indonesia. Both production and consumption gained traction throughout the years, supported by Indonesian biodiesel blending program which continue to increase. As the world’s largest producer of palm oil, the Government of Indonesia needs to establish a strong demand for the commodity to balance the need to export. The Indonesian Government allocated biodiesel quota to several domestic FAME (biodiesel component) producers through Ministry Decree, which rises annually to ensure the supply of biodiesel, with one of the companies is Tunas Baru Lampung (TBLA).

Exhibit 161: Increasing production and consumption of biodiesel in Indonesia

Source : APROBI, Ciptadana Estimates

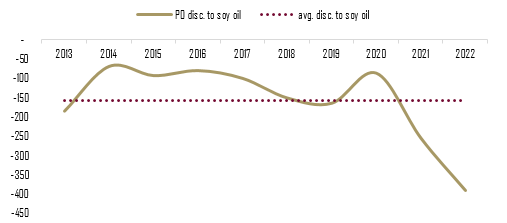

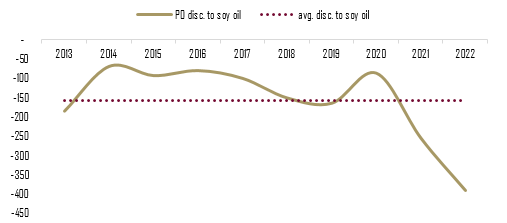

As seen on Exhibit 162, the discount of palm oil price to soybean oil widened since mid-2020 which continue throughout 2022. By the end of September 2022, the price of CPO was USD265/ton cheaper compared to its closest substitute. This should be a positive note for the CPO industry as it should leave an ample room for price increase. For the last 10 years, the average discount of CPO price to soybean oil is USD194/ton, or 26.4% lower compared to latest discount. Though we expect the CPO price will stay flat at RM3,900/ton in 2023, the larger discount should contribute as a bumper to ensure the competitive advantage of CPO.

Exhibit 162: Palm oil price discount to soybean oil

Source : World Bank, Ciptadana Estimates

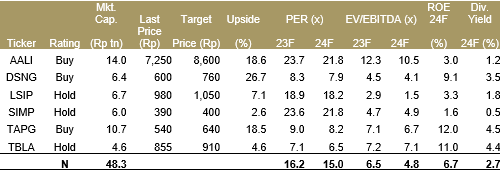

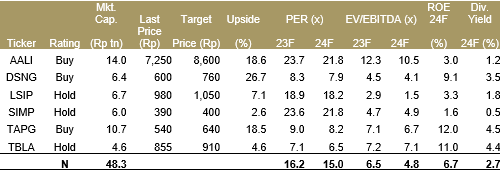

• Top picks: AALI, DSNG, TAPG and TBLA

We maintain NEUTRAL on plantation with our top picks including AALI, DSNG and TAPG. In term of production, AALI has shown stable FFB yield each year amidst rigorous replanting activities. We also still like DSNG and TAPG as their young palm oil trees are promising higher yield growth and their commitment to ESG.

Exhibit 163: Plantation stock rating and valuation

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

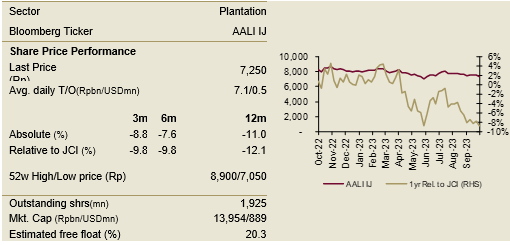

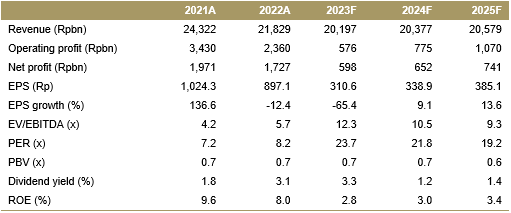

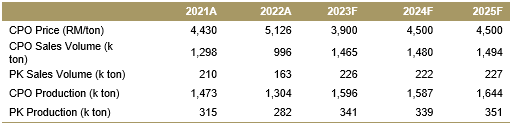

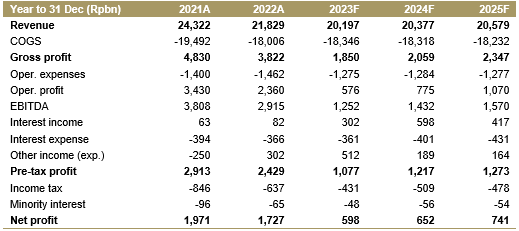

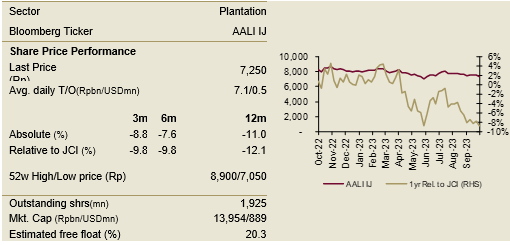

Astra Agro Lestari

BUY TP: Rp8,600 (+18.6%)

Company Profile

Astra Agro Lestari (AALI) has a total plantation area of 287,044 ha spread across Sumatra, Kalimantan and Sulawesi. AALI has expanded its business lines into integrated palm oil sectors, including a cattle-in-palm business and NPK (fertilizer) blending plant.

Key Points

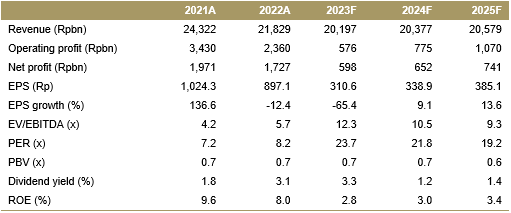

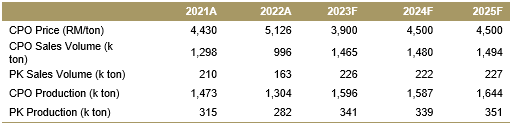

• Sluggish CPO price in 2023F/24F while production on track

AALI’s poor revenues happened mainly because of lower-than-expected global CPO price this year. In term of production, AALI FFB and CPO production underperformed our FY23 estimate though we saw YoY improvement in 8M23. The FFB and CPO production amounted to 2.97 mn tons and 875k tons, rose 8.2% YoY and 1.6% YoY, respectively. Other palm oil products, such as olein climbed by 37.5% YoY to 270k tons, while kernel and PKO production each rose 1.9% YoY and 7.7% YoY to 188k tons and 29k tons, respectively.

• El Nino could be a catalyst to launch price upward

Indonesia implements higher blending of biodiesel at 35% or B35 since 2023. The move should support domestic demand of palm oil hence helped maintain the CPO price. We forecast flat global CPO price of RM3,900/ton in 2023F and RM4,500/ton in 2024F. BMKG has predicted 50% to 60% chance of El Nino happening in 2H23 where extreme weather historically leads to stronger price.

• Maintain BUY rating with TP of Rp8,600/sh

We applied multiple PE of 25.1x (+1SD of last 5-yr mean), resulted to 2024F TP of Rp8,600/sh. Due to recent downturn in the stock price, our TP still offers more than 10% upside from last closing price therefore we reiterate our BUY rating.

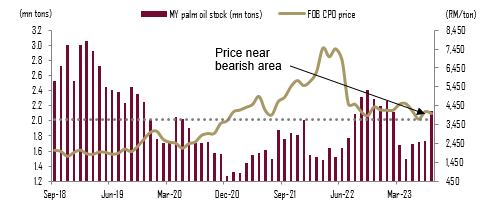

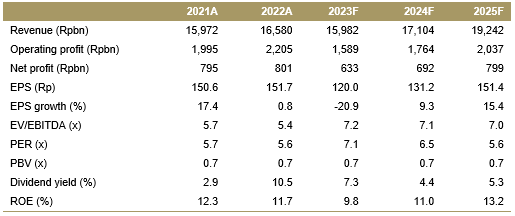

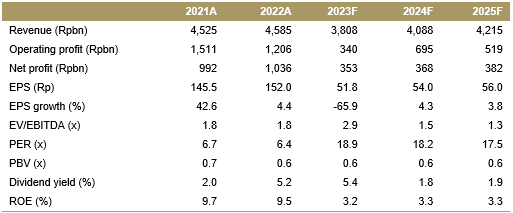

Financial Highlights

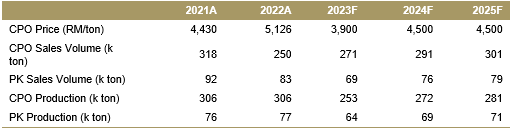

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 7999 soulisayasmin@ciptadana.com

Astra Agro Lestari

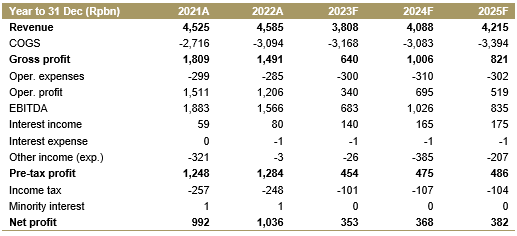

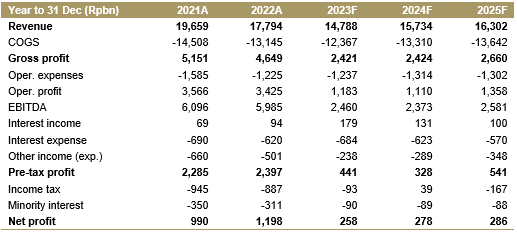

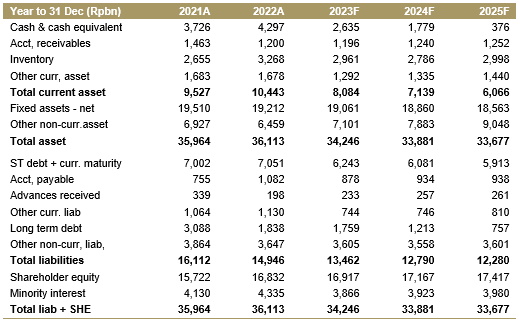

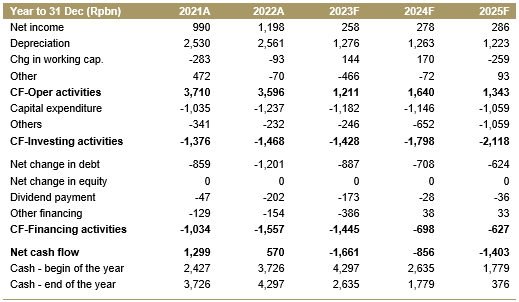

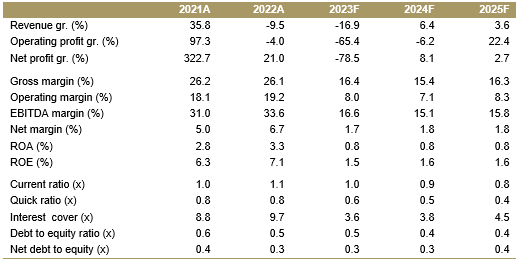

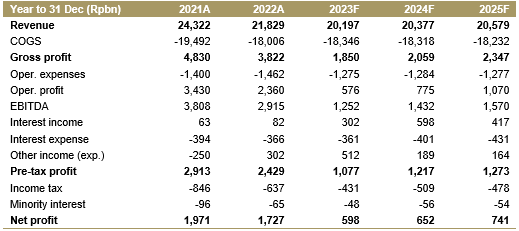

Income Statement

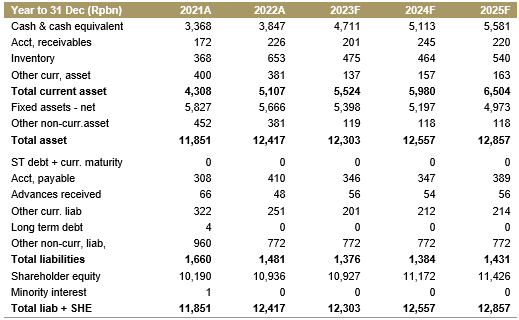

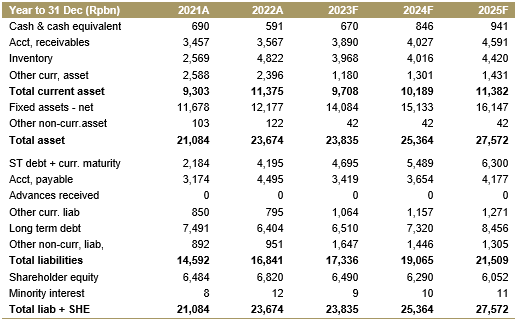

Balance Sheet

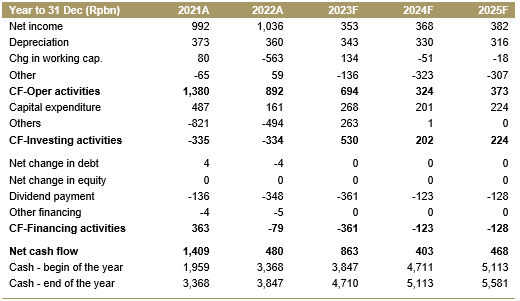

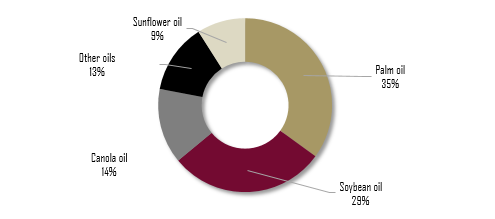

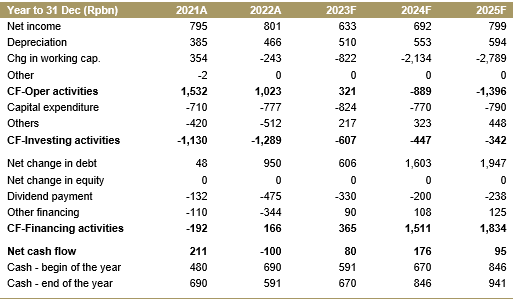

Cash Flow

Key Ratios

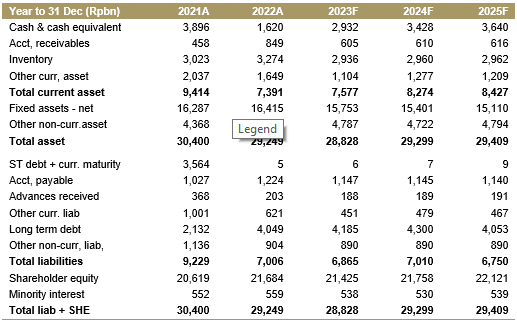

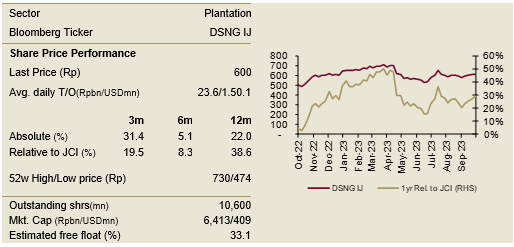

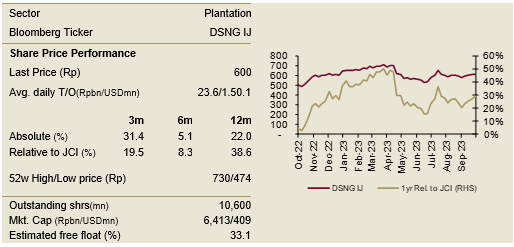

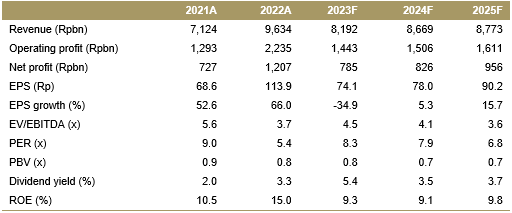

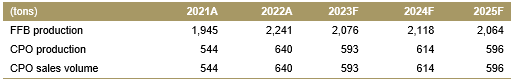

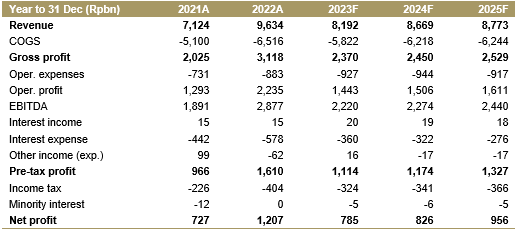

Dharma Satya Nusantara

BUY TP: Rp760 (+26.7%)

Company Profile

Dharma Satya Nusantara (DSNG) has two main businesses, plantation and wood products. Currently, DSNG manages palm oil plantation in East Kalimantan and operates 10 palm oil mills. As of June 2022, the company’s total planted area, including nucleus and plasma, reached 112,800 ha, with an average age of 12.8 years.

Key Points

• Towards more plantation mechanization

The company engages in mechanical harvesting by operating crane grabbers to collect FFB from the ground. The collected fruits are loaded into Bio-CNG truck using scissor lift. The mechanical process is cheaper as it costs only Rp140,316/ton FFB compared to manual operation of Rp143,365/ton FFB.

• Turning waste into bio-CNG

DSNG commissioned the first bio-CNG Plant in Indonesia for the palm oil industry. The electricity from the gas generators is used to power in-situ Palm Kernel Crushing Plant (KCP) which had previously depended on diesel generators for power. The bio-CNG gas is secured safely in gas containers for mobility to transport around our plantation. The containers of bio-CNG gas are distributed to several sites in plantations where it is used to replace fossil fuels typically in electricity generators, as well as in transportation vehicles.

• Maintain BUY with 2024F TP Rp760/sh

Our concern remained to the lacklustre of global CPO price. We apply multiple PE of 9.7x (5-year average) and arrive at 2024F TP of Rp760/sh. Our TP still offers more than 15% upside from last closing price therefore we maintain our BUY rating.

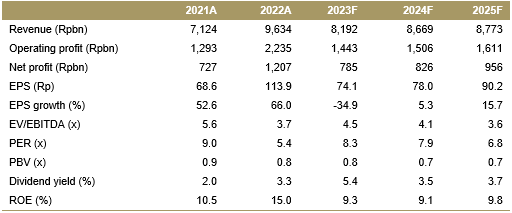

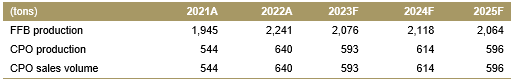

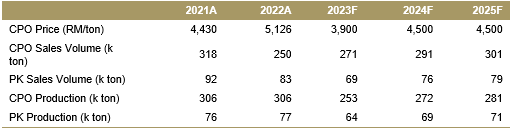

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

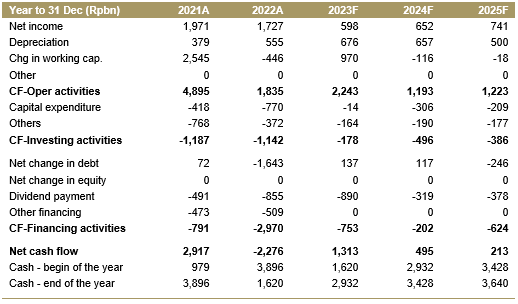

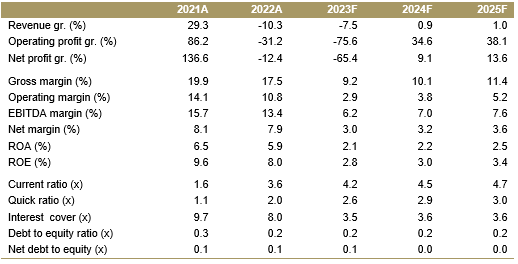

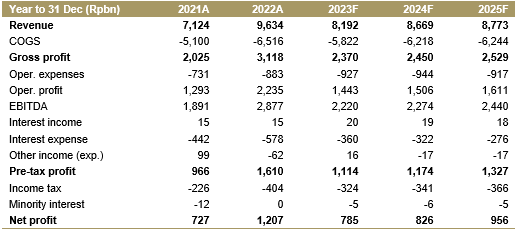

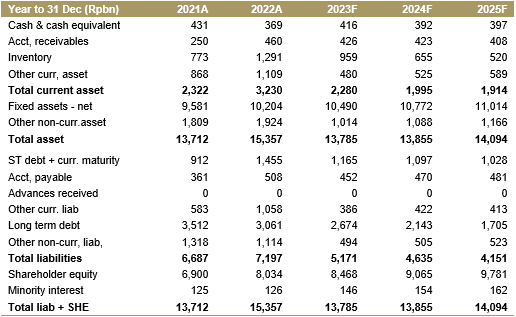

Dharma Satya Nusantara

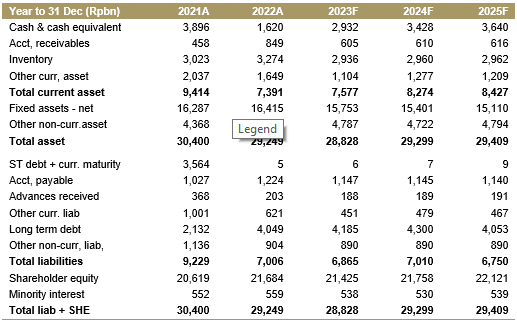

Income Statement

Balance Sheet

Cash Flow

Key Ratios

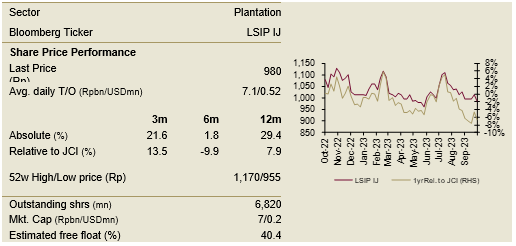

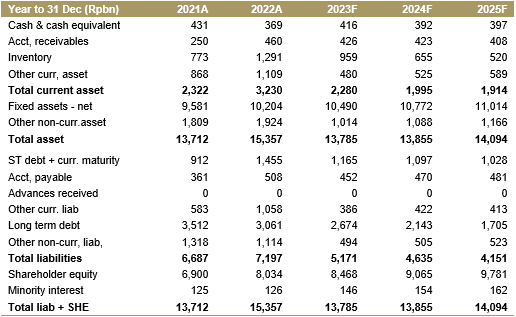

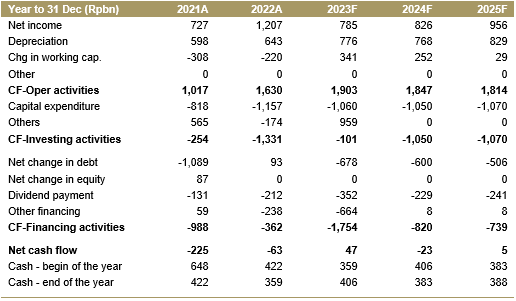

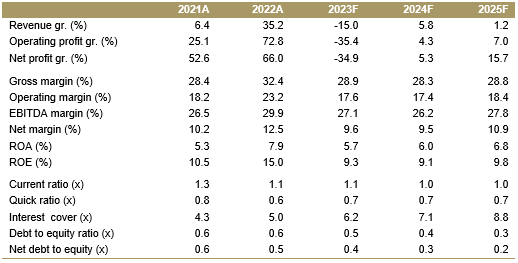

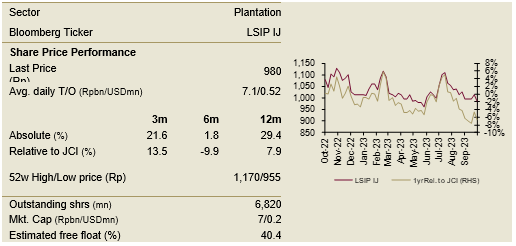

PP London Sumatra Indonesia

HOLD TP: Rp1,050 (+7.1%)

Company Profile

PP London Sumatra Indonesia (LSIP) manages 116,053 ha of nucleus plantation estates in Sumatra, Java, Kalimantan and Sulawesi as of end 2020. The Company operates 12 palm oil mills in Sumatra and Kalimantan with a combined annual FFB processing capacity of up to 2.6 mn tons.

Key Points

• Flat 2024F CPO price at RM4,500 due to high palm oil inventory

Global palm oil inventory remains high throughout this year, resulted to weak CP price. As global CPO price fell -37.8% YoY to average RM3,929/ton in 1H23 , LSIP’s CPO ASP decreased by -22.6% YoY to Rp11,267/kg while PK also down -52.6% YoY to Rp5,666/kg. As such, we forecast pressure from high inventory will continue until next year prompting flat FY24F CPO price of RM4,500/ton.

• Flat 2024F CPO price at RM4,500 due to high palm oil inventory

We remain cautious about high level of CPO inventory in both Indonesia and Malaysia where in the month of August, Malaysian palm oil closing stock increased 22.5% MoM and 1.4% YoY higher amounted to 2.12 mn tons. We expect additional palm oil demand from the B35 mandatory in Indonesia and upcoming Deepavali festivities in 4Q23 would help unburden the high inventory level of palm oil. We expect additional palm oil demand from the B35 mandatory in Indonesia and upcoming Deepavali festivities in 4Q23 would help unburden the high inventory level.

• Maintain HOLD with 2024F TP of Rp1,050/sh

We apply last 5-year mean PE as multiple of 13.24x resulting 2024F TP of Rp1,050/sh. Our TP offers less than 10% from last closing price therefore we reiterate our HOLD rating.

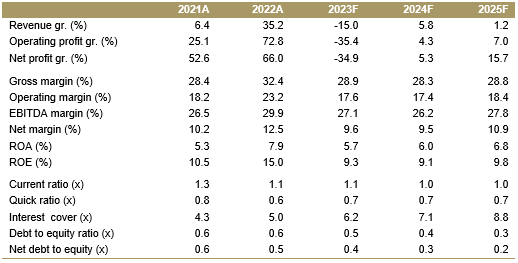

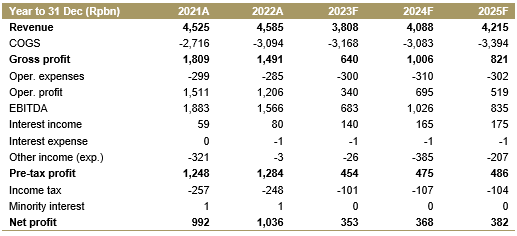

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

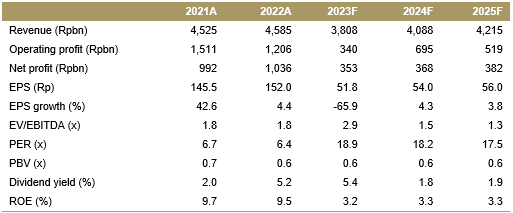

PP London Sumatra Indonesia

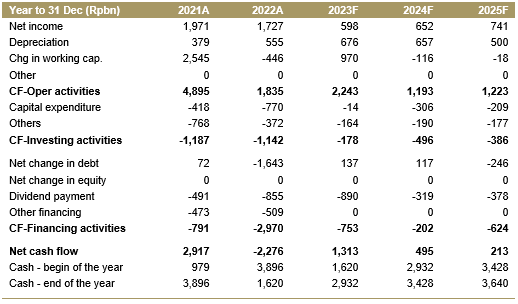

Income Statement

Balance Sheet

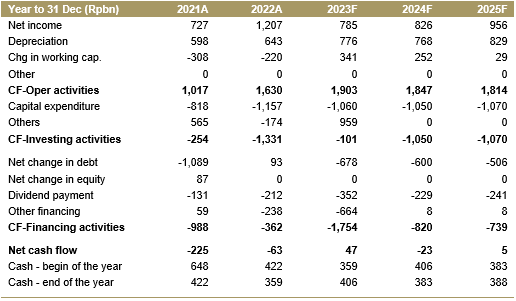

Cash Flow

Key Ratios

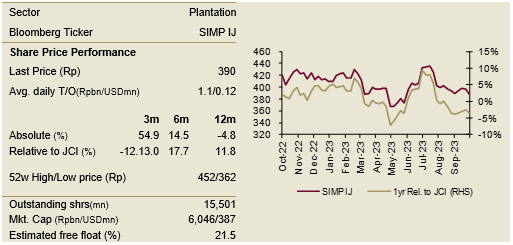

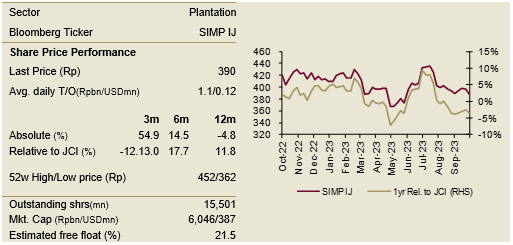

Salim Ivomas Pratama

HOLD TP : Rp400 (+2.6%)

Company Profile

As of 30 June 2023, SIMP manages a total of 244,265 ha palm oil plantation (excluding plasma) with age profile of 19 years. The company’s age profile is considered as ‘mature’ as it exceeds the premium age of 11 years. About 52% of trees are between 7 to 20 years old while 35% comprised of aging trees (older than 20 years).

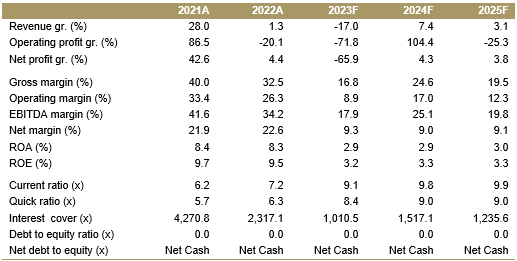

Key Points

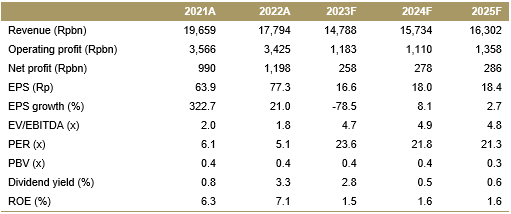

• FFB production to grow 4.6% CAGR 2023F-25F

After delivered sluggish production in recent years as a result of aging trees, we expect SIMP production will improve as more young trees becoming mature this year. We forecast fresh fruit bunch (FFB) nucleus production to improve by +4.6% CAGR between 2023F and 2025F, bottoming up from -5.2% CAGR within 2019-2022.

• CPO price remains under pressure

We slashed our 2023F CPO price to average of RM3,900/ton (from previously RM4,500/ton) based on persistent high inventory level in Indonesia and Malaysia. Palm oil closing stock in Malaysia still rose by 22.5% MoM and 1.4% YoY to 2.12 mn tons in last August while total production in 8M23 recorded lower -1.1% YoY to 11.45 mn tons. As such, we have not seen positive catalyst to launch the CPO price upward.

• Maintain HOLD rating with 2024F TP of Rp400/sh

We incorporate 2023F CPO price of RM3,900/ton and 2024F of RM4,500/ton. We apply +1.5SD of 4-year mean 17.6x PE as multiple, representing investor confident on company’s outlook and arrive at TP of Rp400/sh which only offers limited upside hence HOLD rating.

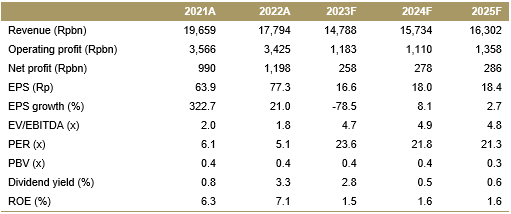

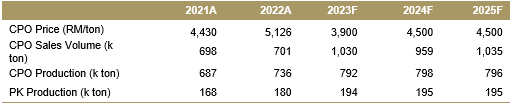

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

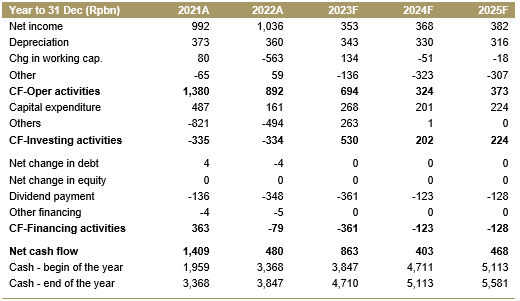

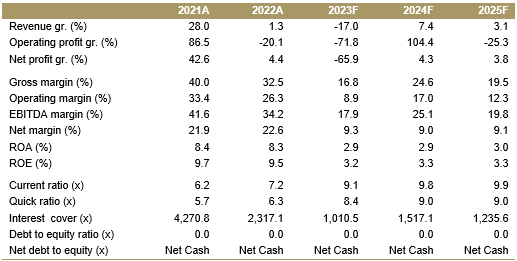

Salim Ivomas Pratama

Income Statement

Balance Sheet

Cash Flow

Key Ratios

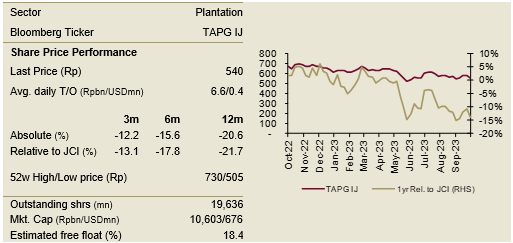

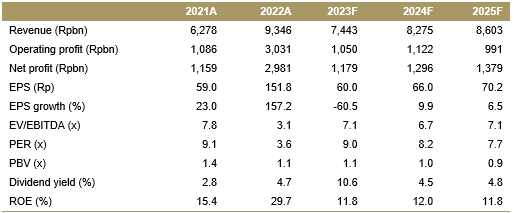

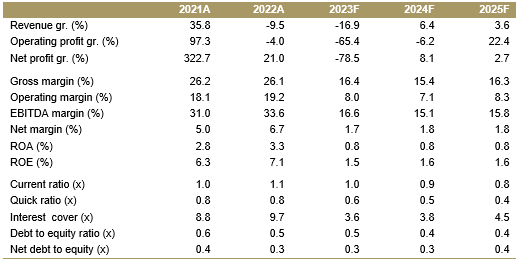

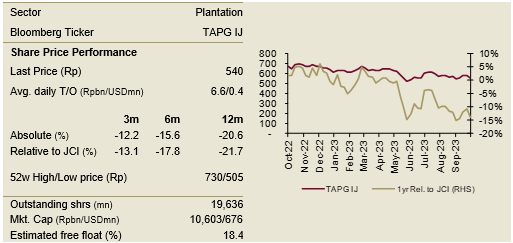

Triputra Agro Persada

BUY TP: Rp640 (+18.5%)

Company Profile

Triputra Agro Persada (TAPG) owns 137,074 ha of palm oil plantation (top 3 largest CPO planters in IDX) as of end of 2020. It has potential significant growth from its young plantations with age profile of 11 years alongside excellent operational metrics.

Key Points

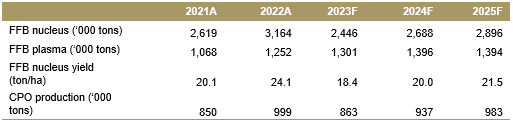

• Production slowly recovers post strong production in 2022

FFB production experienced a recovery period following strong production in 2022. Company’s FFB yield declined to 4.7 ton/ha whilst last year’s still recorded at 5.4 ton/ha. As the plantation was still ramping up production, there was also the possibility of El Nino weather phenomenon had started to kick in the beginning of 2023.

• Production slowly recovers post strong production in 2023

Along with the decrease in FFB production, CPO and PK production also experienced a decrease but lower rainfall in early 2023 caused better pollination, thus making oil extraction rate (OER) slightly higher at 22.82% in 1Q23 compared to last year’s 22.81%. This slightly offset the decline with CPO production only decreased by -9.1% YoY to 200k tons and PK production lower by -12.8% YoY to 41 k tons. For 2023, TAPG will be focused on infrastructure development and fertilizing activity as the preparation for higher production post the recovery period. FFB production is expected to increase in subsequent quarters, in line with more neutral climate. The Company targeted single digit FFB production growth in 2023.

• Maintain BUY with 2024F TP of Rp640/sh

Our DCF valuation with WACC 12.3% resulted to 2024F TP of Rp640/sh which still offers 18% upside, therefore we reiterated our BUY rating.

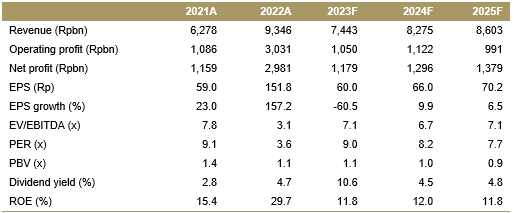

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

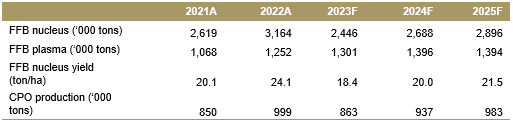

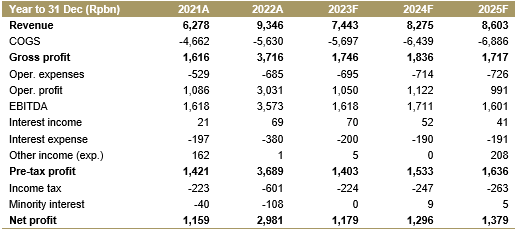

Triputra Agro Persada

Income Statement

Balance Sheet

Cash Flow

Key Ratios

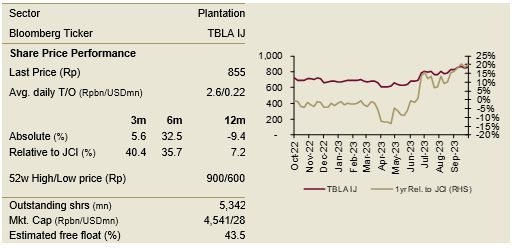

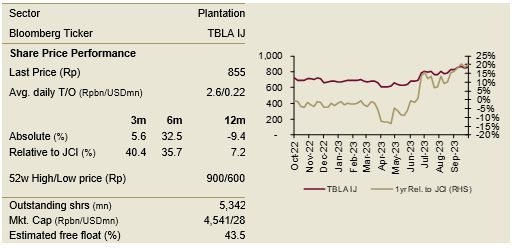

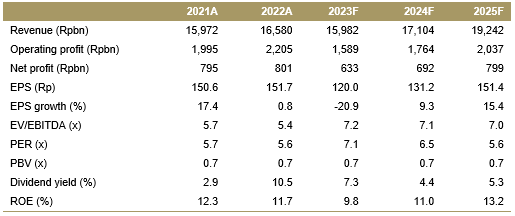

Tunas Baru Lampung

HOLD TP: Rp910 (+6.4%)

Company Profile

Tunas Baru Lampung (TBLA) manages 62,827 ha of palm oil estates and 13,217 ha of sugar cane estates as of end of June 2022. The company has rapidly converted its aging palm oil plantation into sugarcane estates in the recent years.

Key Points

• Sugar division compensates limited palm oil productivity. TBLA recently experienced a downtrend in term of palm oil productivity due to limited mature plantation area and lagged effect of harsh weather happened in 2019. Amidst robust expansion in sugar division, TBLA still relies heavily on palm oil.

• Beneficiary of higher biodiesel blending program. In addition to CPO, TBLA also produces and sells sugar and cooking oil, marketable as Rose Brand. Though both similarly on the uptrend, the rise in sugar sales is more robust due to persistent national sugar shortfall, meanwhile sales of cooking oil are relatively stable because of competitive market. The company also benefited from Indonesian Government plan to gradually increase the biodiesel blending. up to 40% (B40) by next year.

• Maintain HOLD with 2024F TP of Rp910/sh.

We reiterate 2023F and 2024F global CPO price of RM3,900/ton and RM4,500/ton respectively. We forecast CPO price would stabilize in 2024 as supply returns to normal. We apply +1SD for last 5-year mean PE of 6.9x as multiple and arrive at 2024F TP of Rp910/sh. Our TP offers less than 10% than last closing price therefore we maintain our HOLD rating.

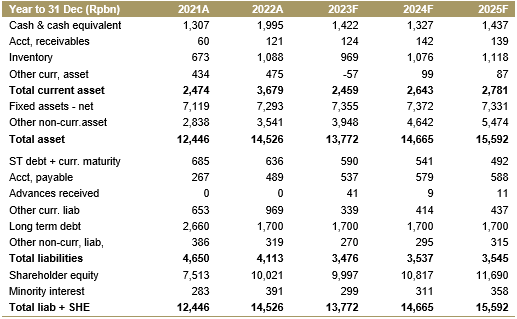

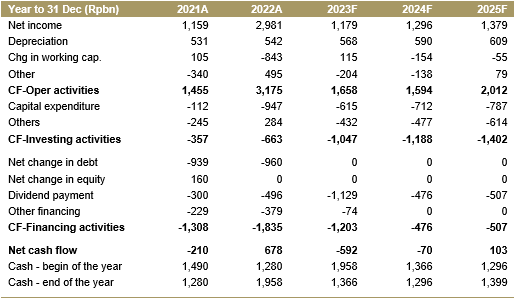

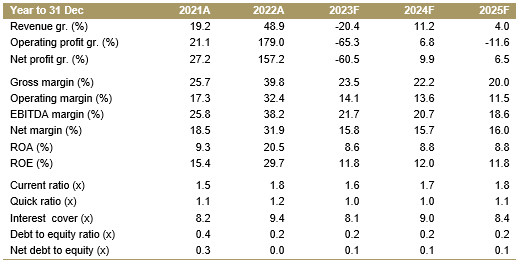

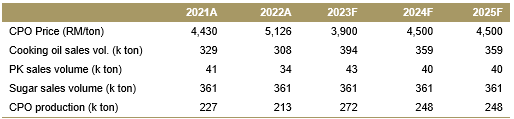

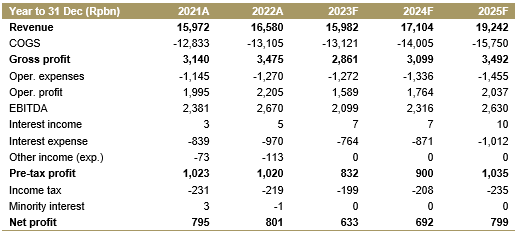

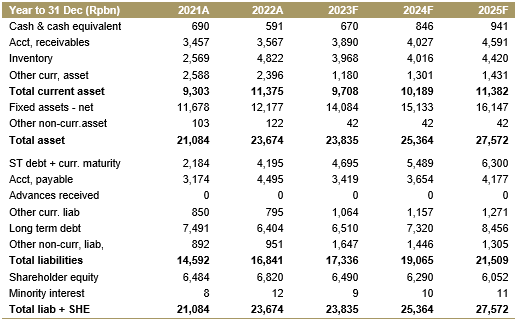

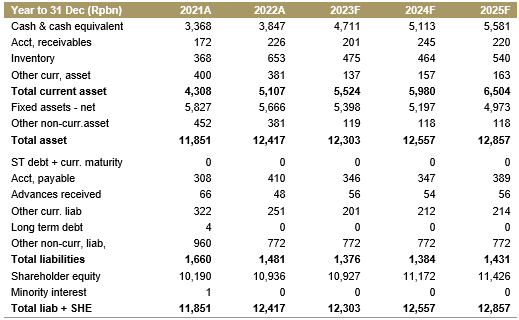

Financial Highlights

Assumptions

Yasmin Soulisa +62 21 2557 4800 ext. 799 soulisayasmin@ciptadana.com

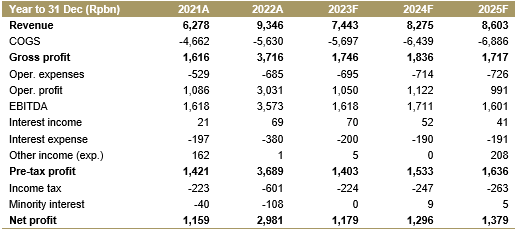

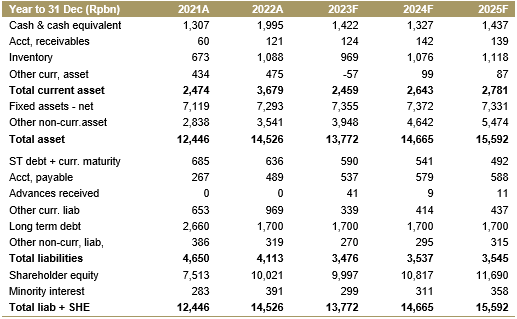

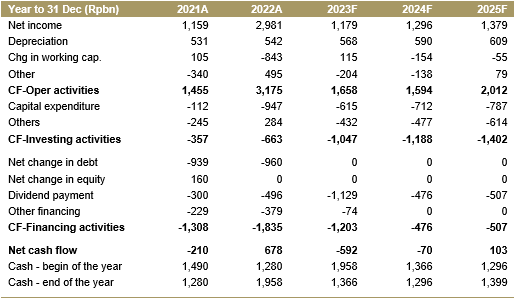

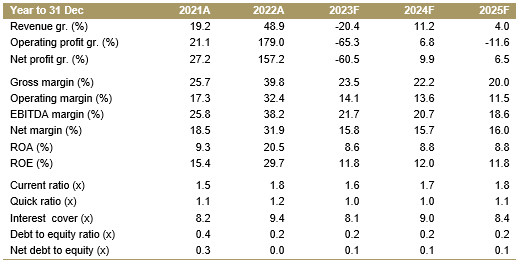

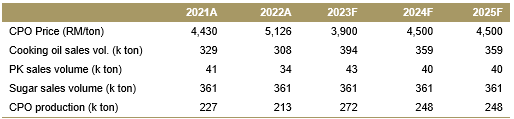

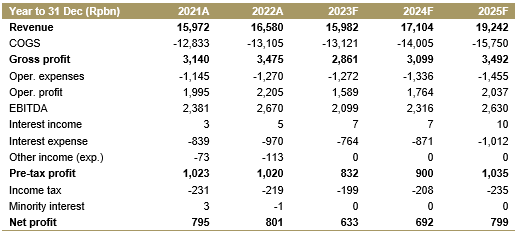

Tunas Baru Lampung

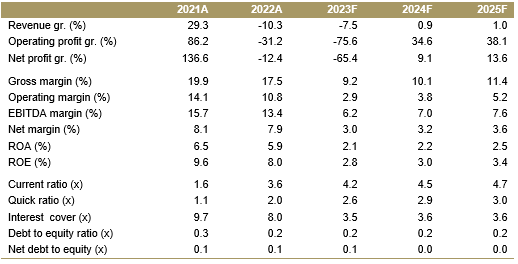

Income Statement

Balance Sheet

Cash Flow

Key Ratios